|

|

|

|

|

|

The Trump Administration may finally be taking serious action against the pharmaceutical industry in a bid to cut down heavily inflated US drug prices, while using the FDA to speed and simplify generic and biosimilar approvals. Additionally, a wave of lawsuits targeting big pharma for their role in the opioid crisis is inching closer to court and, possibly, the largest ever civil litigation settlement agreement in U.S. history.

|

|

|

|

|

|

Over the past five years, brand name drug prices have increased at 10 times the rate of inflation. Humira — the world’s bestselling drug, commonly used to treat arthritis, has seen price hikes 12 times over the last 5 years, causing a 248% increase in cost to consumers. Today, the cost of one prescription is nearing $40,000.

President Donald Trump has announced his first potentially strong action against America’s inordinate prescription drug prices — the first that could meaningfully lower Medicare drug spending. The idea is to narrow the gap between U.S. prices and those of other countries. The strategy concentrates on drugs administered by doctors — mainly the newer, very expensive biologic drugs that treat cancer and chronic conditions such as arthritis and macular degeneration. Medicare’s prices for these drugs are nearly double the average paid in Europe, Japan and Canada. To close the gap, the Trump administration would benchmark Medicare payments to the average foreign price. The Administration estimates that implementation of the new pricing index would save Medicare $17.2 billion over a five year period.

Some critics have noted the prospect that this may end up only raising drug prices in foreign markets and diminishing any potential fall in American markets. However, aggressive negotiation policies in the 16 countries that the new US benchmark will be based on, including Canada, Germany, Japan, and the United Kingdom, provide several avenues to reduce prices, and these nations are oftentimes willing to outrightly exclude high-priced medicines from their market.

Soon, the Trump administration will also require drug companies to disclose the list price of medications in their direct-to-consumer advertising, that fact will become abundantly clear to policymakers and the American people alike. Just as patients need to know about the possible side effects of a drug, they also need to know how much it costs and whether there are more affordable treatments available. In pursuing such transparency, another bill backed by the President, the “Know the Lowest Price Act“, will allow pharmacists to tell patients about the cheapest way to pay for prescription drugs at the counter. The legislation has already won approval in the House of Representatives and bars insurers and pharmacy-benefit managers, or PBMs, from prohibiting pharmacists from telling patients they could potentially save money by paying cash instead of an insurance copayment.

Earlier this year, MRP highlighted an exposé from Axios that brought to light many drug manufacturers’ practice of pumping up revenues by combining multiple generic over-the-counter medications and selling them as ‘convenience drugs’ for up to 100x more than their generic counterparts. Horizon Pharma sells a drug called Vimovo (which is just Nexium and Aleve combined into 1 pill for convenience) for $2,482 per bottle. This drug alone has been responsible for $540 million of Horizon revenue from 2013 through the first six months of 2018. If pharmacists were required to tell patients that they could avoid outrageously inflated prices, they could begin to knock significant figures off of Big Pharma’s margins.

The FDA continues to set records for the number and speed of its generic drug approvals. In fiscal year 2018, the agency approved 781 generics, up 90% from 2014, the first year the Generic Drug User Fee Act was in full effect. Additionally, The FDA has revealed it’s offering a proposalto the International Council on Harmonisation — ICH — to better harmonize scientific and technical standards for generic drugs. The plan is to let generic drug developers implement a single global drug development program, with common elements of applications to file, which will allow for simultaneous approvals in multiple markets, effectively making criteria for sale in American drug markets the same as criteria for European markets.

Numerous opioid-related lawsuits against pharmaceutical companies and individual leadership of pharma companies, as well as retail pharmacies and dispensaries, filed by cities, counties, state’s attorneys general and even Native American tribal councils, have been building up for over a year now. Collectively, when the cases finally go to court, the state-level opioid suits could become the largest civil litigation settlement agreement in U.S. history. Precedence for this lawsuit can be seen in the suits big tobacco faced in the 1990s when forty-six states and six jurisdictions subsequently joined a Master Settlement Agreement (MSA) that set out annual payments would be made by the participating tobacco manufacturers to recoup “taxpayer money spent for health care costs connected to tobacco-related illness,” as well as set new standards and marketing restrictions for tobacco companies going forward. The case for a similar, but even harsher judgment on pharmaceutical companies is that there are much better health records today, as well as pharma paper trails, and in theory, precedence for states receiving money they claim is owed to them through Medicaid and Medicare dollars that did not exist two decades ago. With this evidence, plaintiffs will contend that tens of millions of dollars were intentionally spent by pharmaceutical companies to downplay addiction concerns, market exaggerated benefits of opioids, and lobby doctors to prescribe more.

Additionally, the legal battle against high drug prices could soon spill into the Supreme Court.Maryland Attorney General Brian Frosh is currently petitioning the US Supreme Court on Friday to uphold a first-in-the-nation law against pharmaceutical price gouging. The Maryland law, which was struck down by a federal appeals court panel this year, enabled the state’s attorney general to sue makers of off-patent or generic drugs for price increases that state officials considered ”unconscionable.” That was defined as an excessive increase, unjustified by the cost of producing or distributing the drugs. Frosh noted that prices of generic drugs have skyrocketed in recent years.

The Trump administration maintains their long-promised goal of reducing drug prices, and the beginnings of a serious plan have finally materialized. But it has undeniably been slow-moving thus far. Although pharmaceutical stocks have appreciated strongly since MRP initiated our short theme on the sector, the fundamental cracks in pharma’s armor that we have observed remain very apparent and should begin to be exploited. Therefore, we are re-affirming our short US Pharmaceuticals theme.

|

|

|

|

|

|

|

THEME ALERT

|

|

|

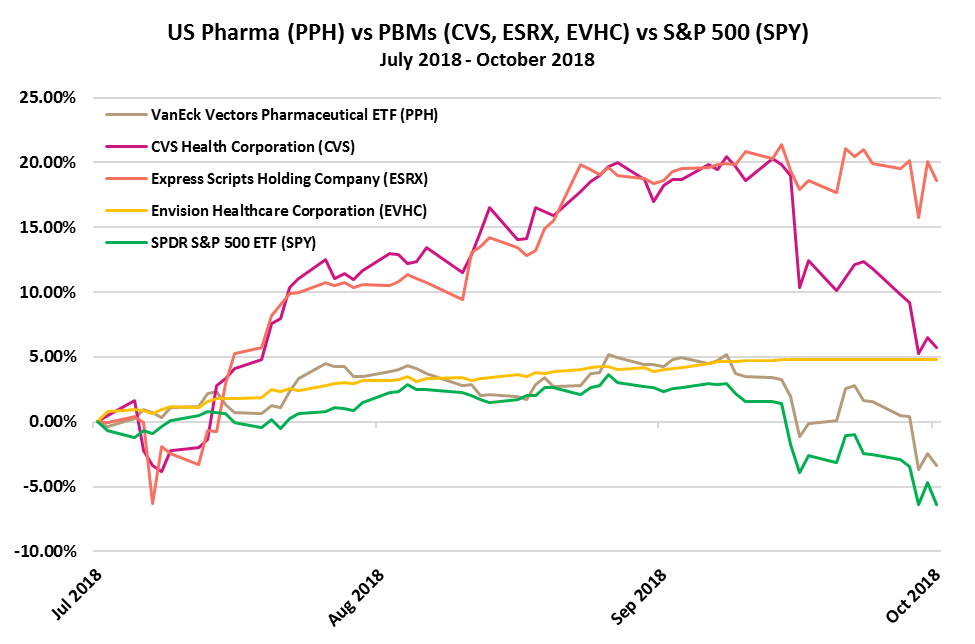

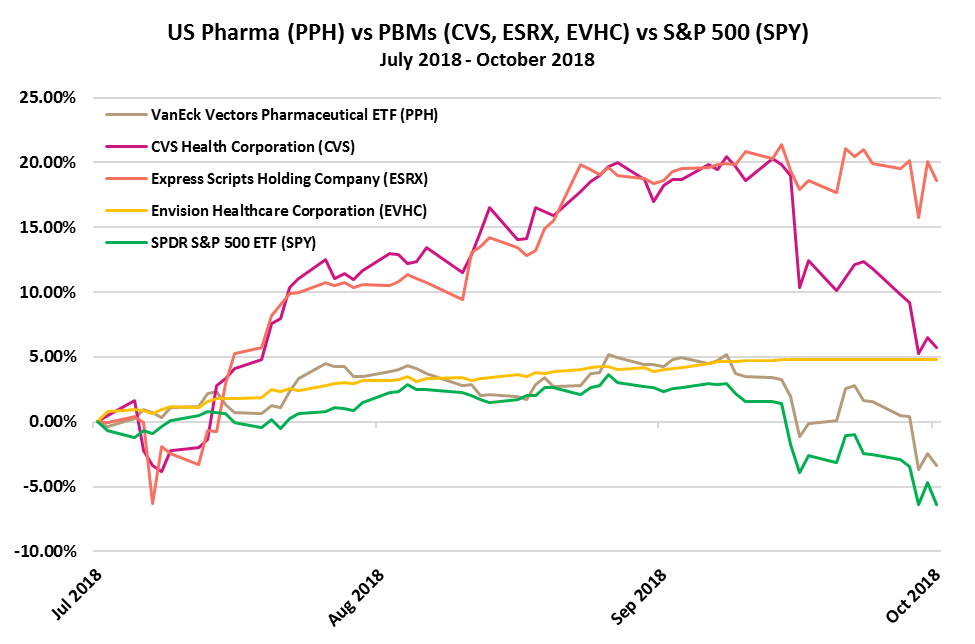

On October 27, 2017, MRP added Short U.S. Pharmaceuticals to our list of investment themes. Since then, the VanEck Vectors Pharmaceutical ETF (PPH) has lost 3%, moderately outperforming the S&P’s loss of 6%.

|

|

|

|

|

|

|

We’ve also summarized the following articles related to this topic in the Biotechnology & Healthcare section of today’s report.

Pharma

|

|

- Trump’s Drug Plan Has the Right Idea

- FDA offers a proposal to help generic drug developers get simultaneous approvals in multiple markets

- Opioid Lawsuits On Par To Become Largest Civil Litigation Agreement In U.S. History

- Drug Companies, Not ‘Middlemen’, Are Responsible For High Drug Prices

|

|

|

|

|

|

|

US Pharma (PPH) vs PBMs (CVS, ESRX, EVHC) vs S&P 500 (SPY)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Brazil

Brazil Assets Climb After Bolsonaro Renews Pledge to Fix Economy

|

|

|

|

|

|

Finance

|

|

|

Fintech

UK P2P lender looks into selling the loans on its platform

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

3DP

Protolabs Reports Record $115.4M Revenue for Q3 2018, 25% Increase in 3D Printing

|

|

|

THEME ALERT Industrials

As Infrastructure Crumbles, So Does US Manufacturing

|

|

|

|

|

|

Transportation

|

|

|

THEME ALERT Autos

China Regulator to Propose 50% Cut to Car Purchase Tax

|

|

|

THEME ALERT Autos

U.S. October auto sales seen down slightly

|

|

|

EVs

Continuous EV Range Increases Will Drive US Shifts To Leasing/Subscriptions & Growth In The Used Car Market

|

|

|

Aviation

Why China is no closer to rivalling Boeing or Airbus

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

THEME ALERT ASEAN

Southeast Asia benefits from FDI surge in first half

|

|

|

|

|

|

Construction & Real Estate

|

|

|

THEME ALERT Housing

The housing market is cooling off — and uncertainty isn’t helping

|

|

|

|

|

|

Services

|

|

|

Food Service

Restaurants Shrink as Food Delivery Apps Get More Popular

|

|

|

Cannabis

Cultivating new business opportunities amid the cannabis boom

|

|

|

|

|

|

Technology

|

|

|

5G

Carmakers want their own 5G networks

|

|

|

|

|

|

Commodities

|

|

|

THEME ALERT Oil

The Real Reason For The Big Sell Off In Oil

|

|

|

|

|

|

Biotechnology & Healthcare

|

|

|

THEME ALERT CRISPR

CRISPR Gene Editing Shows Promise for Treating a Fatal Muscle Disease

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX Matters

The dollar’s ups and downs have had significant repercussions. The earnings of global companies, the trend of interest rates, commodity prices, and many nations’ economies – emerging markets in particular – have all been impacted. This issue of MRP’s Viewpoint first examines the forces driving the dollar’s fluctuations, then looks at where the buck might go next and offers some thoughts on what it could mean for the capital markets.

Joe Mac’s Market Viewpoint: FX Matters →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG

ASEAN Markets

|

|

|

|

|

|

LONG

Defense

|

|

|

|

|

|

LONG

Industrials

|

|

|

|

|

|

LONG

Materials

|

|

|

|

|

|

LONG

Palladium

|

|

|

|

|

|

LONG

Steel

|

|

|

|

|

|

SHORT

U.S. Housing

|

|

|

|

|

|

LONG

Video Gaming

|

|

|

|

|

|

|

|

|

SHORT

Autos

|

|

|

|

|

|

LONG

Electric Utilities

|

|

|

|

|

|

LONG

Lithium

|

|

|

|

|

|

LONG

Obesity

|

|

|

|

|

|

LONG

Robotics & Automation

|

|

|

|

|

|

LONG

TIPS

|

|

|

|

|

|

SHORT

U.S. Pharmaceuticals

|

|

|

|

|

|

|

|

|

|

|

|

LONG

CRISPR

|

|

|

|

|

|

LONG

Gold & Gold Miners

|

|

|

|

|

|

SHORT

Long-Dated UST

|

|

|

|

|

|

LONG

Oil & U.S. Energy

|

|

|

|

|

|

LONG

Solar

|

|

|

|

|

|

LONG

U.S. Financials & Regional Banks

|

|

|

|

|

|

LONG

Value Over Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas Manufacturing Continues to Expand at Solid Pace

The Federal Reserve Bank of Dallas’ general business activity index for manufacturing in Texas rose to 29.4 in October 2018 from 28.1 in the previous month. The employment index went up 6.2 points to 23.9, and the new orders index increased 4.2 points to 18.9. In addition, the company outlook index climbed 6.8 points to 25.0 as fewer than 3 percent of firms noted that their outlook worsened, the lowest share since 2004. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Personal Income Rises the Least in Over a Year

US personal income increased by 0.2 percent from a month earlier in September 2018, easing from an upwardly revised 0.4 percent growth in August and missing market expectations of 0.3 percent. It was the smallest gain in personal income since June 2017, as increases in wages and salaries, government social benefits to persons, and rental income of persons were partially offset by a decline in proprietors’ income. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Personal Spending Matches Forecasts

Personal spending in the United States rose 0.4 percent from a month earlier in September of 2018, following an upwardly revised 0.5 percent rise in August. Figures matched market expectations, mainly boosted by spending in motor vehicles and health care. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US PCE Prices Rise 0.1% MoM in September

The personal consumption expenditure (PCE) price index in the United States increased 0.1 percent month-over-month in September of 2018, the same pace as in the previous three months and matching market expectations. Excluding food and energy, PCE prices were up 0.2 percent, after being flat in August and slightly above market expectations of a 0.1 percent gain. Year-on-year, the PCE price index advanced 2.0 percent, after a 2.2 percent gain in the prior month, and the core index rose 2.0 percent, the same pace as in August. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

European Stocks Rebound

European stock markets recovered from last week’s sharp sell-off and closed in the green on Monday, with auto shares among the best performers following news that China will announce a 50% cut in car purchase taxes. Investors also reacted to Angela Merkel’s decision not to run for re-election and Philip Hammond’s budget plans for the next financial year. TE

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

ASEAN

Southeast Asia benefits from FDI surge in first half

Southeast Asian countries received more foreign direct investment in the first half of this year from a year ago, and this trend is set to continue as escalating U.S.-China trade tensions prompt manufacturers to relocate production from China.

According to last week’s report by the United Nations Conference on Trade and Development, net FDI flow into Southeast Asia rose 18% to $73 billion in the first half of 2018 from a year ago, compared with a global total of minus 41% over the same period. The biggest beneficiaries in the region in terms of growth rate were Thailand, followed by the Philippines and Cambodia. Investment into South Asia — mainly India — also surged 13% to $25 billion.

Southeast Asian countries offer the twin benefits of geographical proximity to major markets like China and India and relatively low labor costs, which make them natural homes for foreign manufacturers wanting to relocate their Asian bases.

A recent survey by the American Chamber of Commerce in China showed that 18.5% of U.S. companies in China are planning to relocate or had already moved their manufacturing facilities to Southeast Asia as a result of high import tariffs that the U.S. and China are slapping on each other’s products. NikkeiAR

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Brazil

Brazil Assets Climb After Bolsonaro Renews Pledge to Fix Economy

Brazil’s next president pledged to trim the deficit, pay down debt and reduce the size of government after results showed him cruising to victory over Fernando Haddad of the left-wing Workers’ Party. That helped Brazilian assets extend gains Monday. While many securities were off the highs they reached in early trading, the currency strengthened 0.2 percent and the Ibovespa index added 1 percent after reaching an intraday record. State-controlled oil producer Petroleo Brasileiro SA added 1.2 percent, and sovereign bonds climbed.

Brazilian assets are the world’s best performers since polls in mid-September showed the conservative lawmaker and former army captain ascending in polls. The comments from Bolsonaro should tamp down on any skepticism that he wasn’t fully committed to pension and tax overhauls — which lingered since the candidate himself often professed an ignorance when it came to economics — pleasing investors who had abandoned Latin America’s largest economy over the past several years as fiscal accounts deteriorated.

“Bolsonaro landed a landslide victory promising Brazil a better future after years of economic downturn and corruption scandals,” said Bernd Berg, a macro and foreign-exchange strategist at Woodman Asset Management in Zug, Switzerland. “I am confident Bolsonaro is going to deliver much needed reforms.” B

|

|

|

|

|

|

|

|

|

|

|

|

Finance

|

|

|

Fintech

UK P2P lender looks into selling the loans on its platform

The chief executive of Lendy has spoken to distressed debt investors about arranging a sale of the loans on its platform, highlighting the pressures on the peer-to-peer property lender as it deals with legal issues and spiralling numbers of late loans. A potential deal would involve selling the loans at a discount to their face value, exposing thousands of retail investors to losses.

Lendy said that it had been carrying out “fairly standard loan servicing steps”, and holds discussions “on a regular basis, with a wide variety of lenders who could provide refinancing to selected borrowers where their loans have gone over term.”

A sale of all or a large number of the loans would represent an escalation of one of the biggest crises to hit the young industry in Europe. Lendy’s troubles come at an awkward time for the sector, with the Financial Conduct Authority already considering stricter rules to prevent overly risky behaviour. Lendy received full authorisation from the FCA less than six months ago.

Politicians and regulators encouraged the growth of peer-to-peer lenders as they helped to fill the gaps left by mainstream banks that cut lending to certain sectors after the financial crisis. However, a recent FCA study identified “poor business practices” at some lenders that meant investors may not fully understand the products and risks they were exposed to. FT

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Real Estate

|

|

|

Housing

The housing market is cooling off — and uncertainty isn’t helping

From rising prices to the new tax law, economists say there are a number of conditions contributing to a slowdown in the US housing market. But there may also be a less tangible factor at play: uncertainty.

The economy is humming, with unemployment at multi-decade lows and signs of upward pressure on wages. Alongside these robust metrics, however, consumers are watching home inventories rise to the highest level in years. “Usually, consumers are used to seeing the housing market perform in tandem with the economy,” said Jonathan Miller, an appraiser and market analyst. “But what’s been especially confusing over the last year and a half or so is that they seem to be disconnected.”

Declines in residential-construction activity and foreclosure rates have led to historic housing shortages across the country in recent years. Together with rising rates, an increasing number of Americans have been priced out of the market.

Meanwhile, analysts say the tax overhaul passed last year isn’t helping. By curbing mortgage-interest deductions and placing a $10,000 cap on state and local tax deductions, it wipes out previous provisions that were designed to encourage Americans to own homes.

“It’s almost like a wet blanket, where the consumer is somewhat confused and they’re taking a breath,” Miller said. “The sense of urgency is not there in the market.” BI

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

|

Food Service

Restaurants Shrink as Food Delivery Apps Get More Popular

People are still eating restaurant food– they’re just not doing it at restaurants as much. Delivery apps from DoorDash Inc., Postmates Inc., GrubHub Inc. and UberEats have made ordering in easier, and have changed the way food chains think about their business. The number of food delivery app downloads is up 380 percent compared with three years ago, according to market-data firm App Annie, and research firm Cowen and Co. predicts that U.S. restaurant delivery sales will rise an average of 12 percent a year to $76 billion in the next four years.

At Firehouse, revenue has increased 7 percent this year, mainly from orders placed online and through delivery apps. Some new restaurant owners are skipping tables and chairs altogether and just leasing kitchen space to prepare food for couriers. Those are called cloud kitchens or virtual restaurants because they have no dining rooms or wait staff and sell their meals through the internet and mobile apps like DoorDash or UberEats.

Even the biggest fast-food chains are embracing the opportunity to sell more food through delivery apps. In August, McDonalds Corp announced that it would spend $6 billion to redesign its U.S. restaurants. As part of the upgrade, many McDonalds restaurants will have designated parking spots for curbside pickups made through mobile orders. B

|

|

|

Cannabis

Cultivating new business opportunities amid the cannabis boom

The marijuana industry encompasses a wide array of businesses including grow operations, product manufacturers and product dispensaries. Each of these operations generate specific wastes which are regulated and managed to avoid public health and environmental impacts. Commercial recycling and disposal services are needed when these businesses open, but the nature of cannabis operations means those services may be different than usual. Waste must be disposed at an approved facility in compliance with regulatory and permit conditions.

Once the marijuana products are manufactured for consumer use, safety standards generally require them be sold in resealable, child-resistant and opaque packaging. Packaging materials and designs are quickly progressing, in many cases with enhanced sustainability qualities. As consumers demand more sustainable options, the industry will need to respond with more recyclable, compostable and innovative material choices.

Another factor to keep in mind is the risks involved in crossing state and national borders not only apply to consumers, but also to service providers. The laws and regulations of the specific state receiving the material and how they apply to cannabis must be reviewed prior to transporting material to any disposal or recycling facilities. WDive

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

3DP

Protolabs Reports Record $115.4M Revenue for Q3 2018, 25% Increase in 3D Printing

Vicki Holt, President and CEO of Protolabs comments, “We are pleased to deliver another quarter with over 30 percent growth. Protolabs again demonstrated strong performance across all of our geographies and in each of our services. As a result of continued strong operations and growth in each of our individual service offerings, we are becoming more of a total solution for some of our customer

Award winning on demand manufacturing provider Protolabs has reported record revenue in its third quarter 2018 financial results. The lastest financial results include a 25% increase in revenue for its 3D Printing segment.

Total revenue for the three months ended September 30, 2018, was $115.4 million, a 31% increase on the same period in 2017, which was $88.1 million. Of that revenue, the 3D Printing segment accounts for $13.8 million in Q3 2018, up from $11.1 million in Q3 2017.

Vicki Holt, President and CEO of Protolabs comments, “We are pleased to deliver another quarter with over 30 percent growth. Protolabs again demonstrated strong performance across all of our geographies and in each of our services. As a result of continued strong operations and growth in each of our individual service offerings, we are becoming more of a total solution for some of our customers.” 3DPI

|

|

|

Industrials

As Infrastructure Crumbles, So Does US Manufacturing

America is essentially in an infrastructure collapse that is having dire effects on manufacturing. Crumbling water systems that are unreliable can shut down production lines. Congested highways mean late deliveries, production loss, increased fuel and wage costs and excessive wear on assets. Port congestion, lock delays and the penalty associated with not having infrastructure in place to handle larger ships make American products more expensive.

So far, the Trump infrastructure rebuilding program does not have a funding solution and does not yet offer specifics or priorities in infrastructure spending. Trump wants $1.5 trillion in new spending on infrastructure, and Congress has, so far, only allocated $21 billion. This is about 1% of the president’s request. So Trump’s proposed public/private infrastructure plan has become fake news.

Despite the political and economic backsliding, rebuilding our infrastructure is perhaps the best economic investment we could make in the 21st Century. In no other major economic investment could we achieve the number of new jobs, increased GDP growth, and immediate safety gains. IW

|

|

|

|

|

|

|

|

|

|

|

|

Technology

|

|

|

5G

Carmakers want their own 5G networks

5G wireless networks will mean data speeds one hundred times faster than today, with information transmission in near-real time. The infrastructure will be critical to delivering new technology linked to the Internet of Things. It will be an essential component for self-driving vehicles on the roads, and automakers also plan to digitize industrial processes, enabling automated and highly flexible car production.

German industry wants to bring self-driving cars into production by 2021. But carmakers are nervous that the country’s telecoms network providers may not be up to the job of rolling out 5G. In response, they are increasingly looking to set up their own local 5G networks, giving them full control over the data that will be the lifeblood of their new factories.

BMW has already informed the Federal Network Agency (BNA) — which oversees use and ownership of Germany’s frequency spectrum — that it is interested in operating local 5G networks. Volkswagen and Daimler, the maker of Mercedes vehicles, have done likewise.

Telekom, Vodafone and Telefónica have all spoken out against local 5G networks, saying they run the risk of fragmenting coverage. But they understand where the demand is coming from: Telekom CEO Timotheus Höttges recently acknowledged the company had been slow to understand industry’s 5G requirements, while announcing a major conference on industrial networks, due to take place next year. HG

|

|

|

|

|

|

|

|

|

| There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html |

|

Leave a Reply