We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

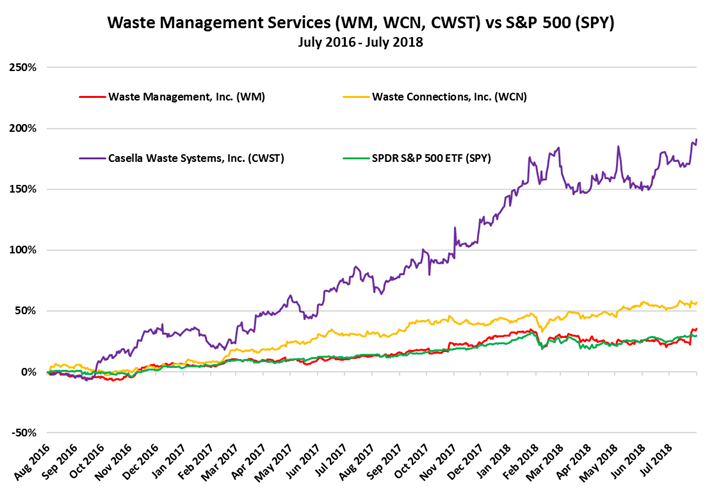

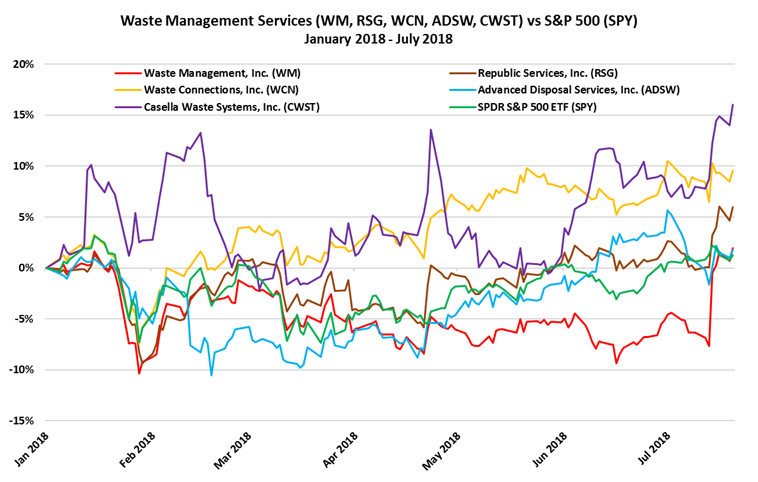

Today’s Featured Topic Global Waste Management Disruption Fails to Spook Investors. For Now. The recycled commodities market industry experienced a major disruption on January 1, when China’s new “National Sword” policy went into effect, officially banning the import of 24 types of solid waste including unsorted paper, various plastics, and some trace metals. The policy also changed the allowed contamination rate for recyclables to just 0.5%. For years, most Western nations had been sending their unwanted scrap metals, plastic and paper to China for re-use. China quickly became, by far, the biggest importer and recycler of such materials to the extent that more than half the world’s exports ended up there, including 55% of all scrap paper. Prior to the ban, China was taking in over 7 million tons of scrap plastic each year from Europe, the US and other parts of Asia. Japan alone accounted for 1.3 million tons or 18% of that plastic waste. The biggest contributor was the United States, which exported more mixed paper and plastics to China than the rest of the world, combined. Last year, $5.2 billion worth of U.S. scrap was exported to China, with nearly 4,000 shipping containers full of recyclables leaving America’s ports daily. This is an arrangement that had suited China for a couple of decades, giving the nation time to develop its own manufacturing supply chain. When the shipments would arrive in China, much of that scrap would be sorted, treated, and transformed into pellets of raw material that Chinese factories could then use to manufacture all sorts of items. The resulting finished goods – from inexpensive office furniture to ironing boards, and fiber-optic cables – would be shipped back to developed economies, helping China build its massive trade surplus. China’s policy change has thrown mixed paper and mixed plastics recyclers into disarray. Recycling commodity prices fell 36% in the first quarter and volumes significantly declined as well. According to China’s Ministry of Ecology and Environment, scrap material imports plunged 57% in Q1 2018 compared with the same period in 2017. Across developed nations, more waste is being sent to landfills and incinerators. Some of it is even being stored in warehouses and parking lots in the U.S. and Canada. As exporters seek new destinations, some Southeast Asian markets, including Vietnam, India, Thailand and Malaysia, have become the new hotspot. However, these countries too are nearing a point of saturation. Between January and end of April, Malaysia imported 185,000 tons of plastic waste from the EU, that’s quadruple what it saw in 2017 over the same period. This deluge has prompted several nations in the region to consider imposing their own import restrictions. Reports that the Chinese government may extend its ban to all scrap imports by 2020 suggest this disruption is far from over and there is further turbulence ahead for the recycled commodities market. Surprisingly the top U.S. waste management companies have proven extremely resilient thus far. The share prices of Waste Management Inc. (WM), Waste Connections Inc. (WCN), Casella Waste Systems (CWST), Republic Services (RSG), and Advanced Disposal Services (ADSW) have even outperformed the broad market year-to-date. There are several reasons for this resilience: First, they have put a renewed focus on educating customers about the necessity of recycling the right way, which helps to reduce the contamination level. Second, many operate landmines where some of the overflow is going. Third, they are restructuring their contracts and shifting costs onto customers. During Waste Management’s Q1 2018 Conference Call, its CEO noted that: “In our new contracts, we are looking to shift even more of the commodity price risk to our customers and more easily recapture our actual processing costs going forward.” Having gone through numerous cycles in the past, the industry has figured out how to adapt to big changes. For many American paper mills, such as Georgia-based Pratt Industries, this ban is an opportunity to source low-cost supply of scrap paper domestically, turn that into packaging for U.S. manufacturers, and regain some of their lost market share. We may see other domestic processing mills emerge to pick up some of the slack. Already, a new paperboard mill will be built in Ohio with mixed paper as a primary feedstock. In addition, two companies have announced plans to grind and pelletize mixed plastics and ship the pellets to China. We’ve also summarized the following articles related to this topic in the Services section of today’s report.

|

|

Chart: Waste Management Services (WM, WCN, CWST) vs S&P 500 (SPY) |

|

Other Disruptive Change

Labor, Education & Demographics

|

|

Joe Mac’s Market Viewpoint |

|

|

|

The U.S. capital markets had a challenging time in the first half of 2018. While the brouhaha about trade wars has been cited by experts as the cause of this year’s rise in volatility, MRP believes otherwise. There are larger forces at play and they will continue to pressure both equity and bond prices in the second half of this year Joe Mac’s Market Viewpoint: U.S. Markets at Midyear →

Other Viewpoint Reports Joe Mac’s Market Viewpoint: CAPEX Booms! → Joe Mac’s Market Viewpoint: The Inflation Complication → |

|

Current MRP Themes |

|

|

|

|

Major Data Points |

|

|

|

1.

|

US Stocks Climb on Tuesday Wall Street closed moderately in the green on Tuesday 31 July 2018, as news that the United States and China are trying to restart trade talks lifted sentiment. TE |

|

2. |

Chicago PMI at 6-Month High in July The Chicago Business Barometer for the US rose 1.4 points to 65.5 in July of 2018, beating market expectations of 62 and reaching a new high since January. New orders and production also recorded six-month highs in July, traditionally a busy month for firms coinciding with the summer holiday season. TE |

|

3.

|

US Home Prices Rise More than Expected: Case-Shiller The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index in the US rose 6.5 percent year-on-year in May 2018, following an upwardly revised 6.7 percent advance in April and beating market expectations of 6.4 percent. Meanwhile, the national index, covering all nine US census divisions rose 6.4 percent in May, the same pace as in the previous month. TE |

|

4. |

US PCE Prices Rise in Line With Forecasts The personal consumption expenditures (PCE) price index in the United States edged up 0.1 percent month-over-month in June of 2018, following a 0.2 percent rise in May, matching market expectations. Year-on-year, the PCE price index rose 2.2 percent, the same as in May and the core index rose 1.9 percent, also the same as in the previous month. TE |

|

5. |

US Employment Costs Rise Less than Expected Compensation costs for civilian workers increased 0.6 percent in the second quarter of 2018, following a 0.8 percent rise in the previous period and slightly below market expectations of 0.7 percent. Wages and salaries, which make up about 70 percent of compensation costs, went up 0.5 percent (vs 0.9 percent in Q1) and benefits, which make up the remaining 30 percent of compensation, rose 0.9 percent (vs 0.7 percent in Q4), the highest gain in four years. Year-on-year, compensation costs for civilian workers increased 2.8 percent, the biggest annual gain since the third quarter of 2008. TE |

|

6. |

US Personal Income Rises 0.4% MoM in June Personal income in the United States increased 0.4 percent month-over-month in June 2018, the same pace as in the previous month and in line with market expectations. Wages and salaries rose faster (0.4 percent from 0.3 percent in May) and disposable income advanced 0.4 percent (the same as in May). The saving rate was unchanged at 6.8 percent. TE |

|

7. |

US Personal Spending Rises 0.4% in June Personal spending in the United States rose 0.4 percent month-over-month in June 2018, following an upwardly revised 0.5 percent gain in May and matching market expectations. It was the smallest increase in personal spending in four months. TE |

|

8. |

Soybeans Prices Rally Soybeans increased by 2% to 894.33 USd/Bu. TE |

|

Other Disruptive Change |

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html |

Leave a Reply