| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – February 5, 2018

FEATURED TOPIC: 4 BOND MARKET DISRUPTIONS CONVERGE TO CREATE HEADWINDS FOR EQUITIES

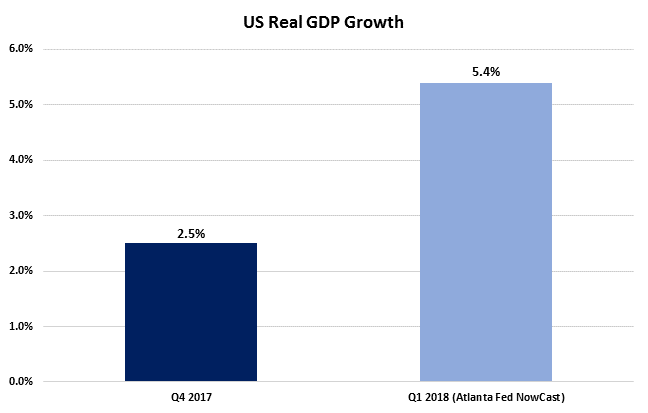

It’s been quite a while since good news was bad news … that is, good news on the economy was bad news for the capital markets. But here we are again. Steadily improving economic news culminating in January’s strong U.S. employment numbers and the Atlanta Fed’s Q1-2018 GDP forecast of 5.4% provided a boost to bond yields and pulled the rug out from under the stock market bulls. In November’s Viewpoint report, BEYOND the Bond Bubble, we had written about four disruptions that would depress bond prices in 2018.

First, the Fed’s balance sheet shrinkage will be an unprecedented event and clearly represents the removal of a powerful force that has helped to prop up bond prices. The Fed’s chosen method is to allow assets to mature instead of selling them outright. Still, that means no reinvestment proceeds being plowed back into the market which will curtail demand. Given that at minimum $1.4 trillion of treasury and mortgage debt in the Fed’s portfolio will mature in less than 5 years, this path should reduce total assets to less than $3 trillion by 2020 from $4.5 trillion today. Also, consider the fact that the ECB and BOJ are very close to trimming their own QE which will take a big bid from under the global bond market. Without this buttress of support for bond prices, yields will rise.

As for the impact of the $1.5 trillion tax bill, it is projected to add about $1 trillion to the U.S. deficit by fiscal year 2027, with more than half of that being frontloaded in fiscal years 2018, 2019 and 2020. As a result, the government’s borrowing needs are expected to rise. The Treasury Borrowing Advisory Committee (TBAC) has estimated that the Treasury would have to borrow on net $955 billion in 2018, $1.083 trillion in fiscal 2019 and $1.128 trillion in fiscal 2020. On the other hand, many economists believe the tax cuts will boost economic growth and treasury revenue sufficiently so the acceleration in borrowing simply won’t be needed.

Second, a rising Fed Funds interest rate cycle has not occurred in a very long time. Since 1971, once a tightening cycle commences, the Fed has raised rates 6 times on average during the first two years. The current cycle is below average, with only 5 hikes since it began in December 2015. Moreover, those five hikes have only brought FF back to 1.5%, compared with an average level of 5.4% over the past 50 years and a median of 5.3%! Similarly, today’s 2.85% yield on the 10-year treasury is extremely low compared to the average level over the past half century: since 1967, the average yield on the 10-year was 6.45% and the median was 6.28%.

Third, the behavior of the Fed in a “heating up” economy could be very different from market expectations. Jerome Powell is taking over the reins at the central bank and it is unclear whether his Fed will adopt the same dovish stance as his predecessor who had once suggested that perhaps it would be beneficial to let the economy “run hot”.

There is good reason to believe the benign inflation numbers the U.S. has enjoyed in recent years is coming to an end. The just-released 2.9% rise in average hourly wages will soon work its way into the core inflation data in time. Moreover, the surge in crude oil prices which MRP was anticipating has finally materialized and will boost the price of energy products. On a year-on-year basis, the impact will be dramatic. Currently, crude is running 24% above where it was at this time last year. But because of the way it sold off in the second quarter of last year, if crude simply stays in the mid-60s for the next few months, the YoY comparison will rise to over 50%, pushing up the headline CPI. Already, there is speculation that the Fed may have to raise rates more than three times this year in order to tame inflation.

Fourth, synchronized global growth was already pushing up rates around the world and now the latest data shows both U.S. growth and inflation picking up. The latest employment report showed job creation of above 200,000, but more notable was the jump in average hourly wage growth to 2.9%. All things considered, we had argued that we believe bond yields may soon start moving in the direction of the US’ nominal growth rate, which itself may be about to accelerate. If the administration hits its real GDP growth goals and the Fed were to hit its inflation target, nominal GDP growth of 5-7% would, in time, suggest a more than doubling in the level of the 10-year yield.

In the meantime, as the economic numbers accelerate and inflation continues to move higher, the Fed is likely to reaffirm plans to continue raising short-term rates and bond yields should climb further, lifting the discount rate used in the present value equation. That could ultimately be the catalyst for the correction that triggers a mean reversion of P/Es and a stormy equity market environment in the year ahead. Unless, of course, faster GDP growth is able to boost earnings growth sufficiently to counterbalance that higher discount rate.

Moreover, longer-term bonds perform poorly in rising interest rate environments, which is why MRP is maintaining its SHORT LONG-DATED U.S. TREASURIES theme. The ProShares UltraShort 20+ Year Treasury ETF (NYSEARCA: TBT) is one way investors can gain leveraged inverse exposure to U.S. treasuries with a remaining maturity of at least 20 years. (Some MRP employees hold positions in the TBT.)

HERE are some articles relating to the bond market (the stories are summarized in the MARKETS section of today’s report):

- Bonds – Bond-Market Pain Reaches 30-Year Treasuries as Yield Breaches 3%

- Bonds – Best wage growth since 2009 spurs talk of more Fed rate hikes

- Bonds – Volatility in Markets From Stocks to Bonds Snaps Back

- Bonds – Looks Like Team Trump Will Not Sanction Russian Bonds

CHART: (1) Average U.S. Hourly Earnings vs 10-Yr Treasury; (2) US Real GDP Growth Q4-2017 & Q1-2018 Projection

OTHER STORIES HIGHLIGHTED IN TODAY’S DIBS:

- Economics and Trade:

- Tariffs – Trump’s Trade Tariffs: You Ain’t Seen Nothing Yet

- Real Estate:

- China Housing – Bank of China pledges $32 bln in funding to spur rental housing market

- China Housing – Why China’s Home Rental Market Could Be The Next Massive Online Push For Alibaba, Tencent

- U.S. Housing – There are 2 reasons why the supply of homes in the US is running dangerously low

- U.S. Housing – Homeownership rate reaches three-year high as rebound from crisis gathers pace

- U.S. Housing – Home prices surge to new high, up 6.2% in November

- U.S. Housing – Pending U.S. Home Sales Rise as Economic Gains Drive Demand

- Labor, Education & Demographics:

- U.S Labor – U.S. adds 200,000 jobs with wage growth fastest in more than 8 years

- Services:

- Advertising – Amazon SmileCodes put a new face on QR codes

- Advertising – GDPR: Lose money if you comply, lose money if you don’t

- Technology:

- 5G – Sprint to Launch 5G Network in 2019

- Quantum – A small-scale demonstration shows how quantum computing could revolutionize data analysis

- Transportation:

- EVs – Chinese Startups Put the Pedal Down on Electric Cars

- EVs – The Breakneck Rise of China’s Colossus of Electric-Car Batteries

- Commodities:

- Mining – Blockchain to track Congo’s cobalt from mine to mobile

- Mining – Electric Cars and Niche Metals Lure Cash to Africa’s Mines

- Biotech:

- Pharma – Blockchain Technologies Poised To Disrupt Stagnant Trial Timelines

- Endnote:

- CHART: EU Migrants – EU Member States Refugee Quota Compared to Population

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: A Review of MRP’s Latest Change-Driven Investment Themes

- Joe Mac’s Market Viewpoint: The Gathering Storm

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Short-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

Emerging Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

- United States, Employment Situation, MoM, JAN: 200,000 from prior 148,000

- United States, Consumer Sentiment, MoM, JAN: 95.7 from prior 94.4

- United States, Factory Orders, MoM, DEC: 1.7% from prior 1.3%

- United States, Baker-Hughes Rig Count, WoW, wk2/22: 946 from prior 947

- Euro Area, PPI, YoY,DEC: 2.2% from prior 2.8%

- Italy, Inflation Rate, YoY, JAN: 0.8% from prior 0.9%

- Ireland, Industrial Production, YoY, DEC: 3% from prior -11.6%

- India, Deposit Growth, YoY, JAN: 5.1% from prior 4.5%

Bonds – Bond-Market Pain Reaches 30-Year Treasuries as Yield Breaches 3%

A large block trade in 10-year Treasury futures sent the 30-year yield through the 3% level. Also, the Treasury increased coupon auction sizes for the first time since 2009. Then, pressure continued to mount as a number of investment-grade corporate bond deals came to market. Such offerings tend to spur selling in Treasuries as investors raise cash to buy the new securities.

The yield curve from 5 to 30 years bear steepened after touching 40 basis points, its flattest level in over a decade. A year ago, the spread was 120 basis points. BMO Capital Markets strategists said that breaching the 40-basis-point level in the yield curve puts 35 basis points into view, “and a break there has little below it to inversion,” which they predict will happen sometime this year.

Yet with undertones of a bear market in the making, no one wants to catch the falling knife that is the $14.5 trillion Treasuries market. B

Bonds – Best wage growth since 2009 spurs talk of more Fed rate hikes

The best wage growth since 2009 sparked speculation that incoming Federal Reserve chair Jerome Powell may have to raise interest rates more than the three times the central bank has forecast in order to tame inflation this year.

Nonfarm payrolls came in at 200,000 for January, higher than the 180,000 forecast, and unemployment remained unchanged at 4.1%. January wage growth rose at an annualized pace of 2.9% and has not been higher since April 2009. Bond yields snapped higher, with the benchmark 10-year reaching as high as 2.84%. Bond yields have been rising as interest rate expectations have been rising, and the wage number confirms signs of wage inflation. CNBC

Bonds – Volatility in Markets From Stocks to Bonds Snaps Back

Since the start of 2018, turbulence in stocks, bonds, commodities and currencies has increased—a distinct shift from last year, when calm dominated markets. The Dow tumbled more than 650 points Friday, capping its worst week since January 2016. The VIX, a measure of expected stock volatility jumped to 17.16 and settled at its highest level since November 2016. A yardstick of Treasury market volatility climbed to a six-month high Thursday while a gauge tracking currency swings has also risen sharply.

One of the biggest changes that has sparked this bout of volatility has been in interest rates. The yield on Treasurys maturing in two years hit the highest level in almost a decade on Thursday, as signs of inflation have started to creep up after years of price gains being subdued. Higher rates spell potential bad news for stocks and emerging markets. Stock dividends compete with bond yields as income for investors, while rising interest rates usually portend higher borrowing costs for developing economies.

It also means the U.S. Federal Reserve may tighten monetary policy at a faster clip. Penn Mutual Asset Management’s Zhiwei Ren warned that that would ripple across markets. WSJ

Bonds – Looks Like Team Trump Will Not Sanction Russian Bonds

Russian bonds are safe from sanctions. Based on the opinion of the Treasury Department, sanctioning the purchase of Russian sovereign debt would lead to economic upheaval, and trigger a sell-off of Russian bonds in the U.S. and probably Europe.

The Treasury Department warned in its report to Congress that Russia’s sovereign debt market is too important to sanction without risking global financial turmoi. That note can be seen as a sign of relief for Russian debt.

Today’s news means Treasury is wary of targeting the Russian bond market, which would threaten penalties on numerous U.S. emerging market bond funds like those at Neuberger Berman. Any threat of penalties could trigger a sell-off, even if the sanctions were not retroactive, meaning they did not punish investors who bought Russian bonds prior to the sanctions rule. Bonds are more than likely out of the woods, but stocks are not. Forbes

Tariffs – Trump’s Trade Tariffs: You Ain’t Seen Nothing Yet

The Trump administration is working on trade measures that will make the recent tariffs on solar panels and washing machines look minor by comparison. At best, these potential measures could protect the U.S. from unfair foreign competition. At worst, they could ignite trade wars that end up harming everyone.

The Trump administration slapped import duties starting as high as 30 percent on solar panels and 50 percent on washing machines under a provision of international trade rules that allows countries to “safeguard” domestic industries that suffer an import surge. Such tariffs must decline each year and last no more than four years. The U.S. doesn’t need to prove that the foreign competition was unfair, and the tariffs aren’t country-specific.

South Korean washing machine makers and Chinese solar panel manufacturers, which will be affected most, are likely to lose if they appeal to the WTO because “countries taking actions are given a lot of discretion,” predicts Jeffrey Schott, a senior fellow at the Peterson Institute for International Economics. B

China Housing – Bank of China pledges $32 bln in funding to spur rental housing market

China’s fourth-biggest bank pledged on Friday to provide eight property firms, including Vanke and Country Garden, with at least 200 billion yuan ($31.84 billion) in response to a government-led push to increase the supply of rental housing. China’s real estate market, dominated by build-to-sell properties, has boomed over the past two years, prompting authorities to tighten control in more than 100 cities to clamp down on speculative buying.

The funding will be used to develop new rental housing projects, as well as converting existing commercial projects including offices into rental homes, it said. R

China Housing – Why China’s Home Rental Market Could Be The Next Massive Online Push For Alibaba, Tencent

In recent months, Alibaba, Tencent and JD.com have all staked out claims in China’s real estate industry, either acquiring stakes in apartment rental startups or announcing plans for their own home rental services.The move comes as Beijing is actively encouraging renting as an alternative to home buying, which authorities believe could help tame skyrocketing property prices and quell disgruntled young professionals who can’t find suitable places to live.

There is plenty of room for such services to grow. According to China’s Orient Securities, the country’s apartment rentals market reached 1 trillion yuan ($158 billion) in 2015. What’s more, policy winds are at the companies’ backs. After President Xi Jinping presented a real estate policy that emphasized renting during a key Party Congress meeting back in October, local officials are rushing to launch pilot schemes. Forbes

U.S. Housing – There are 2 reasons why the supply of homes in the US is running dangerously low

It’s been just over five years since house prices reached their trough and the housing market bottomed out. In the years following that low point, there has been a lot of discussion about how to increase demand and, specifically, why young adults today didn’t want to buy homes. I believed that the lack of desire among millennials was not a generational shift of interest away from homeownership toward perennial renting, but a matter of timing and lifestyle choices.

Yet, now the demand is here. In fact, the challenge the housing market faces in 2018 is not insufficient demand, but a paucity of supply. The reservoir of homes for sale is running dangerously low for two main reasons – existing homeowners have less incentive to sell their homes and home builders have not built enough new homes to keep up with overall demand.

Existing homeowners, the traditional source of supply for the majority of homes for sale, are losing the benefit of a 30-year tailwind — declining mortgage rates. The potential home seller turned home buyer would pay more to borrow an amount equal to their current home’s mortgage to buy another home. BI

U.S. Housing – Homeownership rate reaches three-year high as rebound from crisis gathers pace

More Americans became homeowners in the final three months of last year, fresh evidence that homeownership is rebounding after touching a post-crisis low. The homeownership rate hit an all-time high of 69.1% in 2004 as the housing bubble inflated. In the aftermath of the crisis, it skidded lower and lower, finally bottoming out at 62.9% in 2016. In the fourth quarter of 2017, it jumped to 64.2%, the Census Bureau said Tuesday.

Most housing watchers think there’s no “correct” level of homeownership, but that a natural equilibrium for that number probably lies somewhere between the 2004 high and the 2016 low.

Homeownership among those under 35 jumped to 36% in the fourth quarter from 34.7% a year before. For those aged 35-44, the rate increased, though at a slightly slower rate — to 58.9% from 58.7%. Among those 45-54, it dipped to 69.5 from 69.8%. MW

U.S. Housing – Home prices surge to new high, up 6.2% in November

The supply crisis in the housing market is not letting up, and consequently neither are the gains in home values. National home prices continued their run higher in November, rising 6.2 percent annually on S&P CoreLogic Case-Shiller’s most broad survey, up from 6.1 percent in October. Another S&P index of the nation’s 20 largest housing markets showed a 6.4 percent gain, higher than analysts had expected.

Prices nationally are now 6 percent higher than their 2006 peak, while those in the top 20 markets are still 1.1 percent lower. Blitzer blames the continued lack of supply for the price gains, citing a very slow recovery in the home construction market. Home builders are ramping up production but are still not at even historically normal levels, never mind the huge pent-up demand in the market. CNBC

U.S. Housing – Pending U.S. Home Sales Rise as Economic Gains Drive Demand

While the increase in contract signings suggests sales of previously owned homes will pick up in the coming months, the Realtors group says low supply levels and the impact of the new tax law will constrain any gains in 2018. The legislation limits deductions for mortgage interest and property taxes, changes that are expected to affect high-cost housing markets such as the New York City region.

Existing home sales fell in December for the first time in four months, as the market struggles with record-low supply. Even with steady job growth underpinning the housing market, rising home prices and limited options may stifle would-be buyers. B

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

Leave a Reply