We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

We’ve also summarized the following articles related to this topic in the Politics & Policy section of today’s report.

Brazil

|

|

- Brazilian markets cheer Jair Bolsonaro’s lead in presidential vote

- In Brazil, Bolsonaro Fever Rises

- How To Heal The Brazilian Economy

- Why The Brazilian Elections Should Matter To Financial Institutions

|

|

|

|

|

|

|

Charts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

Markets

|

|

|

Bonds

Bonds in $916 Billion Wipeout Spark Fear of Worst Run Since 1976

|

|

|

Treasuries

It’s the surge in ‘real yields’ that could spell danger for stocks

|

|

|

|

|

|

Finance

|

|

|

ASEAN

Venture capital funding in Southeast Asia at record

|

|

|

Fintech

As Digital Payments Grow in the U.S., Banks and Tech Companies Are Forging Partnerships

|

|

|

|

|

|

Transportation

|

|

|

EVs

Electric Vehicle Company Fundings Are Bright Spot As Clean Energy Investment Slips in Third Quarter

|

|

|

Aerospace

Private Investment in Space Blasts Off

|

|

|

Shipping

Shipping Industry Stares Down New Fuel Restrictions

|

|

|

|

|

|

Biotechnology & Healthcare

|

|

|

Robotics & Automation

China’s quest for the cutting edge in surgical robotics

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Eurozone

Italy-Spain debt spread at 20-year high

|

|

|

Trade War

Trade war escalation will hit China harder than the US, IMF says

|

|

|

EM

Will China’s stimulus prove a boon for emerging markets?

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

4DP

4D-Printed Ceramics: Adding a Time Dimension to Additive Manufacturing

|

|

|

|

|

|

Technology

|

|

|

Blockchain

IBM’s blockchain platform for food goes live and harvests big customers

|

|

|

5G

Dish Network considers $10 billion 5G network instead of spectrum sale

|

|

|

|

|

|

Energy & Environment

|

|

|

Renewables

IEA: Renewables Set For Explosive Growth

|

|

|

Batteries

Tesla’s Battery In South Australia Breaks Stranglehold Of Natural Gas Industry

|

|

|

|

|

|

Endnote

|

|

|

Cryptocurrencies

Crypto Industry on ‘Brink of an Implosion,’ Researcher Says

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX Matters

The dollar’s ups and downs have had significant repercussions. The earnings of global companies, the trend of interest rates, commodity prices, and many nations’ economies – emerging markets in particular – have all been impacted. This issue of MRP’s Viewpoint first examines the forces driving the dollar’s fluctuations, then looks at where the buck might go next and offers some thoughts on what it could mean for the capital markets.

Joe Mac’s Market Viewpoint: FX Matters →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG

ASEAN Markets

|

|

|

|

|

|

LONG

Defense

|

|

|

|

|

|

LONG

Industrials

|

|

|

|

|

|

LONG

Materials

|

|

|

|

|

|

LONG

Palladium

|

|

|

|

|

|

LONG

Steel

|

|

|

|

|

|

SHORT

U.S. Housing

|

|

|

|

|

|

LONG

Video Gaming

|

|

|

|

|

|

|

|

|

SHORT

Autos

|

|

|

|

|

|

LONG

Electric Utilities

|

|

|

|

|

|

LONG

Lithium

|

|

|

|

|

|

LONG

Obesity

|

|

|

|

|

|

LONG

Robotics & Automation

|

|

|

|

|

|

LONG

TIPS

|

|

|

|

|

|

SHORT

U.S. Pharmaceuticals

|

|

|

|

|

|

|

|

|

|

|

|

LONG

CRISPR

|

|

|

|

|

|

LONG

Gold & Gold Miners

|

|

|

|

|

|

SHORT

Long-Dated UST

|

|

|

|

|

|

LONG

Oil & U.S. Energy

|

|

|

|

|

|

LONG

Solar

|

|

|

|

|

|

LONG

U.S. Financials & Regional Banks

|

|

|

|

|

|

LONG

Value Over Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Treasury Sell-Off Continues

The yield on the US 10-year Treasury note continued to rise on Tuesday and hit a new high since May of 2011 of 3.244%. US Treasury yields surged in the beginning of the month after strong US economic data increased fears of a faster tightening by the Fed. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Economic Optimism Beats Estimates in October

The IBD/TIPP Economic Optimism Index increased to 57.8 in October 2018 from 55.7 in the previous month, above market expectations of 54.6. It was the second highest reading since January 2004. The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, rose 4.1 points to 66.7 and the Confidence in Federal Economic Policies, a proprietary IBD/TIPP measure of views on how government economic policies are working, went up 2.1 points to 51.3. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Small Business Optimism Drops from Record High

The NFIB’s Small Business Optimism Index in the US fell to 107.9 in September of 2018 from a record high of 108.8 in August, below market expectations of 108.9. Plans to increase employment (-3 to 23), make capital outlays (-3 to 30) and raise inventories (-7 to 3) declined. Also, the earnings trend worsened (-2 to -1) and less firms think now is a good time to expand (-1 to 33) and expect the economy to improve (-1 to 33). On the other hand, more firms expect real sales to increase (+3 to 29) and improvements were also seen in current inventories (+2 to -1) and future credit conditions (+1 to -5). TE

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Markets

|

|

|

Bonds

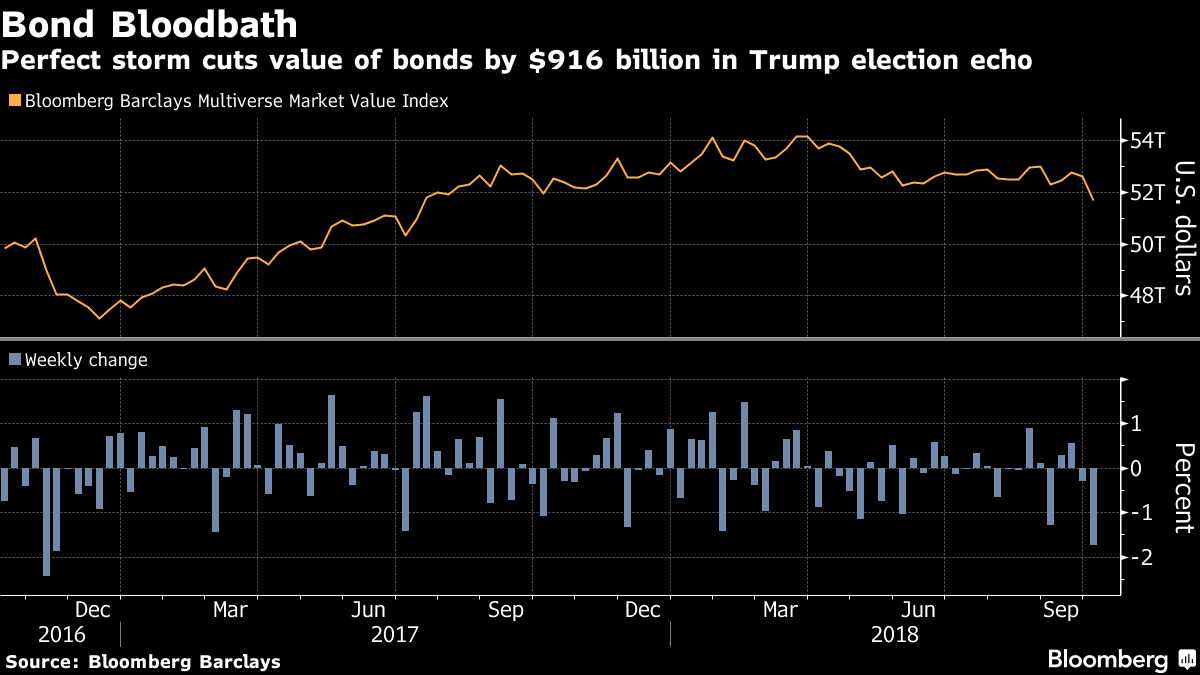

Bonds in $916 Billion Wipeout Spark Fear of Worst Run Since 1976

Global bonds are hitting fresh milestones of misery. Strong U.S. data, a tighter-than-expected monetary trajectory, rising commodity prices and brewing wage pressures are conspiring to push Treasury yields to cycle-highs, hitting money managers of all stripes. The value of the Bloomberg Barclays Multiverse Index, which captures investment-grade and high-yield securities around the world, slumped by $916 billion last week, the most since the aftermath of Donald Trump’s election victory in November 2016.

American high-grade obligations are down 2.53 percent in 2018 — a Bloomberg Barclays index tracking the debt has dropped in just three years since 1976.

The 10-year Treasury benchmark closed at 3.23 percent Friday, the highest since May 2011, while core European and Japanese bond prices have fallen as investors bet the era of ever-looser monetary policy is firmly over.

Money managers continued to flee the iShares 20+ Year Treasury Bond ETF to the tune of $1.06 billion last week, the largest exodus since November 2017 and the most of any U.S.-listed fixed income passive fund. It sank 3.6 percent during the five days ended Oct. 5, the worst week in nearly two years. B

|

|

|

|

|

|

|

|

|

|

|

|

Treasuries

It’s the surge in ‘real yields’ that could spell danger for stocks

In a potentially ominous sign for stocks and other risk assets, analysts say the surge in U.S. government bond yields last week was mostly driven by a jump in the so-called real rate, or the inflation-adjusted yield. Central bankers and market participants closely watch real yields as they indicate how much the Federal Reserve’s interest-rate increases have tightened financial conditions.

Though real yields tend to climb during periods of growing economic optimism, investors say their rapid rise can indicate when rates become unmoored from growth expectations, threatening businesses accustomed to comparatively cheap credit. With the 10-year real yield breaking above its five year trading range, that could spell trouble for equities, though it isn’t clear exactly where the pain threshold lies.

Derived from Treasury inflation-protected securities, or TIPS, the 10-year real yield jumped on Friday to 1.059%, up nearly 30 basis points from where it started in September. Its ascent helped boost the 10-year note yield to a seven-year intraday peak at 3.261% on Tuesday, according to Tradeweb data. The bond market was closed on Monday in observance of Columbus Day. Meanwhile, stocks have struggled, with the S&P 500 down around 1% and the Nasdaq Composite Index down more than 3.9% this month. MW

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Eurozone

Italy-Spain debt spread at 20-year high

The spread between the cost of Italian and Spanish debt is at its highest level for more than 20 years, in a sign that investors remain unconcerned about the future of the eurozone despite Italy’s spiralling bond yields.

Italy’s 10-year yield hit 3.71 per cent on Tuesday, its highest level since February 2014, after the country’s finance minister Giovanni Tria failed to alleviate growing investor jitters over its fiscal position. Short-dated bond yields also rose, although they remain below the highs they hit earlier this year. The yield on two-year debt reached 1.98 per cent on Tuesday, having hit 2.73 per cent in late May when the sell-off first gripped the bond markets as a populist coalition took power.

Markets have become increasingly focused on the likelihood that the coalition government will provoke a confrontation with Brussels over EU public spending rules.Markets have become increasingly focused on the likelihood that the coalition government will provoke a confrontation with Brussels over EU public spending rules.

The yield on Spain’s 10-year bond remains well below its highs for this year at 1.61 per cent. As a result, the spread between it and Italian 10-year debt hit 2.08 percentage points on Tuesday, its highest level since December 1997.

Spain’s fortunes have diverged from Italy’s in the past couple of years. The country is now regarded by some investors as “semi-core”, given its strong economic growth, structural reforms and credit rating upgrades. FT

|

|

|

|

|

|

Trade War

Trade war escalation will hit China harder than the US, IMF says

A further escalation of the trade war between the US and China would take a major toll on economic growth in both countries next year, with China the bigger casualty, according to an economic analysis released by the International Monetary Fund on Tuesday. The world economy would also suffer, the IMF said. Based on the trade tariffs already in place, the organisation revised down its estimates of world growth this year and next by 0.2 of a percentage point to a still healthy 3.7 per cent.

Assuming the US slaps tariffs on all Chinese imports, as US President Donald Trump has threatened to do, the effect on consumer and business confidence combined with the negative financial market reaction would probably cut the GDP of the United States by more than 0.9 per cent in 2019, while Chinese economic output would be 1.6 per cent lower than it otherwise would be, the IMF said.

The institution warned that such economic modelling is inherently imprecise and the effect of a full-blown trade war could be less or even more severe than this calculation. SCMP

|

|

|

EM

Will China’s stimulus prove a boon for emerging markets?

The CSI, an index of big Chinese companies listed on the mainland, tumbled more than 4 per cent on Monday. The drop came despite China’s central bank on Sunday announcing a fresh injection of cash into the domestic banking system, the latest dose of stimulus from authorities in Beijing which had began the year more concerned with curbing credit growth.

That was before Donald Trump started rewriting world trade rules, a strategy that, as recent weeks have underlined, had China as its chief target. Fears over the fallout has driven the CSI index down almost 20 per cent this year. Yet as the fourth quarter begins, an intriguing question for investors is whether China’s efforts to offset the drag from Washington’s trade war will prove an unexpected boon for many emerging markets grappling with rising US interest rates and a stronger dollar.

Jean-Charles Sambor, deputy head of EM debt at BNP Paribas Asset Management, said a move by China to deliver more stimulus would be “positive news for the emerging market macro story”. “It means there’s a low risk of a hard landing . . . so imports should remain quite strong, commodity prices quite strong, and therefore any pass-through would have a positive impact on . . . commodity exporters.” FT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Brazil

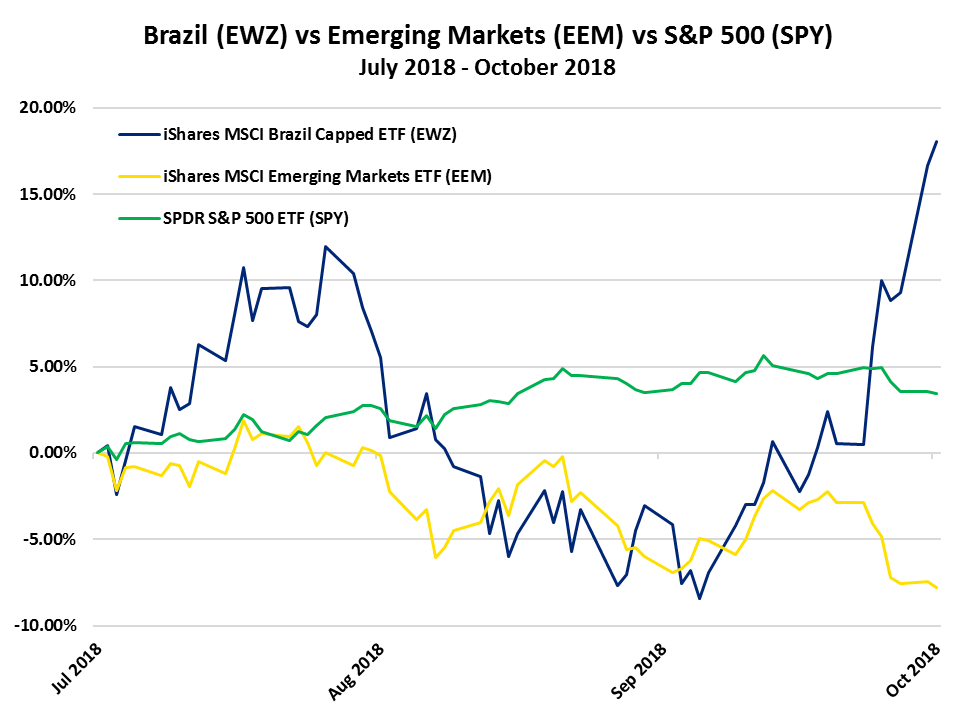

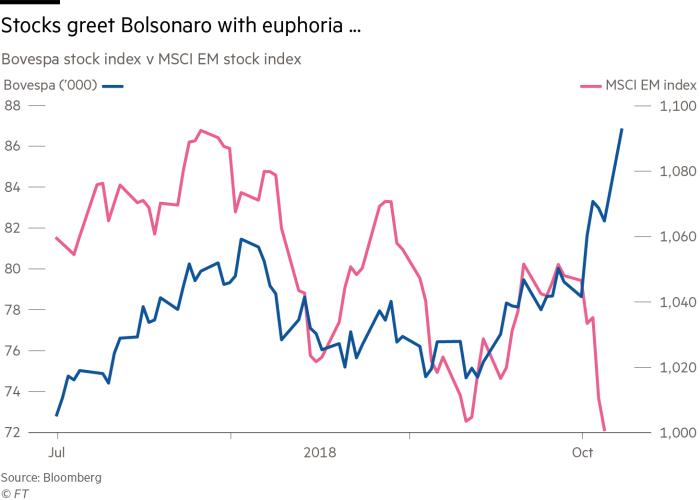

Brazilian markets cheer Jair Bolsonaro’s lead in presidential vote

Brazilian assets have rallied sharply following a better-than-expected showing for the financial market’s favourite candidate in the first round of the country’s presidential election on Sunday. Jair Bolsonaro, the far-right candidate, who had opened up a widening lead over his closest rival over the past week, gained 46 per cent of valid votes in Sunday’s poll, against 29 per cent for Fernando Haddad of the leftwing PT. The result puts Mr Bolsonaro in a commanding position before the two men go into a run-off vote on October 28.

The benchmark Bovespa stock index rose almost 6 per cent in early trading on Monday before trimming its gains slightly by lunchtime. Shares in Petrobras, the scandal-stricken oil company, rose 12 per cent while those in Eletrobras, the state electricity utility, rose as much as 16 per cent.

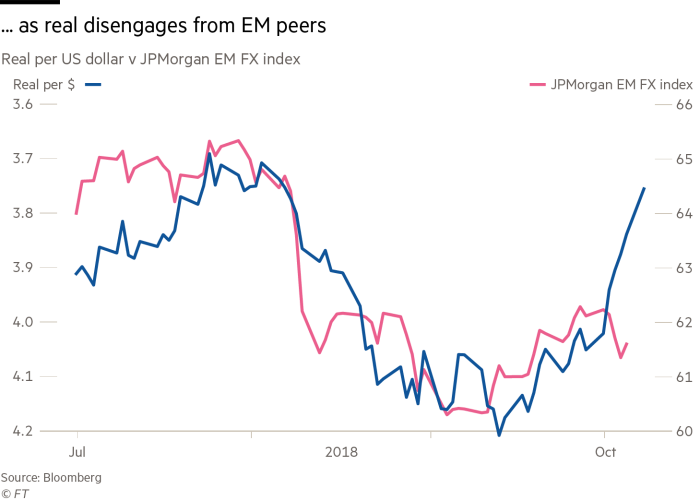

The real rose from 3.84 to the dollar at Friday’s close to less than 3.71 in early trading, a gain of 3.5 per cent, before relaxing slightly. The yield on Brazil’s benchmark 10-year local currency government bond fell from 11.37 per cent to 11.06 per cent.

Analysts have raised doubts about whether Mr Bolsonaro, a political outsider during much of his 28 years in national politics, will be able to enact the tough fiscal reforms that have eluded policymakers for the past quarter of a century. But investors have brushed off such concerns, cheered by his appointment of Paulo Guedes, a Chicago-trained financier, as his one-stop-shop on economic policy, and by the prospect of a break with the big-state policies of the PT, in power from 2003 to 2016. FT

|

|

|

|

|

|

|

|

|

Brazil

In Brazil, Bolsonaro Fever Rises

Bolsonaro was all over the front pages of the Estado and Folha de Sao Paulo newspapers on Wednesday. Below the fold, meanwhile, a survey by the pollsters at Datafolha shows the once mighty Workers Party strongman Luiz Inacio Lula da Silva deserves to be in jail for his role in the Petrobras Car Wash scandal.

The Brazilian real strengthened to R$3.85 today and the MSCI Brazil (EWZ) is up over 5% as investors are betting Bolsonaro goes to the second round against a much weakened Workers Party (PT). The Party is associated with Lula, and Lula is associated with the Petrobras scandal, and that scandal has driven the country into the ground.

PT’s candidate and Lula’s pick to lead it is a one-time São Paulo mayor named Fernando Haddad. If there was no such thing as the Petrobras scandal, Lula would probably be running for a third term and win. If Lula decided to sit it out, Haddad would probably win in his place. PT has led Brazil for 14 years. But the good times in Lula’s first two terms have been largely erased and washed out by Petrobras. Most people blame the PT and their allied parties for the mess Brazil is in today. Forbes

|

|

|

Brazil

How To Heal The Brazilian Economy

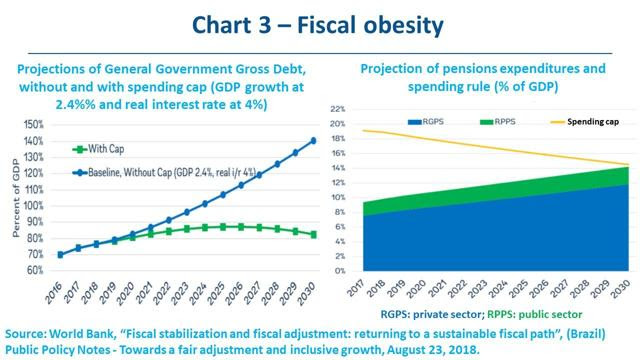

Synthesizing the current situation of the Brazilian economy in one sentence: “it is suffering from a combination of ‘productivity anemia’ and ‘public sector obesity'”. On the one hand, the mediocre performance of productivity in Brazil in recent decades has limited its GDP growth potential. On the other, the gluttony for expanding public spending has become increasingly incompatible with such limits in the potential expansion of GDP, particularly since the former has not been achieving socioeconomic results that match such appetite.

From the mid-1990s onwards, Brazilian production per employee has been increasing at a snail’s pace rate of only 0.7% a year, partly because the level of physical investments has remained low, but mainly because the overall efficiency in the use of human and material resources has remained stagnant.

Meanwhile, annual current public spending has risen sharply in real terms over the past decades: 68% between 2006 and 2017. As a proportion of GDP, public expenditures rose from less than 30 percent in the 1980s to about 40 percent in 2017. Meanwhile, public investment declined – less than 0.7 percent of GDP last year.

Health, education, violence, infrastructure, transportation and logistics and water resources management. In all of them, greater consistency between planning and execution, emphasis on evaluation, and higher fine-tuning between public and private sectors would lead to better socioeconomic results per unit of public expenditure. SA

|

|

|

|

|

|

|

|

|

Brazil

Why The Brazilian Elections Should Matter To Financial Institutions

Brazilians going to the polls on Sunday essentially face two choices out of thirteen candidates, when they vote for a president. The front runner is far right candidate Jair Bolsonaro, a former military officer and legislator, referred to by many in Brazil as Tropical Trump, because of his long list of offensive remarks hurled at just about everybody. Trailing behind him is Fernando Haddad, a moderate from the leftist Workers’ Party (PT), who replaced imprisoned former President Luiz Ignasio ‘Lula’ da Silva for presidential candidate. If no candidate obtains 50%, the second ballot will be October 28. Given Brazil’s role in the global economy and in financial markets, its elections should matter to banks and other financial institutions around the world.

Given years of government and corporate corruption scandals and the adverse effects of a four-year long recession, millions of Brazilians are likely to vote for Bolsonaro not despite his authoritarian streak but because of it. In a Pew Research Center global survey which asked citizens whether a democratic system where representatives elected by citizens decide what becomes law be a good or bad way of governing a country, Brazil has a significant portion of respondents who responded that it would be a bad way of governing. Forbes

|

|

|

|

|

|

|

|

|

| There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html |

|

|

|

|

|

Leave a Reply