|

Gold touched a six-month high yesterday and has continued its rally into this morning, now trading close to $1,855/oz. That is a significant reversal from the seven-month losing streak gold experienced between last April and October, the longest since 1869 according to Deutsche Bank, which drove the metal’s spot price toward multi-year lows under $1,650/oz amid relentless tightening of monetary policy at the US Federal Reserve and other central banks around the world.

However, as MRP had noted for several months going back to August, the Fed had already reached a period of what we termed “Peak Hawkishness”. Although the Fed will continue to raise interest rates for an indefinite period going forward, we noted the size and frequency of rate hikes had reached a peak and the central bank would soon begin to pull back on one or both of those variables. Our expectation that Peak Hawkishness had already been reached was largely solidified last month when the FOMC chose to hike its benchmark fed funds rate by just 50bps, as opposed to the 75bps the committee had voted for in four consecutive meetings prior to December’s.

Minutes from that meeting will be released this afternoon and could provide more fuel to the fire that has been lit under gold. Though the central bank raised its inflation target for 2023, the median projection among policymakers for rates at the end of this year was 5.1%, 60bps from the fed funds rate’s current upper limit of 4.5%. That suggests just two more rate hikes would be sufficient to reach the bank’s projected policy path for the year. Gold’s reaction to today’s release will largely depend on language, however, and whether it has sufficiently moderated.

If Fed Chair Jerome Powell’s own remarks are any indicator of the temperature among policymakers, early signs of a dovish shift may be taking place. While speaking to an audience at the Brookings Institution last month, Powell stated that “Monetary policy affects the economy and inflation with uncertain lags, and the full effects of our rapid tightening so far are yet to be felt. Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down.”

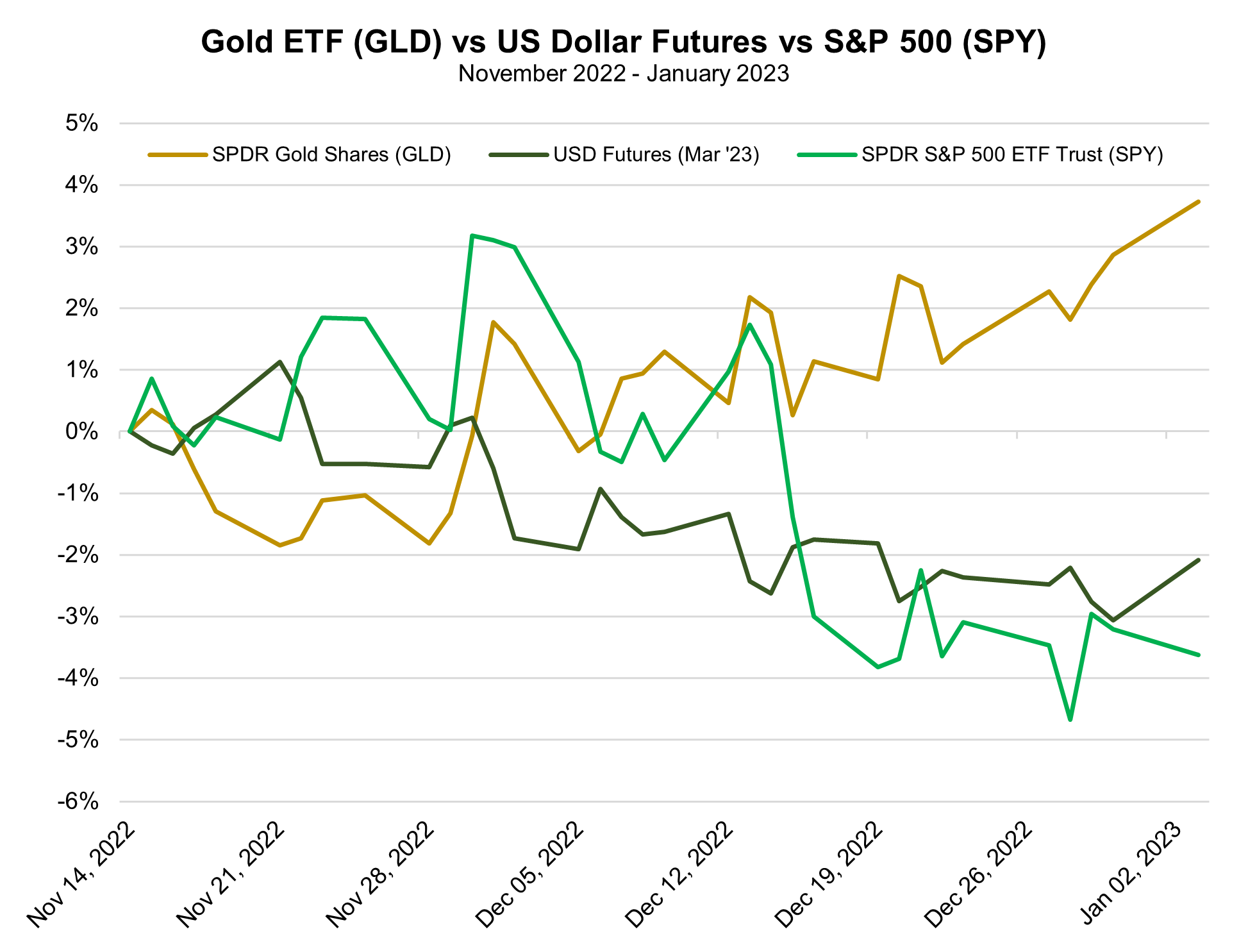

Those comments spurred equities and gold higher, but also depressed the US Dollar, which often trades inversely to gold. The Dollar Index (DXY) has languished throughout most of the past month, continuing a downtrend which took hold in early November. As of this morning the DXY was worth about 104.1, down -8.8% from its 2022 high of 114.1.

Positive news for gold, as well as some burgeoning headwinds for USD, can be found internationally as well.

At the end of last month, Russia’s Finance Ministry doubled the amount of gold it can hold in the national wealth fund (NWF), raising the metal’s potential share of the fund to 40%. The NWF holds Russia’s oil revenues and is worth $186.5 billion, according to Kitco. As we noted last June, the Central Bank of Russia (CBR) resumed purchases of gold from miners in their domestic market, following a two year hiatus, at a fixed price of ₽5,000 per gram (₽141,748 or $2,268 per oz at the time) between March and June of 2022. Following the Ruble’s rapid appreciation, touching a seven year high versus the US Dollar (USD) in June, Russia said they would renegotiate that price. Per Bloomberg, the CBR spent six years continually accumulating a significant gold horde, doubling its holdings and becoming the biggest sovereign buyer throughout the latter part of the 2010s. The CBR held about 2301 tons of gold at the end of 2021, representing the fifth-highest level of reserves worldwide.

This increase in the limit of potential gold holdings in the nation’s wealth fund could signal another round of buying is on tap. Interestingly, Russia also doubled the amount of Chinese Yuan it could hold in the fund as well and. This indicates that their play for gold likely coincides with a broader de-Dollarization strategy that has been developing for several years. Russia is not alone in this venture.

Though the Dollar is the world’s reserve currency, cracks are beginning to appear in the USD’s dominance of global trade. Per Bloomberg, China celebrated a record-high 49.1% share of cross-border payments and receipts transacted in yuan in the first half of 2022. Moreover, Southeast Asian debt issuers, which have long-favored the utilization of Dollar-denominated bonds, sold local-currency debt at a record pace through the first three quarters of 2022. If weaker Demand for the Dollar ends up hurting its exchange rate, relative to other currencies, that could signal even greater strength for gold ahead. |

Leave a Reply