|

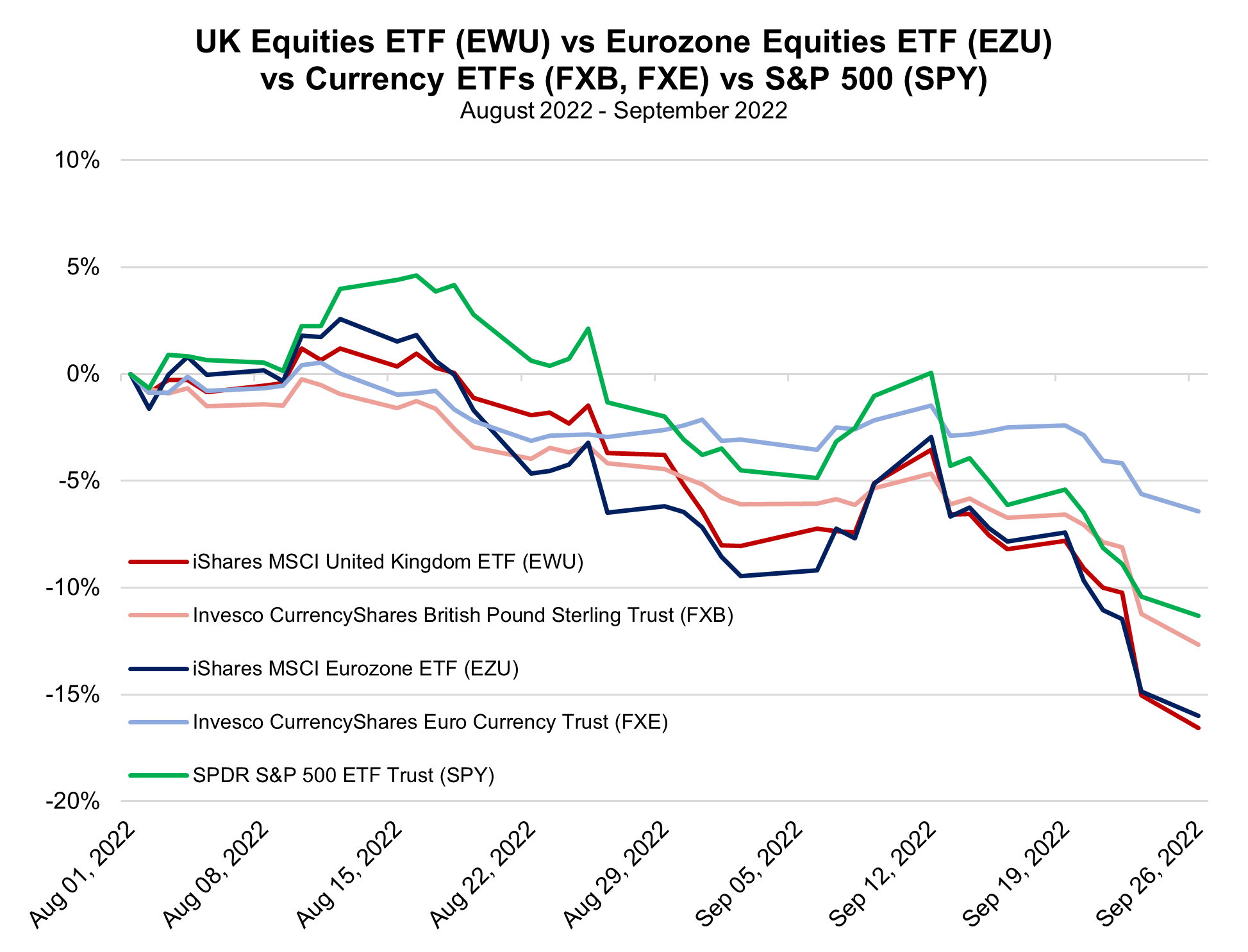

Yesterday was an absolute whirlwind for the United Kingdom as the British Pound Sterling’s (GBP) exchange rate with the Dollar (USD) fell to just $1.03, its lowest level ever recorded. Despite the Bank of England’s (BoE) latest rate hike just last week, which pushed the key base rate to a 14-year high of 2.25%, sentiment is souring on the kingdom’s economy. Inflation appears totally out of control, projected to hit 11.0% in coming months, and the central bank’s forecasting of a potential recession in the current quarter certainly didn’t help matters.

The GBP is far from the only currency languishing against a surging USD, but the pace of the collapse has been unlike anything in recent memory and is uncharacteristic of a developed nation. Underscoring just how significant this moment is, Reuters notes GBP options volatility has surged to its highest since the fallout from the Brexit referendum in mid-2016. Per Bloomberg, Sterling-Dollar implied volatility suggested a 60% probability that spot price will hit parity (1.00) before the end of this year, based on spot trading at 1.0552, nearly double a 32% probability on Friday.

A weak GBP is especially worrying right now as a significant amount of the inflationary pressure the kingdom faces is spawning from energy imports. S&P Global reports that the UK relies on imported natural gas to meet around half of its demand, a form of energy that is harder to come by with the UK ruling out the import of Russian energy supplies. That cutting out of Russian imports means the UK has had to lean more heavily on the US and Qatar, now its top two sources of foreign gas.

Since commodities are typically paid for in USD, a rallying Dollar and falling Sterling will mean UK importers will have to pay more GBP for the same amount of gas, oil, or other material priced in USD. Clearly, this carries the potential to bolster inflation significantly if energy prices continue to spike through the winter. Additionally, while countries in Europe have been racing to stockpile natural gas as they try to reduce their reliance on Russia, CNN notes the UK lacks the large storage capacity of other nations on the continent, leaving it even more exposed to prevailing market prices.

A cap on energy prices charged to households and businesses by utilities providers is expected to dampen the inflationary pressures felt throughout the UK economy once it kicks in on October 1, but this can only contain energy costs so much since the transportation and manufacture of goods – particularly imports – requires the use of expensive energy that will be baked into the final price consumers pay.

The BoE tried to dig GBP out of the ditch with the release of an unexpected statement addressing ongoing market turmoil yesterday, noting that it is monitoring financial market developments “very closely” and will raise interest rates as necessary to return inflation to the two percent target. Unsurprisingly, that failed to inspire a meaningful rally in Sterling, and another wave of volatility ensued. Markets were apparently hoping to get an emergency rate hike, but were largely disappointed.

In the aftermath of more up and down trading throughout the evening and into the night, the GBP/USD pair ultimately reclaimed the $1.08 threshold, back to where it was over the weekend, but still down 7.7% from one month ago.

Beyond creating uncertainty, inflation is meaningful for FX markets because it directly impacts inflation-adjusted, or “real”, interest rates. However enticing a short-term yield may be, it doesn’t buy much if the purchasing power of the currency diminishes by more than the interest earned; or it can buy even more if purchasing power improves. With the UK’s particularly high levels of inflation, their real rates are deeply negative and, if rising inflation continues beating the pace of increases in interest rates, they’re going to continue falling even further below water. In the US, by contrast, it looks like inflation may have already peaked and is gradually headed lower – for now. That imbalance is one of the key factors weighing on the GBP/USD pair and a significant improvement is unlikely until UK inflation reaches its own peak.

Plummeting bond prices compounded the decline in the UK’s currency, as yields on UK debt spiked significantly on Monday. The Wall Street Journal notes that medium-term borrowing costs in Britain jumped past Italy and Greece’s, typically nations with some of the highest yields in Europe. The yield on the UK’s benchmark five-year bond rose above 4.5%, according to Tradeweb data, up from less than 1.0% at the start of the year.

These economic issues are quickly bleeding into the political realm, which could be a vector of even more uncertainty as a newly formed government is now struggling to gain favor and legitimacy.

To cope with the prospect of recession, a wave of income tax cuts and the suspension of an expected increase in the corporate tax has been proposed by Conservative Prime Minister Liz Truss and her cabinet. The slashing of the top income tax rate from 45% to 40%, cancellation of a planned rise in corporation tax to 25% (keeping it at 19%, the lowest rate in the G-20), and significant cuts to stamp duties paid on home purchases, were among the most aggressive measures in Truss’s plan, which is expected to cost £45 billion by 2026-27.

The backlash to this plan has been significant and some even blame the latest plunge in GBP on it. Indeed, it would seem a bit counterintuitive to fight inflation while also cutting taxes and effectively financing it with even more government borrowing, but the ongoing stagflationary environment has put Truss’s government between a rock and hard place, having to balance a fight against recession and inflation simultaneously. Sympathy was hard to come by, however, as members of the Prime Minister’s own party submitted letters of no confidence to the Conservative Private Members’ Committee. Truss is just three weeks into her tenure as Prime Minister.

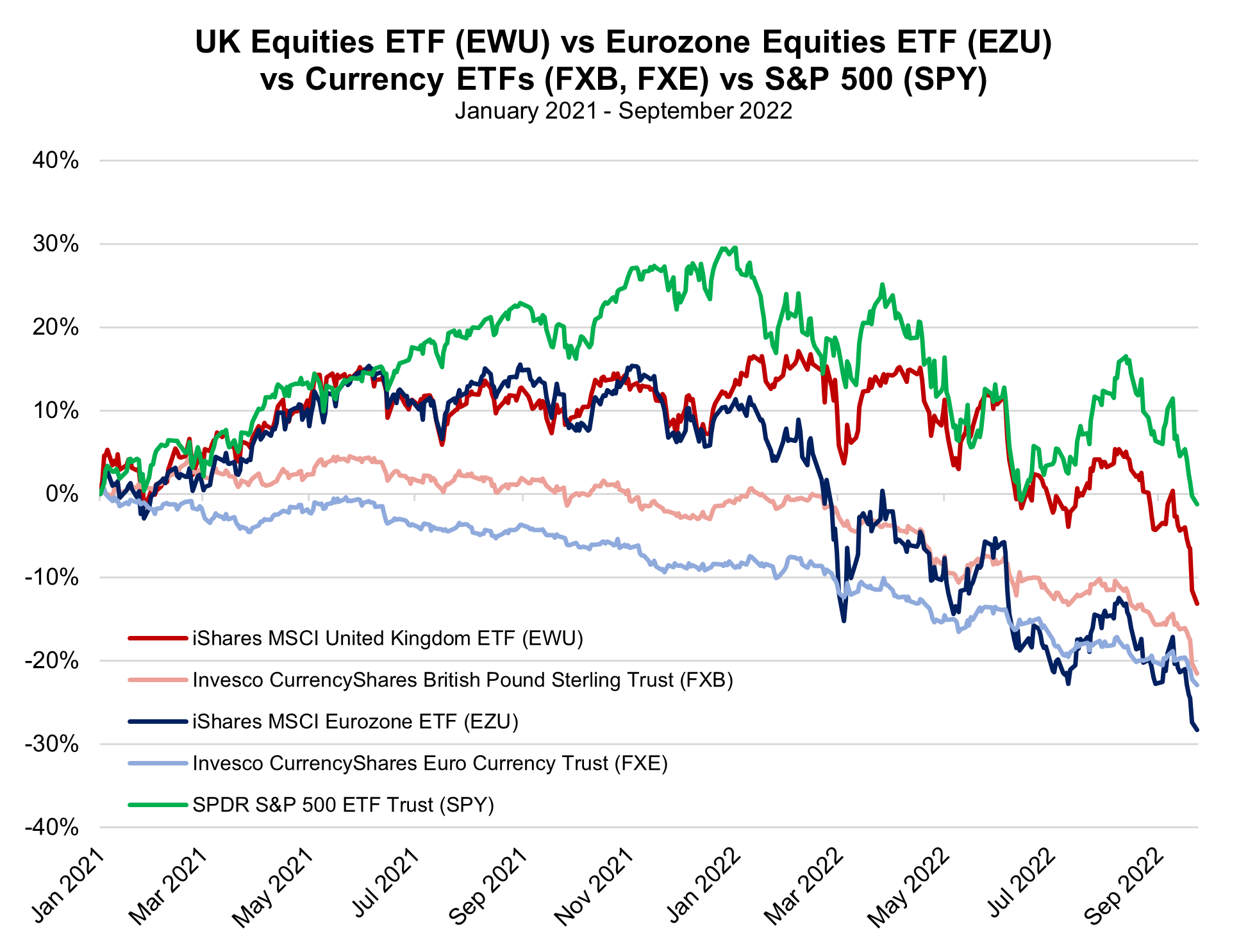

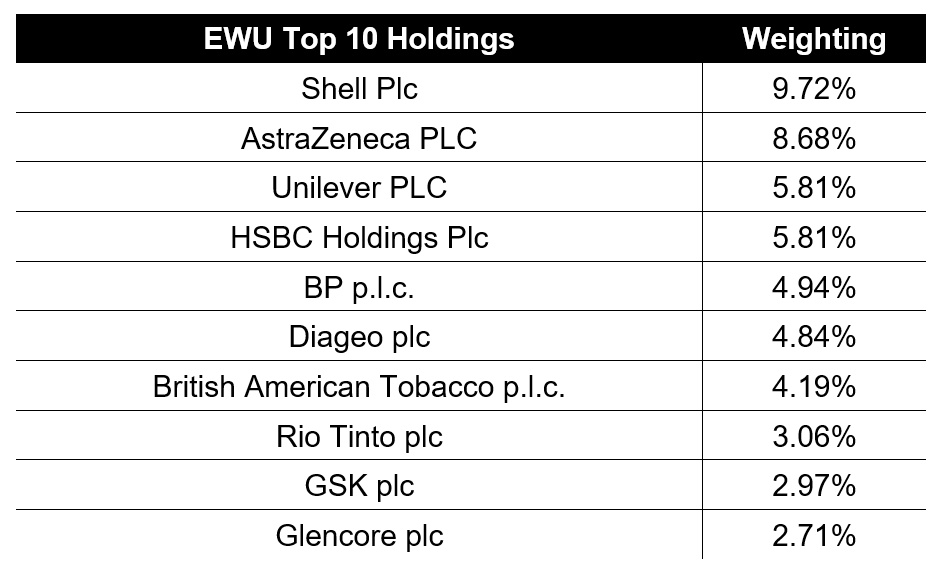

The building crisis in the UK may be a sign of what’s to come for the rest of the European continent as the cold of winter closes in and economic outlooks become more pessimistic. Investors can gain exposure to UK equities and GBP via the iShares MSCI United Kingdom ETF (EWU) and the Invesco CurrencyShares British Pound Sterling Trust (FXB), respectively. |

Leave a Reply