| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – April 9, 2018

FEATURED TOPIC: TRADE WAR DISRUPTION THREATENS ALREADY VULNERABLE SOYBEAN PRODUCERS & SUPPLY CHAIN

Last week, China announced that it would slap 25% tariffs on 106 American products including soybeans, deemed by some to be the “crop of the century”. The tariffs, if carried out, could disrupt global soybean trade flows and change planting decisions at farms across North & South America.

Celebrated for its versatility, the soybean plant can be transformed into many products, be that tofu & cooking oil for the kitchen or biodiesel for agribusiness. It can also be crushed into soya meal and fed to chickens, pigs and fish which will quickly fatten up thanks to the plant’s superlative protein content. As incomes have risen in emerging Asia, so too has the consumption of animal protein, which has driven up demand for feedstock – especially in the form of soya meal – across global farms. While world demand for staples such as wheat has been rising by 1% a year, in line with population growth, soybean demand has been rising by 5% a year.

Accordingly, from the rural United States to the Brazilian interior and Argentine pampas, farmers have been racing to grow enough soybeans to meet this demand. Land used to harvest soybeans around the world has been expanding faster than for any other field crops and will reach 1bn hectares (10 million square kilometers) in a decade. Last year, soybean became the most widely sown crop in the United States, surpassing corn.

As with many commodities, China is the main driver of demand growth, which is why news of a 25% Chinese tariff on American soybeans sent tremors through the market last week. China imports two-thirds of all soybeans traded globally, and accounts for nearly 60% of American soybean exports. In 2017, that amounted to 32 million metric tons of U.S. soybeans sent to China and $12.4 billion in revenues. China purchases eight times more from the U.S. than Mexico, the second biggest buyer. This is what’s at stake for U.S. producers and exporters who are concerned that the tariffs will give Latin American soybeans a competitive advantage over U.S. ones.

As it stands, the U.S. soybean market is quite vulnerable. Bumper harvests have resulted in several years of low crop prices. Now, tariffs could lead to some market share loss if Chinese buyers turn to other suppliers. Under such conditions, U.S. stockpiles could surge, putting further downward pressure on prices. This new risk factor already has some growers thinking they should scale back whatever planting activity and investment in equipment they had planned for the next harvest season. With this ripple effect, the tariffs would also have a negative impact on suppliers of agricultural equipment and fertilizers.

While several industry trade groups are warning that the escalating trade battle will have a “devastating effect” on American soybean farmers, processors and exporters, some analysts question whether China can really afford to impose the duties. The U.S. is the second largest exporter in the world, after Brazil, and China sources 40% of its soybean imports from America. Without U.S. supplies, there may not be enough soybeans in the world to meet Chinese demand.Moreover, import tariffs will raise input prices for China’s livestock industry and soy processing companies, ultimately leading to higher prices for Chinese consumers.

Paradoxically, the recent trade tensions have triggered some large purchases of U.S. soybeans by European buyers, one of the first indications that the tariffs could disrupt global commodity trade flows in unexpected ways. Last week, 458 thousand tons of U.S. soybeans were allegedly sold to processors in the European Union. That would be the largest one-off sale to the bloc in more than 15 years. Traders attribute this activity to the fact that, accelerated buying of Brazilian beans by Chinese importers who want to avoid U.S. tariffs has pushed Brazilian soybean prices to historic highs, making U.S. exports cheaper by comparison for non-Chinese buyers. Until that reverses, we could see the U.S. selling to destinations (and in volumes) not ordinarily seen.

MRP will continue to follow developments relating to the soybean tariffs. China has stated that it would impose the planned tariffs only when the US imposes its own set, which means there is still room for negotiation and the tariffs may not materialize. If there is no resolution, however, a trade war could have very negative consequences for the U.S. agricultural sector, just as the Smoot-Hawley Tariff Act did almost a century ago. Particularly because China’s trade retaliation would arrive at a time when US farm incomes are already shrinking, and forecast to decline 7% to $60 billion in 2018. That would bring net farm income to the lowest point since 2006 just as borrowing costs are rising.

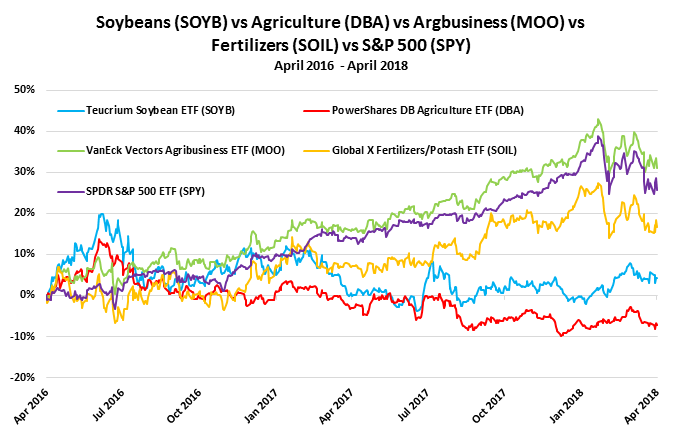

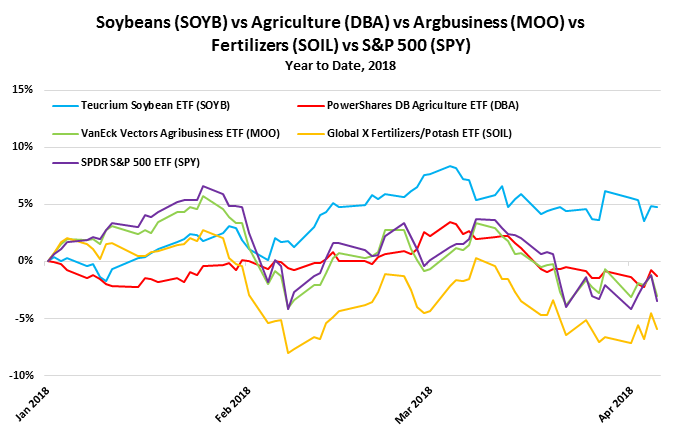

Investors who want to gain some long or short exposure to the unfolding disruption can do so via ETFs such as the Soybean ETF (SOYB), the DB Agriculture ETF (DBA), the Agribusiness ETF (MOO), or the Fertilizers & Potash ETF (SOIL).

HERE IN THE MEANTIME are some articles relating to this featured topic (the stories are summarized in the COMMODITIES section of today’s report):

- Ags – Tariffs on soyabeans will be a big concern for US producers

- Ags – China tariff threat deals another blow to US farmers

- Ags – As U.S. and China trade tariff barbs, others scoop up U.S. soybeans

- Ags – China Tariff Threat Prompts U.S. Farmers to Weigh Changes

- Ags – Cotton Council Says China Tariffs Will “Significantly” Harm US Cotton Sector

CHARTS: Soybeans (SOYB) vs Basket of Agricultural Commodities (DBA) vs Agribusiness (MOO) Fertilizers (SOIL) vs S&P 500 (SPY) : 2-YEAR CHART & YTD CHART

OTHER DISRUPTIVE CHANGE:

- Markets:

- Bonds – What Could Repatriated Dollars Mean for Bonds?

- eMetals – Ripple’s new gateway – ‘eMetals’ to trade physical metals using XRP’s technology

- Funds – BlackRock Plans to Block Walmart, Dick’s From Some Funds Over Guns

- Economics and Trade:

- Trade – Trump threatens tariffs on $100 billion more China goods; Beijing ready to strike

- Labor, Education & Demographics:

- Wages – Share of U.S. Small Businesses Raising Pay Hits 17-Year High

- Services:

- Waste – As US-China trade tensions flare, plastics, aluminum caught in the crossfire

- Transportation:

- Autos – Smaller Subprime Auto Lenders Are Starting to Fold

- Shipping – Shipping industry braces for Chinese trade war

- Commodities:

- Ags – Cauliflower in power: The veggie catches up to the hype

- Ags – Bread and butter lift global food prices

- AgTech – Satellites, supercomputers, and machine learning provide real-time crop type data

- Energy & Environment:

- Renewables – Solar power eclipsed fossil fuels in new 2017 generating capacity: U.N.

- Biotech:

- Pharma – A Rare Loss for U.S. Pharma Lobby Will Cost the Industry Billions

- Endnote:

- Trade – The highs (few) and lows (many) of U.S. trading with China

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: A Review of MRP Themes

- Joe Mac’s Market Viewpoint: Beyond the HOUSING HEADWINDS

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Long-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

ASEAN Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

US Economy Adds Less Jobs than Expected … Unemployment Rate Unchanged at 17-Year Low

Non farm payrolls in the U.S increased by 103 thousand in March 2018, following an upwardly revised 326 thousand in February. It’s the lowest reading since September and well below market expectations of 193 thousand. Employment grew in manufacturing, health care, and mining but fell in construction and retail sectors. ET

The US unemployment rate stood at 4.1% for the sixth consecutive month in March 2018. The number of unemployed decreased by 121 thousand to 6.59 million and employment fell 37 thousand to 155.18 million. The labor force participation rate dropped to 62.9% from a five-month high of 63% in February. ET

German Industrial Output Unexpectedly Tumbles … Construction Sector Shrinks for 1st Time in 3 Years

German industrial production unexpectedly fell by 1.6% MoM in February 2018, missing market consensus of a 0.3% growth. It was the biggest decline since August 2015, as production dropped for capital goods (-3.1%); consumer goods (-1.5%); intermediate goods (-0.7%). ET

The IHS Markit Germany Construction PMI fell to 47 in March 2018 from 52.7 in February. It’s the first contraction in construction activity since January 2015 and the sharpest since June of 2014 as bad weather caused disruption across the sector. But, demand for new construction projects remained resilient and constructors remained optimistic about the outlook over the next 12 months. ET

Russia Inflation Rate Picks Up from Record Low to 2.4%

Russia’s consumer price inflation increased to 2.4% year-on-year in March 2018 from a record low of 2.2% in the previous month, but still well below the central bank’s target of 4%. Meanwhile, annual core inflation rate declined to a new all-time low of 1.8% in March. ET

Spain Industrial Output Growth Picks Up to 3.1%

Industrial production in Spain rose 3.1% YoY in February 2018, up from a 0.7% increase the prior month, but below market expectations of a 5.1% growth. Output slowed for consumer goods (0.3% vs 1.1% in January) and capital goods (2.3% vs 4.3%). Meanwhile, production rose faster for intermediate goods (4.9% vs 4.2%) and rebounded for energy (5.2% vs -7.7%). On a monthly basis, IP rose 1.5%, following a 2.9% decline in January. ET

Bonds – What Could Repatriated Dollars Mean for Bonds?

December’s historic tax reform sharply reduced the US tax rate on foreign earnings which could lead to as much as $1.5 trillion coming back onshore. US companies currently hold around $3 trillion in unremitted foreign earnings, roughly half of which is held in operating assets, and the other in high-quality, short -term assets.

Billions of dollars currently held in short-term assets are expected to be repatriated to the US to be spent in a variety of ways, such as to honor tax obligations. Going forward, companies are expected to purchase fewer short-term investment grade bonds with their overseas cash, as they prepare to bring that cash back to the US.

There may also be a reduction in the issuance of longer-term investment grade bonds – as companies bring cash onshore, there could be less incentive to issue debt and, therefore, a lower supply of intermediate and longer-term bonds.

Over the longer term, these effects are expected to fade, as shorter-term investment grade yields appear relatively more attractive over time. It’s important to keep in mind, however, that future market volatility could provide attractive opportunities on the shorter end of the investment grade yield curve. ETFT

eMetals – Ripple’s new gateway – ‘eMetals’ to trade physical metals using XRP’s technology

Ripple is well known for its inter-operability focus and inter ledger projects for cross-border payments. Now, it is introducing a new gateway, called ‘eMetals’, launched by BPG Group.

BPG Group, a precious metal refiner ensures efficient processing of industrial scrap throughout Europe from various industries. They refine, recycle, fund management and also allow trading. Their shares are traded on the Vienna Stock Exchange. Users can buy either physical metals or digital gold on Ripple through them.

They are now on track to launch a new issuing gateway on the Ripple consensus ledger. They have identified significant market potential in the network in conjunction with the digitization of physical metals. The company has offered an alternative way to invest in, and trade, physical metals by combining the performance of the London clearing system with the transparency of an exchange-traded asset. AMBC

Funds – BlackRock Plans to Block Walmart, Dick’s From Some Funds Over Guns

The world’s largest money manager is stripping retailers that sell guns out of some current and planned exchange-traded funds, the latest sign that weapons sellers are facing the same scrutiny from investors as producers. Walmart Inc., Dick’s Sporting Goods Inc. and Kroger Co. are among the retailers that will be ruled out of new environmental social and governance-focused funds BlackRock Inc. is planning.

BlackRock plans to strip all gun sellers and retailers including Kroger from its current lineup of seven so-called ESG funds, which have some $2.2 billion in assets. It is also planning to offer new ETFs and pooled funds to 401(k) retirement savings plans that exclude gun makers and retailers. One of those ETFs will track the performance of a new bond index that is similar to the Bloomberg Barclays US Aggregate Bond Index, but excludes issuers that make 5% or more or $20 million in revenue from gun-related products.

Money managers and index providers have raced to offer ESG products to investors in recent years. While those products have provided a new source of revenue for Wall Street, it is unclear whether their popularity will last and if the performance of those products will be comparable to traditional investment strategies long term. WSJ

Trade – Trump threatens tariffs on $100 billion more China goods; Beijing ready to strike back

China warned on Friday it was fully prepared to respond with a “fierce counter strike” of fresh trade measures if the United States follows through on President Trump’s threat to slap tariffs on an additional $100 billion in Chinese goods.

On Wednesday, China unveiled a list of 106 U.S. goods – from soybeans and whiskey to frozen beef and aircraft – targeted for tariffs, retaliating just hours after the Trump administration proposed duties on some 1,300 Chinese industrial, technology, transport and medical products.

Among the most affected by a trade war could be the U.S. technology sector, particularly chipmakers. The U.S. semiconductor sector relies on China for about a quarter of its revenue. It also remains to be seen if the trade dispute would trigger a nationalistic backlash in terms of travel. When ties between Beijing and Seoul chilled, Chinese tourism to South Korea plummeted and Made-in-South Korea products were shunned by consumers in China.

A full-blown trade war would have a pronounced effect. The U.S. and China would suffer significant slowdown in real GDP growth – a cumulative loss around 1.0 percentage point, with economic growth cut to 2.5% in 2019 from 3.0% in a baseline scenario. R

Wages – Share of U.S. Small Businesses Raising Pay Hits 17-Year High

Small-business owners in the U.S. are becoming more aggressive with their pay packages as the tight job market makes it difficult to attract talent.

A net 33 percent of small firms raised compensation in March, the largest share since November 2000, as hiring plans picked up. A net 20 percent, up 2 percentage points from a month earlier, said they planned to add to payrolls.

While the number of firms reporting job openings climbed to 53 percent in March from 52 percent a month earlier, 47 percent indicated that they had few or no qualified workers to fill those positions. B

Waste – As US-China trade tensions flare, plastics, aluminum caught in the crossfire

China announced new tariffs on 106 American products, including plastics, while the U.S. is adding tariffs to machinery and molds the domestic industry uses. Final enforcement dates and rates have not been set, but both countries are looking at a tariff of 25%.

Trump’s tariffs could make plastic manufacturing in the U.S. more expensive, meaning domestic manufacturers may be purchasing less feedstock from recyclers. China’s tariffs on aluminum could be especially damaging. Even though there is a large domestic capacity for aluminum recycling, the U.S. exported over $1 billion-worth of aluminum scrap to China in 2017. With Chinese tariffs of 25% on imported aluminum, it is quite possible that Chinese buyers will be less likely to look toward American sellers.

The recent tit-for-tat on trade will almost certainly make any conversations around easing contamination standards less likely to happen. Instead of hoping to repair the damage with China, it may be time for U.S. recyclers to turn inward, focus on quality and find alternative markets. WasteDive

Autos – Smaller Subprime Auto Lenders Are Starting to Fold

Growing numbers of small subprime auto lenders are closing or shutting down after loan losses and slim margins spur banks and private equity owners to cut off funding.

The pain among smaller lenders has parallels with the subprime mortgage crisis last decade. This time around, the financial system’s losses are expected to be much more manageable, because auto lending is a smaller business relative to mortgages, and Wall Street hasn’t packaged as many of the loans into complicated securities and derivatives.

As of the end of September, there were about $280 billion of subprime auto loans outstanding, compared with around $1.3 trillion in subprime mortgage debt at the start of 2007. There isn’t a standardized definition of subprime borrowers, though it generally encompasses borrowers with FICO credit scores below 600 to 640 on an 850 point scale.

For some money managers and companies, though, losses could still hurt. Private equity firms and other investors have poured billions of dollars into subprime auto lenders, hoping for big profits. But subprime and near-prime auto lending volumes by one measure peaked in the first quarter of 2016 at $134 billion, and has declined every quarter since then.

Years of loose lending have resulted in growing numbers of subprime borrowers falling behind on their bills. In the quarter ended September, 9.7 percent of loans that auto-finance companies made to the riskiest borrowers were overdue by 90 days or more, the highest percentage since 2010. B

Shipping – Shipping industry braces for Chinese trade war

Even in times of robust trade, shipping industry profit margins tend to be slim — about 3%. Now that China and the US have threatened to swap 25% tariffs on a range of goods worth a total of about $100 billion, the maritime industry is worried that shipping volume will fall along with profits. The tariffs could put up to 7% of Asia-to-US shipping at risk and impact 1% of total global shipping

Expeditors International of Washington, Inc. (EXPD), a logistics company that purchases cargo space from ocean shipping and airlines and resells it to customers, will take the lion’s share of damage; 31% of their revenue came from China last year.

The next most exposed company is Atlas Air Worldwide Holdings (AAWW), a cargo airline from New York, which does a lot of business with Asian countries. FedEx (FDX) and UPS (UPS) could also be affected as 6% of FedEx’s revenue and 5% of UPS’ revenue are from US-Asia trade.

Rail companies could also be impacted; Union Pacific Corp. (UNP) has 13% of its revenue driven by trade with China because its trains carry the goods inland from the ports. Other big players in the shipping industry are Covenant Transportation (CVTI), Daeske

Ags – Tariffs on soyabeans will be a big concern for US producers

The Chinese Ministry of Commerce is slapping 25% tariffs on 106 American products including soyabeans, other agricultural products, chemicals and selected aircraft. These selected import product lines were worth about $50bn in 2017, strategically the same value of Chinese imports affected by the US tariffs.

Tariffs on soyabeans will be a big concern for US producers. China is by far the largest export market for American soyabean farmers, eight times large than Mexico, the second biggest buyer. Of a total of $22bn in US soyabean exports last year, about 56% went to China. US soyabeans exports to China are worth the same as the next 10 export products on the tariff list combined.

China said it would impose the planned tariffs only when the US does so, a calibrated approach that leaves time for negotiations. FT

Ags – China tariff threat deals another blow to US farmers

Agricultural traders are braced for further volatility amid uncertainty as to if and when a 25% import duty is imposed on soyabeans. This is because China is by far the largest buyer of the oilseed in the world, accounting for two-thirds of the world export market, and there are questions as to whether it can really afford to slap duties on the commodity from the US.

“There aren’t enough soyabeans in the world to meet China’s demand without US supplies,” said Stefan Vogel, head of agri commodity research at Rabobank. An import tariff could mean higher feed prices for the Chinese livestock industry, leading higher pork, chicken and fish prices for the country’s consumers.

Brazil and Argentina are also leading soyabean producers and while China has been buying more of the commodity from Brazil, it still relies on the US for 40% of its imports. A severe drought in Argentina also means that exports from the Latin American country would be limited. FT

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

*

*

Leave a Reply