We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

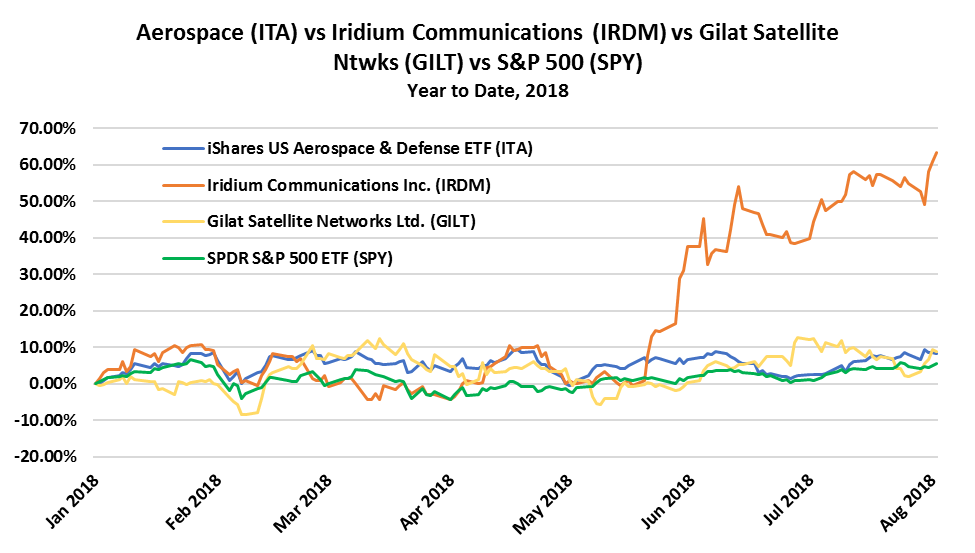

Today’s Featured Topic Aerospace: Private Space Projects Eliminate Barriers to Satellite Disruptors Summary: New innovations and President Trump’s deregulatory agenda have primed ventures in the aerospace industry for a renaissance over the next few years. Since the leading rocket manufacturers like Blue Origin, SpaceX, and Rocket Lab are not publicly listed, the most investor opportunity may lie in the satellite industry. Our devices are constantly becoming more advanced, driving demand for larger networks and more advanced satellite services. Simultaneously, satellites are gaining access to more “real estate” on space flights than ever before. SpaceX, as usual, has dominated the recent headlines in the private space industry. In late July, SpaceX pulled off successful launches of two separate missions carrying Telstar 19V, a heavyweight communication satellite, followed by 10 smaller Iridium satellites. The former will provide broadband service to customers throughout the Americas and Atlantic Ocean region, while the latter increases the number of operating satellites in the Iridium NEXT telephone relay station constellation to a total of 65. While each launch is a milestone for the private space and satellite markets, SpaceX is slated to dwarf all of its previous missions later this year when one of the company’s signature Falcon 9 rockets launches more than 70 satellites into orbit ― the largest batch of satellites sent into space at one time from one of the company’s vehicles or of any other US rocket company. What is even more interesting about recent launches, however, is how much access smaller companies have been receiving due to companies like Spaceflight Industries acting as ridesharing brokers between fledgling satellite and rocket manufacturers. As rockets continue to grow in size and weight, it costs more to launch them. Therefore, having empty capacity on board is becoming less and less efficient. Spaceflight Industries’ main line of business is finding launch “real estate”, extra space inside a rocket, for small satellites that need to get into space. In the same way airlines need to fill the cheap seats with passengers at a lower rate, any open space on a launch will have to be filled out with smaller satellites to reach maximum cost efficiency. So far, Spaceflight Industries has found rides for more than 140 different satellites on multiple launch vehicles. Essentially, larger rockets mean lower barriers to entry for satellite sector disruptors. Although the major players are already solidly defined in the rocket market’s space race, the environment is still extremely differentiated in satellites. While more recognizable names do exist, like the aforementioned Iridium Communications, as well as Gilat Satellite Networks, technology in our connected devices continues to change and adapt as satellite manufacturers are just getting off the ground. In general, satellite companies are clustered around three different themes: broadband internet delivery, hardware development and satellite-enabled services. Due to high the high fixed costs of service networks, the largest concentration of capital is on the broadband front. When it comes to satellites, startups like Softbank-funded OneWeb can take on almost anyone, including tech giant Facebook, who has already planned their own satellite launches in the near future. Hardware-focused startups like Kymeta have developed antenna technology that uses a holograph-like approach to acquire, steer and lock a beam to a satellite. This helps objects which move quickly or make sharp turns maintain communication with a satellite. Satellite services are largely deployed for new geospatial and imaging data. Satellite startup Planet develops and deploys its own array of camera-equipped microsatellites, which regularly capture images of earth. It then sells generalized map and site-specific data feeds to governments, the financial sector, emergency readiness agencies, agriculture companies and others. The company has already launched a 200-satellite constellation network. The satellite industry also stands to benefit from an unprecedented deregulation agenda, thanks to the Trump administration. In May, MRP highlighted The Space Commerce Free Enterprise Bill, which just cleared the Senate Commerce Committee, and the Federal Aviation Administration Reauthorization Act of 2018, also awaiting a senate vote. These bills include tripling the funding of the FAA’s Office of Commercial Space Transportation by 2023, and annual boosts to the Office of Space Commerce of up to $5 million. Further, the administration’s innovative “Space Force” initiative will require new investments as well. Satellites will be right at the forefront of the Space Force agenda as our older, increasingly obsolete telecommunications infrastructure becomes vulnerable to attacks. It was all the way back in 2007, when China first used a ballistic missile to destroy its own old weather satellite orbiting 535 miles above Earth. Russia has been testing a missile that could be used to strike and destroy a satellite or ballistic missile. It’s likely that other nations won’t be far behind. A communications satellite that’s jammed from the ground could mean ground troops suddenly find themselves operating blindly. And because existing international treaties governing space are unclear, even civilian satellites could be targeted by nations looking to contain or punish their enemies. As far in the past as 2001, former Secretary of Defense Donald Rumsfeld concluded that the U.S. wasn’t prepared to defend its enormous dependence on satellites. A move toward satellite defense would likely benefit both rocket and satellite producers, due to the need for new satellite hardware and software that could resist cyber-attacks, as well as spacecraft that could intercept physical attacks from projectiles. Further, private companies would likely be better at handling this kind of transformation. The US Government Accountability Office recently released a report that the Department of Defense (DOD) may be able to save money and add capabilities faster by paying private companies to host government sensors or other equipment on their satellites. In fact, the DOD estimates it has already saved hundreds of millions of dollars from this cost-sharing approach. MRP added Long Aerospace and Defense to our list of themes on November 27, 2013. Since then, the iShares US Aerospace & Defense ETF has returned about 98% versus the S&P’s 56% over that same time period. We’ve also summarized the following articles related to this topic in the Transportation section of today’s report.

|

|

Chart: Aerospace (ITA) vs Iridium Communications (IRDM) vs Gilat Satellite Ntwks (GILT) vs S&P 500 (SPY) |

|

Other Disruptive Change

|

|

Joe Mac’s Market Viewpoint |

|

|

|

The U.S. capital markets had a challenging time in the first half of 2018. While the brouhaha about trade wars has been cited by experts as the cause of this year’s rise in volatility, MRP believes otherwise. Extended valuations, investor sentiment, portfolio leverage, an ageing bull market, inflation, and a Fed tightening cycle are all headwinds. In short, several large forces are at play and they will continue to pressure both equity and bond prices in the second half of this year. Joe Mac’s Market Viewpoint: U.S. Markets at Midyear →

Other Viewpoint Reports Joe Mac’s Market Viewpoint: CAPEX Booms! → Joe Mac’s Market Viewpoint: The Inflation Complication → |

|

Current MRP Themes |

|

|

|

|

|

Major Data Points |

|

|

|

1.

|

US Stocks Close Higher on Monday Wall Street closed in the green on Monday 6 August 2018, as tech stocks extended gains led by Apple and Facebook, offsetting the escalating trade war between China and the US. TE |

|

2. |

Oil Prices Rise on Monday Oil prices rose on Monday, after Saudi Arabia unexpectedly cut crude oil production by around 200,000 bpd in July and the US government decided to reimpose sanctions on Iran. In a statement, President Trump said “We urge all nations to take such steps to make clear that the Iranian regime faces a choice: either change its threatening, destabilizing behavior and reintegrate with the global economy, or continue down a path of economic isolation.” The US crude oil increased 1.3% to $69.91 a barrel and Brent crude went up 1% to $74.07 a barrel around 12:20 PM NY time. TE |

|

3.

|

Pound Hits 11-Month Low The British pound fell to an 11-month low of $1.2955 in early trading on Monday after UK international trade secretary Liam Fox said over the weekend that there is a “60-40” chance that there would be no trade agreement with the EU before March 2019. TE |

|

4. |

Turkish Lira Falls Further to Hit New Record Low The Turkish lira extended losses and hit another all-time low of 5.2036 against the US dollar on Monday after the Trump administration said it was reviewing Turkey’s duty-free access to the US market. Meanwhile, the country’s central bank cut the upper limit of banks’ reserve requirements to 40 percent from 45 percent in an attempt to support the currency, a move that would provide lenders with $2.2 billion of liquidity. TE |

|

Other Disruptive Change |

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html |

Leave a Reply