|

|

|

|

|

|

|

|

|

|

|

|

We’ve also summarized the following articles related to this topic in the Politics & Policysection of today’s report.

Midterms

|

|

- Beyond the midterms: after the smoke clears, China hawks will remain the rule in Washington

- If Democrats win the House, history says the stock market will struggle next year

- Why A Split Congress May Be The Best Stock Market Election Outcome

- How the midterms could impact Trump’s economic policies

- Stocks Could Pop If Republicans Holds the House. Then Comes the Drop.

|

|

|

|

|

|

|

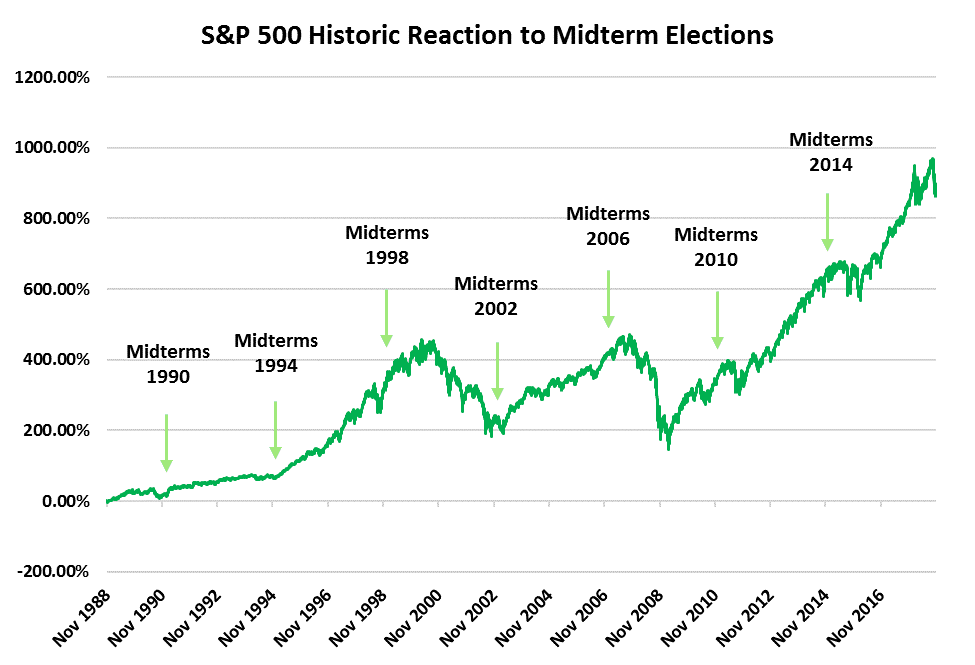

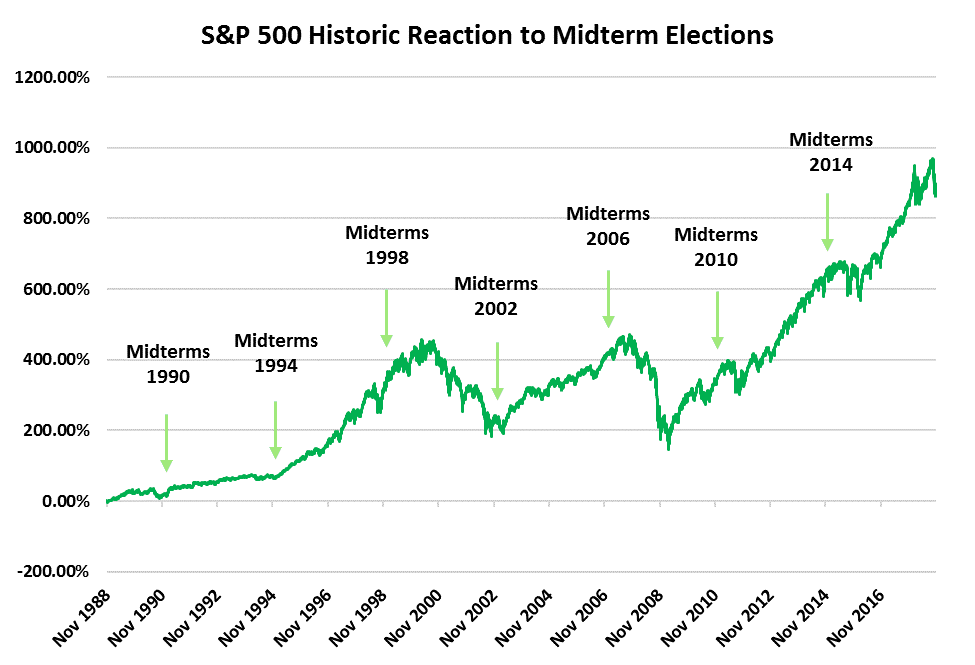

S&P 500 Historic Reaction to Midterm Elections

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Earnings

Third-quarter U.S. profit growth on track to be highest since 2010

|

|

|

|

|

|

Finance

|

|

|

Cryptocurrencies

How the Crypto Crash Could Be Good for Crypto

|

|

|

|

|

|

Labour, Education & Demographics

|

|

|

THEME ALERT Robotics & Automation

10% of U.S. jobs will be lost to automation in 2019

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

3DP

Digital Inventory: How 3D Printing Lets Manufacturers Rely Less On Warehouses Of Stuff

|

|

|

|

|

|

Technology

|

|

|

Semiconductors

As Moore’s law fades, computing seeks a new dimension

|

|

|

Quantum

VW wants to use quantum computing for traffic management

|

|

|

|

|

|

Energy & Environment

|

|

|

Batteries

The Battery Boom Will Draw $1.2 Trillion in Investment by 2040

|

|

|

Batteries

European Battery Manufacturing to Grow 20-Fold by 2025

|

|

|

|

|

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Cannabis

The marijuana ballot measures to watch in U.S. midterm elections

|

|

|

|

|

|

Construction & Real Estate

|

|

|

China

Trade war is not all gloom and doom for China’s property market as logistics firm boost warehouse leasing

|

|

|

China

Three New Signs China’s Housing Market Slowdown Is Taking Hold

|

|

|

|

|

|

Services

|

|

|

THEME ALERT Robotics & Automation

LG is developing robotic carts to automate shopping

|

|

|

Payments

7-Eleven is Bringing Cashier-Less Payments to its Stores

|

|

|

|

|

|

Commodities

|

|

|

Refiners

Once a ‘Dog,’ Refining Becomes Driver of Oil Profits

|

|

|

LNG

Record LNG shipping rates raise capacity concerns

|

|

|

LNG

Stranded LNG Tankers Point To A Major Problem In Gas Markets

|

|

|

|

|

|

Biotechnology & Healthcare

|

|

|

Gene Editing

New gene therapy reprograms brain glial cells into neurons

|

|

|

|

|

|

Endnote

|

|

|

Chart

Video Games Beat Blockbuster Movies Out of the Gate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX Matters

The dollar’s ups and downs have had significant repercussions. The earnings of global companies, the trend of interest rates, commodity prices, and many nations’ economies – emerging markets in particular – have all been impacted. This issue of MRP’s Viewpoint first examines the forces driving the dollar’s fluctuations, then looks at where the buck might go next and offers some thoughts on what it could mean for the capital markets.

Joe Mac’s Market Viewpoint: FX Matters →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LONG

ASEAN Markets

|

|

|

|

|

|

LONG

Defense

|

|

|

|

|

|

LONG

Industrials

|

|

|

|

|

|

LONG

Materials

|

|

|

|

|

|

LONG

Palladium

|

|

|

|

|

|

LONG

Steel

|

|

|

|

|

|

SHORT

U.S. Housing

|

|

|

|

|

|

LONG

Video Gaming

|

|

|

|

|

|

|

|

|

SHORT

Autos

|

|

|

|

|

|

LONG

Electric Utilities

|

|

|

|

|

|

LONG

Lithium

|

|

|

|

|

|

LONG

Obesity

|

|

|

|

|

|

LONG

Robotics & Automation

|

|

|

|

|

|

LONG

TIPS

|

|

|

|

|

|

SHORT

U.S. Pharmaceuticals

|

|

|

|

|

|

|

|

|

|

|

|

LONG

CRISPR

|

|

|

|

|

|

LONG

Gold & Gold Miners

|

|

|

|

|

|

SHORT

Long-Dated UST

|

|

|

|

|

|

LONG

Oil & U.S. Energy

|

|

|

|

|

|

LONG

Solar

|

|

|

|

|

|

LONG

U.S. Financials & Regional Banks

|

|

|

|

|

|

LONG

Value Over Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Job Openings Fall from Record High

The number of job openings dropped by 284,000 to 7.009 million in September 2018 from August’s all-time high of 7.293 million and slightly below market expectations of 7.1 million. The job opening level declined by 188,000 for total private and by 96,000 in government. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Economic Optimism Index Edges Down in November

The IBD/TIPP Economic Optimism Index decreased to 56.4 in November 2018 from 57.8 in October, missing market expectations of 59.2. The Personal Financial Outlook, a measure of how Americans feel about their own finances in the next six months, fell 4.4 points to 62.3 and the Six-Month Economic Outlook, a measure of how consumers feel about the economy’s prospects in the next six months, edged down by 0.1 points to 53.2. Conversely, the Confidence in Federal Economic Policies, a proprietary IBD/TIPP measure of views on how government economic policies are working, went up 0.3 points to 53.7.TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Prices Fall

Oil prices declined on Tuesday after the US on Monday imposed sanctions on Iran’s energy sector but temporarily waived eight big Iran’s oil purchasers, allowing them to keep buying oil from Iran. The US crude was down 2.5% to $61.42 a barrel and the Brent fell 2.4% to $71.33 a barrel around 1:00 PM NY time. TE

|

|

|

|

|

|

|

|

|

|

|

|

Disruptive Change Updates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Earnings

Third-quarter U.S. profit growth on track to be highest since 2010

U.S. earnings growth for S&P 500 companies in the third quarter is on track to be the highest since 2010, eclipsing the strong results from earlier this year, according to IBES data from Refinitiv. Stronger-than-expected earnings have pushed the estimate for third-quarter growth to 27.4 percent, based on results from 381 of the S&P 500 companies and estimates for the rest.

The growth estimate is well above the 21.6 percent growth for the quarter forecast by analysts on Oct. 1, and it would surpass the first quarter’s 26.6 percent growth and the second quarter’s 24.9 percent growth, based on Refinitiv data. The last time quarterly profit growth was higher was in the fourth quarter of 2010, when it was 37.2 percent.

Strong profit growth this year has been fueled in part by the sweeping tax overhaul approved by Congress late last year. But investors have been concerned about rising tariff and other costs for companies that could result in a bigger step down in profit growth next year than analysts are expecting.

Profit growth is expected to slow to 9 percent next year from an estimated 23.9 percent this year, according to Refinitiv data. R

|

|

|

|

|

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Midterms

Beyond the midterms: after the smoke clears, China hawks will remain the rule in Washington

Many of US President Donald Trump’s controversial policies could face more formidable resistance after the country’s midterm elections on Tuesday – which pollsters say could result in a strong comeback by the Democratic Party – but his tough stance against China will likely remain intact.

Wishful thinking is high among some Chinese scholars that a “blue wave” in the midterms – a surge in Democratic victories – would compromise Trump’s tough stance on China. A commentary published in the Chinese Communist Party mouthpiece People’s Daily in August raised the notion that Republicans supportive of free trade – presumably like Charles Koch, a billionaire industrialist – could work with the Democrats after the midterms to push back against Trump’s tariffs.

But signs are few that Democrats would push for a softer approach on China. Some influential Democrats have from the outset of Trump’s trade war supported the tariffs on China exports, and have even stood behind Trump’s confrontational approach on a broader range of issues with China.

Even Senator Elizabeth Warren, a Massachusetts Democrat who is a notable Trump foe, criticised China’s trade practices and treatment of human rights during a visit she made to Beijing in March. SCMP

|

|

|

Midterms

If Democrats win the House, history says the stock market will struggle next year

A lot has been written recently about how U.S. stocks usually perform well after the midterm elections. But a deeper dive into the data shows the post-midterms rally hinges on the majority party maintaining control of the House.

Data compiled by Fundstrat Global Advisors showed the median stock market return since 1896 was only 1.9 percent a year after the House majority flipped from one party to the other. Meanwhile, the median return totaled 16.8 percent when the House majority stayed the same after the midterms.

Many investors are looking at the average gains following all midterm elections and not parsing the data like Fundstrat did. For example, data from Kensho shows the S&P 500 has averaged a gain of 0.95 percent one week after the midterms since 1980. They also show the broad index climbs on average more than 2 percent a month after the election and 5.4 percent in three months.

While stocks have historically thrived under a divided government, this time it could be different as the risk of impeachment for Trump increases in this scenario. The GOP’s economic policies, which have boosted stocks since Trump took office, could also be limited or reversed in a divided Congress. CNBC

|

|

|

Midterms

Why A Split Congress May Be The Best Stock Market Election Outcome

Looking at S&P 500 returns during each two-year election cycle, from election day to election day. The best outcome, an average 18.7% two-year return, came when Congress was divided. Unified control of Congress by the same party as the president yielded an average 17.3% two-year gain. When control of Congress was unified under the opposition party, gains averaged 15.7%.

There’s a huge caveat to basing conclusions on these historical results. While political control of Congress can be important for markets, macroeconomic and geopolitical factors often are a much bigger influence on stock market direction. For example, the writing already was on the wall before the housing bubble burst, dragging down the stock market after Democrats took control of Congress in the 2006 election, in opposition to President George W. Bush.

Continued GOP control is generally seen as the most market friendly. That’s because odds of another Trump tax cut would be slightly higher, if still pretty low. Meanwhile, the defense sector would continue to see higher federal spending.

Democratic control might yield a lot of investigations of Trump and little in the way of policy. An exception is that Democrats might be more likely to gang up with Trump against the pharmaceutical industry. While it’s hard to say what a divided Congress could achieve, the division might create more constructive incentives than outright opposition to Trump. IBD

|

|

|

Midterms

How the midterms could impact Trump’s economic policies

Scenario #1: Democrats win House, GOP holds Senate

This is the most likely outcome, according to polls. It would leave Democrats in charge of only one chamber of Congress, but that’s enough to stall any major legislation that Trump wants to advance, including economic policies around taxes, immigration, health care or trade. That could be OK if the economy keeps rolling ahead. But it also could raise the risk of confidence-rattling government inaction — government shutdowns, debt ceiling fights, and more.

Scenario #2: Republicans keep both

A midterm victory could give added momentum to Trump’s agenda and provide the GOP with the mandate to get more done — even with slimmer majorities in the House. It could lead to more pro-growth policies around taxation, spending and regulation, but it’s unclear whether these measures are sustainable in the long term or just a temporary boost.

Scenario #3: Democrats sweep

This might be the least likely outcome, but it’s probably the most volatile. Democrats in control of Congress could put more pressure on Trump — bringing new investigations into his conflicts of interest and taxes. How Trump would handle a more oppositional Congress is a big wildcard.CNBC

|

|

|

Midterms

Stocks Could Pop If Republicans Holds the House. Then Comes the Drop.

If the consensus is confounded, again, that could change. Spoiler alert: An upset that keeps both chambers under GOP control may be bullish for stocks, at least initially. But it also could mean a renewed surge in Treasury yields, which could mean a resumption in the selloff that hit stocks starting in early October when the 10-year note broke out to the upside.

The widely anticipated outcome of a Democratic House and GOP Senate would lead to some short-lived reactions that would be quickly reversed, according to Deutsche Bank macro strategist Alan Ruskin. U.S. equities would likely dip then recover, while bond yields would move marginally lower and then retrace the decline. The dollar also could ease slightly, less than 1%, but any emerging-markets currency rally also would be transitory.

A Republican sweep would be seen as a vindication of “Trumponomics,” he continues, with potential further tax cuts and a firm U.S. line on China trade. Strong stocks and fiscal stimulus could lift the 10-year Treasury yield above 3.25%, from 3.21% Tuesday afternoon, while the U.S. Dollar Index could rally past 97, from 96.29. Barron’s

|

|

|

Cannabis

The marijuana ballot measures to watch in U.S. midterm elections

California, Colorado and seven other states have legalized recreational marijuana, and there are roughly 30 states that have passed medical cannabis in some form.

On Tuesday, more states could be added to those lists, as two states consider approving recreational marijuana and two others vote on medicinal usage of the drug. While the votes should have little effect on Canadian marijuana companies, as most are precluded from having U.S. operations due to some exchange-listing guidelines, Michigan in particular holds intrigue for cannabis investors.

Though Aurora Cannabis Inc. had to divest its holdings of U.S. companies earlier this year after the Toronto Stock Exchange threatened to delist the company, Aurora held on to an option to buy back stock in at least one former subsidiary, Australis Capital. Now listed on the Canadian Securities Exchange — a listing venue with fewer disclosure requirements — Australis, through one of its subsidiaries, is looking at the medical cannabis market in Michigan. Should Michigan vote in favor of legalizing adult use, Australis may be in a position to capitalize on the change through the work it has already done on the medical side.

Aphria Inc. has a similar option to buy back a stake in Liberty Health Sciences, which it divested earlier this year because of pressure from the TSX. Currently, Liberty Health operates in Florida.MW

|

|

|

|

|

|

|

|

|

|

|

|

Finance

|

|

|

Cryptocurrencies

How the Crypto Crash Could Be Good for Crypto

These days, cryptocurrencies are far from the rage. Many have lost 80 percent or more of their market value from their peak in January, and some have fallen off the map altogether. But perhaps that development is precisely what we need for crypto to take the next step forward.

For context, railroad stocks collapsed after a bubble in the 19th century, but still the railroad continued to transform our world. Internet stocks plunged in the dot-com crash of 2000-2002, but that in turn cleaned out the bad companies and paved the way for the subsequent tech revolution, including the rise of Amazon and Google.

This history is no guarantee crypto will take off. But it does show that a price collapse does not have to herald the end of a technology or its relevance. One problem crypto has had is that too many junky ideas were tossed around and then often funded by ICOs (initial coin offerings). But from an outsider’s point of view, it is hard to tell good from bad.

Now the time has come for crypto to go on a diet. No more easy money. No more thoughts about ICOs leading to quick riches. The rhetoric is shifting toward a more cautious or even apologetic tone. The corresponding reality can perhaps be one of greater focus and relevance. B

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Real Estate

|

|

|

China

Trade war is not all gloom and doom for China’s property market as logistics firm boost warehouse leasing

The US-China trade relationship has clearly entered unchartered territory. The introduction of new and retaliatory tariffs indicates that no resolution is in sight. But where commercial real estate is concerned, it is not all doom and gloom, with several factors potentially alleviating any collateral damage arising from the conflict.

Firstly, China’s economy. The economic landscape in China has remained healthy this year on most metrics, despite the slowest quarterly gross domestic product rate in nearly a decade that was just registered. Secondly, a relatively robust domestic demand story and ongoing infrastructure projects will cushion the short term blows from a prolonged trade conflict.

But there are certain segments of the real estate market that remain more vulnerable. For example, companies operating on a low-cost, labour-intensive business model are most susceptible to the effects of a prolonged trade conflict. To buffer the exodus of firms, China has eased restrictions on foreign direct investment. This policy shift has succeeded in attracting the likes of Tesla, which announced plans to construct a Gigafactory in Shanghai, and BASF, which will develop the first wholly foreign-owned chemicals complex in China.

Another batch of companies we relatively insulated from the US tariffs are logistics companies, whose growth is now largely fuelled by domestic consumption. SCMP

|

|

|

China

Three New Signs China’s Housing Market Slowdown Is Taking Hold

More signs have emerged that China’s housing market is cooling, with sales in the secondary market, land purchases by developers and contracted sales at the biggest builders all falling last month, as these three charts show.

Sales of existing homes, which are quarantined from the government curbs on the new home market, last month plunged to a four-year low in 10 major cities tracked by China Real Estate Information Corp. Lackluster sales will likely weigh on existing-home prices in coming months, Shanghai-based analyst Wang Zhaojin said. In September, new-home price growth slowed for the first time in seven months.

Cash-strapped developers are also pulling back. Land sales in 40 cities tracked by CRIC fell 0.5 percent in the first 10 months from the same period a year ago, a sharp contrast to the previous two years when land sales surged about 40 percent. With builders facing a record $18 billion of bond maturities in the first quarter of 2019, the cooling in the land market is set to intensify.

And it’s no wonder developers are turning cautious. Contracted sales at the 100 biggest builders declined 11 percent in October from September, CRIC data showed, even as some offered incentives ranging from free luxury cars and hefty discounts during a week-long national holiday.B

|

|

|

|

|

|

|

|

|

|

|

|

Labor, Education & Demographics

|

|

|

Robotics & Automation

10% of U.S. jobs will be lost to automation in 2019

Robotic process automation (RPA) and artificial intelligence (AI) will create digital workers — software that automates tasks traditionally performed by humans — for more than 40 percent of companies next year, and a full one-tenth of future startups will employ more digital workers than human ones. Moreover, in 2019 roughly 10 percent of U.S. jobs will be eliminated by automation, which will also be responsible for creating the equivalent of 3 percent of today’s jobs.

The competition for AI talent will remain fierce — two-thirds of executives struggle to find and acquire AI talent. That aligns with a recent survey conducted by Deloitte, which found that enthusiasm for AI and automation — plus a strong desire among executives to “catch up with their rivals” — is contributing to an annual global growth rate in AI-as-a-service solutions of 48.2 percent. Deloitte pegs the cognitive technologies market at $19.1 billion globally.

“Intelligent automation” — a combination of cognitive systems, chatbots, and RPA — will replace one-fifth of service desk interactions, and, in turn, shrink enterprise service management workforces. The McKinsey Global Institute this year forecasted that the portion of jobs calling for “low digital skills” may fall to 30 percent in 2030 from the current 40 percent, as jobs that require higher skills increase to 50 percent from 40 percent. VB

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

|

Robotics & Automation

LG is developing robotic carts to automate shopping

South Korean electronics company LG is developing a smart shopping cart that will follow shoppers around in supermarkets, according to the Yonhap News Agency. The electronics leader has formed a new partnership with E-Mart, the largest supermarket operator in South Korea, to build self-driving shopping carts that can make it easier for shoppers — particularly elderly ones — to navigate, while also potentially setting the stage for shopping automation in grocery stores.

LG’s cart will feature self-propulsion mechanisms and cameras that will provide data for routing and guidance. It will be designed primarily to follow the shopper around as they move through the store. The robotic carts will also include barcode scanners to give pricing information, a screen that can display a shopping list, and it will be programmed with a map of where items are located within the store, which will allow it to lead shoppers to products after they enter a query into a companion smartphone app.

By developing robotic systems for grocery stores, LG is setting the stage for two ways that it can expand the role of electronics and appliance companies in omnichannel shopping and grocery delivery. BI

|

|

|

Payments

7-Eleven is Bringing Cashier-Less Payments to its Stores

7-Eleven is piloting a new mobile check-out process called Scan & Pay. 7-Eleven shoppers can track their items by scanning a product’s QR code with their phone and pay using the 7-Eleven rewards mobile app. The company, which operates more than 65,000 stores in 17 countries, is currently piloting Scan & Pay in 14 Dallas stores. It plans to expand the service to additional cities in 2019.

Customers can pay using Apple Pay, Google Pay or a traditional debit or credit card. The only products banned from cashier-less check-out are hot foods, lottery tickets, alcohol and tobacco.

Headquartered in Dallas, 7-Eleven says 50 percent of the U.S. population lives within one mile of one of its stores.

Like other big brick-and-mortar retailers, it’s doing its best to keep up with tech’s big advancements. Earlier this year, the company partnered with the “Deadpool” series to present an augmented reality experience in its stores, among other experiments. TC

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

3DP

Digital Inventory: How 3D Printing Lets Manufacturers Rely Less On Warehouses Of Stuff

Supply chain management and the production and storage of spare parts represent something of a sticking point for the global manufacturing industry. Spare and replacement parts have traditionally been stored on shelves in warehouses after having been produced alongside the components used in original production assemblies.

Out-of-production original assemblies may become fully obsolete once parts are no longer in stock, leaving owners at a loss and needing to reinvest in wholly new products to replace something that may have only been impacted by one broken component that couldn’t be replaced. Many industries rely on physical inventory to meet aftermarket needs and have accordingly built up global supply and distribution networks.

Expensive, massive warehouses of stuff sit in wait to supply demand that may or may not come — and may or may not be localized enough to be helpful for areas of demand.

Rather than stock a physical warehouse with mass quantities of spare parts that may or may not be in demand at any given time, including parts for now-obsolete original products, design files for components can be stored digitally and made on demand. Additive manufacturing, or 3D printing, is taking its place among the agile technologies enabling the adoption of ‘digital inventories.’ Forbes

|

|

|

|

|

|

|

|

Leave a Reply