|

The commercial satellite business’s role in the defense industry continues to grow, particularly in the vein of satellite imagery.

Earth observation company BlackSky has been one of the leading firms providing the media and US military with imagery, topographical data, and other geospatial information regarding the frontlines in Ukraine throughout the past six months, following Russia’s invasion of the country. Per SpaceNews, the firm will launch new imaging satellites in 2023 and one of them will be used exclusively by the US Army for tests and experiments.

Via Satellite reports Maxar Technologies recently won a new contract with L3Harris Technologies for the design and production of 14 spacecraft platforms and associated support for its Tranche 1 Tracking Layer contract with the Space Development Agency (SDA). That tracking layer, set for delivery by 2024, will provide limited global indications, warning and tracking of conventional and advanced missile threats, including hypersonic missile systems. Generating a defense against hypersonic missiles has become particularly critical for the US, given Russia’s demonstrated capability to deploy them in a battlefield setting.

Elsewhere in the skies over Ukraine, Planet Labs is working with the NASA Harvest team, utilizing satellite data to monitor commodity crops like wheat and maize in Ukraine, one of the leading global producers of wheat and other crops. Planet and NASA have ascertained that “roughly 22% of Ukraine’s farmland—including 28% of winter crops and 18 % of summer crops—is under Russian control,” carrying significant implications for global food security.

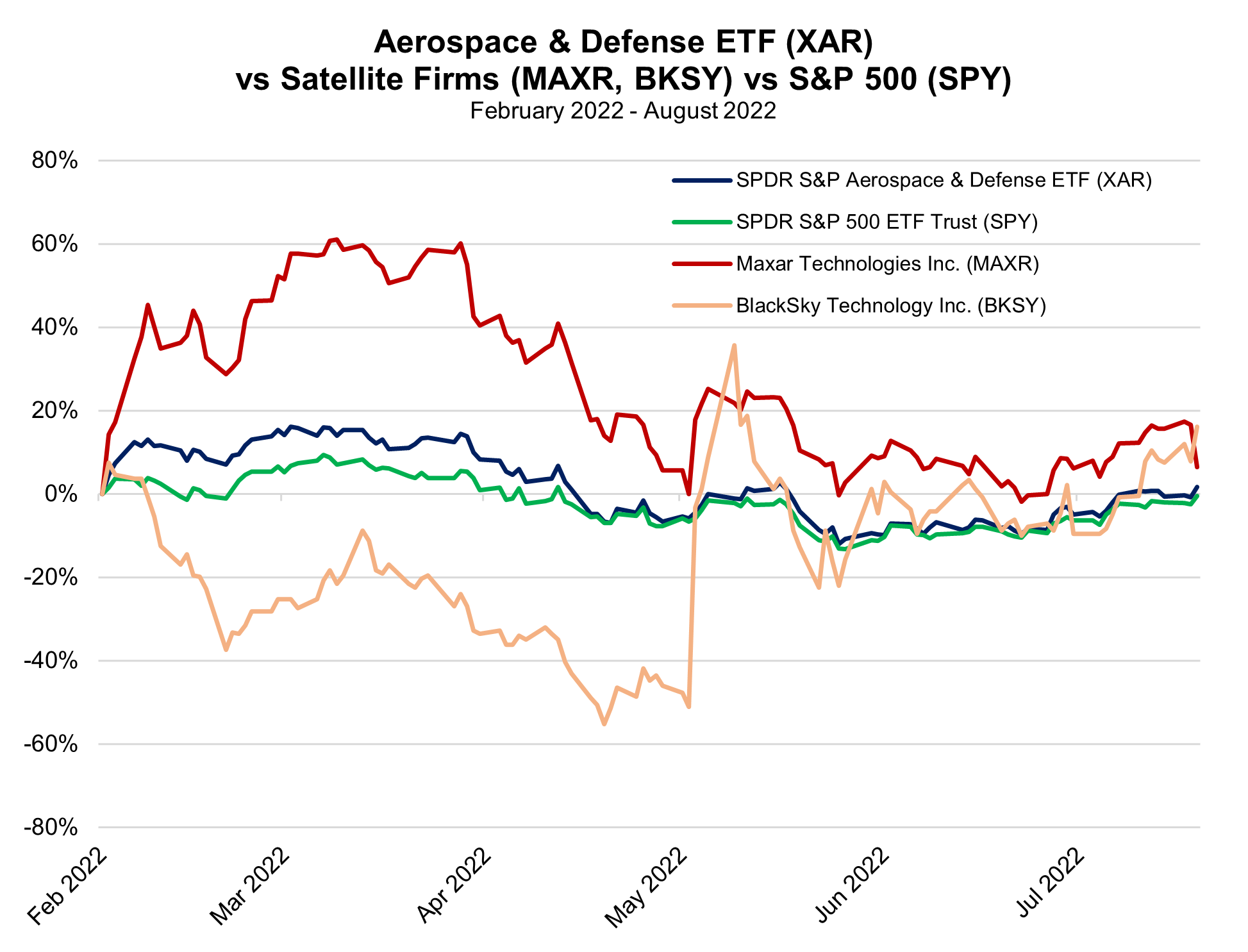

On April 26, MRP first highlighted the key role satellite imagery is playing in the US’s monitoring of Russia’s attack on Ukraine and its implications for the world. Government agencies and media sources alike have been bombarding satellite companies for photographs, 3D mapping, and other data, prompting the firms to expedite the expansion of their constellations. This was referred to as geospatial intelligence’s “internet moment” by Bill Rozier, the vice president of marketing at publicly traded satellite imagery provider BlackSky.

Just about a month later, on May 25, the US National Reconnaissance Office (NRO) announced they’d be funding three firms with billions of dollars in defense contracts throughout the next decade as part of its Electro-Optical Commercial Layer (EOCL) program. Each of those chosen firms, Maxar Technologies Inc., BlackSky Technology Inc., and Planet Labs, were direct focuses of our April intelligence briefing on this budding industry.

BlackSky shares soared yesterday following the company’s quarterly earnings call. Total revenue for the quarter ended June 30 more than doubled to $15.1 million, helping the firm to slice its net loss to just -$0.22 per share, nearly two thirds lower than a net loss of -$0.63 per share in the previous year. Full-year revenue outlook was raised to a range of $62 million – $66 million, up from a previous view of between $58 million – $62 million.

Maxar also reported quarterly earnings yesterday, but the picture wasn’t so rosy. The company hauled in revenues of $438 million in Q2, down -7.4% from $473 million in the same quarter a year ago. As of Jun 30, 2022, the order backlog decreased to $2,945 million from $1,893 million as of the end of 2021. The company swung to a loss of -$0.41 per share in Q2 against earnings of $0.60 in the prior-year quarter.

To offset a downturn in commercial satellite sales, Maxar executives have noted the company plans to lean more heavily into the defense industry. Austin Moeller, aerospace and defense analyst who covers Maxar at Canaccord Genuity, told SpaceNews that Defense and intelligence “just tends to be a more stable market and a lot less bumpy than the commercial comsat market… And when you look at the defense budget, the Space Force has the fastest growing budget of any of the service branches.”

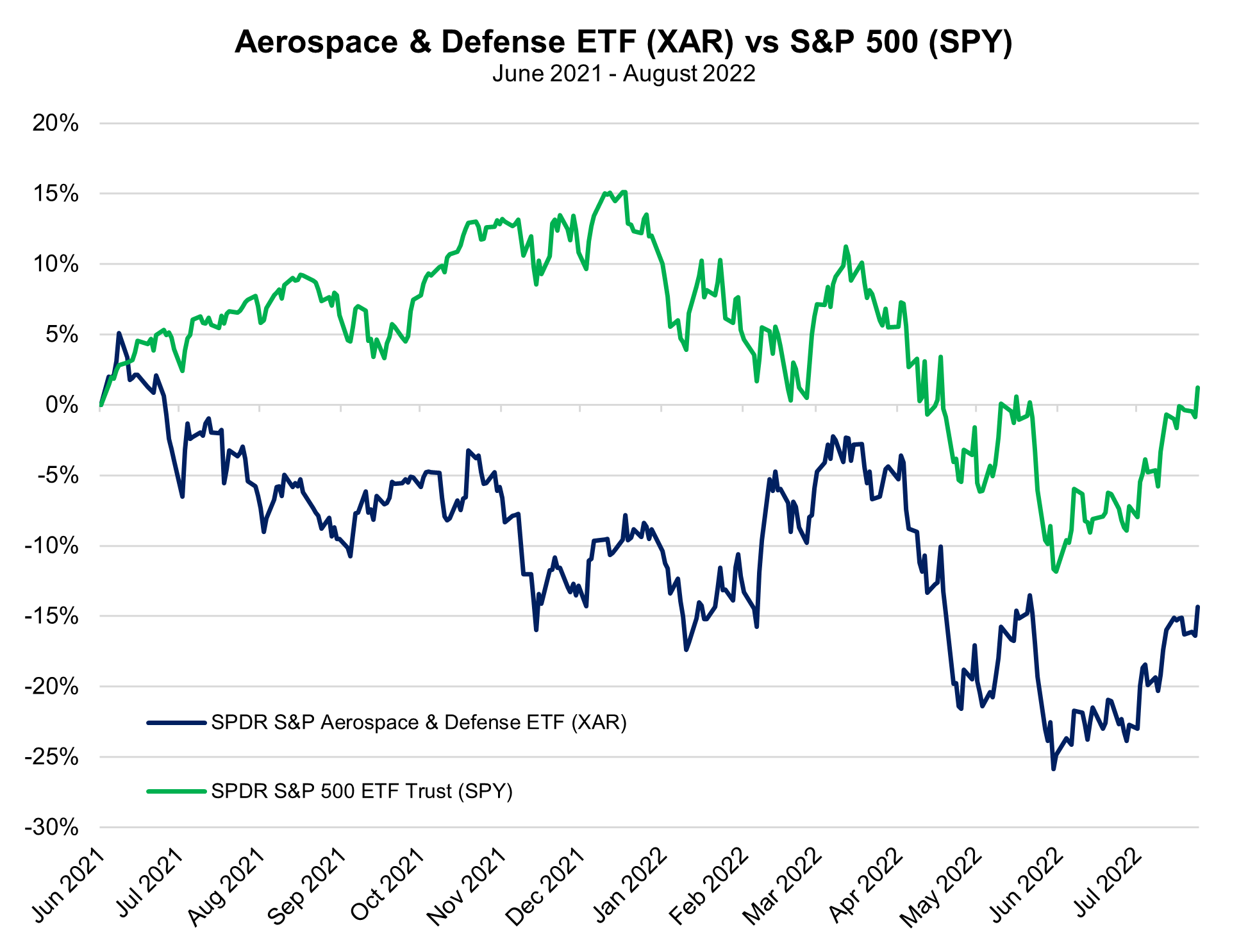

Uses for satellite monitoring have been plentiful throughout the last year, even long before the formal invasion of Ukraine began. As far back as June of 2021, when MRP first began covering Russia’s buildup of their troops in the southwest of the country near the border of Ukraine, satellite images were instrumental in helping the government agencies and media outlets observe Russian training sites, armored vehicles, and other military footprints. By the end of the year, Maxar had already locked up more than $100 million in new defense and intelligence contracts. |

Leave a Reply