|

Coffee futures extended this week’s sharp rally on Wednesday, rising more than 5.0% up to a six-month high. Per Barchart, ICE-monitored arabica inventories last Monday fell to a new 23-year low of 571,580. Following a cooling off from near-decade highs at $2.58 per lb last year, a weak crop and bad weather across Latin America, Africa, and Southeast Asia are re-igniting that momentum once again.

Brazil is by far the world’s biggest exporter of coffee and a key market for arabica in particular. The Wall Street Journal notes that analysts once predicted Brazil’s arabica crop for the 12 months starting in July to match the record set two years earlier of 48.7 million bags, each of which hold 132 pounds of coffee. But the final figure is likely to be much lower, with an early official forecast from Brazil for just 35.7 million bags.

Bloomberg writes that drought and cold in the country curbed flowering last season and severe frosts in July 2021 led farmers to cut down coffee trees when fertilizer supplies thinned. That not only slashed last year’s crop but also curbed the potential for 2022, which is supposed to be the higher-yielding half of Brazil’s two-year harvest cycle. Bean sizes have also declined, which means it takes a lot more beans to fill a single bag.

Per Barchart, satellite data from Maxar Technologies said Monday that ongoing La Niña weather conditions, characterized by hotter and drier conditions, are likely to last through the end of the year. Unsurprisingly, that would exacerbate drought conditions and further stress Brazil’s coffee crops.

Last year, MRP flagged climate change as an additional long-term concern for Brazil’s coffee production. Small changes in temperature and precipitation trends can pose a serious threat to the very precise growing conditions that make Brazil’s coffee harvests so exceptional. Moderate temperatures (between 64 and 70 degrees fahrenheit, to be specific), shade, regular rainfall, and an environment that’s generally free of frost and pests, like coffee leaf rust may now be set to shift in the years ahead.

Coffee rust is a devastating fungus disease that destroys the coffee plant and has become prevalent across Central America and but has even managed to spread to crops in Asia and Hawaii. As The Atlantic has previously reported, increasingly unseasonable warmth and other climate abnormalities have made Brazil’s arabica harvest that much more susceptible to coffee rust outbreaks.

Compounding the downturn in arabica output, production of robusta beans, the “second rate” variety of coffee that’s typically cheaper and easier to grow than arabica, is also down in several key markets. Benchmark robusta prices have surged 17% from a 10-month low in the middle of July on supply worries.

Vietnam, where robusta beans represent 90% of all coffee output, has experienced a major downturn in inventories. Carryover stockpiles are seen at 200,000 tons at the start of the new season on October 1, compared with an estimated 400,000 tons a year earlier. Output may fall 6% to 1.72 million tons in the 2022-23 season, Bloomberg survey data showed.

Uganda, Africa’s largest coffee producer and another key market for robusta beans, saw coffee exports drop 17.7% in July compared to the same month last year, hurt by a prolonged drought that depressed yields across the country.

High coffee bean prices have been floating downstream to US consumers for some time now. The average price of a cup of a coffee in a quick-service shop was $4.90 in the first six months of this year, up 7.6% from the same period last year, according to the Wall Street Journal, citing NPD Group data. The price of brewing coffee at home increased even more steeply, up 20.3% in July, according to the US Labor Department.

However, according to a recent study commissioned by Rabobank and conducted by Earnest Research, steady high inflation and escalating consumer prices has not kept people away from spending money at coffee shops and cafes over the past year. While total restaurant spending plummeted 3.1% in June YoY, purchases at coffee shops and cafes rose 1.9%.

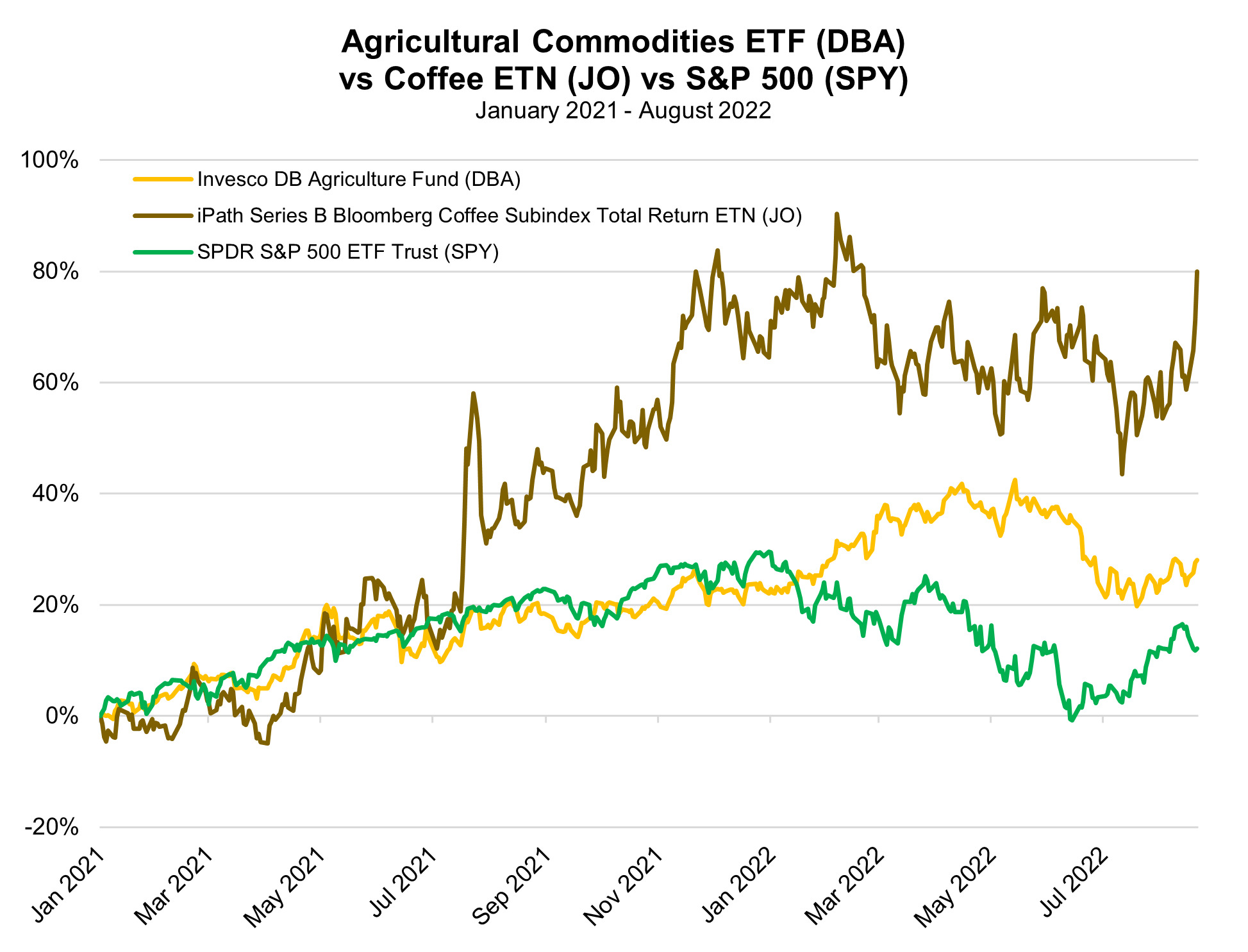

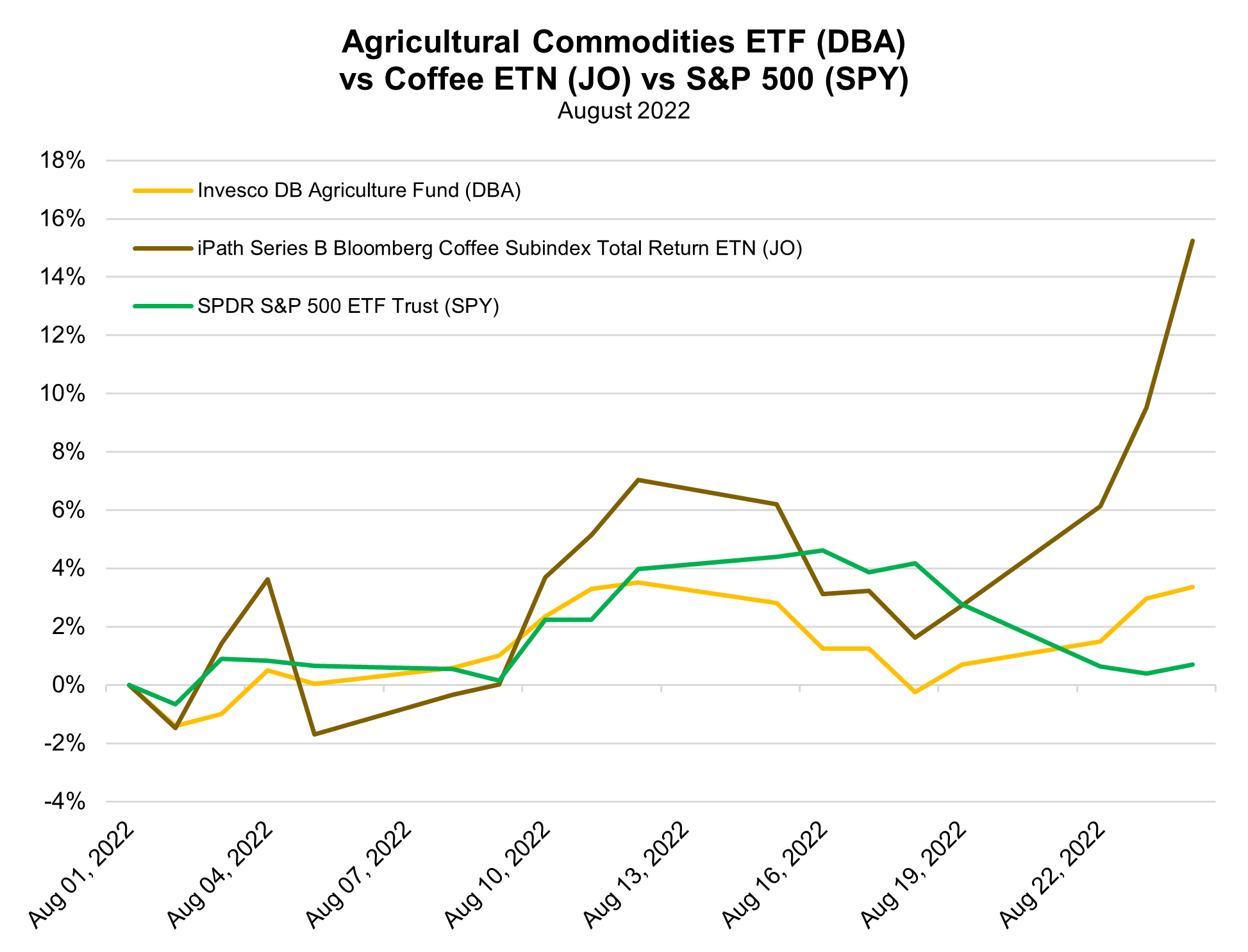

Investors can gain exposure to coffee futures via the iPath Series B Bloomberg Coffee Subindex Total Return ETN (JO). Throughout August, the JO has returned more than 15% and vastly outperformed the S&P 500 and a broader basket of agricultural commodities, represented by the Invesco DB Agriculture Fund (DBA). |

Leave a Reply