|

|

|

|

|

|

|

|

| We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – https://mcalindenresearchpartners.com/free-30-day-trial/

|

|

|

Sales for some of the gaming industry’s most successful franchises fell short of expectations in 2018, leaving many laying blame at the wildly popular Fortnite. The reality, however, is that the “Fortnite Effect” isn’t really about the game itself, but the games-as-a-service model it uses to generate revenue and keep players plugged in.

Read More +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Updates on Previous Featured Topics

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Small Businesses

U.S. Small-Business Optimism Hits Two-Year Low Amid Shutdown

|

|

|

Read More +

|

|

|

|

|

|

Finance

|

|

|

Banks THEME ALERT

The next round of bank mergers has finally arrived

|

|

|

Read More +

|

|

|

|

|

|

Technology

|

|

|

Semiconductors

Asian chipmakers’ profits plunge after smartphone downturn

|

|

|

Big Data

Data is not the new oil

|

|

|

Read More +

|

|

|

|

|

|

Commodities

|

|

|

Oil THEME ALERT

Oil Jumps As Saudis Plan Further Production Cuts

|

|

|

Metals THEME ALERT

China’s demand for electric vehicles charges copper

|

|

|

Read More +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patience, Patience →

A month into the new year, things seem a bit more upbeat than they did at the close of 2018, but recession talk still abound, even with little evidence. In reality, the US economy appears quite robust, touting annual growth near 3% for 2018, and expectations for coming years that will compare well to previous decade. In light of this, the dollar also looks quite strong for now, which could spell trouble for earnings near-term growth. Powell’s patient pause should allow for an extension of the recent rally for a while.

Joe Mac’s Market Viewpoint: Patience, Patience →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select a theme to see recent Featured Topics we’ve written about it

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Job Openings Hit Record High

The number of job openings in the US reached an all-time high of 7.335 million in December 2018 from an upwardly revised 7.166 million in the previous month and above market expectations of 6.9 million. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Stocks Rally on Tuesday

Wall Street rallied on Tuesday 12 February 2019, following news that a second US government shutdown can be avoided through a funding agreement and as investors continue optimistic over a US-China trade deal. Also, investors responded positively to new that lawmakers reached a tentative funding agreement to avoid a second partial government shutdown which includes $1.4 billion to build 55 miles of new border fencing with Mexico, less than $5.7 billion demanded by President Trump. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

European Shares Trade Higher on Wednesday

European stocks traded in the green on Wednesday morning, following gains in Asia with autos shares among the best performers amid optimism over trade talks between the US and China after President Trump said he’s open to extending a March 1 deadline if the two countries were close to a deal. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Prices Rise on OPEC Cut

Oil prices rose on Tuesday, after the latest OPEC monthly report showed a decrease in output by 797,000 barrels per day to 30.8 million in January from 31.6 million bpd in December. Saudi Arabia, the world’s leading oil exporter, pumped about 10.2 million bpd in January, down 350,000 bpd from December and said that it would reduce production to nearly 9.8 million barrels per day in March, over half a million bpd more than originally pledged. Also, US sanctions against Venezuela and Iran weighed on sentiment. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THEME ALERT

|

|

|

The “Fortnite Effect” Foreshadows the Rise of Games-as-a-Service →

|

|

|

|

|

|

Sales for some of the gaming industry’s most successful franchises fell short of expectations in 2018, dragging down stock prices for Activision, EA, and others, and leaving many laying blame at the wildly popular online battle royale, Fortnite.

The reality, however, is that the “Fortnite Effect” isn’t really about the game itself, but the games-as-a-service model it uses to generate revenue and keep players plugged in. Free to play games have been popular for many years, especially among mobile gamers, but digitalization has sped its jump to the console and PC world, leaving most gaming companies just now catching up.

|

|

|

|

|

|

In the midst of a mixed earnings season for the ailing video game sector, the latest diagnosis has been the popularity of Fortnite, a multiplayer online battle royale, developed by Epic Games. The game’s retention is so strong that it is actually hurting sales and drying up revenue for the latest releases of some of the most popular gaming franchises. Late last year, Fortnite said it had 200 million registered users, up from 125 million in June. In fact, the game has become so popular that Netflix said last month that it considered the game more of a competitor for screen time than HBO.

While such dominance of the competition from a single video game is unprecedented, what it means for the future of video games is not actually much of a surprise to those who have been paying attention to the path industry has been is taking.

MRP has highlighted free-to-play games, also known as games-as-a-service (GaaS), in the past. GaaS, similar to software-as-a-service, provides video games or game content on a continuing revenue model, monetizing games either after their initial sale, or to support a free-to-play model through in-game purchases, also called microtransactions. Fortnite fits this mould perfectly: the base game is free to play, but players make in-game purchases to upgrade their characters and game modes.

Originally, this model was hugely successful for some of the most popular mobile games of all time; something MRP noted when we originally launched our Long video games theme in 2017. Fortnite, however, has been a pioneering force in mainstreaming GaaS in the console and PC gaming space.

But it isn’t just Fortnite. Last year, US spending on gaming hardware, software and accessories & game cards tracked by NPD Group touched $16.67 billion. However, subscriptions and microtransactions revenue managed to amass a total of $26.73 billion. As in-game spending alone could approach 50% of total industry revenue by this year, it is becoming abundantly clear that post-launch revenue streams are on their way to becoming a key growth engine for traditional gaming companies.

On average, more than half of the gamers who said they’ve already bought or planned to buy at least one of 15 top games in 2018 planned to purchase downloadable content for the game. More than 50% of the gamers on a UBS survey noted that they had plans to purchase expansion packs or other downloadable content (DLC) for the games they buy.

Console game companies have already pushed harder on titles filled with microtransactions, loot boxes, in-game app purchases, launch date DLC and season passes or even monthly subscription charges. The Business of Video Games, published by DFC Intelligence in October, shows Electronic Arts and Activision have grown by almost $80 billion combined since ramping up their efforts with GaaS in 2012. Although the success of Fortnite has hurt other titles over the last year, it is forcing the industry to finally press the gas pedal into a new, transformative era.

The free to play model, as well as the simplicity of gameplay that makes Fortnite so addictive can also be a weakness, as it is easily duplicated. Just this month, Electronic Arts, for example, released a free-to-play game many are calling a Fortnite copycat, titled “Apex Legends”. Within just a week of its Feb. 4 debut, the number of gamers playing Apex Legends had crossed 25 million and there were about 2 million people playin concurrently at peak volume. The company even believes that adding an online battle royale mode to some games that underperformed expectations in 2018, like Red Dead Redemption 2 and Battlefield 5, may bring in additional revenue.

Obviously not every game from here on out can just copy and repackage Fortnite, but the fact that major gaming companies are finally committing to true GaaS methods shows they have received the message and are prepared to adjust course.

The rise of GaaS should also provide stronger profitability by accelerating the digitalization of gaming. Almost all free to play games are downloadable, not sold as physical disks or other hardware. NPD expects spending on digital content to account for 90% of total gaming content spending in 2019, and a 2018 Piper Jaffray report predicts that all video games could be 100% digital by 2022. This is especially significant for investors since an all-digital revenue future for video games could increase the operating margins of companies like Activision Blizzard and EA by 10%. “Applying modest (5% or less) top line growth and the positive margin impact mentioned above, 2022 publisher earnings per share would be more than double what each just reported for 2017,” they wrote.

Going forward, GaaS via free to play games, as well as more DLC in traditional games, will continue to provide stronger post-launch revenue streams for gaming companies that will likely focus on producing fewer games, but a larger and more drawn out volume of in-game content for the most successful products. Essentially, the Fortnite effect disrupted the gaming industry, creating a short term adjustment period for the sector. But as the adjustment is made and companies respond to demand, investors will feel the longer-term benefits.

|

|

|

|

|

|

|

THEME ALERT

|

|

|

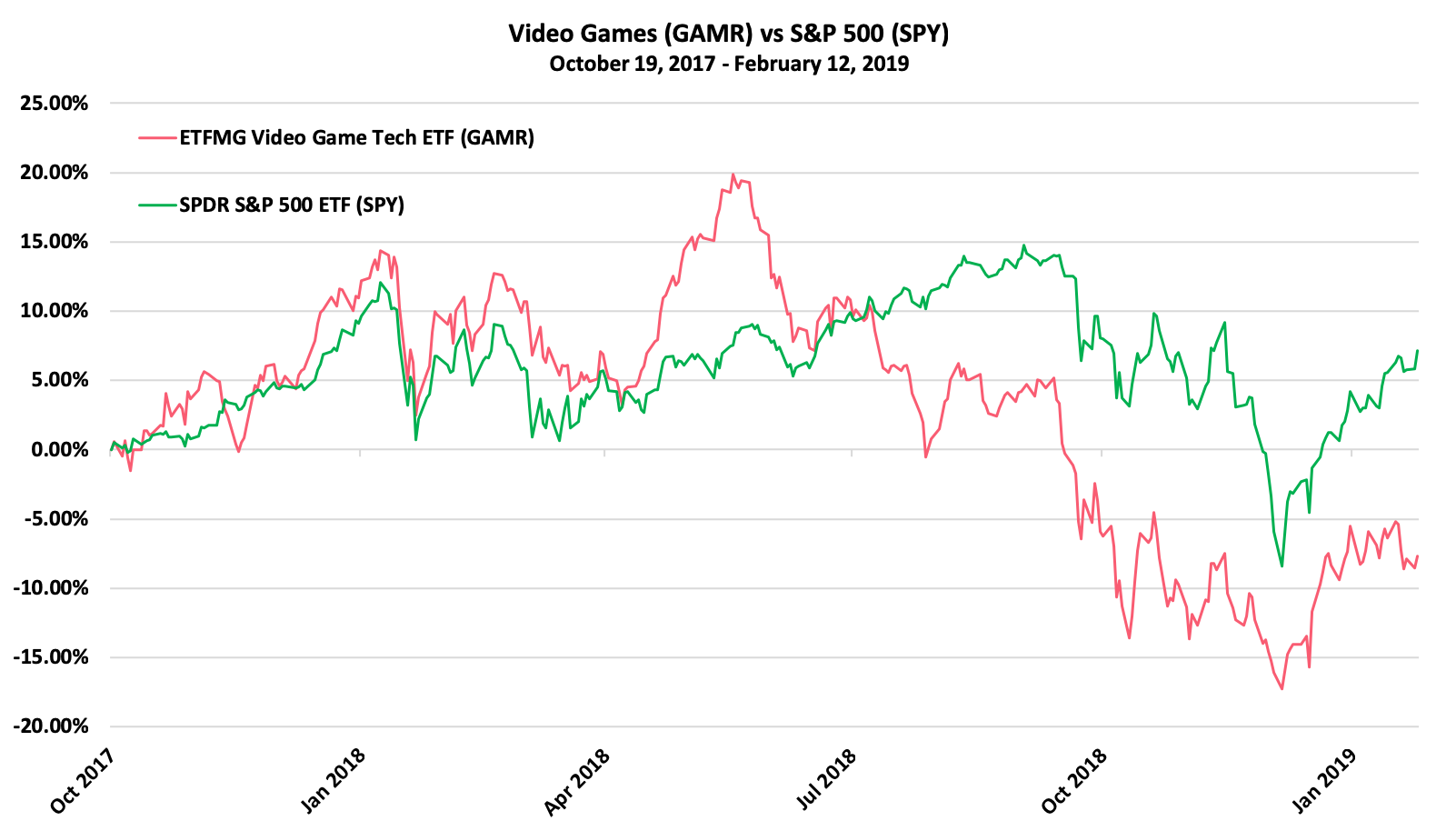

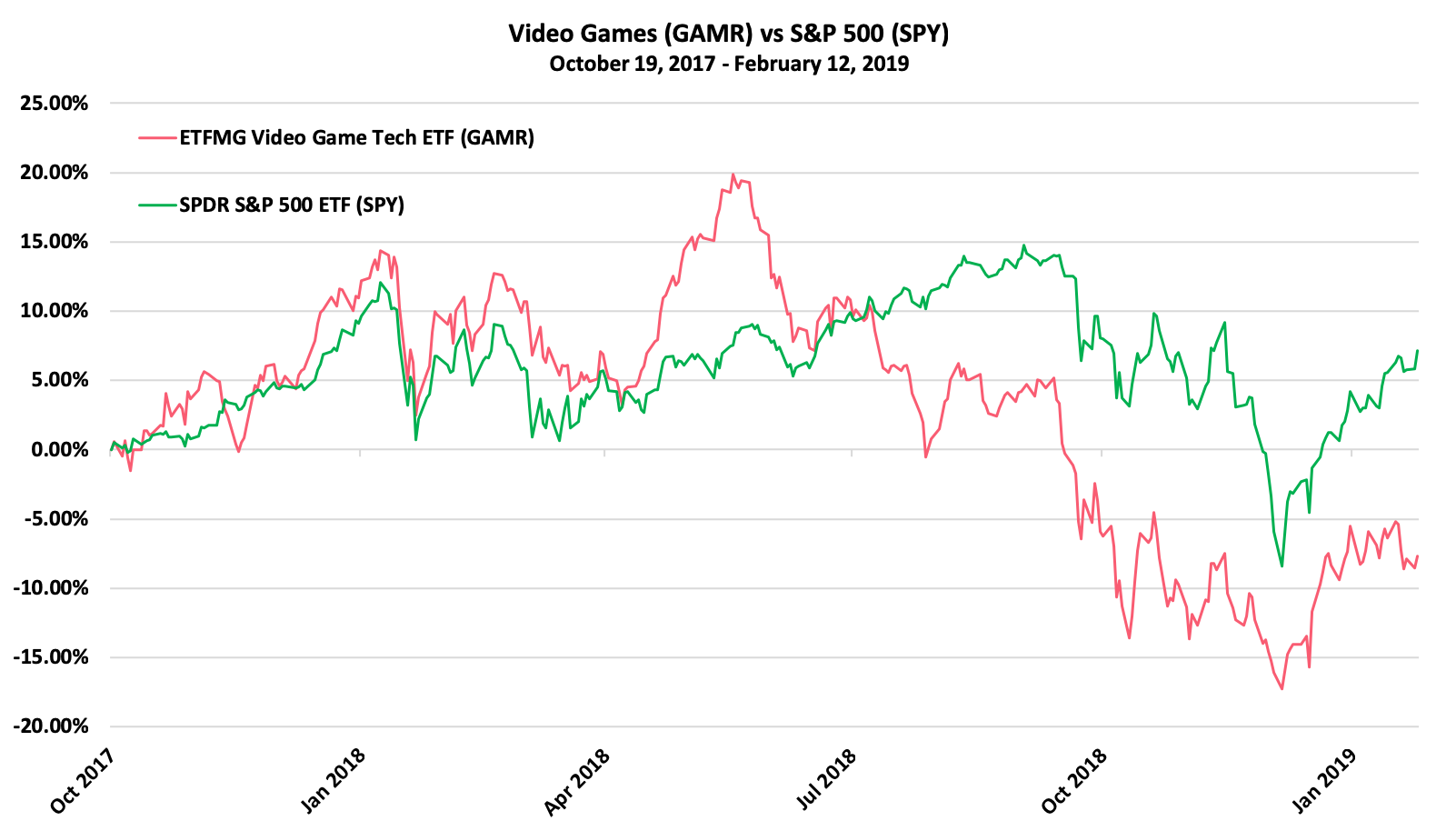

MRP added Long Video Gaming to our list of themes on October 19, 2017. Since then, the Video Game ETF (GAMR) has declined 7.71% vs the S&P 500’s 7.16% return over that same time period.

|

|

|

|

|

|

|

We’ve also summarized the following articles related to this topic in the Services section of today’s report.

Video Games

|

|

- Electronic Arts is surging as Wall Street cheers on ‘Apex Legends’ winning 25 million gamers in a week

- Video Game Stocks Get Clobbered, and Fortnite Is to Blame

- EA accumulate $1 billion in microtransactions, analysts say

- This Is Why Video Game Microtransactions Aren’t Going Anywhere

|

|

|

|

|

|

|

Video Games (GAMR) vs S&P 500 (SPY)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

|

Small Businesses

U.S. Small-Business Optimism Hits Two-Year Low Amid Shutdown

Sentiment among U.S. small businesses slumped in January to the lowest level since Donald Trump became president, as the economic outlook weakened amid the longest-ever U.S. government shutdown.

The National Federation of Independent Business’s optimism index fell 3.2 points to 101.2, the lowest since November 2016, according to a report. That’s below the median estimate of economists surveyed by Bloomberg. The net share of companies expecting business conditions to improve in six months declined to 6 percent, the lowest since October 2016 and down from a post-election peak of 50 percent.

The survey suggests that the political stalemate in Washington over Trump’s demand for a U.S.-Mexico border wall was weighing on business owners. The 35-day shutdown, which ended Jan. 25, halted loan applications while the Small Business Administration was closed. Additionally, many contractors suffered from the shutdown, along with other small firms that rely on federal workers, such as restaurants located near offices. B

|

|

|

|

|

|

|

|

|

|

|

|

Monetary Policy

|

|

|

Fed

Fed Game Changer: Policymakers Mull Anytime QE To Bolster Dow Jones, Economy

The Federal Reserve could be on the verge of an implicit “whatever it takes” moment. On Friday, San Francisco Fed President Mary Daly revealed that the Fed is considering using quantitative easing, or QE, more regularly — not just as a last resort. The late-afternoon news seemed to give the Dow Jones and broad stock market only a modest boost toward the end of the session, but it could be a game-changer.

Such a move would seem to suggest that the Fed isn’t about to let a crisis of investor confidence help drag the U.S. back into recession — or even close to one. That’s reminiscent of ECB President Mario Draghi’s “whatever it takes” vow in 2012 to resuscitate the euro area. The Fed surely has its reasons. Numerous economists and investors have warned that the next recession could be hard to shake, as the threat of deflation, pension crises, massive deficits and political populism all rise to the surface. IBD

|

|

|

|

|

|

|

|

|

|

|

|

Finance

|

|

|

Banks

The next round of bank mergers has finally arrived

After a decade-long lull, flashy mergers between American banks are back. The announcement last week that BB&T (BBT) and SunTrust (STI) will join forces, forming the sixth-largest US bank, has sparked industry chatter that other mid-size US banks could team up to take on the sector’s heavyweights.

There are several reasons why this makes sense. Rising tech costs make scale more attractive. Competition from the banking giants, startups and even non-banks, like private equity firms, is squeezing regional players. And middle-tier banks want to keep expanding their balance sheets, forcing them to find other ways to chase growth. “Bigger does make sense,” said Brian Klock, an analyst at Keefe, Bruyette & Woods who covers large US regional banks.

After the 2008 financial crisis, mergers and acquisitions in the banking sector stalled as regulation of the industry ramped up and the public remained wary of “too big to fail” institutions. Ten years later, another round of consolidation appears imminent, according to Alan McIntyre, Accenture’s senior managing director for banking. CNN

|

|

|

|

|

|

|

|

|

|

|

|

Services

|

|

|

Video Games

Electronic Arts is surging as Wall Street cheers on ‘Apex Legends’ winning 25 million gamers in a week

Electronic Arts is rallying, up 8.65% to $105.65 apiece early Tuesday after Wall Street analysts sent out bullish views on the player data update of its latest game “Apex Legends.”

The company announced late Monday that the number of gamers playing “Apex Legends” had crossed 25 million since it was launched on February 4, and over the weekend it had over 2 million concurrent players at the peak. It previously said more than 10 million players jumped into the game within three days of its debut.

Apex is considered a challenger to widely popular “Fortnite” in providing a free-to-play battle royale experience where multiple players fight for survival at the same time.

The user data released by EA impressed analysts across Wall Street, prompting them to raise their price targets. “For reference, it took Fortnite 3 months to reach 30 million,” Bernstein analyst Todd Juenger said in a note out on Tuesday. “AL’s stunning success should also greatly reduce the frustration with management sometimes expressed by investors. AL demonstrates a brave innovation.” BI

|

|

|

Video Games

Video Game Stocks Get Clobbered, and Fortnite Is to Blame

Shares of video game makers slid on Wednesday after Electronic Arts and Take-Two Interactive Software delivered disappointing results. Those two stocks, as well as shares of rival Activision Blizzard, were down more than 10 percent. One reason for the disappointing performance? Competition from Epic Games’ Fortnite.

Fortnite has become a sensation around the world since it was released in late 2017. The game, which features an online battle royale in which hundreds of players fight for survival, is free to play. Players make in-game purchases to upgrade their characters. By late last year, Fortnite said it had 200 million registered users, up from 125 million in June. In fact, Fortnite has become so popular that Netflix said last month that it considered the game more of a competitor than HBO.

Late Tuesday, Electronic Arts said that unit sales of its newest version of Battlefield had fallen about one million short of expectations and that, as a result, it was lowering its forecast for 2019. Take-Two also offered a weaker outlook than expected. As consumers have increasingly embraced free-to-play games such as Fortnite over the past year, sales of traditional console games have suffered.

Shares of Electronic Arts and Activision are down more than 43 percent since the end of June. Take-Two is off 22 percent over that period. NYT

|

|

|

Video Games

EA accumulate $1 billion in microtransactions, analysts say

EA’s mobile sports line-up has raked in over $1 billion for the publishing hydra to date, according to an analysis by Sensor Tower. Games from the NFL Madden free-to-play line-up account for a majority of microtransaction revenue. These figures relate to in-app purchases across all self-published EA Sports free-to-play mobile titles released on the App Store and Google Play worldwide. The titles in question include UFC, NBA Live, FIFA Soccer, Madden NFL and a whole range of others.

The largest contributor to this revenue stream is the Madden NFL branch of EA’s mobile sports line-up, accounting for nearly half of all in-app purchase revenue, or roughly $490 million worth of player-spending. FIFA titles – FIFA Soccer and FIFA 15 Soccer Ultimate Team to be more precise, come in at a close second, providing for roughly 36 per cent of revenue.

When it comes to a breakdown of revenue by region, US customers contribute a clear majority of purchases with approximately 62 per cent of that $1 billion figure being generated in the region. Microtransactions from Great Britain and Japan account for 5.7 and 5.4 per cent of the total revenue respectively. AltChar

|

|

|

Video Games

This Is Why Video Game Microtransactions Aren’t Going Anywhere

2018 was a great year for the US video game industry according to the NPD Group. Overall, industry spending in the US was up 13% over 2017, with total spending reaching $16.67 billion over 2017’s $14.716 billion. This number doesn’t include everything, however. Once you figure in subscriptions and microtransactions, total spending balloons to $43.4 billion over the previous year’s $36.9 billion. (Note, all these numbers are for console and PC game sales, not mobile, and the NPD Group doesn’t track all digital or PC sales across all publishers so this data isn’t complete.)

Hardware, Software and Accessories & Game Cards all saw growth in 2018. Hardware was up 8%, driven largely by the Nintendo Switch. Software, not including MTX or subscriptions, was up 7%. But Game Accessories & Game Cards (headsets, gamepads, etc.) was up a whopping 33%.

Still, the total of all three of those categories was just $16.67 billion. That’s not even half of the total $43.4 billion the NPD says US consumers spent on video games in 2018. In fact, that leaves $26.73 billion up for grabs, all of which comes from the NPD’s “Software, including in-game purchases and subscriptions” category.

When you look at it in this light you can really see why Games As Service have taken off in recent years, and why the industry puts so much emphasis on microtransactions, whether those are skins in Fortnite (a game the NPD doesn’t even track) reticles in Black Ops 4 or Gold Bars in Red Dead Online. Forbes

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

Lasers

Pentagon Warns That Enemies Could Shoot US Satellites With Lasers

On Monday, the Pentagon released a report titled “Challenges to Security in Space” in which a key claim is that Russia, China, Iran, and North Korea are in the process of developing technologies they could use to attack U.S. satellites.

According to the report, at least two of these nations — China and Russia — are “likely” pursuing “laser weapons to disrupt, degrade, or damage satellites and their sensors.” “China likely will field a ground-based laser weapon that can counter low-orbit space-based sensors by 2020,” the report reads, “and by the mid-to-late 2020s, it may field higher power systems that extend the threat to the structures of non-optical satellites.”

Russia, meanwhile, already has a land-based laser weapon the Pentagon believes is “likely intended for an anti-satellite mission.” The nation is now reportedly “developing an airborne (anti-satellite) laser weapon system to use against space-based missile defense sensors.”

The importance of satellites to modern life — not just modern military operations — is nearly impossible to overstate. If one nation did want to wreak havoc on another, taking out its satellites would certainly do the trick. So if the intel behind the Pentagon’s new report is solid, it’s imperative that the U.S. find ways to counter any laser threats to U.S. satellites. Futurism

|

|

|

Satellites

SpaceX wants to build up to 1 million Earth satellite internet connections

You still need ground-based systems to receive a signal from satellite internet. With SpaceX’s February 1 filing to the US Federal Communications Commission, it’s requesting to deploy up to a million ground stations in the US—including in Alaska, Hawaii, the Virgin Islands, and Puerto Rico—to provide connection points to its internet satellites on behalf of its sister company SpaceX Services.

SpaceX has already received the go-ahead from the FCC on the launch of 4,425 satellites that will make up its Starlink internet constellation. It still hasn’t divulged much information about the service it will offer and where, but it successfully launched two test satellites—called Tintin A and Tintin B—into orbit in February 2018.

The thousands of satellites will be gradually launched over five years and won’t all be in low-Earth orbit until 2024. The company plans to send up the first members of the initial constellation later in 2019. A further 7,500 satellites will—at some point—add additional capacity. MIT

|

|

|

Defense

Are Cyborg Warriors a Good Idea?

Science fiction has been warning about cyborg warriors for a long time, mainstream journalism not so much. But several recent articles have focused on this potential peril, including one in The Atlantic titled “The Pentagon Wants to Weaponize the Brain.” The subtitle asks, “What Could Go Wrong?”

Journalist Michael Joseph Gross reports on efforts of the Pentagon’s think tank, the Defense Advanced Research Projects Agency, to create technologies that result in “merging minds and machines.” The most dramatic are brain chips, arrays of electrodes that, when implanted in the brain, can receive electrical signals from and send them to neural tissue.

Officially, Darpa intends brain chips to help paralyzed and otherwise disabled veterans—for example, by allowing them to control computers and robotic limbs. Darpa is also interested in upgrading healthy soldiers, according to Gross. “What the agency learns from healing makes way for enhancement,” he writes. “The mission is to make human beings something other than what we are, with powers beyond the ones we’re born with and beyond ones we can organically attain.”

Gross cautions that “when scientists put electrodes in the brain, those devices eventually fail—after a few months or a few years.” He quotes a neural engineer asserting that an implanted memory prosthesis, which requires understanding how the brain encodes complex information, is “far out of reach right now.” SciAm

|

|

|

3DP

Is the Revolution of 3D-Printed Building Getting Closer?

3D printing is sometimes hailed as a revolution for architecture and construction. Enthusiasts say the technology is much faster and cheaper than conventional building, and that it has a smaller environmental footprint. But so far, machine-printed buildings have not materialized in significant numbers. Most examples are one-offs and are not fully habitable. The technology is hard to reconcile with building codes, and large-scale printers are scarce and expensive.

However, robotic architecture is still maturing. Recent examples include an office space in Copenhagen (2017) and a micro-home in Amsterdam (2016). Last March, an Austin startup named Icon debuted a tiny 3D-printed house, built in less than 48 hours, at South by Southwest. The company has partnered with the non-profit New Story on a plan to construct dozens of 3D-printed homes in El Salvador.

Meanwhile, the U.S. Marine Corps has 3D-printed a 500-square-foot concrete barracks hut, with an eye to robots eventually building military structures on demand. And last month, two companies announced a 3D-printed homebuilding system called We Print Houses, which they intend to license to builders and contractors around the U.S. CityLab

|

|

|

|

|

|

| There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – https://mcalindenresearchpartners.com/free-30-day-trial/ |

|

|

|

|

|

|

|

|

|

Leave a Reply