|

|

|

|

|

|

|

|

|

|

|

|

In the age of globalization and increasing migration, cross-border remittances have ballooned in recent years, reaching double digit growth in 2018. But innovation has not kept pace with the massive size of the market and, saddling many senders with large fees, and receivers with long waiting periods as cash has to pass through a number of financial intermediaries.

That all could change in the coming years, however, as many fintech and digital payment firms work toward cutting down costs and time requirements in remittances.

Read More +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change-Driven Themes: Updates on Previous Featured Topics

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

China

China Factory, Consumer Inflation Slows Amid Weakening Demand

|

|

|

Read More +

|

|

|

|

|

|

Services

|

|

|

Cannabis

Pot May Be Next for Tobacco Farmers Already Turning to Hemp

|

|

|

Cannabis

Public Banks Could Help Serve Marijuana Industry

|

|

|

Read More +

|

|

|

|

|

|

Technology

|

|

|

5G

Japan latest country to exclude Huawei, ZTE from 5G roll-out over security concerns

|

|

|

Smartphones

Apple Hit With Sales Ban on Older iPhones in China, Qualcomm Says

|

|

|

Read More +

|

|

|

|

|

|

Commodities

|

|

|

Oil THEME ALERT

OPEC+ Succeeds, What’s Next For Oil?

|

|

|

Read More +

|

|

|

|

|

|

Endnote

|

|

|

Retail

110+ Startups Disrupting Brick-And-Mortar Retail

|

|

|

Read More +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you haven’t signed up for website access already, see the bottom of the report for a how-to

|

|

|

|

|

|

|

The Next Handle →

Stocks and bonds have struggled over the last year as yields have risen strongly, but MRP believes this is only the beginning. Further tightening of monetary policy is expected to continue delivering upward pressure on yields as slowing earnings and GDP growth begin to bite.

Joe Mac’s Market Viewpoint: The Next Handle →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select a theme to see recent Featured Topics we’ve written about it

|

|

|

|

|

|

|

If you haven’t signed up for website access already, see the bottom of the report for a how-to

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Job Openings Beat Forecasts

The number of job openings in the US increased to 7,079 thousand in October of 2018 from a downwardly revised 6,960 in September and above market expectations of 6,995 thousand. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Stocks Edge Higher on Monday

Wall Street rebounded modestly on Monday 10 December 2018 after sharp losses in the previous week, as stocks reverted deep losses early in the session triggered by tense trade policy and prevailing uncertainty on the global economy’s cycle evolution. The Dow Jones gained 34 points or 0.1% to 24423. The S&P 500 edged up 5 points or 0.2% to 2638. The Nasdaq climbed 51 points or 0.7% to 7021. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

European Stocks Slump on Growth, Brexit Worries

European stock markets closed deep in the red on Monday amid heightened fears that Britain could drop out of the EU in March with no deal after Prime Minister Theresa May canceled a parliamentary vote on her Brexit agreement on expectations it would be rejected by a significant margin. In addition, a slump in oil prices and poor economic data from the world’s largest economies including the US, China, Japan, the UK and Germany raised concerns over slowing economic growth while trade tensions intensified following last week’s arrest of the Huawei CFO. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sterling Falls on Brexit Uncertainty

The British pound extended losses on Monday and touched multi-month lows during the afternoon, after UK Prime Minister Theresa May called of a vote in Parliament on her Brexit deal on Tuesday. Poor economic data showing the country’s manufacturing and construction industries shrank last month also weighed. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you haven’t signed up for website access already, see the bottom of the report for a how-to

|

|

|

|

|

|

|

|

|

The Remittance Revolution: Digitalization Takes on Notorious Fees and Wait Times in a $700 Billion Payments Market →

|

|

|

|

|

|

In the age of globalization and increasing migration, cross-border remittances have ballooned in recent years, reaching double digit growth in 2018. But innovation has not kept pace with the massive size of the market, saddling many senders with large fees, and receivers with long waiting periods as cash has to pass through a number of financial intermediaries.

That all could change in the coming years, however, as many fintech and digital payment firms work toward cutting down costs and time requirements in remittances.

|

|

|

|

|

|

2018 total global remittances are approaching $700 billion this year and are expected to grow 3.7 percent to $715 billion next year. However, remittance payments are still slow, costly, and in dire need of technological innovation.

In remittances’ current format, a person who wants to send money from New York to New Delhi, for example, has to have the funds pass through several intermediaries within the payment corridor. There is a local bank that would first send the funds to a banking partner in London. There the payment would wait for confirmation for a few days before making its way to the, say, Dubai, where the partner bank of the New Delhi bank is located. Add a few more days before the funds get confirmed and sent to the destined New Delhi bank account.

PayPal’s Xoom service, focused on international payments, recently increased its send limits to US$25,000 per transaction for over 50 countries, including India, Canada, the United Kingdom and the Philippines. In a report published in early 2017, it was found that sending money overseas through a digital service like Xoom/PayPal costs nearly half of the average cost of traditional remittances services. The company also signed a deal with Euronet Worldwide subsidiary Ria, which will offer Xoom customers cash pickup services at more than 150,000 of Ria’s international network locations.

To keep pace, established companies like Western Union have begun rebranding themselves as digital companies. WU’s revenue from digital money transfers increased by 23% in 2017, to over $400m. It remains to be seen, though, how far yesterday’s financial service companies can go to fight steep costs and long wait times in the remittance market.

Fees on remittances currently average about 7% of the total sum sent, although some remittance corridors in parts of Africa and other remote areas can carry fees of over 20%. World leaders have pledged to cut the cost of sending remittances to 3% under the sustainable development goals, which could end up saving migrants more than $25 billion each year.

While remittances to developed economies has continued to grow, the larger focus has been on developing nations. The World Bank estimates that officially-recorded remittances to developing countries will increase by 10.8% to reach $528 billion in 2018. This new record level follows a robust growth of 7.8% in 2017. This level of explosive growth is directly reflective of an ever-growing stock of foreign workers from developing countries, a demographic rapidly approaching 200 million, settling in Europe and the Americas.

Last month, Southeast Asian ride-sharing platform Grab threw their hat into the ring by announcing the launch of their own P2P remittance product in 2019, working to a regional eWallet network that will eventually connect the entirety of the Association of Southeast Asian Nations (ASEAN). According to Grab, the remittance market in Southeast Asia was estimated to be valued at $70 billion last year, but Grab said the industry suffers from opaque and expensive pricing structures and inefficient delivery operations, resulting in a sub-optimal user experience in which vast sums are lost and unaccounted for during the process.

A clutch of Europe’s leading financial technology companies, including online remittance providers Azimo and WorldRemit, are also planning to seize market share in Asian remittances and shake up the established retail banking market with new digital payment and wealth management services. The World Bank estimates remittances to South Asia will increase by13.5% to $132 billion in 2018.

Blockchain may also become a serious disruptor in digital payments, especially remittances and other cross-border transfers. The blockchain has already opened alternative payment corridors where money can be sent as quickly as email – without paying hefty commissions. According to the World Bank, the use of blockchain could reduce the spending on fees to as little as 1%.

In India, the largest national recipient of remittance payments ($80 billion in 2018), banks, have begun partnering with global blockchain initiatives to build low-cost remittance solutions that include the use of cryptocurrencies to settle payments.

While the current Indian legal framework is somewhat restrictive toward cryptos, other countries have been working toward a blockchain-based remittance system as well, including 40 within RippleNet, an international blockchain network based on the XRP cryptocurrency. Members of Ripplenet including InstaReM and RationalFX have opened up new payment corridors from the United Kingdom to Malaysia, Vietnam, Indonesia, Sri Lanka and Bangladesh. Specifically, Ripple’s blockchain-based solution has been deployed in Malaysia to expand banking group CIMB‘s existing proprietary remittance system, SpeedSend. The RippleNet integration is already facilitating “instant” remittances through corridors such as to Australia, USA, UK and Hong Kong.

Additionally, Remitr and FlutterWave established a RippleNet corridor to Nigeria from Canada, the first connection on RippleNet in Africa. Sompo Holdings, Inc., one of the largest insurers in Japan has also seen the opportunity for blockchain remittances and cross-border payments in Africa, as the firim has announced a business alliance with the leading digital foreign exchange platform and treasury solution based in Africa, BitPesa. Together, Sompo Holdings and BitPesa believe that using virtual currencies will make it possible to resolve the problems of expensive exchange fees, while reducing long processing times to only an hour.

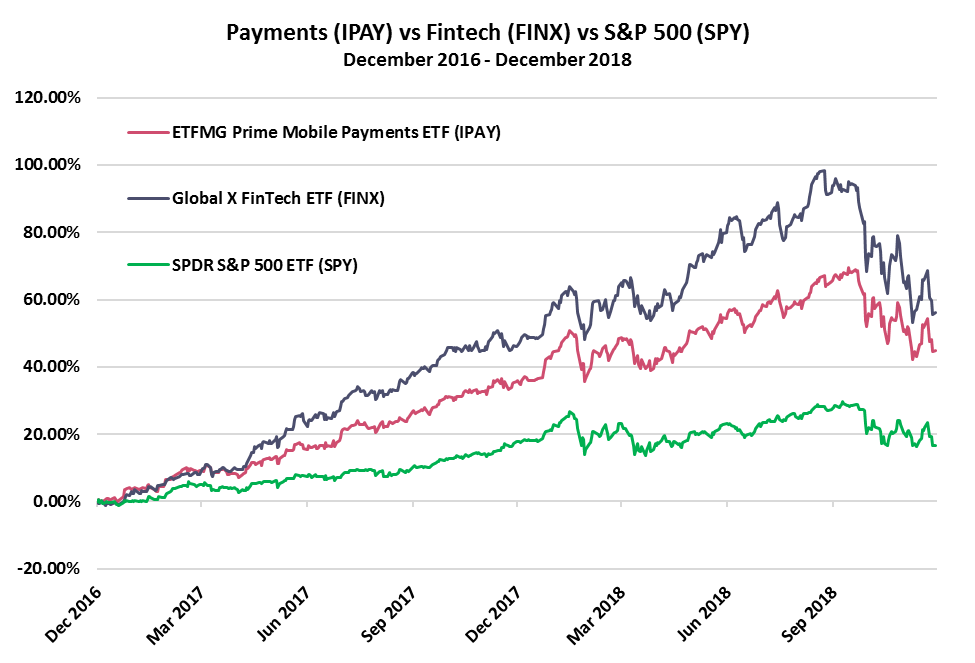

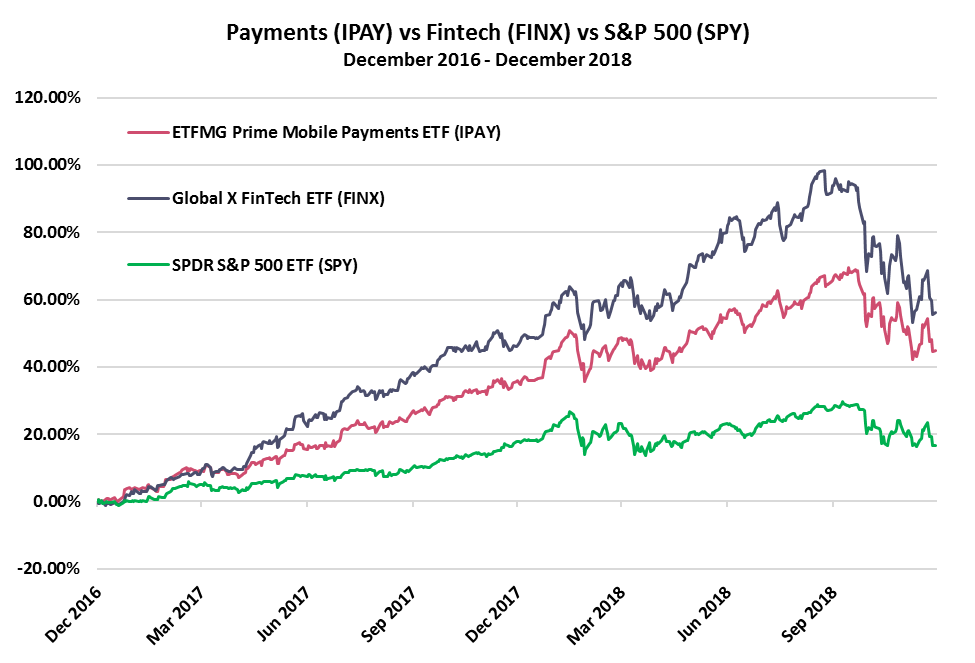

Through bank interconnectivity, blockchain, and other initiatives, the battle is undoubtedly on for market share in remittance payments. Investors can gain access to Payments, Fintech, and Blockchain innovators via the ETFMG Prime Mobile Payments ETF (IPAY) and Global X FinTech ETF (FINX), and Reality Shares Nasdaq NexGen Economy ETF (BLCN), respectively.

|

|

|

|

|

|

|

We’ve also summarized the following articles related to this topic in the Finance section of today’s report.

Payments

|

|

- Strong Advanced Economies Fuel Record 2018 Remittance Flows

- Fintech: Why Europe’s Fintech Firms Are Making a Beeline to This Continent

- India Receives $80 Billion in Remittance, Big Potential for Crypto?

- Grab Launches P2P Remittance Product

|

|

|

|

|

|

|

Payments (IPAY) vs Fintech (FINX) vs S&P 500 (SPY)

————————————————————————————————

Payments (IPAY) vs Blockchain (BLCN) vs Fintech (FINX) vs S&P 500 (SPY)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change-Driven Theme Updates

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Markets

|

|

|

Bonds

Cracks in corporate debt market begin to show

Storm clouds are gathering around the corporate debt market, with investors eyeing higher borrowing costs, deteriorating credit quality and fraught trade conditions.

In the US, about a quarter of junk-rated issuers are now rated at B minus or lower, up from 17 per cent four years ago and the highest level since 2009, according to data from S&P, the rating group.

Diane Vazza, head of fixed income research at S&P, said these “lowest grade issuers”, which have benefited from investors’ desperate search for yield, were eight times more likely to default than other speculative grade issuers, describing it as “having one foot on the banana peel”.

In another sign of the potential cracks in the credit market, Cantor Fitzgerald, the investment bank, has said a third of the US investment grade market has leverage ratios, a measure of a company’s ability to pay its debt, that would otherwise be considered as high yield. “Leverage in corporate credit markets overall has increased to an extreme level since the Great Recession,” said Peter Cecchini, chief market strategist at Cantor.

Spreads are still below the peaks reached during the oil price collapse in 2014-15 and during market ructions in the summer of 2011. FT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

China

China Factory, Consumer Inflation Slows Amid Weakening Demand

China’s factory inflation slowed further amid weakening demand, while gains in the consumer price index moderated. The producer price index climbed 2.7 percent in November from a year earlier, the slowest pace in more than two years. The consumer price index rose 2.2 percent, slower than estimated .

Weaker factory prices add to evidence that demand remains sluggish despite stimulus measures to cut personal income taxes and support private sector financing. This could signal a further deceleration of industrial profits.

Tame inflation gives China’s central bank some room for maneuver should easier monetary policy be required. The space is limited though, as the yuan is vulnerable to downward pressure.

Leading indicators suggest price pressures will continue to moderate going forward. The input and output price components in both the official and Caixin manufacturing purchasing managers’ index data declined in November.

Core inflation, excluding food and energy prices, remained stable at 1.8 percent. The fall in global oil prices was the main driver of the slowdown in PPI inflation, according to Bloomberg Economics. B

|

|

|

|

|

|

|

|

|

|

|

|

Politics & Policy

|

|

|

Payments

Strong Advanced Economies Fuel Record 2018 Remittance Flows

Remittances to low- and middle-income countries are projected to jump by almost 11 percent this year to a record of $528 billion in 2018, according to the latest edition of the World Bank’s Migration and Development Brief. This increase is on top of a 7.8 percent gain last year.

When high-income countries are included, 2018 total global remittances are approaching $700 billion this year and are expected to grow 3.7 percent to $715 billion next year, as remittance to low- and middle-income countries are expected to grow at a slower pace of 4 percent in 2019.

“The future growth of remittances is vulnerable to lower oil prices, restrictive migration policies, and an overall moderation of economic growth,” said Michal Rutkowski, senior director of the World Bank’s Social Protection and Jobs Global Practice.

The strong economy and employment situation in the U.S. was a key driver of remittance growth, according to the report, which specifically cited Latin America and the Caribbean, South Asia, and sub-Saharan Africa as beneficiaries. In particular, remittance recipients were led by India with a total of $80 billion this year, followed by China’s $67 billion, Mexico and the Philippines with $34 billion each, and Egypt with $26 billion. B

|

|

|

Payments

Why Europe’s Fintech Firms Are Making a Beeline to This Continent

A clutch of Europe’s leading financial technology companies are expanding into Asia in an attempt to shake up the established retail banking market with new digital payment and wealth management services.

Nutmeg, an online wealth manager, and Revolut, an app-based current account and money transfer service, plan to launch across Asia to capitalize on the nascent digital banking and investment sector, and to diversify their businesses away from the U.K.

Martin Stead, chief executive of Nutmeg, says he sees “a significant growth opportunity” beyond the U.K. for digital wealth management. Nutmeg plans to launch its online investment services in Hong Kong next year. The company, which allows people to invest with low fees, will work with its biggest shareholder, Hong Kong-based financial services group Convoy, to expand into the local market.

“Asian markets have a large and growing population that is currently under-served and over-charged by the traditional players, and where there is no established wealth tech player either,” says Stead. “This year we have formed partnerships and developed our technology in readiness for launch into our first Asian markets next year.”

The latest development comes only weeks after Tandem, an app-based bank in the U.K., said it had struck a deal with Convoy, which is also a shareholder in the bank, to secure funding and to launch one of the first digital lenders in Hong Kong. OZY

|

|

|

Payments

India Receives $80 Billion in Remittance, Big Potential for Crypto?

The World Bank in its latest report revealed that India has received the largest amount in remittance in 2018 with $80 billion being sent from abroad. At the same time, users paid $4 billion in cuts to payment services.

Remittance in its current format has one-too-many checkpoints. In the entire process, each participant takes away a considerable part of the funds. This is how traditional remittance models become too expensive for day-to-day users. According to the World Bank, in more than 25% of the remittance corridors, commissions are more than 10% higher. So sending a $100 back home can at least cost one $10 in cuts.

Blockchain has opened alternative payment corridors where money can be sent as quickly as email – without paying hefty commissions. In times when people lose on average 7.45% of their money in fees, according to the World Bank, the use of blockchain could reduce the spending to as minimum as 1%.

A good number of Indian freelancers are already accepting Bitcoins as payments and exchanging them for Indian Rupees via p2p exchanges. NBTC

|

|

|

Payments

Grab Launches P2P Remittance Product

Grab, the ride-sharing platform out of Southeast Asia, announced on Thursday (Nov. 15) the launch of a remittance offering under the company’s financial services arm. In a press release, Grab said the launch of the remittance offering marks a “significant milestone” toward the company’s vision for on ASEAN eWallet that will improve financial inclusion for the growing middle class and micro-entrepreneurs in the region. Grab made the announcement during the 33rd ASEAN Summit.

“Inter-operable, real-time regional payment systems will expand opportunities, especially for citizens and small businesses, to access products and services across ASEAN. We hope to see more of such innovative digital services from the private sector,” said Dr. Vivian Balakrishnan, Singapore Minister for Foreign Affairs, in the press release.

According to Grab, the remittance market in Southeast Asia was estimated to be valued at $70 billion last year, and is currently dominated by money transfer operators and financial institutions.

Grab’s product will let banked and unbanked senders remit money instantly and securely to recipients in another country using a GrabPay wallet. Receivers are able to transfer funds instantaneously, and can choose to either cash out the remitted sum through the regular network or use them on everyday transactions, such as bill payments. PYMNTS

|

|

|

|

|

|

|

|

|

|

|

|

Construction & Real Estate

|

|

|

Housing

The Housing Boom Is Already Gigantic. How Long Can It Last?

We are, once again, experiencing one of the greatest housing booms in United States history. How long this will last and where it is heading next are impossible to know now.

Since February 2012, when the price declines associated with the last financial crisis ended, prices for existing homes in the United States have been rising steadily and enormously. According to the S&P/CoreLogic/Case-Shiller National Home Price Index as of September, the prices were 53 percent higher than they were at the bottom of the market in 2012. That means, on average, a house that sold for, say, $200,000 in 2012 would bring over $300,000 in September.

Even after factoring in Consumer Price Index inflation, real existing home prices were up almost 40 percent during that period. That is a substantial increase in less than seven years. It amounts to the third strongest national boom in real terms since the Consumer Price Index began in 1913, behind only the explosive run-up in prices that led to the great financial crisis of a decade ago, and one connected with World War II and the great postwar Baby Boom.

The data can’t tell us when prices will level off, or whether they will plunge catastrophically. All we do know is that prices have been roaring higher at a speed rarely seen in American history.NYT

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

|

Cannabis

Pot May Be Next for Tobacco Farmers Already Turning to Hemp

Altria Group Inc., the U.S. maker of Marlboro cigarettes, made a $1.8 billion investment in Cronos Group Inc. on Friday amid pressure to find new growth avenues as U.S. smoking rates decline.

The partnership, which includes the option for Altria to take majority control in the future, may see the firm’s U.S. tobacco suppliers switch to cannabis if the drug is legalized, said Mike Gorenstein, chief executive officer of Toronto-based Cronos. While several states have legalized marijuana, it remains banned at the federal level.

“It’s certainly helpful that Altria already has a relationship with local contract farmers,” Gorenstein said in a phone interview Friday. “We can help those farmers transition immediately into cannabis cultivation.” Altria outsources tobacco production to “several thousand” farmers, according to the company’s website.

Cronos grows its own cannabis at a facility about 130 kilometers (80 miles) north of Toronto but it’s more focused on genetics and intellectual property than cultivation, Gorenstein said on a conference call with analysts Friday. Its shares surged 22 percent to a market value of C$3 billion ($2.3 billion) on the Altria deal, making it the fourth-biggest pot company. B

|

|

|

Cannabis

Public Banks Could Help Serve Marijuana Industry

The Bank of North Dakota is the only state-owned and state-run bank in the U.S. Born of necessity, the banking model pioneered by North Dakota has since proved profitable – to the tune of 14 consecutive years of record-breaking profits.

The bank ended 2017 with $145.3 million in net earnings and a 17 percent return on investment – which stands in contrast to the average 8.77 percent return on equity for U.S. banks. There are two central elements to the bank’s operation: its independence from the federal government and a conservative, partnership-driven approach to banking that focuses on what benefits the state and its residents.

While seven other states have tried to establish public banks since Congress declined to renew the Second Bank of the United States in 1834, North Dakota is the only state that has found success, largely because of the void in local lending for farmers that the bank filled. Today, a similar void can be found in states where recreational marijuana is legal, creating a sizeable industry that is currently unbanked thanks to marijuana’s designation as a controlled substance on the federal level, meaning that any bank associated with the federal government – anything from using a federal routing number to being insured by the Federal Deposit Insurance Corp. – can’t accept marijuana money. USNews

|

|

|

|

|

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – https://mcalindenresearchpartners.com/free-30-day-trial/ |

|

Leave a Reply