|

|

|

|

| We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – https://mcalindenresearchpartners.com/free-30-day-trial/

|

|

The real estate industry, a long-term laggard when it comes to innovation, is undergoing a digital transformation. Proptech upstarts are making it easier and cheaper than ever to buy/sell property, taking business away from traditional brokers and middlemen in the real estate ecosystem.

Read More +

|

|

|

|

|

|

|

|

|

|

Updates on Previous Featured Topics

|

|

|

|

Markets

|

|

Digital Currencies

CME Group’s Bitcoin Futures See a Surge of Institutional Interest

|

|

Digital Currencies

Major European Derivatives Exchange to Launch Cryptocurrency Futures

|

|

Stocks

Rally in Stocks and Bonds Reveals Diverging Views on the Economy

|

|

Stocks

Forget FANGs, Lay Off Drugs. Industrials Are the New Big Trade

|

|

FX/Gold

Is The U.S. Dollar’s Hegemony Beginning To Wane?

|

|

Read More +

|

|

|

|

Manufacturing & Logistics

|

|

Industrials

Here are the companies poised to profit from the Trump border wall

|

|

Read More +

|

|

|

|

Technology

|

|

Asteroid Mining

Why Japan’s mission to bring space rocks to Earth is so incredible

|

|

Robotics and Automation THEME ALERT

A new RFID tracking system from MIT could make robotics cheaper and easier

|

|

Read More +

|

|

|

|

Commodities

|

|

Crops

25 million tonnes of US soybeans will go unsold this year as a direct consequence of the trade war with China

|

|

Metals THEME ALERT

Will Copper’s Revival Last? China Is the X-Factor.

|

|

Lithium THEME ALERT

Albemarle Stock Is Up. That’s Good For These 5 Other Stocks, Too.

|

|

Read More +

|

|

|

|

|

|

|

Economics & Trade

|

|

US Consumers

Tax refunds are $11.5 billion behind our forecast: UBS

|

|

Read More +

|

|

|

|

Construction & Real Estate

|

|

US Housing THEME ALERT

Home sales continue to get whacked, falling to a 3-year low, and an increase in mortgage delinquencies is looming

|

|

Read More +

|

|

|

|

Services

|

|

E-Cigs

Juul Expects Skyrocketing Sales of $3.4 Billion, Despite Flavored Vape Ban

|

|

Plant-Based

Good Catch hopes consumers will bite as it launches plant-based tuna at national retailers

|

|

Waste Management

‘Moment of reckoning’: US cities burn recyclables after China bans imports

|

|

Read More +

|

|

|

|

Transportation

|

|

Private Space

SpaceX is about to launch an Israeli mission to the moon. If successful, it would be the world’s first private lunar landing.

|

|

Read More +

|

|

|

|

Biotechnology & Healthcare

|

|

CRISPR THEME ALERT

CRISPR Could Make You Immune To The Flu

|

|

CRISPR THEME ALERT

CRISPR twins’ brains may have been unintentionally ‘enhanced’

|

|

Pharma THEME ALERT

Germans develop breast cancer blood test

|

|

Read More +

|

|

|

|

Endnote

|

|

PropTech

Billions of Dollars are Heading Toward ‘PropTech’

|

|

Read More +

|

|

|

|

|

|

|

|

|

Joe Mac’s Market Viewpoint

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Patience, Patience →

A month into the new year, things seem a bit more upbeat than they did at the close of 2018, but recession talk still abound, even with little evidence. In reality, the US economy appears quite robust, touting annual growth near 3% for 2018, and expectations for coming years that will compare well to previous decade. In light of this, the dollar also looks quite strong for now, which could spell trouble for earnings near-term growth. Powell’s patient pause should allow for an extension of the recent rally for a while.

Joe Mac’s Market Viewpoint: Patience, Patience →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select a theme to see recent Featured Topics we’ve written about it

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Week Ahead

This week the US Q4 GDP report will be keenly watched, alongside ISM Manufacturing PMI, personal income and outlays, housing data and factory orders. Elsewhere, important releases include: UK consumer confidence and Markit Manufacturing PMI; Eurozone business survey, inflation and unemployment; Germany consumer morale and retail trade; Japan industrial output, retail sales, consumer sentiment and jobless rate; China NBS and Caixin Manufacturing PMIs and NBS Non-Manufacturing PMI; and Q4 GDP growth rates from India, Canada and Brazil. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Trade Talks with China Extended for Two More Days

President Trump met with Chinese Vice Premier Liu He on Friday 22 February 2019, with reports pointing to a late-March meeting in Florida and a 1.2 trillion commitment from China to buy US goods. Both sides agreed to extend high-level negotiations in Washington for two more days. Treasury Secretary Mnuchin said that the March meeting may depend on the outcome of the next few days of negotiations. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Chinese Yuan Hits 32-week High

USDCNY decreased to a 32-week low of 6.6823. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Palladium Hits All-time High

Palladium increased to an all-time high of 1504 USD/t.oz. TE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proptech is Uberizing the Real Estate Industry →

|

|

|

|

The real estate industry, a long-term laggard when it comes to innovation, is undergoing a digital transformation. Proptech upstarts are making it easier and cheaper than ever to buy/sell property, taking business away from traditional brokers and middlemen in the real estate ecosystem.

|

|

|

|

Until recently, the real estate industry still relied on archaic technology and expensive middlemen to connect the demand and supply sides of the market. Now, a wave of Proptech firms is changing the landscape, especially the way that today’s consumers search for, negotiate, buy/rent and finance their home.

Proptech, broadly defined as technology used in the real estate market, is to the real estate industry what Fintech is to the banking industry. Just as Fintech automated processes people used to do in person within banking (such as depositing a check at the teller instead of just scanning it with your phone), Proptech is cutting the use of paper-heavy, fax-facilitated, lawyer-involved, realtor-mediated transactions.

These newcomers are leveraging mobility technology, big data, connected objects (e.g. IoT) and digitization to make real estate transactions more transparent, convenient, speedy and cheap. The areas of disruption include property-search, transaction-processing and deal-closings.

Traditionally, property buyers and sellers have relied on live real estate agents to list and show a home and to close the transaction. However, power is shifting away from the middleman to the consumer thanks to the proliferation of online and mobile real estate platforms. These platforms can be subscription-based or transaction-based and they generate high fees from users, be they brokers or homebuyers, sellers or renters.

Until recently, the biggest tech innovations to hit the residential real estate market came from listing sites like Zillow and Redfin. These early market entrants quickly figured out that their listings platforms would attract millions of consumer traffic which in turn would generate valuable market data that could be repurposed to offer additional paying services to their users.

A new crop of start-ups has taken the game further, eliminating the need for consumers to hire a real estate agent to guide them from start to finish.

If you’re looking to sell your house in the United States, for example, San Francisco-based startup Opendoor will save you from the hassle of listings, showings, and months of uncertainty. Operating in 14 cities across the country, Opendoor purchases property online directly from homeowners, and at a price that is set by the startup’s proprietary algorithm driven by big data.

This “uberization” of real estate is a giant step forward. The traditional real estate closing process is still quite antiquated and inefficient. It takes 44 days on average to close on a mortgage in the United States. Even buyers who are preapproved for a mortgage are looking at 30 days. Now, there are options around this lengthy process, and all one needs is a mobile phone.

If a would-be seller accepts Opendoor’s value for their house, the company will buy the property, charging a 6.5% transaction fee to the homeowner for the convenience. After renovating the property, Opendoor puts it back on the market and tries to resell it within 90 days using connected locks and cameras to enable self-guided visits from prospective homebuyers.

Across the pond, HouseSimple offers the same convenience to UK homeowners. CEO Alex Gosling says that online real estate brokers have captured 5% of the market and estimates that they might reach 15-20% by 2020.

In the rental market, Barcelona-based startup Badi uses an algorithm powered by artificial intelligence to match roommates in four major European markets: Spain, France, Italy and the UK. Badi applies machine learning technology to help with the matching process — learning from users of its platform as they match and agree to become roommates, and then feeding “compatibility insights” back in to keep improving its recommendations.

Badi was founded in 2015 to address the rising trends of urban living and tourism that’s been driving up rents and squeezing more people into shared houses to try to make city living affordable. Consumers are embracing the concept. Badi has already received 12 million rental requests and passed one million registered users in November 2018, up from around 700,000 in February 2018.

Other startups are designed to offer support to real estate professionals rather than replace them completely. IMRE, for instance, runs artificial intelligence-based personal assistants for realtors. Chatbots respond to questions from prospective clients 24/7 on behalf of the realtor. IMRE uses machine learning to answer objective questions about listings such as price, number of bedrooms, school district, crime rates etc. This frees up the agent’s time to focus on more added-value services or more subjective matters.

Meanwhile, blockchain technology is helping make transaction processes more efficient. Most real estate transactions are still conducted through wire transfers and require often-costly verification processes that can take days to complete. Blockchain-based transactions intend to streamline that process, shorten transaction times, and reduce costs.

Thanks to blockchain, any real estate property can have a unique digital identity that consolidates historical information such as vacancies, tenant profiles, financial and legal status, and performance metrics. All data, except for public information like property location, can remain confidential and encrypted. Moreover, that data is distributed across a peer-to-peer decentralized network, allowing for greater market transparency and security at a lower cost.

Several real estate-focused startups are already leveraging blockchain to reduce legal, accounting, and transaction costs, as well as to decrease risks such as fraud and corruption. Imbrex, a property listing marketplace built on the Ethereum blockchain, plans to introduce smart contract-enabled transactions. Similarly, ChromaWay uses blockchain technology to digitize and authenticate sale contracts and to streamline the transference of property deeds.

Winners and Losers

It is still early days yet for the Proptech industry. Today, 4.2 billion people are active internet users, paving the way for new players to disrupt the real estate industry. More than 800 registered real estate startups have cropped up over the past 4 years, and they are tackling a wide range of areas, from appraisals and financing to enabling co-working and co-living arrangements.

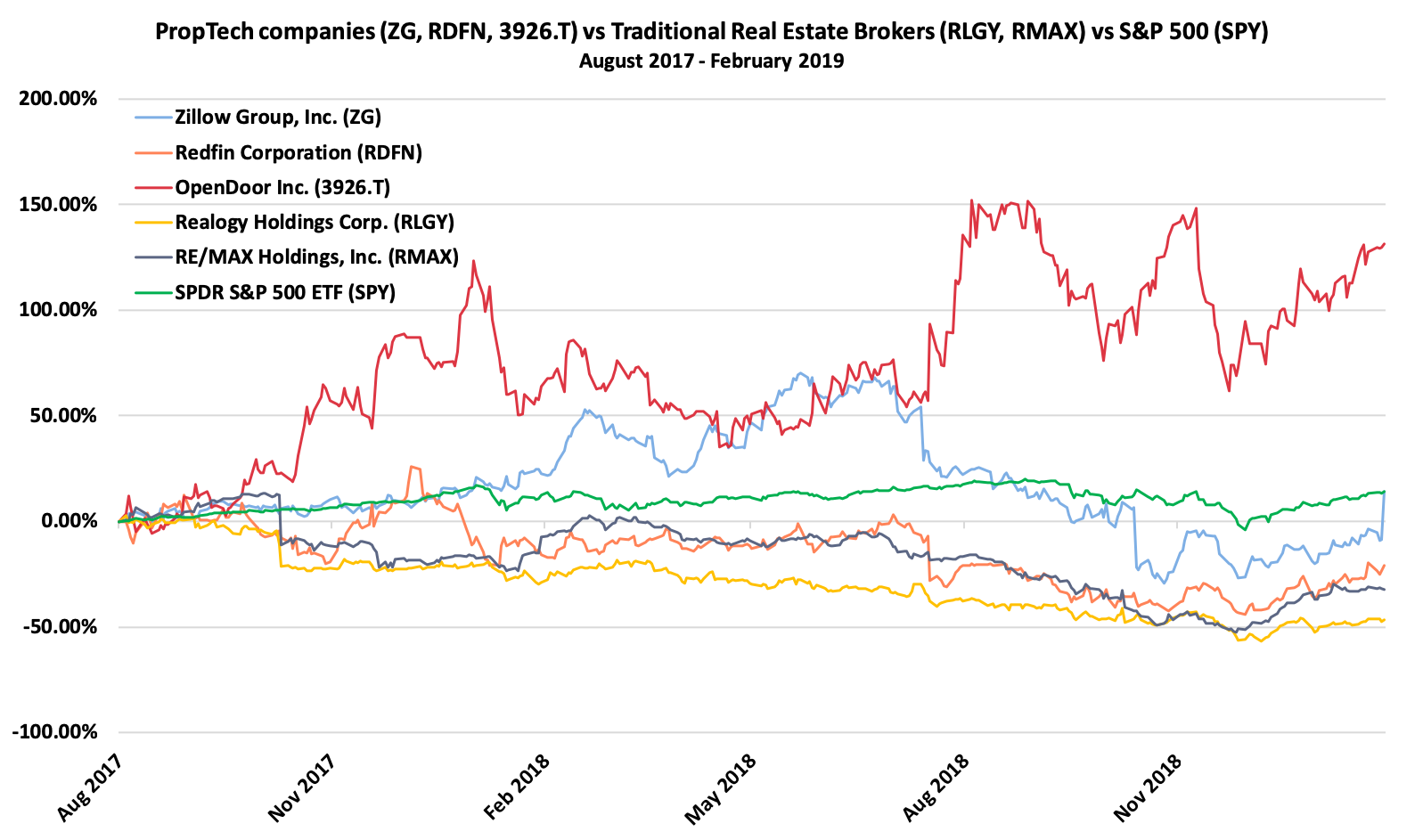

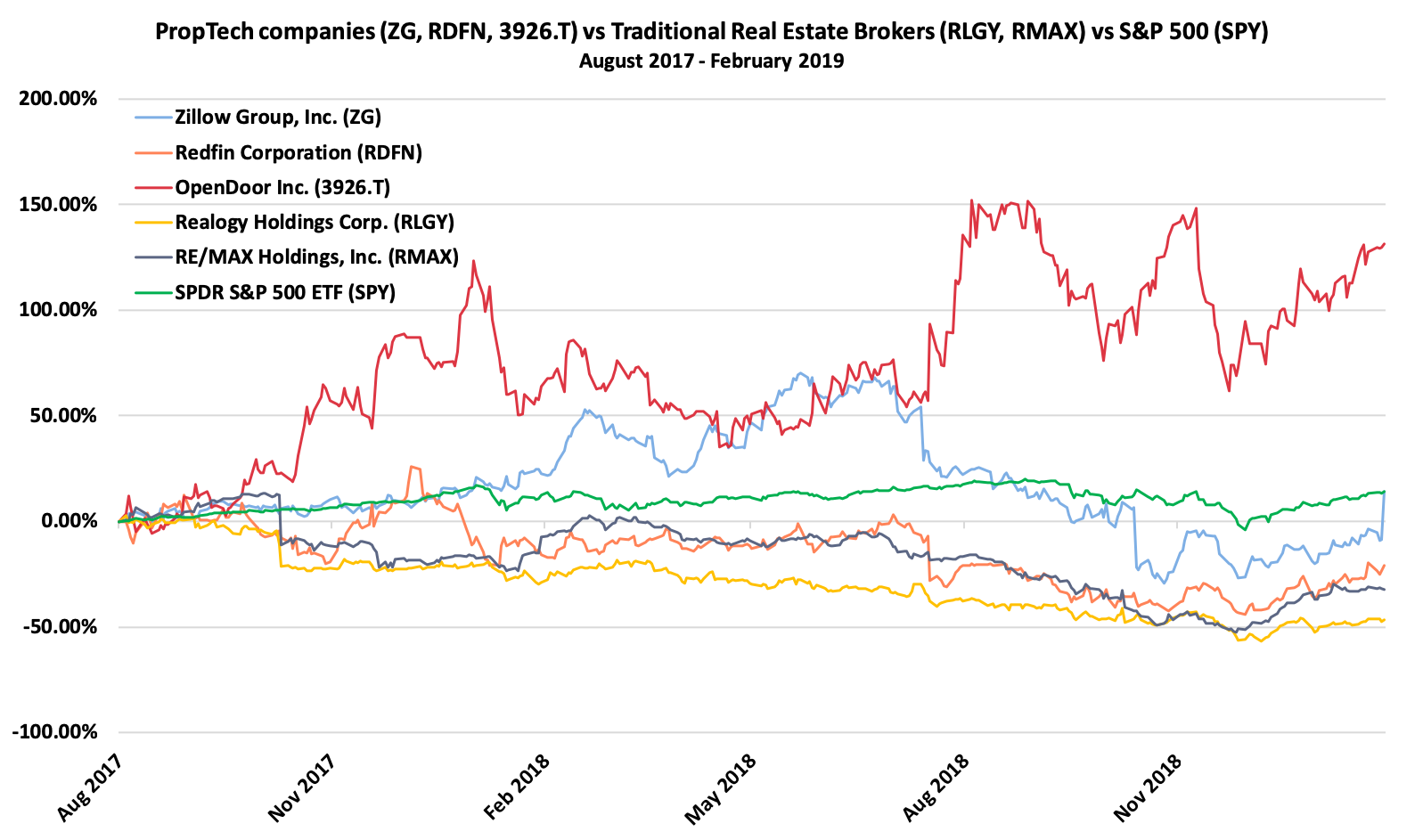

Most of these companies fall into one of two main categories: They are either startups offering support for real estate professionals to enhance their productivity or they are startups looking to replace real estate professionals. A few tentatively fall in between the two. The success of Opendoor (3926.T) and HouseSimple has prompted established Proptech players like Redfin (RDFN) and Zillow (ZG) to enter the house-flipping business even though Zillow derives about 70% of its revenues from real estate agents.

In 2013, Proptech firms attracted $459 million in global venture capital funding. The amount of funding skyrocketed to $12.6 billion in 2017, an indication that interest and opportunity in the space has picked up.

Over time, Proptech will increasingly take business away from traditional players in the real estate ecosystem. As evidenced above, old time brokerage firms are among the first casualties of this disruption. Escrow companies are also at risk of blockchain and smart-contracts making their services redundant.

|

|

|

|

We’ve also summarized the following articles related to this topic in the Construction & Real Estate section of today’s report.

PropTech

|

- Volatility And A Maturing PropTech Industy Underscore MetaProp 2018 Year-End Index

- The Future Of Real Estate is in TechProp

- The AI taking the rental world by storm

- How Blockchain Technology Could Disrupt Real Estate

- It pays to bet smart on proptech

- PropTech Costs Are Down, Effectiveness Is Up And It’s Changing The Outlook For CRE

|

|

|

|

PropTech companies (ZG, RDFN, 3926.T)

vs Traditional Real Estate Brokers (RLGY, RMAX) vs S&P 500 (SPY)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Markets

|

|

Digital Currencies

CME Group’s Bitcoin Futures See a Surge of Institutional Interest

The Chicago Mercantile Exchange (CME Group) has seen a big spike in bitcoin futures volumes according to an internal investors email sent to clients on Feb. 19. CME Group’s note explains that last Tuesday’s BTC-based futures volumes touched a new record with 18,338 contracts traded and the firm says increased volumes may be due to gradually rising institutional interest.

Cryptocurrency derivatives kicked into high gear in 2017 when two of the largest FX exchanges in the world, Cboe and CME Group, launched their bitcoin futures products. Initially, interest in these markets was high, but a few months later crypto derivatives volumes on these exchanges started to wane. Then in the summer of 2018, futures contracts from the two regulated exchanges began to rise again and interest in these products started to increase significantly.

Last December, futures volumes were lower and spectators saw some signs of backwardation which means the derivatives predictions on the price of BTC are significantly lower than the prices on global spot exchanges. However, there was a shift in 2019 as prices returned to normalcy between both futures and spot values and volumes increased in January.

“Futures products from traditionally regulated exchanges (CME and CBOE) represented 11.7% of the Bitcoin to USD futures market in January, up from 6.36% in December,” explains Cryptocompare’s January exchange research. Bitcoin

|

|

|

|

|

|

Digital Currencies

Major European Derivatives Exchange to Launch Cryptocurrency Futures

Eurex, a Germany-based derivatives exchange operated by Deutsche Boerse, is reportedly planning to launch futures contracts tied to digital assets, financial technologies-focused news outlet The Block reported on Feb. 21.

People familiar with the matter reportedly told the Block that Eurex is planning to launch futures contracts tied to such digital currencies as Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), having already had meetings with market-making companies to discuss the products.

Deutsche Boerse has reportedly been considering the introduction of digital currency futures since December, 2017. A spokesperson for the exchange then said that “we are thinking about futures, with which private investors and institutional investors can protect existing investments in Bitcoin or set for falling prices of the cyber currency.”

In September 2018, Deutsche Boerse established a “DLT, Crypto Assets and New Market Structures” unit, that would explore the disruptive potential the technology could have for financial market infrastructure, as well as the new products the exchange could develop to enhance its existing offerings. CT

|

|

Stocks

Rally in Stocks and Bonds Reveals Diverging Views on the Economy

Simultaneous rebounds in the stock and bond markets are sending conflicting signals about the direction of the United States economy.

The S&P 500 is off to its best start to a year in nearly a decade, up 11 percent so far on optimism about economic growth in the second half of 2019. Bond investors have taken a more pessimistic view on the economy’s fate. Prices on the benchmark 10-year Treasury note have risen this year, pushing down its yield to 2.69 percent, from 3.23 percent just three months ago. Yields fall when bond prices rise.

Stock and bond prices are not supposed to rise and fall in tandem. Historically, when investors fret about the future, they pull money out of stock markets and buy relatively safe United States Treasury securities. This dual stock-bond rally has added to doubts about the current rebound in stock prices.

Behind the dual rally is the Federal Reserve’s decision last month to pause its interest rate increases. The Fed’s shift has left investors in a familiar situation: an economy that isn’t strong enough to compel the Fed to raise rates but is strong enough for corporate America to keep expanding its bottom line. NYT

|

|

Stocks

Forget FANGs, Lay Off Drugs. Industrials Are the New Big Trade

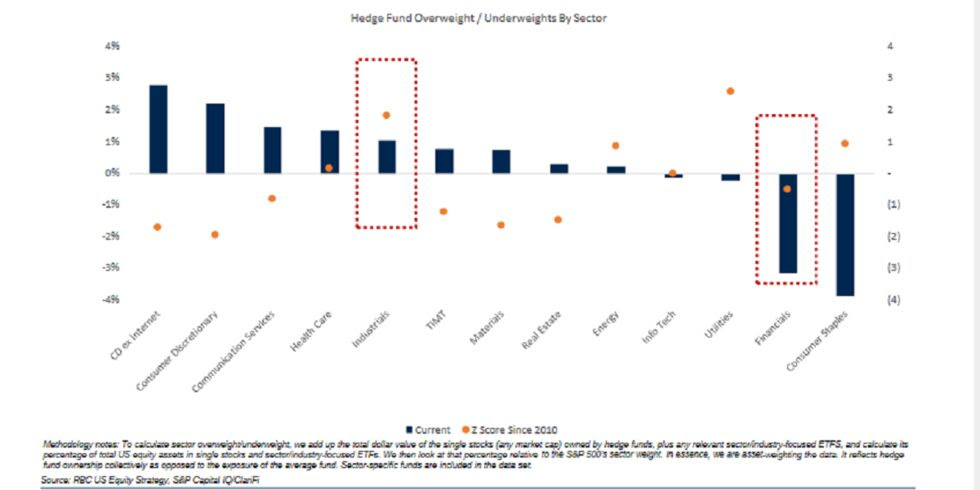

Never mind the FANG block of internet giants. Never mind drugmakers or biotechs. The smart money’s new obsession is the old economy: industrial stocks.

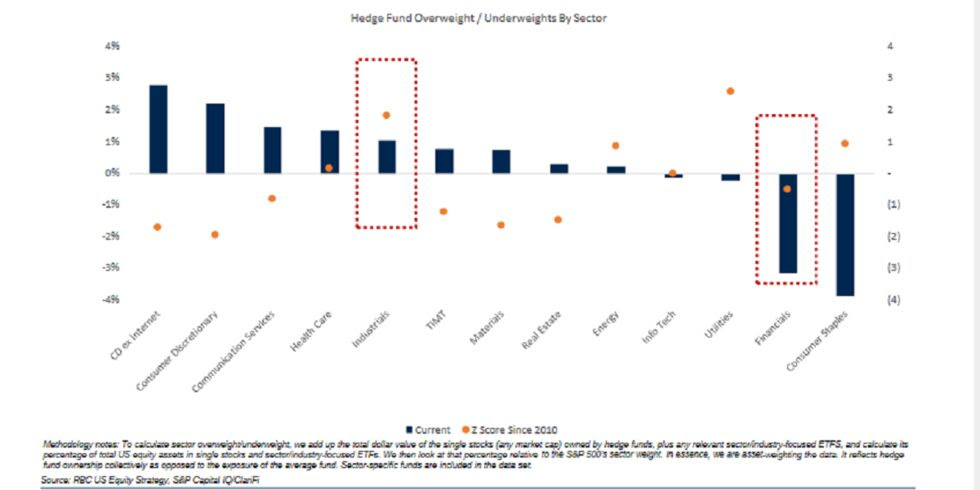

So says RBC Capital Markets after studying quarterly filings of more than 300 hedge funds. By aggregating their holdings in each sector and comparing them to the market over time, strategists led by Lori Calvasina found that machinery and equipment makers have the “most crowding risk.” That’s because fund managers have earmarked more money to the group than their representation in benchmarks with ownership swelling past historic norms.

It’s paying off, at least for now, as industrial shares have led the equity rally this year, jumping almost 18 percent for the best performance among 11 S&P 500 major groups. Part of the gains are likely driven by optimism over U.S.-China trade talks, an issue that has held the likes of Boeing Co. and Caterpillar Inc. hostage with tensions rising over the past year.

But Calvasina urges investors to be alert to the risk of unwinding. That is, too much money is chasing the same stocks and when it pulls out, the decline is that much worse. The elevated exposure to industrial stocks stands in contrast with a retreat from stocks broadly. As RBC data showed, equity holdings by hedge funds as a percentage of the S&P 500’s market value have fallen to the lowest level since 2012. B

|

|

|

|

FX/Gold

Is The U.S. Dollar’s Hegemony Beginning To Wane?

The U.S. dollar’s reign has been of such duration that all of our investing models necessarily have the dollar as world reserve currency implicitly embedded in them. But we may have seen “peak U.S. dollar”, although any decline will be very slow and perhaps not tradable. Nonetheless, the underlying foreign demand for U.S. treasuries may slowly decline, which would be a mild but persistent headwind for bonds.

Similarly, the increased use of gold as central bank reserves would be a minor long-term stimulus for gold. There’s a trend of increased holdings since 2005, with net accumulation beginning in 2008. If de-dollarization does indeed occur, we may see this trend accelerate. SA

|

|

|

|

|

|

|

|

|

|

|

|

|

Economics & Trade

|

|

US Consumers

Tax refunds are $11.5 billion behind our forecast: UBS

Spring tax refunds typically give the economy a boost as the money rolls in and people either pay down debt or go out and spend, so economists and analysts pay close attention to the size of these windfalls.

A new research note from UBS finds that net payments to households are now running below its economists’ forecast, a shortfall of $11.5 billion of the $20 billion in extra cash that the economists had expected compared to last year. As of the latest IRS numbers, 27 million returns have been processed and the average refund is $1,949, down 8.7% compared to last year .

It is still relatively early in the refund season, but UBS noted that should this continue, it would have a “meaningful effect” on its Q1 forecast. The economists, “with hesitance,” maintain their forecast for the additional $20 billion coming to households compared to last year by the end of May.

Once again, UBS repeated its mantra for the 2019 tax season: “Nobody—not us, not other economists, not the US government—knows whether refunds will be larger or smaller than in past years.” Many economists from banks like UBS and Merrill Lynch expected tax refunds to be especially large, given the changes in the tax code. For example, Merrill Lynch expected refunds to be 26% larger this year. Y

|

|

|

|

|

|

|

Construction & Real Estate

|

|

PropTech

Volatility And A Maturing PropTech Industy Underscore MetaProp 2018 Year-End Index

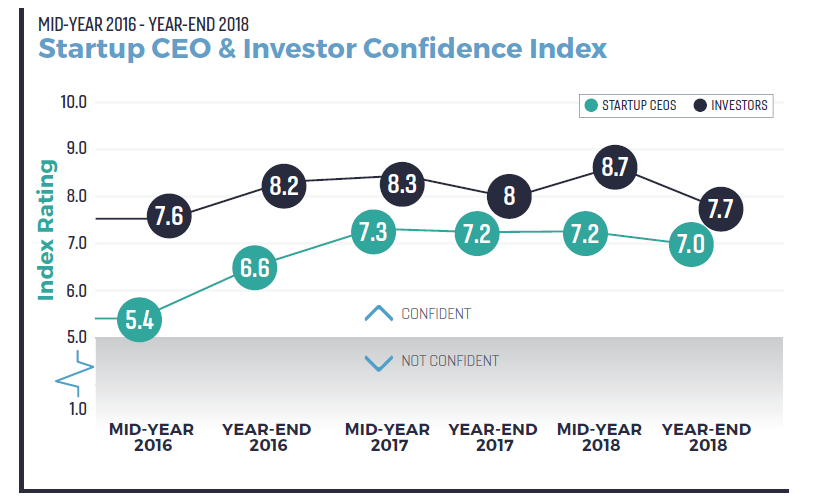

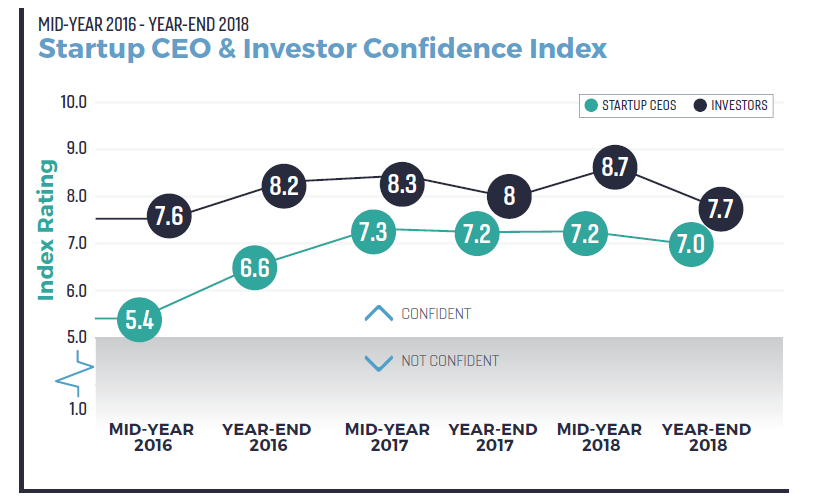

MetaProp, a leading New-York based PropTech VC, just released the results of its latest Global PropTech Confidence Index. The Global PropTech Confidence Index is a unique barometer of the real estate tech market’s health from the perspective of the most active PropTech Investors and startup CEOs and Founders around the world. Startup and investor confidence both remained strong, though investor confidence especially was dampened by geopolitical and economic volatility in 2018. There is also a feeling of greater maturity being reached in the PropTech space. Let’s take a closer look at the key indicators.

While startup levels, albeit lower, have remained in line with what they were in the last three reports, investor sentiment has dropped significantly from 8.7 in mid-year 2018 to 7.7 today. Aaron Block, Managing Partner and co-founder of MetaProp, said that “Geopolitical and economic volatility have dominated international headlines over the last few months. Unsurprisingly, this uncertainty may be impacting the broader real estate technology investment ecosystem.” For both investors and startups, it is M&A and other liquidity events that are propping up sentiment, as capital raising or funding optimism has definitely been dampened in the second half of 2018. Forbes

|

|

|

|

PropTech

The Future Of Real Estate is in TechProp

Even in an era of startups, digital disruptors and online everything, traditional established companies don’t have to take a backseat and get left behind. For instance, within the OrangeTee group, OrangeTee & Tie, Singapore’s third largest real estate agency with its 4,200-strong team of property agents work, communicate and research on its digital assets such as in-house Agent App, Property Agents Review portal, digital marketing tools and many more.

Mr Steven Tan, OrangeTee & Tie’s managing director mentions a new term “TechProp” often, believing that it is the future for the traditional real estate companies or even the industry.

“PropTech companies usually focus on narrow functions or segments with high friction level or those underserved by traditional real estate companies. Their aim is to provide a better experience using digital technologies to reduce costs, increase revenue and remove friction. Hence, many Proptech companies are also the disruptors of our industry. TechProp companies refer to the traditional real estate companies that are able to transform their business by accelerating innovation, building new skills, participating in the ecosystem and disrupting themselves to come out stronger in this digital age,” he explains.

Mr Tan is confident that OrangeTee has the foundation to be the first TechProp company in Singapore because it has expertise in areas as diverse as agency, project marketing, valuation, and investment sales, and also because it has always been at the forefront of technology. ST

|

|

PropTech

The AI taking the rental world by storm

In a world where dating apps have transformed the social lives of discerning singles and property prices have pushed home ownership into the distant future for a generation, it was only a matter of time before tech began solving the tricky problem of flat-sharing.

“Using smart algorithms, we’ve paired landlords with renters by developing a recommendation engine for listers,” says Carol Jiang, global managing director at room rental platform badi. “AI can also eliminate any initial bias when meeting people, providing an arguably more accurate match than perhaps our first impressions.”

Tom Gatzen, co-founder of the tenant-finding service ideal flatmate, developed a similar technology to help match tenants who are a good fit with existing residents: “We became frustrated with existing flatsharing sites as they focus solely on the property when the most important factor in whether you are happy in your home is that you get on with the people you live with.

The boom in property-related technology, known generally as proptech, shows no sign of slowing as new companies try to disrupt the traditional rental norms to take advantage of the growing number of affluent renters – priced out of buying their own home but with high expectations for the homes they rent instead. Independent

|

|

PropTech

How Blockchain Technology Could Disrupt Real Estate

While historically a “pen and pencil” business — often relying on inefficient and archaic methods for doing business and keeping records — technology has begun to help reshape the expanding global market. Blockchain technology, especially, is feeding into this transformation (in ways similar to how the emerging tech is disrupting other long-established industries like banking and insurance).

The decentralized-record-keeping technology, which is designed to instill trust in the authenticity of digital transactions, could be used to create efficient solutions for both commercial and residential real estate — from buying property to conducting due diligence to enabling crowd-sourced investments, and more.

Some big incumbents are already betting on the tech: Real estate giant RE/MAX has entered into several partnerships to explore blockchain use cases, while Hilton Worldwide has begun using a blockchain-based property management system.

Areas of real estate being transformed by blockchain technology include: Property search process; Due Diligence and Financial Evaluation Process; Property management; Title management; Financing and payment systems; Real estate investing. CBI

|

|

PropTech

It pays to bet smart on proptech

Last year was a bumper one for proptech. Not only did tech giants continue to validate proptech, with investments such as Softbank’s big bets on WeWork, Oyo, Reonomy, OpenDoor and Compass, real estate investors piled in as well.

Altus’ latest CRE Innovation Report found that 53% of real estate investor respondents with more than $250m of assets are directly investing in proptech. 2018 also saw the rise of proptech-specific venture capital firms.

Looking ahead, investors are prepared to double down on their stakes in 2019; 96% of investors in the MetaProp Mid-Year 2018 Global PropTech Confidence Index said they planned to make the same number of proptech investments or more in the next 12 months.

Venture funds and real estate firms will bet big on “smart” proptech in 2019, and the evidence suggests it will be extensively implemented across asset classes and regions. Let’s see what else the year holds! PW

|

|

PropTech

PropTech Costs Are Down, Effectiveness Is Up And It’s Changing The Outlook For CRE

For years, experimenting with technology in commercial real estate was costly, time-consuming and, worst of all, often produced little benefit. But industry experts believe that has finally started to change.

Across the industry, from construction and design, to building management and tenant experience, people are looking for ways to use technology to save costs and stand out from the pack. As building costs have soared — and tenants increasingly are demanding better workplace experiences — leveraging technology is more crucial than ever.

“We’ve seen huge changes in terms of what we all expect from our workplaces, the bar keeps going up,” said Gabrielle McMillan, the CEO of Equiem, an online platform for tenants to use the amenities and resources within their buildings. “Landlords need to be engaging with every single person in their asset, and they need to get their hands on that data and use it to constantly curate an experience that is going to keep those people there.”

There is a new era of development and landlord/tenant relationships, following a flood of PropTech firms entering the market and advancing ways to aggregate and analyze data. Being cautious about which companies you do business with, and figuring out the best way to use one’s data, is what companies should now be focused on to get ahead. Bisnow

|

|

US Housing

Home sales continue to get whacked, falling to a 3-year low, and an increase in mortgage delinquencies is looming

Another month, another rash of bad news for the US housing market. The National Association of Realtors (NAR) on Thursday released the January numbers for existing-home sales, which fell 8.5% from last year to a rate of 4.95 million. That’s the lowest level in more than three years, and it follows a series of gloomy results in the closing months of 2018.

US existing-home sales cratered to 4.99 million in December, 10.3% below the mark from the year-ago period. That followed year-over-year declines of 7.8% in November and 5.1% in October, according to NAR. NAR released data earlier this month showing that pending home sales also fell in December by 2.2%, reaching the lowest mark since 2014.

UBS analysts, amid the ugly housing numbers, wrote in a note last month that “the deterioration in housing and its intensification since midyear raise the possibility of underlying weakness in the household sector.”

Causes for the slowdown are myriad, but experts have pinned much of the blame on higher interest rates and home prices. The median home price increased to $247,500 in January, the 83rd straight month of year-over-year gains, according to the NAR. BI

|

|

|

|

|

|

|

Services

|

|

E-Cigs

Juul Expects Skyrocketing Sales of $3.4 Billion, Despite Flavored Vape Ban

Juul Labs Inc.’s move to stop selling most flavored e-cigarettes in U.S. stores dealt a blow to the company’s financial results last quarter, but the maker of America’s most popular e-cigarette device sees it as a minor setback. Juul forecasts revenue of $3.4 billion for 2019, almost triple what it generated last year, according to a person who was briefed on the numbers.

The financial outlook indicates high expectations from the company to sell more of its slender Juul vaping devices and accompanying nicotine pods overseas. It also suggests confidence that other governments won’t follow the U.S. in cracking down on the products, a move prompted by widespread use by teens across the country.

Juul posted fourth-quarter revenue of $424 million, a 2.5 percent decline from the previous quarter, said the person, who asked not to be identified because the information is private. Over the same periods, Juul’s adjusted loss was $70.4 million, compared with a $17 million profit in the prior quarter.

The financial results, which haven’t been previously reported, help explain why American tobacco giant Altria Group Inc. paid a hefty premium for Juul stock in December. Altria, which sells Marlboro cigarettes in the U.S., acquired a 35 percent stake in Juul and valued the vaping business at $38 billion. That made the San Francisco-based company one of the world’s most valuable startups and turned the two founders into billionaires. B

|

|

Plant-Based

Good Catch hopes consumers will bite as it launches plant-based tuna at national retailers

Plant-based tuna from Good Catch Foods will be available this week at Whole Foods Market and Thrive Market outlets nationwide, the company announced. The two retailers will be the first to carry the shelf-stable product.

The New York-based startup said in its statement it is aiming both to appeal to consumers and protect ocean fisheries with its new product. Nearly 90% of the world’s marine fish stocks are either overexploited or depleted, Good Catch said, adding that scientists predict global fisheries may totally collapse by 2048.

Plant-based tuna avoids the high mercury levels, PCBs, dioxins and other contaminants found in ocean-based fish. It also avoids the diseases and other problems presented by factory fish farming and aquaculture, the company said.

Tuna was undoubtedly a deliberate choice for this new plant-based product since it’s one of the most popular — and overfished — species in the world, according to Forbes. Good Catch’s mission is to disrupt the seafood category with products consumers want without any of the negatives. Company officials claim it is the first plant-based brand that truly rivals real fish. FDive

|

|

Waste Management

‘Moment of reckoning’: US cities burn recyclables after China bans imports

The conscientious citizens of Philadelphia continue to put their pizza boxes, plastic bottles, yoghurt containers and other items into recycling bins. But in the past three months, half of these recyclables have been loaded on to trucks, taken to a hulking incineration facility and burned, according to the city’s government. It’s a situation being replicated across the US as cities struggle to adapt to a recent ban by China on the import of items intended for reuse.

The loss of this overseas dumping ground means that plastics, paper and glass set aside for recycling by Americans is being stuffed into domestic landfills or is simply burned in vast volumes. This new reality risks an increase of plumes of toxic pollution that threaten the largely black and Latino communities who live near heavy industry and dumping sites in the US.

About 200 tons of recycling material is sent to the huge Covanta incinerator in Chester City, Pennsylvania, just outside Philadelphia, every day since China’s import ban came into practice last year, the company says.

Some experts worry that burning plastic recycling will create a new fog of dioxins that will worsen an already alarming health situation in Chester. Nearly four in 10 children in the city have asthma, while the rate of ovarian cancer is 64% higher than the rest of Pennsylvania and lung cancer rates are 24% higher, according to state health statistics. Guardian

|

|

|

|

|

|

|

Manufacturing & Logistics

|

|

Industrials

Here are the companies poised to profit from the Trump border wall

Washington’s border-security deal provides $1.375 billion to build about 55 miles of border barriers, setting up government contractors to compete for their piece of that money. The bipartisan deal allows for the use of any barrier materials previously used, such as steel slats or levee wall systems. It bars the use of new designs, such as the concrete prototypes commissioned by the Trump administration.

The new 55 miles of barriers in Hidalgo and Starr counties likely will get built by companies with previous experience in this type of work, and these companies range from a privately held Texas firm to publicly traded Israeli contractors, according to experts. The firms have a history of giving money mostly to Republican politicians.

“Galveston contractor SLSCO is building some of the current sections in the RGV. If I had to guess, they would be likely to get future contracts as well,” said Reece Jones, author of the book “Violent Borders”. Montana-based Barnard Construction Co., given its past experience, also could get a chance to build some of the 55 miles of barriers, according to James R. Phelps, a consultant, author and professor who teaches courses on homeland security at universities.

Firms such as SLSCO and Barnard could be “go-to companies” for Customs and Border Protection, the agency that will award contracts for the work, Phelps said. MW

|

|

|

|

|

|

|

Technology

|

|

Asteroid Mining

Why Japan’s mission to bring space rocks to Earth is so incredible

A spacecraft launched by the Japanese Aerospace Exploration Agency (JAXA) in 2014 successfully touched down on a speeding near-Earth asteroid, and has collected samples to bring back for scientists to study.

This is a goosebumps-raising achievement because the asteroid Ryugu is a tiny rock, floating in space about 300 million km (186 million miles) away from our planet. It took the Hayabusa2 spacecraft almost four years to reach the asteroid, and it’s only the second time humans have been able to collect samples from an astroid like this.

Hayabusa2’s main goal is to help scientists better understand the solar system’s early history and evolution, especially that of the inner planets – Mercury, Venus, Earth, and Mars. The mission could also help us understand the role of asteroids such as Ryugu in the emergence of life on Earth – which remains a mystery to this day. Scientists now believe that water, which is believed to have been a key piece of the puzzle, may have come to Earth from asteroids. TNW

|

|

Robotics and Automation

A new RFID tracking system from MIT could make robotics cheaper and easier

Robotics could become cheaper and easier in the near future: A new object tracking system for robots from researchers at MIT enables these units to employ radio frequency identification (RFID) tags to orient themselves, according to Engadget.

Using this technique, companies could create robots that are better able to find and grasp objects near them, which can have major cost savings and create more efficient operations in manufacturing as well as logistics and warehouse management.

The new, RFID-based technique could provide a cheap and effective alternative to the computer vision model currently in use. Most existing robotic systems use computer vision to track where moving objects are located at any given point. This requires them to use capable — and thus expensive — cameras paired with powerful computer hardware that can interpret video data in real time, allowing the robot’s AI to make decisions around the movement of its arms or graspers.

The new system does away with expensive cameras, using relatively cheap RFID tags to communicate with a sensor built into the robot, which then determines the location of the item affixed with that tag. In addition to being inexpensive, the system is also accurate and quick: According to the researchers, it has an error range of about one centimeter and can locate an object in 7.5 milliseconds. BI

|

|

|

| There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – https://mcalindenresearchpartners.com/free-30-day-trial/ |

|

|

|

|

|

|

|

Leave a Reply