We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

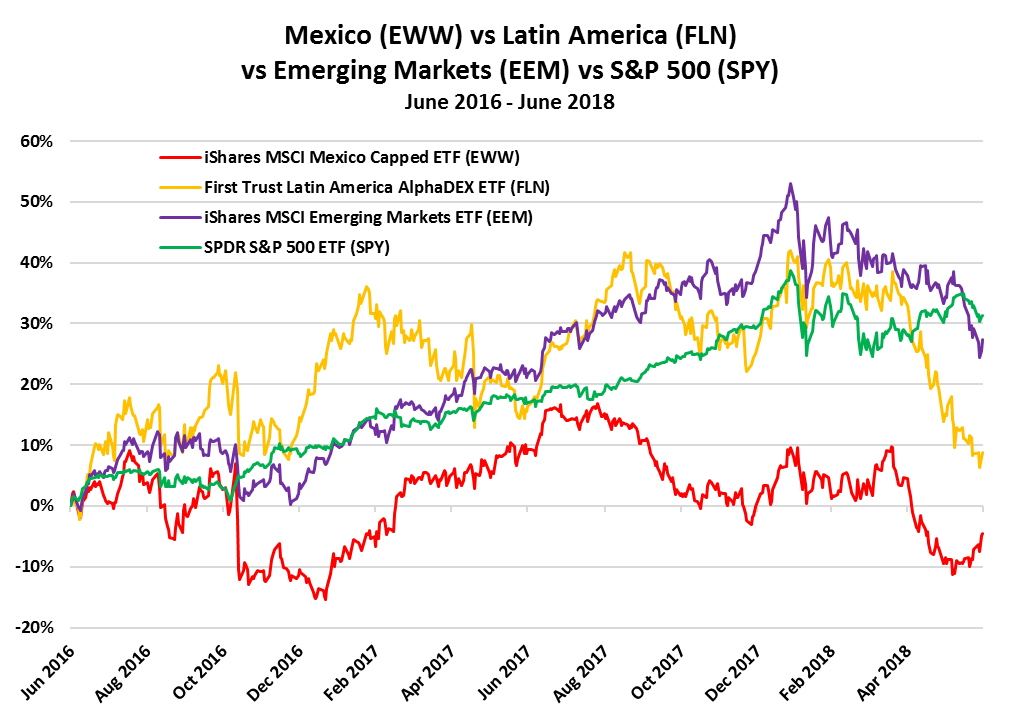

Today’s Featured Topic Mexico’s President-Elect Wins Sweeping Mandate to Reshape the Country SUMMARY: Seismic changes lie ahead for Mexico with the election of Andrés Manuel López Obrador as the country’s next president. Whether the Mexican economy under AMLO goes the way of Venezuela under Hugo Chavez or Brazil in the initial years of Lula’s presidency remains to be seen. Two areas that will surely be disrupted are energy and trade. Yesterday, Mexicans voted resoundingly against the establishment by electing left-wing populist Andrés Manuel López Obrador (“AMLO”) as their next president. He will be sworn into office on December 1, 2018. This was the largest election in Mexico’s history, with some 3,400 federal, state and local races contested in all, so there will be changes at the federal, regional and local level. ALMO’s victory is a political earthquake in a country where almost all voters alive today have never been governed by a president who was not either from the PRI or PAN, the two parties that have dominated Mexican politics for the past 89 years. Moreover, he could become Mexico’s strongest president in more than 30 years if it turns out that his MORENA party has captured a majority in both houses. Just like with the Macron election in France last year, the majority would give AMLO enough power to push through his plans with little interference. CURRENT CONDITIONS Until the 1980s, Mexico was an inward-looking state ruled by a single party. Then, subsequent presidents undertook some transformative initiatives such as joining the global trade regime, privatizing state enterprises, creating the framework for transparent competitive elections, and other market-friendly measures that opened up Mexico’s economy and markets to the world. Those changes lifted Mexico from an economy dependent on oil exports to a manufacturing powerhouse with a rising middle class. But the country’s improved prosperity has not benefited everyone equally, and economic growth has been modest. GDP has expanded at a tepid annualized rate of 2.5% over the past six years, inflation-adjusted wages have been stagnant, and the poverty rate has risen from 32% in 2006 to 39% last year. Foreign direct investment dropped from $3.9 billion in 2012 to about 500 million in 2017. And, because of rampant corruption, Mexico is now ranked 135th out of 180 countries in the corruption perception index of Transparency International, worse than Sierra Leone and alongside Russia and Paraguay. At the same time, Mexico’s crime rate has spiraled out of control, leading some firms to pull out of the most affected areas. In May alone, nearly 2,900 people were murdered — roughly 4 victims per hour. There have been 13,298 registered homicides YTD, a 21% spike on the same period last year, and over 200,000 lives have been claimed by violence since 2007. The mere act of running for local office has been a death sentence for many. Since campaigning began in September 2017, over 130 political candidates have been killed, most commonly due to their unwillingness to comply with Mexico’s powerful drug cartels. AMLO has vowed to tackle the poverty, violence, and corruption and to give more attention to the domestic economy. Some of his stated plans, such as building oil refineries and trying to achieve food self-sufficiency, signal a bigger economic role for the state going forward. ECONOMIC POLICY AMLO avers that he would lead a market-friendly government — without tax increases, new taxes or an increase in public debt — respect the independence of the central bank, and maintain the free-floating peso. During his tenure as Mayor of Mexico City from 2000 to 2005, he acquired a reputation as an economic pragmatist and fiscal hawk. His proposals to fight poverty center on increased social spending and public investment, including a public-works program to employ 2.3 million young people, a plan to double the retirement pensions of the elderly, guaranteed food prices for small farmers, and subsidized gasoline prices. AMLO intends to pay for all this, not by raising taxes, but with the $25 billion a year he will purportedly get by ending corruption, and $20 billion more a year he will save through an austerity plan. He aims to balance the budget in three years by scrapping government employee perks, ending inefficient social programs, and halving civil servants’ pay. The estimated cost of these projects is about 2.5% of GDP. Expectations of success are mixed, but most economists are skeptical the sums add up, given that Mexico already runs a budget deficit that’s about 2.5% of GDP. Rafael Elias, an analyst at emerging markets investment bank Exotix, suspects “finances would be much less orthodox, public spending would balloon, current account would deteriorate, and perhaps we could even see a ratings downgrade as public finances worsen.” This scenario would lead to a weaker currency, falling FDI, capital flight and perhaps a recession. In other words, AMLO will likely face a choice between scaling back his promises or taking on debt, possibly damaging Mexico’s hard-won financial stability. Not everyone is pessimistic. These optimists believe AMLO will transition from a redistributive candidate to a staunchly middle-class president who will soften his leftist stance. They draw parallels between him and Luiz Inácio Lula da Silva (“Lula”), Brazil’s former president. Lula too had radical leftist views prior to election, but reversed policies once in office, and ended up presiding over a business-friendly economic boom, albeit a short-lived one. But, skeptics point to differences between AMLO’s and Lula’s business experiences and philosophies that would suggest otherwise. Whether Mexico ends up going the way of Venezuela under Hugo Chavez or Brazil in the initial years of Lula’s presidency remains to be seen. Two areas that will surely be disrupted under AMLO are energy and trade. OIL For decades AMLO has described Mexican oil reserves as the property of “the people,” meaning the government. He has also said that Mexico will have an “open door” for private investment in everything except energy. It is therefore highly likely that he will roll back energy reform. The oil tenders that began under Peña Nieto will be paused while more than 100 contracts are examined. Oil companies have so far put $4bn on the table, with as much as $200bn of investment to follow. But, this will probably be put on hold as well. The net effect will be less Mexican oil flowing into global markets. AMLO has also suggested that Mexico should re-build its oil refining capacity, a proposition unlikely to find private sector support. TRADE AMLO maintains that he will continue negotiations to revamp NAFTA. He is expected to take a hardline position in areas like agriculture and manufacturing to gain credibility with his base, and has expressed a willingness to walk away from the talks if he feels Trump has gone too far. If that happens, he would have to quickly secure new partners, as trade agreements are a big reason for Mexico’s success. Notably, 81% of Mexico’s exports went to the United States last year. If NAFTA was torn up, Oxford Economics estimates that Mexico’s GDP would lose 4 percentage points by 2022 and fall into a technical recession by mid-2019. The Mexican peso would fall further to around 23 to 25 per dollar from its current value of 19.72 pesos per USD. Mexico, with a GDP of $1.1 trillion, is Latin America’s second largest economy and the 15th largest in the world in nominal terms. The country has enjoyed an unprecedented period of macroeconomic stability, which has reduced inflation and interest rates to record lows and has increased per capita income. With this disruptive election result, the BIG question is whether the nation’s transformation into a modern, advanced democracy can withstand a six-year term under a leftwing government. Investors can take a bit of comfort in the fact that major economic reforms would have to be preceded by congressional votes or referendums. That would give market participants some time to evaluate their options before the grounds shifts further underneath them. Investors can gain exposure to Mexico’s equity markets via the iShares MSCI Mexico Capped ETF (EWW). The ETF has underperformed the S&P 500 (SPY) by 12 percentage points since MRP’s April 2 DIBs report titled Mexico’s Economic Model Could Shift After July 1. We’ve also summarized the following articles related to this topic in the POLITICS & POLICY section of today’s report.

|

|

Chart: Mexico (EWW) vs Latin America (FLN) vs Emerging Markets (EEM) vs S&P 500 (SPY) |

|

Other Disruptive Change

Labor, Education & Demographics

|

|

Joe Mac’s Market Viewpoint |

|

|

|

The Federal Reserve has said for years that it wants to get inflation in the U.S. back to 2% per year. Some indicators are already showing inflation rates higher than that. But, the Fed persists with its fixation on the core personal consumption expenditures (“PCE”) deflator as a superior measure. That number has been stuck below 2% since May 2012. The trend of the inflation data, however, may be changing soon. Joe Mac’s Market Viewpoint: CAPEX Booms! →

Other Viewpoint Reports Joe Mac’s Market Viewpoint: The Inflation Complication → Joe Mac’s Market Viewpoint: A Review of MRP Themes → |

|

Current MRP Themes |

|

|

|

|

Major Data Points |

|

|

|

1.

|

US Personal Spending Rises Less than ExpectedPersonal spending in the United States rose 0.2 percent month-over-month in May of 2018, following a downwardly revised 0.5 percent gain and below market expectations of 0.4 percent. It is the smallest increase in personal spending in four months, mainly due to a drop in outlays on household utilities. TE |

|

2. |

United States Consumer SentimentThe University of Michigan’s consumer sentiment for the US stood at 98.2 in June 2018, compared with a preliminary reading of 99.3 and slightly above May’s 98. Both consumer expectations and current economic conditions came in weaker than initially thought. Inflation expectations for the year ahead rose to 3 percent in June from 2.8 percent in May, above a preliminary 2.9 percent. The 5-year outlook for inflation increased to 2.6 percent from 2.5 percent. TE |

|

3.

|

Japan Consumer Confidence The Consumer Confidence Index in Japan edged down to 43.7 in June of 2018 from 43.8 in the prior month and below market consensus of 43.9. Consumer Confidence in Japan averaged 42.25 Index Points from 1982 until 2018, reaching an all time high of 50.80 Index Points in December of 1988 and a record low of 27.50 Index Points in January of 2009. TE |

|

4. |

United Kingdom GDP Annual Growth RateThe gross domestic product in the United Kingdom expanded 1.2 percent year-on-year in the first quarter of 2018, unrevised from the second estimate and following a downwardly revised 1.3 percent growth in the previous period. It was the weakest pace of expansion since the second quarter of 2012, due to a slowdown in both household consumption and fixed investment. TE |

|

Other Disruptive Change |

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html |

*

* *

*

Leave a Reply