|

SpaceX made headlines this week, launching its aviation specific Starlink satellite internet service for private aircraft. CNBC reports that the company will charge $150,000 for the hardware needed to connect a jet to Starlink, with monthly service costs ranging between $12,500 – $25,000 per month. Starlink’s on-board internet access promises to deliver unlimited data at speeds of up to 350 megabits per second (Mbps), much faster than similar satellite options that only offer speeds of up to 100 Mbps. Deliveries are scheduled to start in mid-2023, according to a SpaceX statement.

Per Teslarati, more than two-thirds the 4408 Starlink satellites required to complete its constellation are already in orbit and working as expected. Of those 3131 working satellites in orbit, approximately 2700 are at their operational altitudes and theoretically capable of serving customers on Earth.

SpaceX is currently racing to compete with satellite internet mainstays like OneWeb, which just announced an agreement with in-flight broadband giant Panasonic Avionics, who offers service to some 70 airlines, to market and sell the company’s broadband service to airlines by mid-2023. Per SpaceNews, OneWeb said its network has achieved speeds up to 260 mbps, but that trails Starlink significantly. Combined, Panasonic and rival Intelsat currently represent more than 75% of the long-haul in-flight connectivity market.

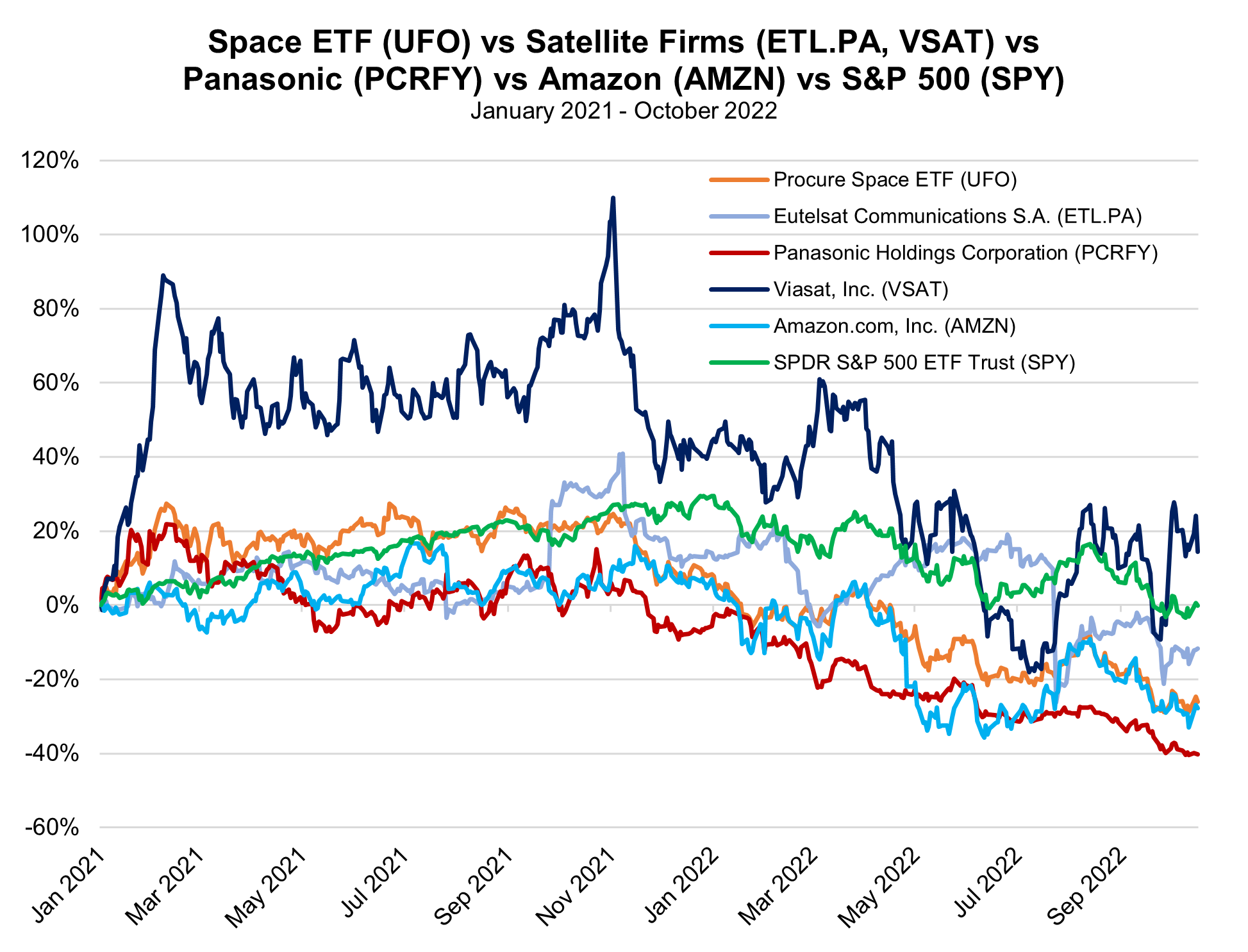

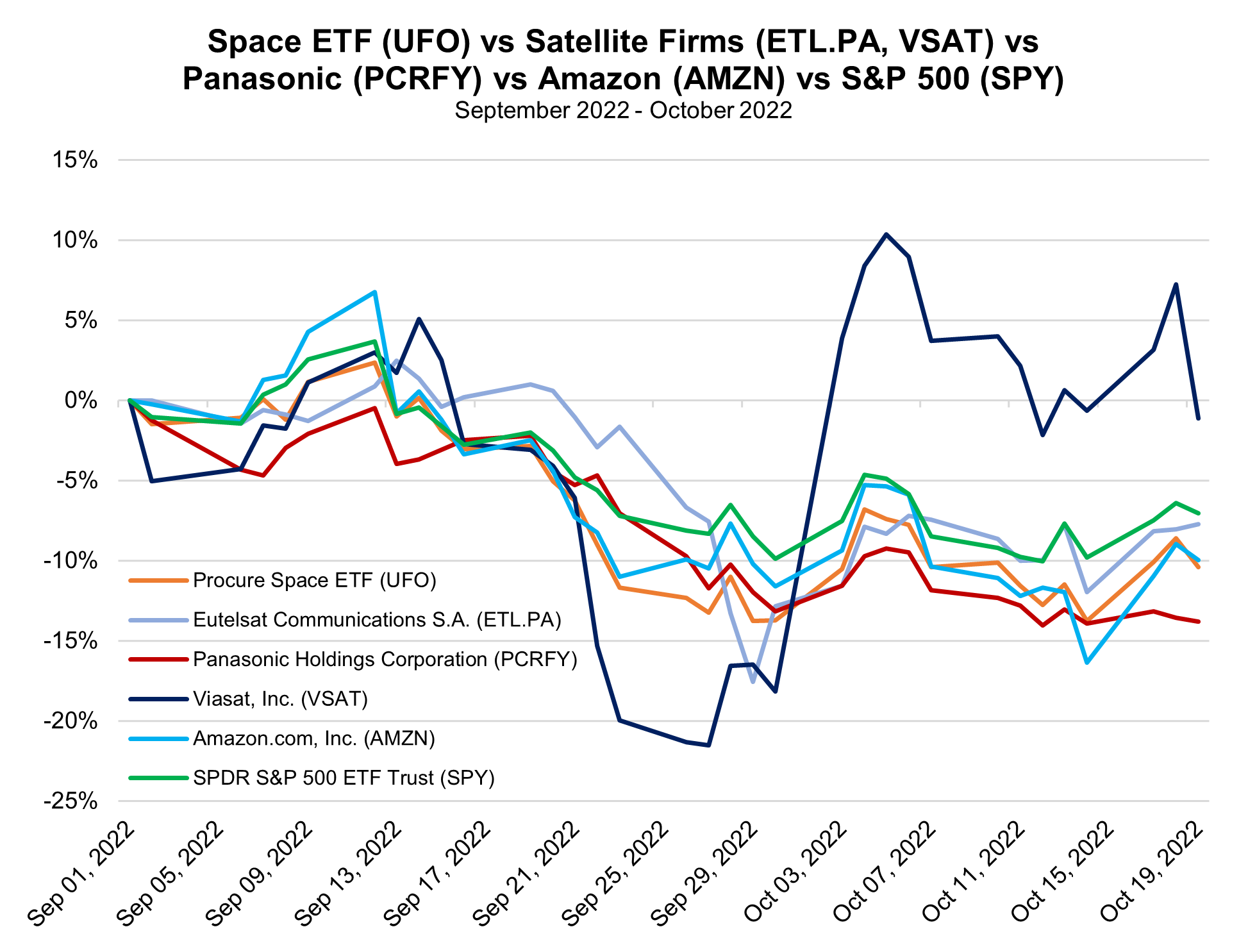

With the satellite internet industry beginning to mature, it is currently undergoing a broad consolidation.

OneWeb agreed to be fully acquired by France’s Eutelsat Communications in July, the world’s third-biggest satellite operator by revenue, which had previously maintained a 24% stake in the company. Eutelsat said earlier this month that its planned tie-up with OneWeb is expected to lift annual sales to €2 billion in 2027, from €1.2 billion in 2023. Eutelsat is currently listed in Paris, but plans to pursue an additional listing on the London Stock Exchange soon. This merger is still subject to review by UK regulators on the grounds of national security. That deal followed ViaSat’s 2021 purchase of British rival Inmarsat in a transaction worth $7.3, which is still being probed by the UK’s Competition and Markets Authority (CMA).

Going forward, Starlink will also face competition from Amazon’s Project Kuiper internet network, which will launch two test satellites (Kuipersat-1 and Kuipersat-2) in early 2023. Those tests will form the base of Amazon’s planned constellation, set to be made up of 3,236 satellites. Per The Verge, half of those need to be launched by 2026 for the company to maintain its Federal Communications Commission (FCC) license.

The initial Kuiper launches and 38 additional missions will be handled by the Vulcan Centaur rocket from the United Launch Alliance (ULA), but up to 27 future launches will be facilitated by Blue Origin’s New Glenn rocket. Blue Origin is headed by Amazon’s Executive Chairman and former CEO Jeff Bezos. Competition between Kuiper and Starlink is especially intriguing as it will be the latest manifestation of a long-standing rivalry between Bezos and SpaceX CEO Elon Musk.

In addition to providing commercial internet services, Amazon will likely use its Kuiper network to pursue defense contracts. SpaceNews reports that Amazon’s Project Kuiper is in discussions with the US Department of Defense (DoD) about the possibility of installing laser communications terminals on some of the company’s internet satellites so they can transfer data from remote-sensing satellites directly into the military’s mesh network in low Earth orbit.

MRP has previously highlighted the major role private satellite networks will play in the military going forward. In particular, satellite imagery provided by firms like Maxar Technologies Inc., BlackSky Technology Inc., and Planet Labs PBC have been critical in providing America and its allies with critical data from the frontlines in Ukraine since last February when Russia invaded the country. In May, the US National Reconnaissance Office (NRO) announced they’d be funding each of those firms with billions of dollars in defense contracts throughout the next decade as part of its Electro-Optical Commercial Layer (EOCL) program.

Commercial satellite networks can bolster the military’s efficiency by serving as “translators”, supporting high-speed data transfer, for example, from imaging satellites to military users on the ground.

Starlink has been supporting Ukrainian military communications on the battlefield since April, with SpaceX delivering up to 25,000 terminals that utilize the satellite network. Musk claims his company has received no government funding and has spent over $80 million to provide these services at no cost, but Politico reports that SpaceX could soon begin to receive compensation from the Pentagon’s Ukraine Security Assistance Initiative. |

Leave a Reply