|

|

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today by contacting hugh@mcalindenresearch.com |

|

|

|

Daily Intelligence Briefing

|

|

Identifying Change-Driven Investment Themes

|

|

|

|

|

|

|

Each Daily Intelligence Briefing has five sections, click the blue links to jump to the relevant section for more extensive coverage:

|

|

|

|

|

|

|

|

|

|

|

I. TODAY’S MARKET INSIGHT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

THEME ALERT: AN ACTIVE MRP THEME

|

|

|

Obesity’s Tipping Point: More people are Now Obese than Underweight Globally

|

|

|

|

|

|

|

|

|

|

|

The world is seeing an escalation of obesity due to energy-sparing technology, sugary drinks, packaged or fast food, and the proliferation of desk jobs. That’s benefitting companies that provide treatments for obesity-related ailments or that offer weight loss programs and plus-sized clothing.

|

|

|

|

Obesity has been observed throughout human history, however, the phenomenon only became common in the 20th century, prompting the World Health Organization (WHO) to formally recognize obesity as a global epidemic in 1997. By 2013, an estimated 2.1 billion adults were overweight, up from 857 million in 1980. Of adults who are overweight, 31% are obese. Fast-forward six years and considering the trend of rising global obesity rates, it would not be too much of a stretch to guesstimate that about 1 billion people on the planet are obese today.

Take the United States, for example, where at least 30% of adults in 29 states are obese and nearly one in six young Americans aged 10-17 already qualifies as obese. It has been forecast that 42% of Americans will be obese by 2030.

In the UK, more than 7 in 10 millennials will be obese by the time they reach middle age, making them one of the heaviest generations in history, according to Cancer Research UK.

Staggering Financial Cost of Obesity

Aside from the psychological and physiological discomforts associated with being overweight, there is a great financial cost, as obesity is one of the biggest drivers of preventable chronic diseases and healthcare costs in the United States.

Body Mass Index (BMI) is a measure which takes into account a person’s weight and height to gauge total body fat. Someone with a BMI of 26 to 27 is about 20% overweight. A BMI of 30 and higher is considered obese. As a person’s body max index (BMI) increases, so do the number of sick days, medical claims and healthcare costs.

For instance, moderately obese individuals (BMI of 30 to 35) are twice as likely as healthy weight individuals to be prescribed pharmaceutical drugs to manage medical conditions, which is why obese adults typically spend 42% more on direct healthcare costs. For severely obese adults (BMI >40), the per capita healthcare cost is 81% higher than for healthy weight adults.

Altogether, the healthcare costs of obesity-related illnesses in the US are estimated to range between $147-$210 billion per year. On top of this, job absenteeism related to obesity is said to cost an additional $4.3 billion annually. The American Medical Association (AMA) even goes so far as to classify obesity itself as a disease.

Obesity Spreads to Every Region Around the World

Now, what was once considered a problem only in high-income countries is spreading around the world. Globally, there are now more people who are obese than who are underweight, a trend observed in almost every region around the world.

Even Africa is struggling with an increase in noncommunicable diseases (NCD) nowadays, most of them related to obesity. Cardiovascular diseases account for most NCD deaths, followed by cancer, respiratory diseases and diabetes. One of the primary causes is dietary habits that include too many refined carbohydrates, oils and sugars that have come with the proliferation of convenience foods. According to a Kenyan government survey more than 40% of women aged 30 to 40 are overweight or obese.

Researchers Blame Capitalism & Free Trade

Whether justly-deserved or not, the modern rise and spread of obesity is being attributed to the United States.

According to a series of papers published by UC San Francisco, tobacco conglomerates that used colors, flavors and marketing techniques to entice children as future smokers transferred these same strategies to sweetened beverages when they bought food and drink companies starting in 1963.

Until the mid-2000s, for example, Marlboro-maker Philip Morris (now Altria) was the same conglomerate that also manufactured Kraft Macaroni & Cheese and Kool Aid. Similarly, RJR Nabisco once simultaneously contained the companies that made Camel cigarettes and Chips Ahoy! cookies. And while the companies have since split their tobacco businesses from their food businesses, the same heavy-handed product marketing tactics remain deeply ingrained in the DNA of Big Food today.

The indirect result is that American youth currently consume an average of 143 calories a day in sugary beverages, sweetened with added sugars including fructose, glucose, sucrose, dextrose and corn syrup. On average, children consume over 30 gallons of sugary drinks each year – the equivalent of a bathtub full of sugar. These calorie-dense drinks are associated with obesity and metabolic syndrome, a cluster of conditions that increase the risk for heart disease, stroke and Type 2 diabetes.

Meanwhile, separate research by the Harvard University school of public health has pinpointed free trade deals involving the US as a key factor in a process of “nutrition transition” – from a traditional native diet to a much more western one – which is producing greater obesity in countries.

In other words, globalization has allowed American (and European) multinational companies and fast-food chains to expand into new countries and expose natives of those countries to different, cheap and, often, unhealthy foods. When combined with more sedentary, urban lifestyles, the new consumption patterns have contributed to the rise of obesity and obesity-related disease.

Expect More Sugar Taxes in the Future

The American Academy of Pediatrics (AAP) and American Heart Association (AHA), two of the nation’s most prominent health organizations, issued a joint statement last week calling for widespread public health regulation to reduce the amount of sugary drinks that children consume. They support measures such as additional taxes across the country on sugary beverages.

Sugar tax policies are gaining traction around the world, as evidenced by Bermuda’s decision to impose a 75% tax on all chocolate bars that contain sugar starting in April. That’s because taxation has proven to be very effective in some cases. Consumption of sugary drinks dropped 52% among Berkeley’s low-income residents in the three years after the city enacted a penny-per-ounce excise tax on sugar-sweetened beverages in early 2015. Water consumption also saw a bump, going up 29% over the three-year period.

|

|

|

|

THEME ALERT

|

|

MRP Added Long Obesity to its list of investment themes on June 25, 2018. We are monitoring the theme’s performance via The Obesity ETF (SLIM) managed by Janus Henderson Investors. SLIM invests globally in biotech, drug makers, health care and medical device companies whose businesses are focused on obesity & obesity related disease, as well as companies focused on weight loss programs, weight loss supplements, or plus-sized apparel. At least 80% of the ETF’s net assets are in stocks that comprise the Solactive Obesity Index.

|

|

|

|

|

|

|

|

|

|

Source material for today’s market insight…

|

|

|

|

|

|

|

Obesity

Soft drink companies copy tobacco playbook to lure young users

Tobacco conglomerates that used colors, flavors and marketing techniques to entice children as future smokers transferred these same strategies to sweetened beverages when they bought food and drink companies starting in 1963, according to a study by researchers at UC San Francisco.

The study, which draws from a cache of previously secret documents from the tobacco industry that is part of the UCSF Industry Documents Library tracked the acquisition and subsequent marketing campaigns of sweetened drink brands by two leading tobacco companies: R.J. Reynolds and Philip Morris. It found that as tobacco was facing increased scrutiny from health authorities, its executives transferred the same products and tactics to peddle soft drinks. The study publishes March 14, 2019, in The BMJ.

“Executives in the two largest U.S.-based tobacco companies had developed colors and flavors as additives for cigarettes and used them to build major children’s beverage product lines, including Hawaiian Punch, Kool-Aid, Tang and Capri Sun,” said senior author Laura Schmidt, Ph.D., MSW, MPH, of the UCSF Philip R. Lee Institute for Health Policy Studies . “Even after the tobacco companies sold these brands to food and beverage corporations, many of the product lines and marketing techniques designed to attract kids are still in use today.”

Read the full article from Medical Express +

|

|

|

|

|

|

|

|

Obesity

Obesity Is Now Africa’s Health Care Crisis, Too

When it comes to health issues in Africa, people think of chronic hunger, or infectious diseases such as malaria or HIV/AIDS. But Africa is simultaneously struggling with an increase in noncommunicable diseases, most of them related to obesity.

The recently published Global Wellness Index set alarm bells ringing when South Africa scored poorly for life expectancy, alcohol use, depression and diabetes. When stacked up alongside the G20 nations and the 20 most populous countries, South Africa – once a shining beacon of economic growth – came last. But for anyone who has worked in health care in the country, or elsewhere in Africa, this is no surprise at all.

South Africa is not alone in facing these challenges. Other parts of Africa have some of the highest rates of high blood pressure in the world, estimated to afflict 46 percent of adults, while obesity, another risk factor, is on the increase. According to a Kenyan government survey more than 40 percent of women aged 30 to 40 are overweight or obese.

One of the main causes are dietary habits that include too many refined carbohydrates, oils and sugars that have come with the proliferation of convenience foods. In addition, there is a traditional belief that excess weight is a symbol of prosperity and wealth.

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

Obesity

UK anti-obesity drive at risk from new US trade deal, doctors warn

Britain’s post-Brexit trade deal with the United States could lead to even higher rates of obesity through the import of American foods high in fat and sugar, children’s doctors have warned. US “hostility” towards measures aimed at promoting healthier eating habits, such as traffic light labelling, is also a major threat to the government’s anti-obesity drive, it has been claimed.

The Royal College of Paediatrics and Child Health (RCPCH) is urging ministers to resist pressure to unwind key public health measures in their quest for a future transatlantic trade deal.

“We’re concerned by the evidence of US hostility in trade talks towards countries that want to set their own domestic agenda on reducing sugar intake, particularly the push [from the US] to keep traffic light labelling voluntary. We can’t allow trade talks to undermine efforts to tackle childhood obesity,” said Prof Russell Viner, the RCPCH president. “Children’s health outcomes are much worse in the US than in many other comparable countries, and we don’t want to import these along with the sugar.”

Viner’s warning comes as Liam Fox, the international trade secretary, prepares to fly to Washington this week for talks about the shape of a future UK/US trade deal after Britain has left the EU.

Read the full article from Guardian +

|

|

|

|

|

|

|

|

Obesity

Smartphone-based weight loss program comparable to gold standard

A mobile smartphone-based behavioral obesity intervention achieved weight loss outcomes similar to that of a more intensive gold standard group-based approach, according to findings published in Obesity.

“Behavioral obesity treatments focused on improving eating, physical activity and related behaviors reliably produce mean weight losses of 5% to 10% of initial body weight,” J. Graham Thomas, PhD, associate professor in the department of psychiatry and human behavior at the Warren Alpert Medical School of Brown University, and colleagues wrote.

“These weight losses reduce the risk and severity of multiple diseases, including cardiovascular disease, type 2 diabetes, and cancer. However, these treatments are not widely available because they are highly intensive.” More accessible and less costly approaches to behavioral obesity treatments are necessary, and a mobile health approach may fill that need, according to the researchers.

Read the full article from Healio +

|

|

|

|

|

|

|

|

Obesity

New Millennial Diet: Vegan + Paleo = Peganism

The pegan diet is catching on fast. And because it’s millennials who are driving the global shift toward new food trends — as per an Organic Trade Association report, 52 percent of millennials are consumers of organic food, and 40 percent are taking on a plant-based diet — the clearest evidence of the pegan boom is showing up on their preferred means of communication: social media.

On the surface, paleo and vegan diets might appear at cross-purposes. But proponents of the pegan diet argue that it gives followers the chance to choose a combination of options from its two dietary influences. A vegan diet doesn’t allow meat, and a paleo diet doesn’t emphasize fruits and vegetables. Pegans, on the other hand, eat a predominantly plant-based diet, with meat serving as a side dish (around 25 percent, usually). Peganism also emphasizes heart-healthy fats, and serves as a good foundation for a healthy diet, says Vandana Sheth, a dietitian nutritionist with the Academy of Nutrition and Dietetics in Chicago.

Read the full article from OZY +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. MARKET INSIGHT UPDATES

|

|

|

|

|

|

|

|

|

|

|

|

Markets →

|

|

Bonds

U.S. Treasury Yield Curve Inverts for First Time Since 2007

|

|

Bonds

German 10-year bond yields turn negative for the first time since October 2016

|

|

|

|

Economics & Trade →

|

|

US Inflation

Inflation Is Alive and Well and Living in S&P 500 Income Statements

|

|

GDP

Grounding of 737 Max Is Seen Swaying Some U.S. Economic Data

|

|

|

|

Monetary Policy →

|

|

Interest Rates

A Central Banking Domino Effect Is in Motion

|

|

|

|

Construction & Real Estate →

|

|

Commercial Real Estate

E-commerce driving US warehouse construction

|

|

|

|

Labor, Education & Demographics →

|

|

Category

Article

|

|

|

|

Services →

|

|

Video Games THEME ALERT

Walmart is reportedly looking into launching its own cloud gaming service

|

|

|

|

Technology →

|

|

3DP THEME ALERT

Move over, 3D: 4D printing is now here to change the world

|

|

Robotics & Automation THEME ALERT

Your future coworkers could be swarms of robots

|

|

|

|

Commodities →

|

|

Biofuels

Aviation Biofuel Research Kicks Into High Gear

|

|

Crops

Forecasters Warn Flooding Could Be The Worst On Record In Much Of The US This Spring

|

|

LNG

Canada’s Natural Gas Crisis Is Going Under The Radar

|

|

Metals

Invest in the EV Revolution and Chinese Demand With Copper Stocks

|

|

|

|

Energy & Environment →

|

|

Renewables

Big Pivot In Energy Is Gaining Momentum

|

|

|

|

Biotechnology & Healthcare →

|

|

Obesity THEME ALERT

Soft drink companies copy tobacco playbook to lure young users

|

|

Obesity THEME ALERT

Obesity Is Now Africa’s Health Care Crisis, Too

|

|

Obesity THEME ALERT

UK anti-obesity drive at risk from new US trade deal, doctors warn

|

|

Obesity THEME ALERT

Smartphone-based weight loss program comparable to gold standard

|

|

Obesity THEME ALERT

New Millennial Diet: Vegan + Paleo = Peganism

|

|

CRISPR THEME ALERT

A More Humane Livestock Industry, Brought to You by Crispr

|

|

US Healthcare

GAO finds 3 biggest payers dominate private, ACA markets

|

|

|

|

Endnote →

|

|

Demographics

These Are the World’s Happiest (and Most Miserable) Countries

|

|

|

|

|

|

|

|

|

|

|

|

III. ACTIVE THEMATIC IDEAS

|

|

|

|

|

|

|

|

|

|

|

Select a theme to see when and why we added it. Also included is a link to all recent Market Insight reports we’ve written about that theme, allowing you to track its progress.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV. MACROECONOMIC INDICATORS

|

|

|

|

|

|

|

|

|

|

|

|

Week Ahead

This week the final estimate of US Q4 GDP growth will be keenly watched, alongside foreign trade, personal income and outlays, housing data and current account. Elsewhere, important releases include: UK final Q4 GDP growth, consumer sentiment and monetary indicators; Eurozone business survey; Germany consumer and business morale, inflation, retail trade and unemployment; Japan industrial output, retail sales and jobless rate; China NBS PMIs; and Australia private sector credit. Investors will also react to US-China trade talks and the ongoing Brexit negotiations.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US 10-Year Yield Inverts for 1st Time Since 2007

The yield on the US 10-year Treasury note was down to 2.44% on Friday, the lowest since the last working day of 2017 amid increasing global growth concerns. On Friday, preliminary Markit PMIs for Japan, Europe and the US came weaker-than-expected, following an economic downgrade from the Fed earlier in the week and persistent uncertainties over the US-China trade deal. The US 10-year yield fell below the US 3-month Bill yield at 2.453% for the first time since 2007, which usually is seen as a sign of an economic recession in the near future.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Private Sector Output Growth Slows in March: Markit

The IHS Markit US Composite PMI dropped to 54.3 in March 2019 from a seven-month high of 55.5 in the previous month and below market consensus of 55.2, a preliminary estimate showed. Looking ahead, business optimism dipped to the lowest since June 2016.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Services Activity Growth Eases in March: Markit

The IHS Markit US Services PMI fell to 54.8 in March 2019 from 56 in the previous month and below market expectations of 56, a preliminary estimate showed. Still, the latest reading signaled a solid overall upturn in business activity across the service economy. New work growth slowed and employment rose the least since May 2017.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Factory Growth Lowest since 2017

The IHS Markit US Manufacturing PMI fell to 52.5 in March of 2019 from 53 in February and below market expectations of 53.6, preliminary estimates showed.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Wholesale Inventories Rise the Most in 15 Months

Wholesale stocks in the United States rose 1.2 percent from a month earlier in January of 2019, following a 1.1 percent increase in the previous month and easily beating market expectations of a 0.2 percent gain. It was the biggest gain in wholesale inventories since October last year, when stocks fell by 0.5 percent. Year-on-year, wholesale stocks advanced 7.7 percent.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Existing Home Sales Beat Forecasts

Sales of previously owned houses in the US surged 11.8 percent from the previous month to a seasonally adjusted annual rate of 5.51 million in February of 2019. It is the highest reading in eleven months and the biggest monthly rise since December of 2015. It follows a downwardly revised 4.93 million in January and compares with market expectations of 5.1 million. Year-on-year, existing home sales dropped 1.8 percent.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

US Posts Largest Budget Gap Ever for February

The US government budget deficit increased to USD 234 billion in February of 2019 from a USD 215 billion gap a year earlier and above market expectations of a USD 227 billion shortfall. It is the highest budget gap ever for a February month as federal spending rose 8 percent on the year while receipts increased only 7 percent.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

Sterling Rebounds as EU Extends Brexit Date

The British pound attempted to recover against the USD during early trading hours in Europe after the European Union agreed on Thursday to extend the Brexit date until May 22nd if the Prime Minister Theresa May is able to pass her deal in the British Parliament next week. If the deal is rejected again, the extension will be until April 12th only.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

February 28, 2019

|

|

|

After the Inflation Intermission →

|

|

|

Headline inflation has shifted into a downtrend over the past few months, largely due to a sharp decline in energy prices toward the end of 2018. The core CPI, however, shows that, aside from food and energy, inflation remains above 2%.While the Fed is going to need more than that to shift them out of their “patient” position on interest rates, MRP believes thata rebound in the price of crude oil and other commodities, as well as consumer staples and other finished goods will continueto push inflation higher throughout 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. MARKET INSIGHT UPDATES

|

|

|

|

|

|

|

|

|

|

MARKET INSIGHT UPDATES: SUMMARIES

|

|

|

|

|

|

|

|

|

|

|

|

Bonds

U.S. Treasury Yield Curve Inverts for First Time Since 2007

The Treasury yield curve inverted for the first time since the last crisis Friday, triggering the first reliable market signal of an impending recession and rate-cutting cycle.

The gap between the three-month and 10-year yields vanished as a surge of buying pushed the latter to a 14-month low of 2.416 percent. Inversion is considered a reliable harbinger of recession in the U.S., within roughly the next 18 months.

Demand for government bonds gained momentum Wednesday, when U.S. central bank policy makers lowered both their growth projections and their interest-rate outlook. The majority of officials now envisages no hikes this year, down from a median call of two at their December meeting. Traders took that dovish shift as their cue to dig into positions for a Fed easing cycle, pricing in a cut by the end of 2020 and a one-in-two chance of a reduction as soon as this year.

“It looks like the global slowdown worries have been confirmed and the market is beginning to price in Fed easing, potential recession down the road,” said Kathy Jones, chief fixed-income strategist at Charles Schwab & Co. “It’s clearly a sign that the market is worried about growth and moving into Treasuries from riskier asset classes.”

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

Bonds

German 10-year bond yields turn negative for the first time since October 2016

Bond yields globally were already under pressure earlier in the day but Germany’s woeful factory activity data just kicked things into overdrive and is accelerating the drop in bund yields today.

The bright side for the euro and yield lovers is that whenever Germany tends to come into contact with ‘Japanification’, yields tend to rebound shortly afterwards as we have seen in early 2015 and mid-to-late 2016.

That said, this time around is more of a synchronised drop and with headwinds surrounding the global economy still blowing strong, it’ll be a tough argument to say that things are going to get better in the near future.

Read the full article from ForexLive +

|

|

|

|

|

|

|

|

|

|

|

|

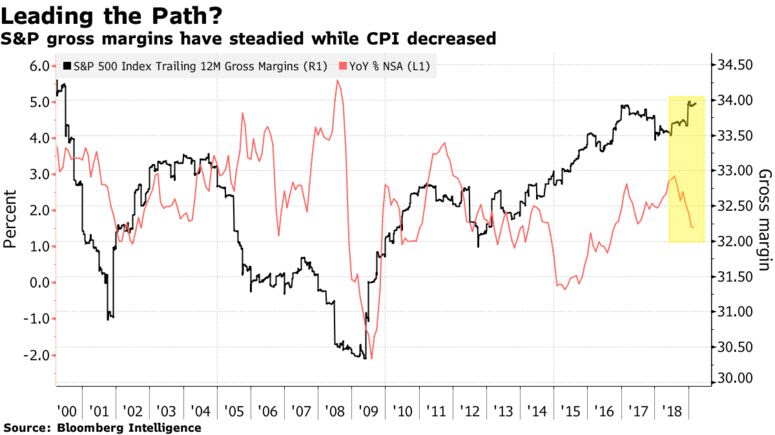

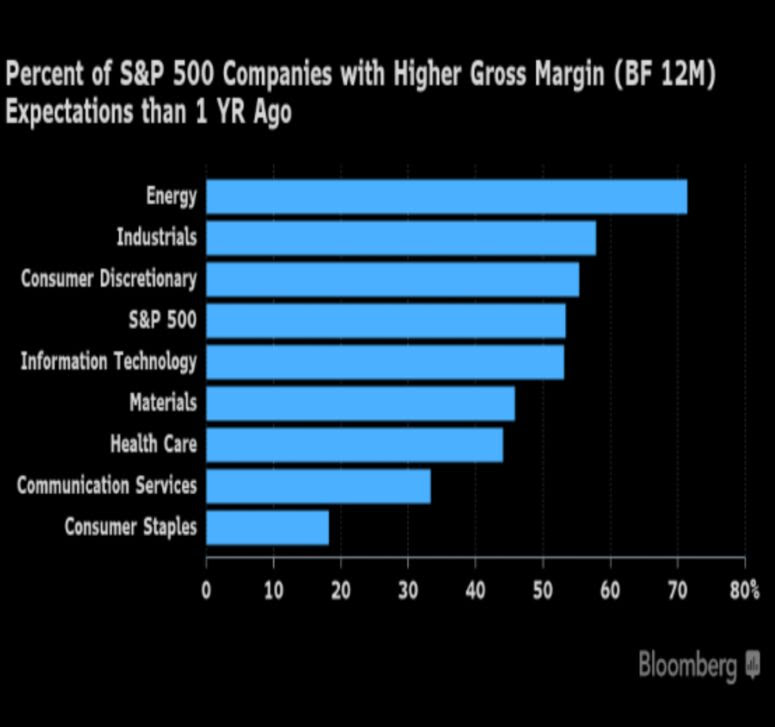

US Inflation

Inflation Is Alive and Well and Living in S&P 500 Income Statements

The Federal Reserve may not see much inflation, but the stock market sure can, and its whereabouts helps explain why enthusiasm for equities continues to build.

To find it you must drill into the earnings statements of American companies — beyond sales and earnings and down to the lines that track profitability and pricing power. It’s in the row labeled gross margin, which the terminal defines as the percentage of revenue a company keeps after the costs of producing the goods and services it sells.

Long story short, for the majority of S&P 500 constituents, it’s going up, evidence most companies still are managing to raise prices faster than wages and raw material costs eat into sales. To some it’s an incipient inflation harbinger, though one that along with rising sales helps explain why analysts see another year of earnings growth in the benchmark index. Combine it with a Fed that is all but committed to holding rates steady for the rest of 2019, and it becomes a recipe for rational exuberance among risk-loving investors.

“S&P 500 gross margins show companies aren’t having too much trouble passing prices on to consumers despite the evident slowdown in global growth last fall,” wrote Bloomberg Intelligence analysts led by chief equity strategist Gina Martin Adams. “Pricing power is intact, implying inflation may be ‘stickier’ than is ideal for a shift to dovish Fed policy.”

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

|

|

GDP

Grounding of 737 Max Is Seen Swaying Some U.S. Economic Data

The grounding of Boeing Co.’s 737 Max after a second crash is poised to start percolating through major U.S. economic indicators ranging from international trade to durable goods, according to JPMorgan Chase & Co.

For now, the issues affecting the aircraft probably won’t have a short-run impact on gross domestic product because production continues, but they will affect the composition of GDP, with more inventory growth and less of a boost for business investment and gross exports, JPMorgan’s Chief U.S. Economist Michael Feroli wrote in a note Thursday.

“Boeing is continuing to produce the plane, with most, if not all of the final product, being put into inventory pending the completion of the investigation,” Feroli wrote. “This means that GDP should be largely unaffected for now, as weaker exports and business investment would be offset by more stockbuilding.”

Still, Feroli warns things can change if the jetliner’s production is halted for a time. That would shave about 0.15 percent off the level of GDP, or about 0.6 percentage point from the quarterly annualized growth rate of GDP in the three-month period that manufacturing halts, he said.

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rates

A Central Banking Domino Effect Is in Motion

Abrupt changes in the policies of the world’s largest central banks have rippled through smaller economies, leaving them with the prospect of low and even negative interest rates for years to come despite having mostly healthy economies. The danger is that these easy-money policies could fuel destabilizing bubbles in real estate and other asset markets. They may also leave banks with little ammunition to respond to the next economic downturn.

Economies like Switzerland’s, whose central bank signaled no change in its negative-rate policies for years to come, are small compared with the U.S. and eurozone. Still, they are home to major global banks and companies that are sensitive to exchange rates and financial conditions.

On Wednesday, the Federal Reserve left its key policy rate in a range between 2.25% and 2.5% and indicated that it is unlikely to raise rates this year. In late 2018, officials had signaled they expected between one and three increases this year. Two weeks ago, the European Central Bank went further, saying it would launch new stimulus to support the eurozone economy via cheap loans for banks. It also said it expected to keep its key interest rate at minus 0.4% at least through 2019, a longer horizon than before.

Here’s why Fed and ECB decisions matter for countries that don’t use the dollar or euro: Switzerland and countries near the eurozone but not part of it—like Sweden and Denmark—rely on the bloc for much of their exports and imports. That makes growth and inflation highly dependent on the exchange rate. Central-bank stimulus tends to weaken a country’s exchange rate, so when the ECB embraces easy-money policies as it did two weeks ago it tends to weaken the euro against other European currencies such as the Swiss franc. Because the ECB is so large, Switzerland and others can do little to offset it.

“The gravity pull is very strong” from the Fed and ECB, said Sebastien Galy, macro strategist at Nordea Asset Management. “The consequence is [non-euro central banks in Europe] mostly end up importing policy from the ECB, so you end up with housing bubbles and a misallocation of capital.”

Read the full article from The Wall Street Journal +

|

|

|

|

|

|

|

|

|

|

Construction & Real Estate

|

|

|

|

|

|

|

|

Commercial Real Estate

Title

E-commerce has changed how Americans shop and, according to a recent report from Dodge Data & Analytics, it’s also changing the way the construction industry builds. Warehouses are being built with greater frequency, but they’re also getting bigger. The total square footage of warehouse construction starts increased from 49 million square feet in 2010 to 283 million square feet in 2018, although square footage peaked in 2017 at 300 million. And from 2007 through 2018, the number of warehouse projects of 1 million square feet or more increased from 23 to 48, a figure that represents more than 64 million square feet of space.

The 1 million-square-foot warehouse has become standard, Jeff Bischoff, executive vice president of business development at Lexington, Kentucky-based Gray Construction, told Construction Dive in an interview. Warehouses and distribution/fulfillment centers are some of Gray’s specialties. Historically they have made up about 35% of the company’s annual revenue, 20% so far for this fiscal year, he said.

Brick-and-mortar retail clients typically have internet sales components and are increasing their warehouse stock. However, Dodge found that most of the growth in e-commerce warehouse construction is coming from online-only companies like Amazon, which broke ground on 23 warehouse projects last year. Almost half of those were 1 million square feet or more, and four were the largest of all warehouse projects that broke ground in 2018.

Read the full article from Construction Dive +

|

|

|

|

|

|

|

|

|

|

|

|

Video Games

Walmart is reportedly looking into launching its own cloud gaming service

Cloud gaming services are one of the biggest topics in tech this week, and yet, you wouldn’t necessarily expect that Walmart would enter the fray. Google’s announcement of Stadia, its upcoming game-streaming service, is already being intercepted by a report at US Gamer. “Multiple sources familiar with Walmart’s plans, who wish to remain anonymous” tell USG that Walmart is at least exploring the possibilities of launching its own cloud gaming service to compete with the likes of Google’s own.

If you think about it, it’s not entirely unlikely. As one of the largest retail corporations in the world, Walmart surely has the capital to fund a pet project like this. What’s even more interesting is that Walmart has shown it’s theoretically capable of running the kind of infrastructure required: it has six giant server farms that contain sensitive customer information and company data.

Google’s Stadia platform will be heavily reliant on similar data centers, the same kind that other tech companies like Apple, Google, and Microsoft manage and use for their own services. But it’s worth noting that Walmart isn’t keeping the cloud in-house: it recently entered a five-year partnership with Microsoft to use Azure and Microsoft 365 products across the company on projects geared toward machine learning, AI, and data platforms, and Microsoft is building a game-streaming service of its own.

Read the full article from The Verge +

|

|

|

|

|

|

|

|

|

|

|

|

3DP

Move over, 3D: 4D printing is now here to change the world

New research published to Materials Horizons by a team from Rutgers University has shown that the 3D-printing revolution was just a starting point for what we now call 4D printing.

In a standard 3D-printed design, an object is built from the ground up using a gradual additive process. Its ability to create objects of incredibly intricacy for a multitude of uses – particularly in aerospace and medical sectors – has been heralded as being vital to a number of breakthroughs. However, a number of new flexible, lightweight materials produced by the Rutgers University team have shown themselves to be even more capable.

Unlike 3D-printed objects, those made in 4D can change shape with environmental conditions such as temperature acting as a trigger, and the fourth dimension – time – allowing objects to change shape. “We believe this unprecedented interplay of materials science, mechanics and 3D printing will create a new pathway to a wide range of exciting applications that will improve technology, health, safety and quality of life,” said senior author of the study, Howon Lee.

The new ‘metamaterials’ created by the team demonstrate pretty unusual and counterintuitive properties not found in nature, with their stiffness capable of being adjusted more than 100-fold in temperatures between 22 degrees Celsius (room temperature) and 90 degrees Celsius.

Read the full article from Silicon Republic +

|

|

|

|

|

|

|

|

Robotics & Automation

Your future coworkers could be swarms of robots

Imagine there’s a flock of aerial robots searching for a lost hiker, for example. They have to cover a large area of remote bush and a central commander won’t work because they’re so spread out. So, instead, the robots work cooperatively to calculate the best way to cover and search this large area accurately and speedily.

This scenario is less Black Mirror than it sounds, and more about focusing on practical solutions for jobs that are difficult for humans to do, says Airlie Chapman from the Melbourne School of Engineering. Describing the focus of her research in mechatronic engineering, Chapman says “it centers on multi-vehicle robotics, or many robots working together to achieve a common goal”.

Mechatronic engineers explore developments in automation and manufacturing—blending multiple disciplines of engineering. And it can involve creating smart machines that are aware of their surroundings and can make autonomous decisions.

Chapman works specifically in the field of multi-vehicle, or swarm, robotics. Using a combination of mechanical, electrical, and software engineering to build the robots, Chapman then programs the vehicles using algorithms to react and think autonomously.

Read the full article from Futurity +

|

|

|

|

| There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today by contacting hugh@mcalindenresearch.com |

|

|

|

|

|

|

|

|

|

|

Leave a Reply