|

Back in July, it was uncovered that China had quietly advanced their semiconductor fabrication processes to include the production of 7 nanometer (nm) chips. Per The Register, Chinese semiconductor giant Semiconductor Manufacturing International Corporation (SMIC) had been producing the advanced chips since last year. Until then, most analysts thought SMIC was capable of producing only 14nm chips and that it would take them years to make newer generations of semiconductors.

As The Diplomat writes, the most significant difference between the 7nm and 14nm processes is that the number of transistors per unit area of the 7nm process increases greatly, and its energy consumption is reduced substantially. In short, 7nm chips are far more powerful than 14nm, yet also more economical, actually decreasing the cost per unit to manufacture.

Those economic advantages and mass commercialization of the chips are likely not yet being realized by China since they’re effectively locked out from acquiring the extreme ultraviolet (EUV) lithography machines typically used to produce them. Instead, China is probably using less efficient deep ultraviolet lithography (DUV) machines to complete their 7nm chips. Al-Jazeera reports China has been stocking up on ASML’s DUV lithography machines, buying up 81 machines last year alone.

TechInsights discovered China’s breakthrough after acquiring a cryptocurrency-mining ASIC manufactured by SMIC and found that it uses a quasi-7nm process. The chip was described as a “close copy” of ones utilized by Taiwan Semiconductor Manufacturing Corp (TSMC) and is likely a “stepping stone” toward SMIC’s own proprietary 7nm tech.

7nm technology is just one generation behind 5nm, used for some of the most high-end tech devices. Since late 2020, Bloomberg notes the US has barred the unlicensed sale to the Chinese firm of equipment that can be used to fabricate semiconductors of 10nm and beyond. This jump beyond that 10nm barrier has set off alarm bells for the US, which is now pushing to broaden a wave of restrictions against its own firms selling equipment to China.

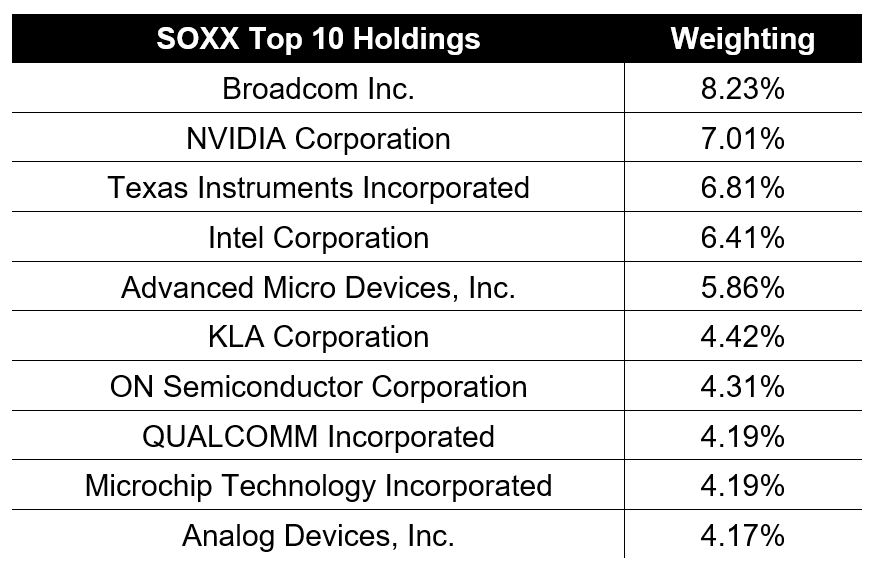

New rules to cut back on semiconductor equipment sales to China have already been communicated in letters from the US Commerce Department to three American companies – KLA, Lam Research and Applied Materials. The Biden administration is preparing to formally announce and roll them out next month.

Per Reuters, the rules would also codify restrictions on Nvidia Corp and Advanced Micro Devices, which instruct them to halt shipments of several artificial intelligence computing chips to China unless they obtain licenses. New restrictions could represent a material financial blow US semiconductor companies, considering China’s leading position among buyers of semiconductors and semiconductor manufacturing equipment.

In 2020, with sales worth $18.72 billion, the Chinese mainland became the world’s largest market for semiconductor manufacturing equipment for the first time, growing by 39% YoY, according to a report by SEMI, a US-based industry association, cited by Caixin.

As for chips themselves, China accounted for about $212 billion of the $582 billion in chips sold globally in 2021, according to IDC. Per TechCrunch, Nvidia has said the regulations on shipping its A100 and H100 chips could cause it to lose as much as $400 million of revenue this quarter. TSMC, the world’s largest contract chip maker, also stands to lose from the export control as it does a lot of manufacturing for Nvidia; in particular, the H100. South China Morning Post notes that China accounts for about a quarter of total sales at Nvidia, in gross terms.

The impact of the ban on AI chips will undoubtedly have ramifications for the pace of Chinese advancement of AI technologies, but it is hard to tell how long lasting they will be. What we do know is that Nvidia controls a 95% share of the market for chips that go into data centers used to train AI models, according to Fubon Securities Investment Services, with the remainder of the market being dominated by AMD. China has managed to leverage its massive trove of data on more than 1 billion citizens to advance their AI ambitions through institutions like Tsinghua University, China’s highest-ranked university globally. Reuters reports Tsinghua spent over $400,000 last October on two Nvidia AI supercomputers, each powered by four A100 chips. Large sums have also been spent on similar products by the Institute of Computing Technology at the Chinese Academy of Sciences (CAS), the cybersecurity college of Guangdong-based Jinan University, and others.

Despite strict rules around what kind of semiconductors Chinese firms are allowed to acquire, they have shown a resilience in being able to work around such issues. The US is likely only buying time with new restrictions on trade with China, but that time should allow America to stay ahead of the curve while it implements the recently passed CHIPS Act to spur a renaissance of domestic chip-making and development. MRP covered CHIPS in August, which includes $52 billion to subsidize US semiconductor production and an investment tax credit for chip plants estimated to be worth another $24 billion. |

Leave a Reply