|

Pharma, Flush with Cash, in a Race Against $180 billion Patent Cliff

Financial services firm Ernst & Young found that 2021 was one of the least active years for biopharma M&A in the last decade. At $108 billion, last year’s cumulative deal value was lower than the $128 billion recorded in 2020 and less than half the $261 billion seen in 2019, according to EY.

2022’s first half was not much better. Deal values were down by 58% and volume has decreased by 33%, according to PwC. However, a “flurry of deals” could characterize the second half for the pharmaceutical and biopharma industry. As MRP has previously noted, there is certainly no shortage of capital to go around in the biopharma space.

Jefferies analyst Michael Yee estimates that the combined market capitalization of all the biotech stocks valued at under $5 billion is around $350 billion. That compares to a combined cash balance among the top 20 biopharma companies worth over $300 billion. “We have reached a point where Big Pharma has so much cash they could basically buy the whole smid-cap universe,” Yee wrote.

At the end of last year, MRP highlighted a report from SVB Leerink analyst Geoffrey Porges and his team, estimating that eighteen large-cap US and European biopharmas will have more than $500 billion in cash on hand by the end of 2022. Porges said those 18 biopharma majors will have total M&A capacity of $1.72 trillion.

Wells Fargo analysts have echoed that assessment of cash balances among major pharmaceutical and biopharma firms. In a recent note, cited by VettaFi, the analysts wrote “Big BioPharma needs growth, and the 5 major US companies with the biggest need have $400B+ cash available from now to 2025, and revenue need of ~$65B+.”

For early-stage deals, PwC’s report notes pharma is looking for assets that can start to provide value from 2024 as patent cliffs – the point at which a firm’s revenues could “fall off a cliff” when one or more established products go off-patent – have put about $180 billion in revenue for the largest companies at risk in the 2023 through 2028 time frame.

June closed out the first half of the year with a below average M&A haul. The pharma industry reported 61 deals worth $6.4 billion as compared to the 12-month average (June 2021 to May 2022) of 81 deals worth $14.8 billion, according to a GlobalData report.

Smaller Deals Precede Merck Closing in on Largest Transaction in 3 Years

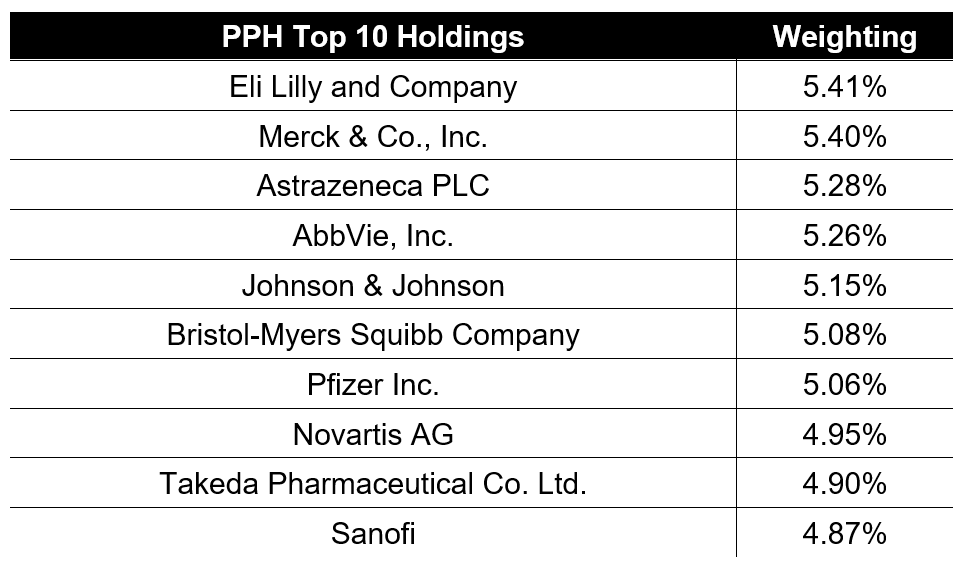

One deal that could be a flashpoint in igniting a coming wave of acquisition activity could be spearheaded by Merck & Co., maker of the COVID-19 pill Lagevrio and the blockbuster cancer therapy Keytruda. The pharma giant is in advanced talks to acquire Seagen Inc. and is aiming to agree on a purchase of the cancer biotech in the next few weeks. According to the Wall Street Journal, the deal could be worth roughly $40 billion or more. Seagen had $1.4 billion in sales last year. Meanwhile, Merck had nearly $8.6 billion in cash and cash equivalents by the end of March.

If Merck were to successfully buy Seagen for more than $200 per share, as reported, Fierce Pharma notes it would be the largest biopharma transaction involving a drugmaker in about three years, and easily outpacing this year’s biggest deal thus far – Pfizer Inc’s $11.6 billion deal for migraine specialist Biohaven Pharmaceutical, announced in May.

Some smaller biopharma deals have begun to crop up throughout the past few weeks.

Pharmaceutical Technology reported earlier this week that Innoviva has signed a definitive merger agreement for the acquisition of all of the outstanding shares of La Jolla Pharmaceutical Company for $6.23 for each share in cash or an enterprise value of nearly $149 million.

Around the same time, Vertex Pharmaceuticals signed a definitive agreement for the acquisition of biotechnology company ViaCyte in a deal totalling $320 million in cash. MRP recently highlighted Vertex’s ongoing work with CRISPR therapeutics to treat fatal blood disorders via gene editing as part of a as part of a $900 million agreement. |

Leave a Reply