Keynote Speakers

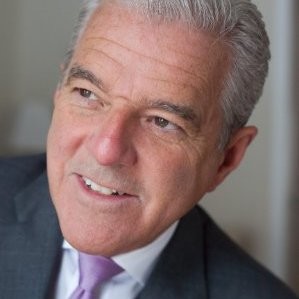

General Wesley K Clark (Ret.)

Founder

Renew America Together

View BioGeneral Wesley K. Clark (ret.) is a businessman, educator, writer and commentator.

General Clark serves as Chairman and CEO of Wesley K. Clark & Associates, a strategic consulting firm; Chairman and Founder of Enverra, Inc. a licensed investment bank; Chairman of Energy Security Partners, LLC; as well as numerous corporate boards including BNK Petroleum and Leagold Mining. He is active in energy, including oil and gas, biofuels, electric power and batteries, finance, and security. During his business career he has served as an advisory, consultant or board member of over ninety private and publicly traded companies. In the not-for-profit space, he is a Senior Fellow at UCLA's Burkle Center for International Relations, Director of the Atlantic Council; and Founding Chair of City Year Little Rock/North Little Rock. A best-selling author, General Clark has written four books and is a frequent contributor on TV and to newspapers.

Clark retired as a four star general after 38 years in the United States Army, having served in his last assignments as Commander of US Southern Command and then as Commander of US European Command/ Supreme Allied Commander, Europe. He graduated first in his class at West Point and completed degrees in Philosophy, Politics and Economics at Oxford University (B.A. and M.A.) as a Rhodes scholar. While serving in Vietnam, he commanded an infantry company in combat, where he was severely wounded and evacuated home on a stretcher. He later commanded at the battalion, brigade and division level, and served in a number of significant staff positions, including service as the Director, Strategic Plans and Policy (J-5). He was the principal author of both the US National Military Strategy and Joint Vision 2010, prescribing US warfighting for full-spectrum dominance. He also worked with Ambassador Richard Holbrooke in the Dayton Peace Process, where he helped write and negotiate significant portions of the 1995 Dayton Peace Agreement. In his final assignment as Supreme Allied Commander Europe he led NATO forces to victory in Operation Allied Force, a 78-day air campaign, backed by ground invasion planning and a diplomatic process, saving 1.5 million Albanians from ethnic cleansing.

His awards include the Presidential Medal of Freedom, Defense Distinguished Service Medal (five awards), Silver star, bronze star, purple heart, honorary knighthoods from the British and Dutch governments, and numerous other awards from other governments, including award of Commander of the Legion of Honor (France). He has also been awarded the Department of State Distinguished Service Award and numerous honorary doctorates and civilian honors.

Steve Kuhn

Founder

IDEAL Immigration

View BioSteve Kuhn is the founder of the IDEAL Immigration. Steve worked at some of the top financial firms and his career culminated as a hedge fund manager at Pine River Capital Management. He retired and dedicated his life to philanthropic pursuits. Steve serves on the board of the Immigrant Justice Corps and is involved with Water, Young Voices of Austin, the Andy Roddick Foundation.

Jeremy Robbins

Executive Director

New American Economy

View BioJeremy Robbins is the Executive Director of the New American Economy, a bipartisan coalition of more than 500 CEOs and mayors making the economic case for immigration reform. Jeremy previously worked as a policy advisor and special counsel in the Office of New York City Mayor Michael Bloomberg, a judicial law clerk on the United States Court of Appeals, a Robert L. Bernstein International Human Rights Fellow working on prisoners rights issues in Argentina, and a litigation associate at WilmerHale in Boston where he was part of the firm's team representing six Bosnian men detained at Guantanamo Bay, Cuba. Jeremy received a JD from Yale Law School and a BA in political science from Brown University.

Robert Smith

Entrepreneur

View BioRobert is a former Division 1 athlete turned serial entrepreneur. He created a proprietary algorithmic formula known as the “Influencer Model” centered around the macroeconomic effects influencers have in TET (Technology, Entertainment, and Trends). As the Founder & Managing Partner of IECP Ventures, he was the lead investor and fund manager playing an integral role in building a portfolio of over 80 digital media companies with notable exits including: InDMusic acquired by LiveNation, FameBit acquired by Google, Vessel acquired by Verizon, StarMaker acquired by Everyone Happy, HelloGiggles acquired by Time Inc., and Overdog acquired by Odd Networks. He is also the founder of Digima the first Impact focused Creative Agency and Venture Studio responsible for the creation and management of the NUE (Network of Untapped Entrepreneurs) Initiative.

His innovative Internet marketing concepts have led to identifying the most lucrative global niche markets in digital media. With extensive relationships in the world of sports and entertainment Robert has become a successful negotiation and brokerage liaison of key financial deals for numerous clients.

Mark Yusko

CEO and CIO

Morgan Creek Capital Management

View BioMark Yusko is the Founder, CEO and Chief Investment Officer of Morgan Creek Capital Management. Prior to forming Morgan Creek, Mr. Yusko was President, Chief Investment Officer and Founder of UNC Management Company, the Endowment investment office for the University of North Carolina at Chapel Hill, from 1998 to 2004. Throughout his tenure, he directly oversaw strategic and tactical asset allocation recommendations to the Investment Fund Board, investment manager selection, manager performance evaluation, spending policy management and performance reporting. Total assets under management were $1.5 billion ($1.2 billion in endowment assets and $300 million in working capital). Until 1998, Mr. Yusko was the Senior Investment Director for the University of Notre Dame Investment Office where he joined as the Assistant Investment Officer in October of 1993. He worked with the Chief Investment Officer in all aspects of Endowment Management. Mr. Yusko received his Bachelor of Science Degree, with Honors, in Biology and Chemistry from the University of Notre Dame and a Master of Business Administration in Accounting and Finance from the University of Chicago. Mr. Yusko is an Advisory Board member of a number of private capital partnerships and alternative investment programs and has served as a consultant on alternative investments to a select group of institutions. Mr. Yusko is an Investment Committee member of the MCNC Endowment, President and Chairman of the Investment Committee of The Hesburgh-Yusko Scholars Foundation at the University of Notre Dame, and President and Head of the Investment Committee of the Morgan Creek Foundation.

Featured Speakers

Thierry Adant

Director, Head of Illiquid Credit

Willis Towers Watson

View BioThierry is Head of Illiquid Credit at Willis Towers Watson.

In this role he is responsible for asset allocation and due diligence of investment opportunities for institutional investors globally.

Thierry is a member of the Investment Committee managing Willis Towers Watson's Alternative Credit Fund.

Thierry's experience includes six years as part of the research team in London were he led the securitized credit research effort. In 2015 he relocated to New York to expand the research effort in the US

Lionel Erdely

Head and Chief Investment Officer, Absolute Return Investments

Investcorp

View BioLionel Erdely is the Head and CIO of Alternative Investment Solutions at Investcorp, overseeing its diverse offerings in Hedge Fund Partnerships, Special Opportunity Portfolios, Alternative Risk Premia and Multi-manager Solutions. Under his leadership, the AIS platform has broadened its institutional investor base globally including large public pension plans, sovereign wealth funds, insurance companies, endowments and foundations and family offices. Mr. Erdely was instrumental in developing a dedicated cross asset research team and early adoption of Alternative Risk Premia as a key competency. Investcorp continues to specialize in Emerging Managers and has invested in more than 80 managers in the first year of their launch and 20 managers on Day 1 as a Strategic Partner. Mr. Erdely serves as a member of Investcorp's Operating Committee, the Financial and Risk Management Committee, and chairs the Investment Committees for Alternative Investment Solutions.

Prior to joining Investcorp in 2013, Mr. Erdely worked for 11 years at Lyxor Asset Management, where he held the dual position of Chief Investment Officer (2004 – 2013) and Chief Executive Officer of Lyxor Inc. (2009 – 2013). Prior to joining Lyxor, he was a Vice President in the Equity Corporate Finance department at Société Générale, where he worked on several IPOs, capital increases and convertible bond issues. Mr. Erdely holds an M.B.A. degree in Finance from the école Supérieure des Sciences économiques et Commerciales (ESSEC) in Paris.

Maura Harris

Director of Due Diligence

Bostwick Capital

View BioMaura Harris manages operational and vendor due diligence at Bostwick Capital, a fund of funds based in New York. In addition, Maura is an Advisor to Centrl, a next generation financial technology platform automating third party due diligence. Previously, Maura designed, implemented and managed a global operational due diligence program at the Permal Group, an institutional multi-strategy multi-manager investment firm (rebranded Entrust Global). Maura's experience in operational due diligence dates back to the early 2000s. Today, she strongly advocates for modernizing processes with technology in an effort to create efficiencies and seek validated risk opinions.

Over her 25+ year financial services industry career, Maura has worked at AITEC, GAM, Bank of America, Prudential and Scor.

Donald Koch

Managing Director

Howard Hughes Medical Institute

View BioMember of senior team managing HHMI's $18 billion endowment. Lead research on global markets and the Fund's asset allocation and overall risk profile. Vet all investments decisions and source managers and investment opportunities across all assets. Publish quarterly investment strategy reports for the Board of Trustees and present key findings. Manage, mentor and hire a team of analysts working across all asset classes to conduct macroeconomic research and help evaluate the attractiveness of new investment opportunities. Previously managed a $2 billion alternative asset portfolio of investments in hedge funds, opportunistic distressed strategies, real assets and related co-investments

Joshua Leonardi

Director

TD Prime Services

View BioJosh Leonardi is a Director and the Head of Capital Introduction at TD Securities LLC. Josh joined TD in May 2018 and is responsible for overseeing TD's Capital Introduction offering. Prior to joining TD, Josh was at Goldman, Sachs & Co. for 7 years where he first served as a Vice President and Assistant General Counsel for the Prime Services business before moving to Goldman's Capital Introduction team in 2015. Josh began his career at Fried Frank in 2006 where he was an associate in the firm's Asset Management practice and focused primarily on the structuring and representation of hedge funds and other alternative investment products. Josh received a B.B.A. in Finance from The George Washington University and his J.D. from New York Law School.

Joanne Lin

Principal

Newark Venture Partners

View BioJoanne joins NVP with a unique blend of experience including investment banking, private equity/venture capital and entrepreneurship. In her most recent role as an education investor with University Ventures, Joanne sourced, vetted and supported seed and growth stage investments in companies transforming the higher education space. She is also co-founder of a Newark-based social enterprise, called Locus Labs, aimed at expanding community access to digital manufacturing technology. Joanne was previously an investment banking Associate at JPMorgan, and a TeachForAmerica corps member in NYC. Joanne has a M. Ed from Hunter College and a BA in Economics from Barnard.

Donald Motschwiller

CEO

FNY Investment Advisors

View BioAs CEO, Donald develops and executes on business strategies and oversees all allocating and operations. Donald is responsible for creating and implementing the strategic vision of the firm.

Michael Pierog

Managing Director

Blackstone

View BioMichael Pierog is a Managing Director and Head of the Strategic Alliance Fund ("SAF") Group, Blackstone's hedge fund seeding business, for the Hedge Fund Solutions Group. Prior to joining the SAF Group, Mr. Pierog was head of Credit Strategies in BAAM, where he was involved in hedge fund manager evaluation, selection, and monitoring as well as structured and corporate credit investments.

Before joining Blackstone in 2013, Mr. Pierog was a Vice President in the Distressed and Special Situations group at Barclays Capital. Prior to working at Barclays, Mr. Pierog was an associate at Davidson Kempner Capital Management.

Mr. Pierog received a BA in Economics from Amherst College where he graduated cum laude and an MBA from the Wharton School of Business at the University of Pennsylvania.

James Rosebush

CEO

GrowthStrategy

View BioJames Rosebush is a widely recognized leader in building and managing corporate and philanthropic organizations and serving as the outsourced CEO and senior advisor for wealth families, and family offices. For over twenty years he has been CEO of an international consulting firm, GrowthStrategy, Inc. a company focused on management strategies, finance and wealth management, marketing, and communications, throughout the world.

He pioneered a holistic approach to organizational consulting which has resulted in measurable growth in earnings or assets under management for corporate clients. GrowthStrategy clients have included major international companies and startups such as JPMorgan, Mercedes-Benz, Tudor Investments, Bankers Trust, Bessemer Trust, McDonald's, Sapient, Cannon, Coca-Cola, The Carlyle Group, Stargazer Fund, GlobalBond Fund, Columbia Capital, Cisco Systems, Calibre, Northgate Capital, Medigo, Children's Hospital Los Angeles, Mitretek, and over 300 others.

Jackie Rosner

Managing Director

PAAMCO Prisma

View BioJackie Rosner is a Managing Director, joined the firm in 2013 and is a member of the Portfolio Management team, with a specific focus on global macro, relative value, managed futures, and quantitative strategies. Prior to joining, Jackie was a Managing Director, head of global macro and systematic trading strategies, and a member of the executive committee at Union Bancaire Privee Asset Management in New York. Prior to UBP, he was a proprietary trader at BNP Paribas in New York. Jackie has also been a portfolio manager at both Archeus Capital Management and Millennium Partners, and was a founding member of a proprietary trading desk in the fixed income department of Chase Manhattan Bank/J.P. Morgan. Jackie began his career at Salomon Brothers (Citibank) where he held various positions of increasing responsibility primarily focused on quant, trading, and fixed income strategies. He is on the advisory board for the MIT Sloan Department of Finance, volunteers as a master's thesis supervisor at the Department of Mathematics at NYU Courant, and guest lectures at Columbia University's Department of Financial Engineering. Jackie holds a BS in Economics, a BS in Management Science, and an MSc in Management from the Sloan School of Management at Massachusetts Institute of Technology. He also holds an MSc in Mathematical Finance from New York University and has earned the following designations: CFA, CAIA, CMT and FRM.

Richard Schimel

Co-Founder/Co-CIO

Cinctive Capital Management

View BioRichard Schimel is the co-founder and Co-CIO of Cinctive Capital Management. Rich has over 30 years of experience in the investment management industry. Previously Rich was Head of Aptigon Capital, a division of Citadel, where he served on the firm's Portfolio Committee. Rich founded Sterling Ridge Capital in 2013 and oversaw all firm activity, including management of the investment portfolio. Rich co-founded Diamondback Capital with Larry Sapanski in 2005. He co-managed the firm as well as portions of the firm's best ideas portfolio. Prior to Diamondback, Rich began his buy-side career at SAC Capital where he was a portfolio manager from 2000 to 2005. Rich began his career in fixed income at PaineWebber in 1990. Rich graduated from the University of Michigan with a B.A. in Economics. Rich serves as President of "A Little Hope", a nonprofit focused on childhood grief counseling and bereavement support.

Chris Solarz

Managing Director

Cliffwater LLC

View BioChris is a Managing Director at Cliffwater LLC covering global macro and relative value strategies on the hedge fund research team. Prior to joining Cliffwater in 2011, Chris was a Senior Analyst at SAIL Advisors, where he focused on manager selection and due diligence as Head of Research for tactical trading and relative value strategies. Previous experience includes working for ING Investment Management, Antarctica Asset Management, Societe Generale Barr Devlin, and CIBC World Markets.

He earned a BA in Economics and Anthropology from the University of Pennsylvania and a MComm in Finance from the University of New South Wales, where he was a Federation Scholar. Chris is a Certified Public Accountant, holds the Chartered Alternative Investment Analyst designation, the Chartered Financial Analyst designation, and is a member of the New York Society of Security Analysts.Chris has broken 9 Guinness World Records, and has run marathons on all 7 continents and in all 50 US states.

Lisa Vioni

CEO

Hedge Connection

View BioLisa is Hedge Connection's CEO and founding partner. Lisa's vision for the company stems from her extensive experience in marketing alternative investments and institutional sales.

Before founding Hedge Connection in 2005, Lisa served as Director of Marketing at Ellington Management Group and previously at Singleterry & Company. At both firms, Lisa oversaw all aspects of client relationships including raising money, organizing company events, developing marketing strategy and client servicing.

Prior to her career in hedge fund marketing, Lisa was on the sell side, rising to Senior Vice President in Mortgage Backed Securities-Institutional Sales at Lehman Brothers Securities.

Outside of the financial industry, Lisa has produced three Broadway shows including Long Day's Journey Into Night for which she won a Tony Award.

Lisa earned a B.A. in French Studies with a minor in Economics from Smith College. She currently holds a Series 65 license.

Mithra Warrier

Managing Director

TD Prime Services

View BioMithra Warrier joined TD Securities in November 2017 and is Managing Director, US Head of Prime Brokerage Sales. Her responsibilities cover the client facing activities of TD Prime Services, which include origination, client service, and capital introduction.

Prior to joining TD, Mithra was at Barclays, where she held several roles in prime brokerage including origination sales, hedge fund financing, and Head of Client Service.

Mithra joined Barclays through the acquisition of Lehman Brothers in 2008. At Lehman Brothers, Mithra was a member of the repo desk and held both sales and trading roles.

Mithra is a member of TD Securities Women in Leadership and Minorities in Leadership. Mithra graduated from Northwestern University in 2002 with a Bachelor of Arts In Economics.

Sherry Witter

Managing Partner, Co-Founder, and CIO

Witter Family Offices

View BioSherry Pryor Witter is the Managing Partner, Co-Founder and Chief Investment Officer of the Witter (Dean Witter) Family Offices, headquartered in New York City. She is responsible for overseeing all aspects of investing and operating activities. Sherry has managed assets for over two decades and has a strong commitment to developing and incubating new and unexploited trading strategies. As a Family Office, the Witters' assets are invested in real estate, private equity, venture opportunities, art, fine musical instruments, and hedge funds.

Through Sherry's management, she has multiplied her family's net worth four-fold and the performance has largely been derived from her hedge fund investments. As a strategy, Sherry deploys a venture approach to hedge fund investing and continues to be the early partner, sometimes the seeder of small and emerging hedge fund managers. Since 2011, Sherry has seeded or early invested in over one hundred hedge funds/trading strategies. She continues to add to her stable of traders which includes a diversified set of liquid strategies that encompass crypto arbitrage, CTAs, event driven, equity long/short, directional, commodities, among others.

On the private side, Sherry continues to be the lead and/or co-investor direct to companies and in funds. Prior to forming the Witter Family Offices with her husband Michael D. Witter in 2011, Sherry started her first hedge fund in 1998 and has since launched seven opportunistic liquid funds where she continues to be a General Partner. These strategies are designed to only manage the assets of the GPs, Sherry and her husband, Michael D. Witter.

Sherry began her career at Lazard Frères followed by ESL Investments, Sherry went to the University of Pennsylvania, the Wharton Undergraduate School and The Juilliard School, Pre-College Division. She was born in New York City and continues to reside in New York with her husband and two sons.

Featured Participants

David Abramson

Partner/Head of Talent Acquisition

FNY Investment Advisers

View BioI grew up in the Insurance business running an Independent Property and Casualty Brokerage. In 1998 I joined First New York as a trading assistant for one of the partners working within their Domestic Equity Group. I then transitioned to running my own long/short equity portfolio focusing on the Insurance Industry in the middle of 1999. I moved from First New York to Carlin Financial Group and then the Royal Bank of Canada functioning as the COO and Managing Director of a few different proprietary trading broker dealers. In June 2014, I returned to FNY to work the management team on building a robust allocation platform in a very entrepreneurial fashion.

I am from Monticello, NY but currently live in Demarest NJ. I graduated from Syracuse University and I am married with three children.

Chris Antonio

Founder & CIO

Dipsea Capital

View BioChristopher Antonio began his career on the Pacific Stock Exchange in 1985. He later co-managed the listed securities business for Paine Webber on the PSE, before departing in 1995 to start his own firm and manage client monies. He established the current Investment Management Company, Dipsea Capital, LLC in 2007. From 1995 through present, his clients have not ever withstood a negative return year. Mr. Antonio has a Bachelor's Degree from the University of California at Davis in Biological Sciences.

Kirsten Bay

CEO

Cysurance

View BioKirsten Bay brings over 25 years of experience in risk intelligence, information management, and policy expertise across a variety of sectors. In the last 6 years, Kirsten has been the CEO of big data and cyber security companies, leading the strategy and development of next generation analytics and attack detection technologies.

Throughout her career, Kirsten has been appointed to congressional committees developing cyber policies, initiatives and recommendations for the intelligence community and held executive roles at Cyber adapt, Attensity Group, and iSIGHT Partners.

Milton Berg

CEO/Chief Investment Strategist

MB Advisors

View BioMilton Berg, CFA, is the CEO and Chief Investment Strategist of MB Advisors, LLC. He has worked in the financial services industry since 1978, with an extensive background in various roles on the buy side. Milton founded MB Advisors in 2012 to address a need for high-quality independent research with a macro, technical and historical focus.

Milton began his career as a Commodities Analyst and Trader at Swiss-based Erlanger and Company. In 1980, he was a Fund Manager at First Investors Corp. and managed a natural resource fund as well as an option writing fund. In 1984, he moved to Oppenheimer and managed three mutual funds which were each ranked as the top performer over a five-year period by Lipper. Milton then became a Partner at Steinhardt, one of the earliest hedge funds on Wall Street. More recently, he has worked with well-known titans of the hedge fund world including Michael Steinhardt, George Soros, and Stanley Druckenmiller (Duquesne).

Milton's work has been featured in the Wall Street Journal, New York Times, Barron's, and Institutional Investor, in addition to other media outlets. His groundbreaking report “The Boundaries of Technical Analysis” was published in the summer of 2008 in the MTA's Journal of Technical Analysis. His 2015 research report “Approach to the Markets” outlines his method for analyzing the stock market.

Milton has held a Chartered Financial Analyst designation since 1979. The Institute for Economic Research named Milton as the Mutual Fund Manager of the Year in 1987 given his performance during the crash. That same year, Milton was jointly named with Stanley Druckenmiller as Mutual Fund Manager of the Year by Sylvia Porter's Personal Finance Magazine.

Lawrence Chiarello

Portfolio Manager

SkyView Investment Advisors

View BioLarry is a co-founder of SkyView Investment advisors and his career spanned a number of milestones within the financial industry.At Riverview Investment Advisors, Larry focused on manager research and helped grow assets under management in excess of $2 billion internationally. He also served as a risk manager for BPV Capital as AUM grew from under $200m to over $2 billion.Larry's career at Soros Fund Management spanned over 16 years where he built the performance and risk analytics group. He also expanded the outside manager (i.e. satellite) network to over $4 billion. While at Soros assets under management grew from under $400 million to over $25 billion.While at Drexel Burnham, Larry was a member of the Los Angeles based High Yield & Convertible Bond Group headed by Michael Milken. Larry frequently speaks and contributes to various venues within the alternative asset industry. He has met with hundreds of managers during his career. He is an active community member and devotes his time to expanding access to the arts.

Alison Gerlach

Managing Partner

Breakthrough Ventures

View BioAlison Gerlach has over 20 years of experience as a seasoned executive, serial entrepreneur, strategic management consultant, investor, and lecturer with expertise in, and a passion for, building businesses. Ms. Gerlach has done extensive research in optimizing the business start-up and funding process and has founded and built businesses in a variety of industries. Prior to her entrepreneurial endeavors, she was a strategic management consultant with Booz, Allen & Hamilton working with Fortune 100 media and consumer companies.

Today, Today, Ms. Gerlach continues to build and invest in high growth companies as the Founder and Managing Partner of Breakthrough Ventures. She sits on the board of private equity funds as well as select early stage ventures. She is the host of the popular podcast, "The Unapologetic Capitalist" which focuses on building value in ventures at any stage.

Ms. Gerlach is also an active academic. She served on faculty at Cornell University as the Entrepreneur in Residence. In addition, she has taught courses in the Management department at San Diego State University in Business Plan Writing and Strategic Management. She is a frequent guest lecturer at top universities around the country on Entrepreneurship, Leadership, Negotiation, and Conflict Management.

Ms. Gerlach graduated at the top of her class from the MIT Sloan School of Management earning an MBA with focus on New Venture Development and Systems Optimization. She earned her BA in economics and mathematics from Cornell University.

Alkesh Gianchandani

Head of Investor Relations North America

Lombard Odier Investment Managers

View BioAlkesh Gianchandani is the head of Investor Relations for North America for Lombard Odier Investment Managers. Lombard Odier Investment Managers (LOIM) has more than 50 years of experience managing institutional assets, with over USD 48 billion under management. The LOIM 1798 Alternatives business provides clients with strategies leveraging differentiated, capacity-constrained, focused expertise with the resources of a global investment firm. The portfolio managers benefit from the robust infrastructure, support, and collaborative environment provided by the 1798 Alternatives business, while managing their differentiated strategies in an autonomous manner. The 1798 strategies of LOIM aim to provide a source of solutions with varied risk/return profiles dependent on the needs of the investor.

Prior to LOIM, Alkesh was a Senior Member of the Institutional Sales team and a Lead Product Expert in the Hedge Fund and Alternative Risk Premia business at Deutsche Bank. Prior to Deutsche Bank, Alkesh held senior marketing roles at private equity and hedge funds, focusing on distribution efforts exclusively to Institutional Investors. Alkesh started his Alternatives career by building out the hedge fund business at RiskMetrics Group (now MSCI) and spearheading the work on the HedgePlatform risk transparency reporting services. After RiskMetrics, Alkesh headed up Institutional Sales at Robeco Asset Management and Monsoon Capital. Alkesh is a graduate of New York University (MBA) and Lehigh University (BS).

Abhi Kane

Director, Senior Investment Analyst

SkyBridge Capital

View BioAbhi Kane is a Director and Senior Investment Analyst at SkyBridge Capital. His responsibilities include Manager Sourcing, Investment Research, and Due Diligence for a variety of hedge fund strategies. Prior to this, Mr. Kane performed similar functions for the Hedge Fund Management Group at Citigroup Alternative Investments (CAI). Prior to joining CAI in 2003, Mr. Kane ran a software consulting company specializing in building complex analytical, trading, and portfolio management systems for American International Group, Bank One, Government Securities Clearing Corporation and Citigroup Asset Management.

Mr. Kane received an M.B.A. in Finance from NYU Stern School of Business in 2001 and B.E. in Computer Engineering (with Distinction) from PICT, Pune in 1993. He is also a CAIA charterholder.

Jason Kliewer

Partner & Chief Investment Officer

Trumark Companies

View BioMr. Kliewer is a partner and Chief Investment Officer for Trumark Companies, and serves on its Board of Directors. He was instrumental in the launch of Trumark Investments and continues to be responsible for all aspects of operations. Mr. Kliewer brings a deep background in real estate acquisitions, financing and neighborhood design developed over the past two decades at Trumark Companies. He became president of Trumark Companies in June 2002 after four successful years of running the company's land acquisitions as vice president. Prior to joining Trumark, Mr. Kliewer worked at the law firm of Luce, Forward, Hamilton & Scripps LLP in San Diego. Mr. Kliewer received a J.D. degree from Pepperdine University School of Law where he was a member of the Pepperdine Law Review. Additionally, he received his B.A. degree from the University of California, Los Angeles.

Joseph Marren

President & CEO

KStone Partners

View BioJoseph H. Marren is the President, Chief Executive Officer and Chief Compliance Officer of KStone Partners LLC. He is a member of its Investment Committee and leads the firm’s marketing efforts.

Joe spent the twenty-three years prior to starting KStone in investment banking primarily as head of the business development function in the merger and acquisition departments at a number of leading Wall Street firms including Sagent Advisors, Citigroup, Credit-Suisse, Donaldson, Lufkin & Jenrette, The Bridgeford Group, Prudential Securities and Kidder Peabody & Co. He specialized in identifying attractive investment opportunities for corporations, financial sponsors and entrepreneurs as well as assisting in the execution of transactions. Before moving to Wall Street in 1985, he worked for American Maize-Products Company, a diversified conglomerate. Mr. Marren began his career in 1976 at Price Waterhouse & Co.

He is the author of two books "Mergers & Acquisitions: A Valuation Handbook" and "Mergers & Acquisitions: Will You Overpay?", taught M&A for several years as an Adjunct Professor at NYU Stern School of Business and has guest lectured at Fordham Law, Columbia Law and Columbia Business School. He received a BBA from the College of William & Mary, a JD from Fordham University School of Law and an MBA from NYU Stern School of Business.

In 2017, Mr. Marren joined the advisory Board of IBP Institute, which has developed the investment banking professional credential.

Lee Meddin

President & CIO

Sagacious Capital

View BioHighlights

Former World Bank/IFC Deputy Treasurer & Global Head of Structured Products; completed financial transactions across 60+ countries Private sector derivatives trader, structured and traded across asset classes

* Career highlighted by positions across numerous countries in the US, Europe and Asia

Notable

Received numerous financial press accolades, inclusive of twice being cited as one of the "100 Most Influential People in Finance" by Treasury & Risk Management. Extensive publication of research featuring structured products in emerging markets

Education

* MBA, University of Michigan, 1993; BSE, Mechanical Engineering, Tulane University, 1989

Lawrence Newhook

President & CEO

Alpha Innovations Ltd. & Laureate Digital Securities Ltd.

View BioLawrence Newhook is a veteran investment professional with a 20+ year track record investing globally across all asset classes. He has built successful investment and hedge fund portfolios for the pension, family office, and high net worth investor communities, with a particular focus on identifying and extracting sources of alpha from both public and private markets. Mr. Newhook serves as the President & CEO of Alpha Innovations, where he oversees all facets of the business, including product innovation, alpha identification, and risk management. Lawrence also leads Laureate Digital Securities, a cutting edge technology firm that is creating an institutional blockchain platform of investment funds.

Prior to launching Alpha Innovations and Laureate Digital Securities, Lawrence was a member of the management team at Point72 Asset Management LP for twelve years, where he managed the team responsible for the firm's external investments in hedge funds, private equity, venture capital and real estate. His team was also responsible for evaluating all discretionary and quantitative PMs, analysts and traders to ensure the standard of only hiring best in class investment talent. Earlier in his career, Mr. Newhook was the Portfolio Manager of Alternative Strategies for OMERS, one of the largest Canadian pension plans, where he designed, developed, and managed its hedge fund and active currency programs. Prior to this, he traded international OTC and listed derivatives and cash markets, and helped manage global derivatives and FX portfolios for both the pension fund and large banks.

Mr. Newhook holds a Masters degree in Financial Economics from the University of London and is a CFA Charterholder.

Jessica Nicosia

Vice President

Wilshire Associates

View BioJessica Nicosia has worked in the alternatives space for 15+ years, and is currently a Vice-President with Wilshire Associates, where she assists in developing Wilshire's robust alternatives offering, supporting the firm's efforts to identify and provide customized alternative investment solutions to financial intermediaries and institutions globally. Nicosia brings to Wilshire 15 years of experience in the alternative investment industry. Prior to joining Wilshire Associates, she held roles with a focus on marketing quantitative hedge funds at R. G. Niederhoffer Capital Management, Vegasoul and J. E. Moody & Company.

Valerie Novakoff

Founder

Broadway Women's Fund

View BioValerie Novakoff is the founder of the Broadway Women's Fund, a private equity fund that invests in women-led Broadway shows. She is a commercial theater producer and manager of investor relations at Davenport Theatrical Enterprises, a Tony Award-winning producing office and Broadway's first Inc. 5000 company, where she has overseen over $20 million in Broadway investments to date. She previously worked for 321 Theatrical Management (Wicked, Fun Home), Tony Award-winning producer Orin Wolf (The Band's Visit), Tony Award-winning director Des McAnuff (Jersey Boys, Tommy), and The Drama League. Her studies on gender parity on Broadway have been referenced in Fast Company and the New York Times.

David Scalzo

Founder and Managing Partner

Kirenaga Partners

View BioDavid co-founded and served as CFO for AdvisorEngine Inc, and now sits on its Board of Directors. In addition, he has 20+ years experience initiating, growing and managing businesses; having served as COO for the Securities Client Management Team at Credit Suisse, as Head of Investor Services and Client Services at Citadel Solutions, as a Managing Director at Bear Stearns in charge of Strategy and Business Development for the Global Clearing Services Division, and as Director of Operations for Precision Plating Company in Chicago.

David serves on the Board for the Northwestern University Wildcat Athletic Venture Enterprise (NU/WAVE) investment fund, as well as numerous former and current portfolio companies.

David graduated with a BS in Mechanical Engineering from Northwestern University, a Masters in Manufacturing Engineering from the Illinois Institute of Technology, a Masters in Engineering Management from Northwestern University, and a Masters in Business Administration from the Kellogg School of Management at Northwestern University.

Ken Shewer

Founder

KAS Holdings

View BioKen Shewer is the Founder of KAS Holdings a multifaceted family holding company. Through KAS Holdings he became a Founder and Managing Member of Inception Point and a Founder of AIKAS Partners. In addition he was a Founding Partner of The Kenmar Group.

Inception Point was formed in 2017 to seed and accelerate hedge fund managers. Through Inception Point Ken and his partners are looking to invest in and help grow the next generation of asset management firms.

AIKAS Partners was created in 2016 to invest in and advise on strategy for start up FinTech companies.

The Kenmar Group started in 1983. At Kenmar he built and acquired numerous hedge fund businesses.

Ken, on behalf of the companies which he was/is a partner, has invested billions of dollars with asset managers and financial technology companies globally, many of whom he backed on day one or early in their careers.

Ken has managed large teams dedicated to research and due diligence. He has overseen the risk and operational soundness of both the investors, investments and their investment vehicles. He has structured and operated investments around the globe in multiple jurisdictions to suit investors' needs.

Prior to forming The Kenmar Group, Ken worked in the international commodities trade as a Vice President and Director of Pasternak, Baum and Co, where he was responsible for the merchandising of grains to importers and exporters around the world.

Ken has participated in various charitable causes as a board member and contributor throughout his career. He graduated from Syracuse University with a BS degree.

Alan Snyder

Managing Partner

Shinnecock Partners

View BioAlan is the Founder and Managing Partner of Shinnecock Partners. Alan was the Founder, CEO, President, and Chairman of the Board of Answer Financial Inc. and Insurance Answer Center, CEO of Aurora National Life Assurance, President/COO of First Executive Corporation and Executive Vice President and Board Member at Dean Witter Financial Services Group (predecessor to Morgan Stanley), where he formulated the launch of the Discover Card as a member of a three-person team. He is also the former Chairman, President and Board Member of the Western Los Angeles Boy Scout Council. Alan is a graduate of Georgetown University and Harvard Business School, where he was a Baker Scholar.

Jeffrey Spotts

Principal

Prophecy Asset Management, LLC

View BioJeffrey Spotts, CMT has 27 years of professional experience providing portfolio management services to institutions and high-net-worth clients. He launched the firm in 2001, with a single strategy, technical trading fund focused on equities. Mr. Spotts has managed a first-loss capital allocation since 2000.

Prior to Prophecy, Mr. Spotts worked at Merrill Lynch from 1989 to 2001. During his tenure, he worked in various areas of the firm, including origination, research and asset management. He lead a portfolio management team with $500 million of AUM. He also managed a discretionary hedged product from 1999-2001 at Merrill Lynch, and from 2001 to present at Prophecy.

Mr. Spotts is published on trading strategies. He graduated in 1989 from the Pennsylvania State University with a Bachelor of Science in Business Administration.

Susanne Wei

Vice President

Cliffwater LLC

View BioSusanne Wei is a Vice President of Cliffwater LLC and a member of the hedge fund research team. Susanne is responsible for manager selection and due diligence on Global Macro, Managed Futures, and Market Neutral strategies. Prior to joining Cliffwater, Susanne was a research analyst at Bank of America Merrill Lynch, where she was responsible for manager due diligence for the hedge fund platform.

She earned a BS in Business Administration with a concentration in Finance from Boston College. Susanne holds the Chartered Financial Analyst designation.

Hedge Connection has been producing investor introduction events since 2003. Over this time we have forged strong relationships with many family offices and institutional investors. Thousands of investors and fund managers have participated in our events in the New York area, San Francisco and Chicago.

Contact us if you would like to know more about our registered participants.

Sample hedge fund strategies

- Asset Based Lending (ABL)

- CMBS

- Convertible Arbitrage

- Credit Arbitrage

- Cryptocurrencies

- CTA/Managed Futures

- Currency

- Distressed

- Emerging Markets

- Environmental

- Fund of Funds

- Global Macro

- Long/Short Fixed Income

- Long/Short Equity

- Merger Arbitrage

- Mortgage Backed Securities (MBS)

- Multi-Strategy

- Precious Metals

- Private Equity

- Sector Specific

- Short Equity

- Special Situations

- Structured Finance

- Venture Capital

Sample of previous investor participants

- Absolute Developments (Private) Ltd.

- AC Investment Management

- Accelerate

- Access Capital

- Access Industries

- AI International

- Alan M. Gold Development Co., Inc

- Alchemy Ventures, Inc.

- Allard Investment

- Alternative Asset Managers

- Alterra

- Althea Group LLC

- American Optical Foundation

- Ameriprise

- AMG Capital Group

- Amundi Investment Solutions Americas LLC

- ARCAP Partners LLC

- ARIS Capital

- Arlon Group

- Arsenal Investimentos

- Ascendant Capital Partners

- Asset Alliance Corporation

- Atlantic Trust

- Aurum Capital Partners, S.A.

- Axis Capital

- Banco ABC Brasil SA

- Banco BPI

- Banque Privee Edmond De Rothschild

- Barclays Capital

- Bard Associates

- Bedrock Advisors LLC

- Beninvest & Associates

- Bentley Associates L.P.

- Black Swan Advisors

- Blacktree Capital Management

- Blantyre Advisors, LLC

- Carnegie Management Group LLC

- Charles Schwab

- Citi Private Bank

- CMH Wealth Management

- Cogo Wolf Asset Management, LLC

- Commerz International Associates, LLC

- Contego Capital Partners

- Core Capital Management

- Cowen and Company

- CPP Investment Board

- Credit Suisse Asset Management Division

- Cypress Advisory Services, Ltd, LLP

- Desjardins Asset Management

- DIAM USA Inc.

- Discovery Capital

- Diversified Portfolio Strategies, LLC

- Doyle Fund Management

- Eagle Rock Diversified Fund

- Edge Portfolio Management

- EDS Pension Trustee Limited

- EFG Bank & Trust (Bahamas) Ltd.

- Emerald Strategies LLC

- Emerging Star Capital, LLC

- Endevon Capital LLC

- Executive Monetary Management (EMM)

- Family Office Advisor

- Fiduciary Trust International

- Focus Investment Group

- FQS

- FRM

- Galileo Investment Management

- Generali USA

- GL Funds AG

- Gregoire Capital

- Guggenheim Capital Markets

- Harbourton Enterprises

- HedgeMark Institutional Consultants, LLC

- Hennessee Group

- Hollencrest Capital Management

- Hull Capital

- Hunt Investment Company

- IBM

- Inflection Management

- ING Alternative Asset Management

- Investcorp

- Joslin Capital Advisors

- JPMorgan Alternative Asset Management

- K2 Advisors

- Kenmar

- Kilowatt Capital, LLC

- Kovacs family

- Krusen Capital Management, LLC

- Lake Partners, Inc.

- Larch Lane Advisors

- Lasair Capital LLC

- Lazard Asset Management

- Los Angeles Water & Power Employees' Retirement Plan

- M.D. Sass Investors Services

- Maihar Capital

- Mariner Investment Group

- Massey, Quick & Co., LLC

- MayerCap LLC

- MB Advisors - A Montrose/Belmont JV

- MDE Group

- Merrill Lynch Alternative Investments

- Metcircle Networking LLC

- Millennium Partners

- Miller Chaffin, LLC

- MIO Partners

- Montcalm Partners

- Morgan Creek Capital Management

- Morgan Stanley

- Muirfield Capital Management

- National Bancorp

- New Finance Capital LLC

- Nikko Alternative Asset Management

- Nomura Funds Research and Technologies America

- Northern Trust

- NYS Insurance

- Oceania Capital Partners

- Oppenheimer & Co.

- Paradigm Consulting Services, LLC

- Paradigm Global Advisors

- Parker Global Strategies, LLC

- Persistent Asset Management

- Persistent Edge

- Pickwick Capital Partners

- Pitcairn Financial Group

- Platinum Management LLC

- Proctor Investment Managers LLC

- Rock Maple Funds

- RoundTable Financial Group, LLC

- Safra Asset Managment

- Sands Brothers Asset Management

- Schonfeld Group

- Schultz Financial Group Inc.

- Scotia Capital

- SCS Asset Management

- Select Advisors LLC

- SFG Asset Advisors

- Sinclair Capital LLC

- Skybridge Capital

- SkyView Investment Advisors

- Societe Generale

- Spouting Rock Financial Partners

- St. Esprit Asset Management

- Stanley Goldstein & Co

- Starlight Investments, LLC

- Stern Investment Advisors

- Storebrand

- Summit Financial Resources

- Summit Private Investments, Inc

- Swisscanto

- TAG Associates, LLC

- Tennessee Valley Authority

- The Juilliard School

- The LongChamp Group

- Thomas H. Lee Capital

- Torshen Capital Management

- Treesdale Partners, LLC

- UBS

- UN Consulting

- Unicorn Advisory Group

- Valira Asset Management

- Veda Asset management

- Wedge Alternatives

- Wells Fargo Advisors

- Wilshire Investment

- WR Capital Management LP

- Zdenek Financial Planning, LLC