|

|

|

|

|

|

|

|

Daily Intelligence Briefing

|

|

|

|

|

|

|

|

|

|

|

|

|

Identifying Change-Driven Investment Themes – Five sections, explained here.

|

|

|

|

|

|

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today. McAlinden Research Partners is offering a complimentary one-month subscription to receive the Daily Intelligence Briefing – to Hedge Connection clients/friends. Activate yours by contacting Rob@mcalindenresearch.com and mentioning “Sent by Hedge Connection” |

|

|

|

|

I. Today’s Thematic Investment Idea

A deep dive into a market driver with alpha generating potential.

|

|

|

Yuan Slide Could Kick up Currency War as World Awaits Trump Retaliation→

|

|

|

The Trump administration, on Monday, designated China a “currency manipulator”, reviving speculation that Trump would seek to unilaterally weaken the dollar through the Treasury Department. Whether these are the first shots of a brewing currency war, it absolutely marks new territory in the US-China trade war and has global ramifications for FX markets, treasuries, and equities. Read more +

|

|

|

|

|

|

|

|

|

|

|

|

II. Updates of Themes on MRP’s Radar

Follow-up analysis of key market drivers monitored by MRP.

|

|

|

|

|

|

|

Brexit: Just 3 in 10 British firms that export to the EU are prepared for a no-deal Brexit

|

|

|

Payments: Cashless payment booms in China and India spell end of the ATM

|

|

|

Wages: What Apocalypse? Retail Worker Pay Hits 15-Year High

|

|

|

Video Games LONG: XRDC: 59% of AR/VR developers are working on games

|

|

|

Firearms: Gun industry’s woes are accelerating on Trump’s watch

|

|

|

Autos SHORT: Japanese Car Sales to Korea Slide 32% as Trade Tensions Heat Up

|

|

|

Aviation SHORT: Airline surveys point to ongoing production problems at Boeing’s SC plant

|

|

|

Ride-Sharing: Will Uber ever make money? Day of reckoning looms for ride-sharing firm

|

|

|

Meat: Surplus pork is biting US hog markets as trade war turns the world’s biggest customer away from American farmers

|

|

|

Metals: There’s One Metal Worrying Tesla and EV Battery Suppliers

|

|

|

Oil: Oil Price Correction Triggers Shale Meltdown

|

|

|

LNG: United States sets new daily record high for natural gas use in the power sector

|

|

|

AI: The United States Of Artificial Intelligence Startups

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IV. Active Thematic Ideas

MRP’s active long and short themes, with an archive of follow-up reports.

|

|

|

See Them Here →

|

|

|

|

|

|

|

|

|

|

V. Macroeconomic Indicators

Key data releases relevant to MRP’s Active Thematic Ideas.

|

|

|

See Them Here →

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yuan Slide Could Kick up Currency War as World Awaits Trump Retaliation

|

|

|

|

|

|

|

|

|

|

|

|

Stocks slid just over 3% on Monday, marking the S&P 500’s worst day of 2019, on news that China had allowed the Yuan to slip past a politically critical benchmark. The Trump administration followed it up by designating China a “currency manipulator”, reviving speculation that Trump would seek to unilaterally weaken the dollar through the Treasury Department. Whether these are the first shots of a brewing currency war, it absolutely marks new territory in the US-China trade war and has global ramifications for FX markets, treasuries, and equities.

|

|

|

|

|

|

Last autumn, MRP warned ongoing global trade disputes would continue to hit foreign exchange markets hard; particularly China’s Yuan. At the time, we noted the Trump administration’s trade policies pushing the exchange rate for the Chinese Yuan to US Dollars toward a rate of 7 Yuan to 1 USD, a level that strategists say is technically and psychologically important, for some time now. That level had not been seen since 2008; until yesterday.

The Yuan has lost 4% since hitting a high in February of 6.6862 to the dollar. Trump’s latest escalation of the trade war, new 10% duties on $300 million worth of Chinese exports, saw the People’s Bank of China (PBOC) respond by setting a daily rate for the currency at its weakest level in eight months, abandoning their efforts to keep the USD/Yuan exchange rate from breaking below the critical 7 level. This is especially significant since China’s central bank doesn’t have the authority alone to let the yuan break 7. According to Lingling Wei, the Wall Street Journal’s China policy reporter, “the move had to be signed off by the top leadership.”

A weaker Yuan will help prices of Chinese goods become competitive on prices again, following huge mark-ups on the country’s exports to the US due to tariffs already levied. “This is therefore bad news for manufacturers outside of China, at a time when global manufacturing is struggling with weakening demand growth and the negative impact of the U.S.-China trade dispute on their supply lines and profits”, according to Devere Group.

The US Treasury followed up on Monday by officially designating China a “currency manipulator”. While the devaluation is technically not manipulation of their currency, the PBOC had long taken measures to avoid this scenario. Even in the aftermath of the Chinese stock market meltdown back in 2015, China refused to allow the Yuan to weaken to this level. The drop on Monday morning “shows that China doesn’t care about [US accusations of currency manipulation] any longer” and that Beijing now believes “the US will impose additional tariffs no matter what China does,” according to Standard Chartered Bank.

Paired with a total suspension of Chinese orders for US agricultural products, the world has clearly entered a new phase of the US-China trade war, one which could see measures beyond tariffs being taken. Although Trump’s economic adviser Larry Kudlow so far has ruled out any currency intervention by the U.S. Treasury to weaken the dollar, that claim was hard to believe at first, and now, is likely moot. Not only has Trump previously advocated for a weaker dollar, but he continued his calls for the Fed to accelerate easing of US interest rates.

While Trump is already on his way to getting his wish as Federal-funds futures already show a 40% chance of at least three more quarter-point rate cuts in 2019, according to CME Group. That’s up from 8.2% one month ago and could continue to rise further if inflation remains subdued and market volatility continues to rise. However, if Trump is as convinced as he seems that China is now manipulating its currency and trying to gain an edge on the US, that pace may not be fast enough.

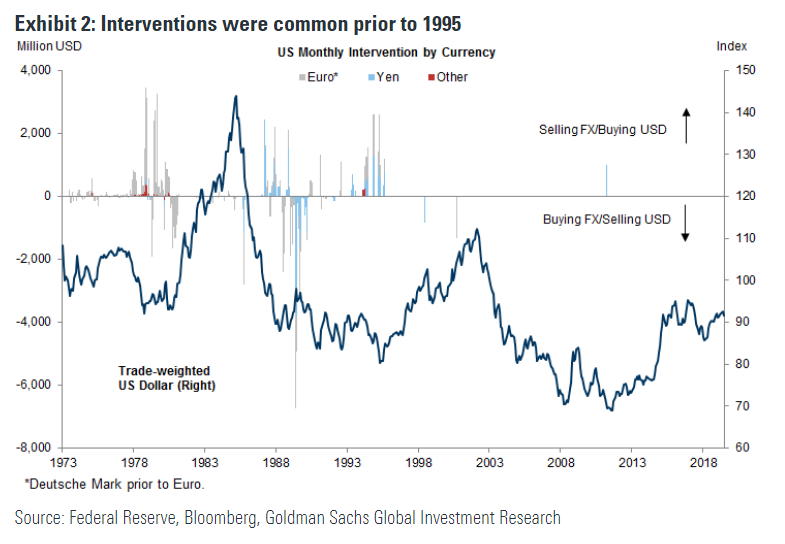

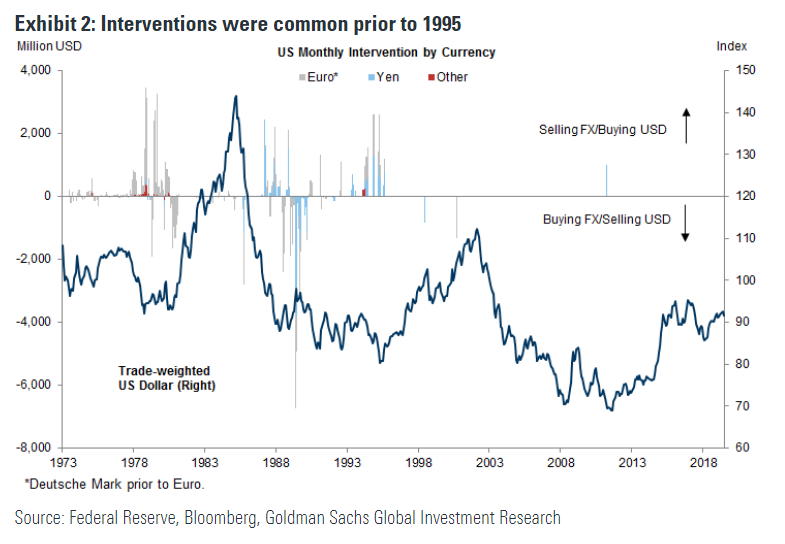

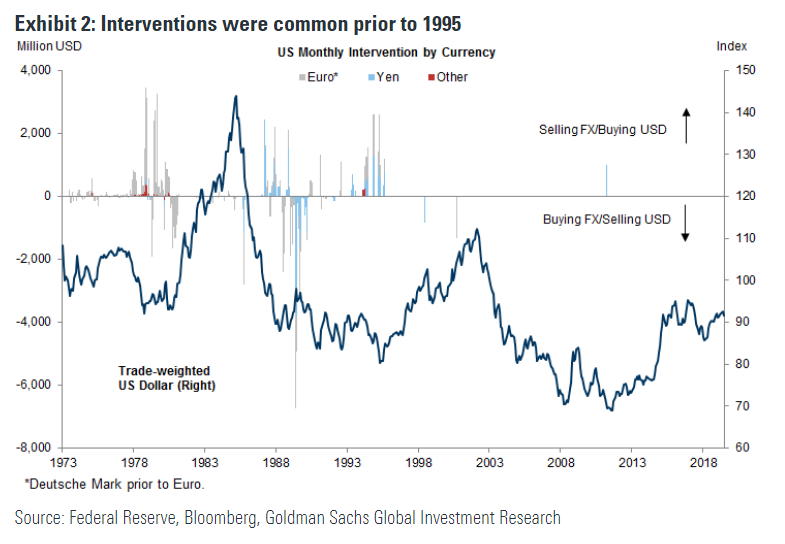

Before Kudlow’s announcement, Trump reportedly asked aides to look for ways to weaken the dollar. While it is not public knowledge what the White House may have come up with ways to weaken the dollar unilaterally, past interventions have seen the US utilize the Federal Reserve holdings and the Treasury’s Exchange Stabilization Fund.

While the Fed is responsible for executing any FX intervention, dollar policy is traditionally the purview of the Treasury Department. The Treasury’s Exchange Stabilization Fund has around just $22 billion in U.S. dollars — and another $51 billion in IMF Special Drawing Rights, or SDRs, that could be converted — that it could tap, The Fed can use its balance sheet, giving it vastly more firepower. While some have speculated whether the Fed would go along with the Treasury if ordered by the President to take action on the dollar, Goldman Sachs believes the Fed “would probably defer to the Treasury and go along even if it does not agree.” Even if Trump doesn’t go so far as to order the Treasury to pursue a weak dollar policy, something that hasn’t been done in decades, simply using the prospect as a bully pulpit and threatening to do so would likely move FX markets.

A weaker yuan is by itself very bad news for Europe. As Societe Generale SA, points out, the euro is even more exposed to trade with China than it is to trade in dollars. Germany’s exports, for instance, equate to nearly half of its gross domestic product, compared to 12% for the U.S. and 20% for China. An unwanted rise in the euro as China and the U.S. duke it out to weaken their own currencies would be a disaster for Europe’s export-dependent manufacturers and could plunge the continent into recession.

While the European Central Bank has already laid out plans to begin easing and boost stimulus, in the coming months, it may be stuck behind the curve. The Euro was one of the few currencies that strengthened on Monday, and if action isn’t taken, it’s now very possible that relative strength in the Euro could prevail throughout the rest of the year.

A currency war would mean rapid, back and forth devaluations of the dollar and the Yuan that could create huge volatility in equities and send bond prices soaring. Yields have now fallen to their lowest level since 2016 and, despite the Fed’s hope that a 25bps rate cut in July would help pull the yield curve out of inversion, could fall even further.

Investors can gain exposure to the US dollar, Yuan, and Euro via the Invesco DB US Dollar Index Bullish Fund (UUP), Market Vectors Chinese Renminbi/USD ETN (CNY), and Invesco CurrencyShares Euro Currency Trust (FXE), respectively. Investors can also gain exposure to US treasuries via the iShares 7-10 Year Treasury Bond ETF (IEF).

|

|

|

|

|

|

|

|

|

|

|

|

US Dollar vs Yuan vs Euro vs US Treasuries vs S&P 500

|

|

|

|

|

|

|

|

|

|

|

|

|

Source material for today’s market insight…

|

|

|

|

|

|

|

|

|

|

|

|

FX

A U.S.-China Currency War Would Do Some Serious Damage

Although Trump’s economic adviser Larry Kudlow so far has ruled out any currency intervention by the U.S. Treasury to weaken the dollar, it would be a brave trader who took this at face value.

Perhaps the people to feel most sorry for in this arm-wrestling between the world’s two most powerful countries are the Europeans and the Japanese, who might end up as collateral damage. Both the U.S. Treasury and the Chinese authorities have the capacity to ramp up or deescalate their currency hostilities. After years of ultra-expansive monetary policy, Japan and Europe have almost no room left for their own defensive maneuvers.

The ECB has already fired its biggest policy gun by signalling a move toward even deeper negative rates after the summer and the possible restart of net bond purchases. It is out of ammunition. In the meantime, a weaker yuan is by itself very bad news for Europe. An unwanted rise in the euro as China and the U.S. duke it out to weaken their own currencies would be a disaster for Europe’s export-dependent manufacturers and could plunge the continent into recession.

Japan, the world’s third-largest economy, is similarly at the mercy of its bigger rivals. The yen has strengthened recently against the dollar to early 2018 levels and is back to 2016 valuations versus the yuan. That puts huge pressure on Shinzo Abe’s government in its efforts to resuscitate the economy.

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

China lets yuan weaken and stops buying U.S. crops, escalating trade war

The U.S. Treasury Department announced late on Monday that it had determined for the first time since 1994 that China was manipulating its currency, knocking the U.S. dollar .DXY sharply lower and sending gold prices XAU= to a six-year high. The designation by U.S. Treasury Secretary Steven Mnuchin starts a formal process of bilateral negotiations between the world’s two largest economies, and fulfills a promise made by U.S. President Donald Trump on his first day in office.

The IMF had no immediate comment. Last month, the global lender said China’s yuan was broadly in line with economic fundamentals, while the U.S. dollar was overvalued by 6% to 12%.

The Treasury statement, made after the stock trading session ended, sent S&P 500 futures EScv1 down more than 1%, suggesting investors expect Wall Street to open on Tuesday with additional losses following Monday’s drop of 3% on the S&P 500.

The U.S. action came after China let its currency weaken 1.4%, sending it past the key 7-per-dollar level for the first time in more than a decade. Beijing also halted U.S. agricultural purchases, inflaming a trade war that has roiled financial markets, disrupted supply chains and slowed global growth.

Read the full article from Reuters +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

Currency intervention: Here’s how the U.S. could move to weaken the dollar

While still seen as a long shot — Goldman Sachs described it last week as a “low but rising risk” — a growing number of analysts are warning that President Donald Trump’s longstanding frustration with the U.S. dollar’s relative strength versus major rivals could eventually lead to U.S. government to intervene in the currency market in an effort to weaken the greenback.

Last week, Bloomberg News reported that Trump has asked aides to look for ways to weaken the dollar and asked about the currency in job interviews with the candidates he’s selected for seats on the Federal Reserve’s board.

Intervention occurs when a central bank buys or sells its own currency in an effort to influence the exchange rate. A government might take action to halt a precipitous slide or a sharp runup in its currency following a shock. It could also act in concert with or on behalf of other countries in an effort to stabilize a particular currency. In fact, the last time the U.S. intervened in the currency market was in March 2011, as part of a coordinated effort by the Group of Seven nations to arrest a surge in the Japanese yen following a devastating earthquake and tsunami.

Utilizing their massive reserves, central banks can get their way, at least in the short term. A credible threat — explicit or implied — to intervene around a certain level can often hold sway, particularly if underlying fundamentals and other factors stand in the central bank’s favor.

Read the full article from MarketWatch +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

US declares China a currency manipulator, says it’s using yuan to gain ‘unfair advantage’ in trade

The U.S. Treasury Department on Monday designated China as currency manipulator, a historic move that no White House had exercised since the Clinton administration.

“Secretary Mnuchin, under the auspices of President Trump, has today determined that China is a Currency Manipulator,” the Treasury Department said in a release. “As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.”

“In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past,” the Treasury Department added. “The context of these actions and the implausibility of China’s market stability rationale confirm that the purpose of China’s currency devaluation is to gain unfair competitive advantage in international trade.” The yuan fell to 7 against the dollar earlier in the session for the first time since 2008.

Even before the formal designation, President Donald Trump took to Twitter to voice his opinion, accusing Beijing of manipulating its currency as the trade war between the world’s largest economies intensified.

Read the full article from CNBC +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select a theme to see when and why we added it. Also included is a link to all recent Market Insight reports we’ve written about that theme, allowing you to track its progress.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Composite PMI Revised Higher: Markit

The IHS Markit Composite PMI was revised higher to 52.6 in July 2019 from a preliminary estimate of 51.6 in the previous month and compared to June’s final reading of 51.5. Services activity output increased at a faster pace (PMI at 53.0 from 51.5) while manufacturing expansion was the weakest since September 2009 (PMI at 50.4 from 50.6).

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Services PMI Revised Higher: Markit

The IHS Markit US Services PMI increased to 53 in July of 2019 from 51.5 in the previous month and above preliminary estimates of 52.2. It is the fastest pace of expansion in services since April.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US Non Manufacturing Sector Growth at 3-Year Low

The ISM Non-Manufacturing PMI for the United States dropped to 53.7 in July 2019 from 55.1 in the previous month and below market expectations of 55.5. The latest reading pointed to the weakest pace of expansion in the non-manufacturing sector since August 2016.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

US 10-Year Yield Inversion Deepens

The 10-year US Treasury note yield fell as much as 7bps to 1.7752% on Monday morning, its lowest level since October of 2016, on growing demand for safe haven assets after China allowed its currency to drop to its weakest level since 2008 in retaliation to last week’s President Donald Trump decision to slap an additional 10% tariff on the remaining Chinese imports. At the same time, the yield on the 3-month Treasury note declined 2.32bps to 2.025%.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gold Rallies to Over 6-Year High

Gold prices rose to the highest since May 2013 on Monday, extending gains from the previous session, amid a deterioration in US-china trade relations while persistent worries regarding a global economic slowdown increased investors’ appetite for safe-haven assets. Prices were also supported by a weaker dollar and gold purchases by the central banks. Gold prices rose as much as 1.7% to $1468.66 an ounce around 12:30 PM New York time.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UK 10-Year Gilt Yield Slides to Record Low

Britain’s 10-year gilt yield fell below 0.5% on Monday morning, its lowest level on record, as trade tensions between Washington and Beijing mount after China let the yuan fell to its lowest level in over a decade, while political and Brexit uncertainty increased on the back of a reduced Boris Johnson’s majority in parliament.

Click here to access the data +

|

|

|

|

|

|

|

|

|

|

|

|

MARKET INSIGHT UPDATES: SUMMARIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

A U.S.-China Currency War Would Do Some Serious Damage

Although Trump’s economic adviser Larry Kudlow so far has ruled out any currency intervention by the U.S. Treasury to weaken the dollar, it would be a brave trader who took this at face value.

Perhaps the people to feel most sorry for in this arm-wrestling between the world’s two most powerful countries are the Europeans and the Japanese, who might end up as collateral damage. Both the U.S. Treasury and the Chinese authorities have the capacity to ramp up or deescalate their currency hostilities. After years of ultra-expansive monetary policy, Japan and Europe have almost no room left for their own defensive maneuvers.

The ECB has already fired its biggest policy gun by signalling a move toward even deeper negative rates after the summer and the possible restart of net bond purchases. It is out of ammunition. In the meantime, a weaker yuan is by itself very bad news for Europe. An unwanted rise in the euro as China and the U.S. duke it out to weaken their own currencies would be a disaster for Europe’s export-dependent manufacturers and could plunge the continent into recession.

Japan, the world’s third-largest economy, is similarly at the mercy of its bigger rivals. The yen has strengthened recently against the dollar to early 2018 levels and is back to 2016 valuations versus the yuan. That puts huge pressure on Shinzo Abe’s government in its efforts to resuscitate the economy.

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

China lets yuan weaken and stops buying U.S. crops, escalating trade war

The U.S. Treasury Department announced late on Monday that it had determined for the first time since 1994 that China was manipulating its currency, knocking the U.S. dollar .DXY sharply lower and sending gold prices XAU= to a six-year high. The designation by U.S. Treasury Secretary Steven Mnuchin starts a formal process of bilateral negotiations between the world’s two largest economies, and fulfills a promise made by U.S. President Donald Trump on his first day in office.

The IMF had no immediate comment. Last month, the global lender said China’s yuan was broadly in line with economic fundamentals, while the U.S. dollar was overvalued by 6% to 12%.

The Treasury statement, made after the stock trading session ended, sent S&P 500 futures EScv1 down more than 1%, suggesting investors expect Wall Street to open on Tuesday with additional losses following Monday’s drop of 3% on the S&P 500.

The U.S. action came after China let its currency weaken 1.4%, sending it past the key 7-per-dollar level for the first time in more than a decade. Beijing also halted U.S. agricultural purchases, inflaming a trade war that has roiled financial markets, disrupted supply chains and slowed global growth.

Read the full article from Reuters +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

Currency intervention: Here’s how the U.S. could move to weaken the dollar

While still seen as a long shot — Goldman Sachs described it last week as a “low but rising risk” — a growing number of analysts are warning that President Donald Trump’s longstanding frustration with the U.S. dollar’s relative strength versus major rivals could eventually lead to U.S. government to intervene in the currency market in an effort to weaken the greenback.

Last week, Bloomberg News reported that Trump has asked aides to look for ways to weaken the dollar and asked about the currency in job interviews with the candidates he’s selected for seats on the Federal Reserve’s board.

Intervention occurs when a central bank buys or sells its own currency in an effort to influence the exchange rate. A government might take action to halt a precipitous slide or a sharp runup in its currency following a shock. It could also act in concert with or on behalf of other countries in an effort to stabilize a particular currency. In fact, the last time the U.S. intervened in the currency market was in March 2011, as part of a coordinated effort by the Group of Seven nations to arrest a surge in the Japanese yen following a devastating earthquake and tsunami.

Utilizing their massive reserves, central banks can get their way, at least in the short term. A credible threat — explicit or implied — to intervene around a certain level can often hold sway, particularly if underlying fundamentals and other factors stand in the central bank’s favor.

Read the full article from MarketWatch +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FX

US declares China a currency manipulator, says it’s using yuan to gain ‘unfair advantage’ in trade

The U.S. Treasury Department on Monday designated China as currency manipulator, a historic move that no White House had exercised since the Clinton administration.

“Secretary Mnuchin, under the auspices of President Trump, has today determined that China is a Currency Manipulator,” the Treasury Department said in a release. “As a result of this determination, Secretary Mnuchin will engage with the International Monetary Fund to eliminate the unfair competitive advantage created by China’s latest actions.”

“In recent days, China has taken concrete steps to devalue its currency, while maintaining substantial foreign exchange reserves despite active use of such tools in the past,” the Treasury Department added. “The context of these actions and the implausibility of China’s market stability rationale confirm that the purpose of China’s currency devaluation is to gain unfair competitive advantage in international trade.” The yuan fell to 7 against the dollar earlier in the session for the first time since 2008.

Even before the formal designation, President Donald Trump took to Twitter to voice his opinion, accusing Beijing of manipulating its currency as the trade war between the world’s largest economies intensified.

Read the full article from CNBC +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Brexit

Just 3 in 10 British firms that export to the EU are prepared for a no-deal Brexit

Less than a third of British companies that export to the European Union have secured crucial registration which they need to continue trading with the EU in a no-deal Brexit, government figures have shown.

The Treasury has published figures showing that just 27% of businesses that export to the EU have an Economic Operator Registration and Identification (EORI) number, which they need to trade with the EU in a no-deal exit. The figures — obtained from the government by the Liberal Democrats — also show that if exporters to EU apply for EORI numbers at the current rate, all businesses won’t be registered until at least the beginning of 2021.

Chuka Umunna, the anti-Brexit party’s Treasury spokesperson, said the figures show that “an overwhelming majority of UK exporters to the EU are unprepared for a ‘no deal’ Brexit and will not be in a position to deal with the mountain of red tape and bureaucracy it will burden them with on 31 October.”

It also reported last month that a number of measures that were put in place to mitigate some effects of a no-deal Brexit in March had not been rolled over to cover a no-deal exit in October.

Read the full article from Business Insider +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments

Cashless payment booms in China and India spell end of the ATM

The total number of ATMs around the world fell for the first time in 2018, slipping 1% to about 3.24 million units at the end of the year, according to Retail Banking Research, a British research company specializing in banking technology, cards and payments.

In China, the world’s largest market, the number of ATMs fell 6.8% from a year earlier to 690,000. The U.S., the second-largest ATM market, saw the total drop 0.9% to 433,500.

The total number of branches in the in the 36-member Organization for Economic Cooperation and Development, a grouping of developed economies, fell 2.8% in 2017 to 268,900, according to data from the International Monetary Fund.

Driving the decline in brick-and-mortar financial services is the fall in cash transactions and growing use of cashless payments, including credit cards, contactless payments, cryptocurrencies and fintech-based services. Smartphone payment services that use QR code technology have spread rapidly in the world’s second-largest economy, leading Chinese, especially young people, to carry less cash.

Read the full article from Nikkei Asian Review +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Labor, Education & Demographics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wages

What Apocalypse? Retail Worker Pay Hits 15-Year High

Despite an industry shakeout that’s been dubbed the retail apocalypse, store workers who have hung in there are seeing better pay than a generation ago, even with inflation. Minimum wage increases by states and across major chains, like Walmart Inc. and Target Corp., coupled with a tight labor market, have jump-started the income gains. Average hourly earnings for 13.4 million non-supervisory retail workers surged 5.1% last year for the biggest advance since 1981, according to the U.S. Bureau of Labor Statistics. And they’ve kept rising, hitting $16.65 an hour in July. When adjusted for inflation, that’s the highest level since December 2003.

But it’s important to remember that while retail workers are getting paid more, there are fewer of them. The industry’s payrolls peaked in January 2017, with department stores and clothing chains hit especially hard since then. A mix of online competition, too much debt and mismanagement have recently wiped out chains such as Toys “R” Us, Bon-Ton, Payless and Gymboree. Meanwhile, operating chains, like Sears, J.C. Penney and Gap, continue to shutter underperforming stores and cut jobs.

And while retail associates have made recent gains, they still earn much less than hourly workers in many other sectors. They are now making 29% less than the average for all non-supervisory employees, just a marginal improvement from 30% a decade ago. Inflation-adjusted retail wages also still have a ways to go to surpass their levels in the 1970s, even as pay for hourly workers in general last year finally passed their inflation-adjusted 1973 peak.

Read the full article from Bloomberg +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Video Games

XRDC: 59% of AR/VR developers are working on games

Games continue to make up the largest chunk of VR, AR, and XR development in a year where the industry has seen releases of two major new headsets: the Oculus Quest, and the Valve Index. In a survey of over 900 professionals working in AR, VR, and XR development, XRDC determined that 59% of them were working on video games. Non-game entertainment projects had the second-largest share of projects, with 38%.

By platform, 29% of developers said they were working on projects for the Oculus Rift, 24% for the Quest, and 24% for the HTC Vive. The HTC Vive has had the largest share of projects for the past three years until now, with the Rift surpassing it and the Quest tying it. 23% also said they were developing for Android phones and tablets using ARCore. 52% of developers said they were designing their project specifically for AR/VR, and thus were not concerned about adapting the project for 2D platforms.

Looking at funding, a trend from previous years continued as 41% of developers reported their projects were being supported by existing company funds. Outside investment still seemed to be a less viable funding option, with 23% reporting using personal funds, and 27% saying the funding came from clients.

Read the full article from Games Industry +

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing & Logistics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firearms

Gun industry’s woes are accelerating on Trump’s watch

Even as U.S. stocks trade near all-time highs, one industry has taken it on the chin in the Trump era: gun manufacturers. The National Rifle Association, the powerful lobbying organization that represents the gun industry, has serious problems too. Fifteen of the NRA’s most reliable House Republicans were voted out last November, and Democrats, now in the majority, have passed a variety of gun control legislation.

The NRA has been unable to halt, much less reverse, the corporate, consumer, demographic and investment trends that are slowly and steadily moving against them, and have been for years. For all the hand-wringing about how Washington won’t act on guns—and it certainly won’t now—it’s clear that the marketplace is doing so, whether the gun lobby likes it or not.

But Republicans still control the Senate and White House of course, so Nancy Pelosi can pass all the bills she wants, and nothing will come of it. All Republicans have to do is hang onto either the Senate or White House in the 2020 election (and they could hang on to both) and the NRA’s agenda is safe well into the next decade.

Read the full article from MarketWatch +

|

|

|

|

|

|

|

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is offering a complimentary one-month subscription to receive the Daily Intelligence Briefing – to Hedge Connection clients/friends. Activate yours by contacting Rob@mcalindenresearch.com and mentioning “Sent by Hedge Connection” |

|

Leave a Reply