|

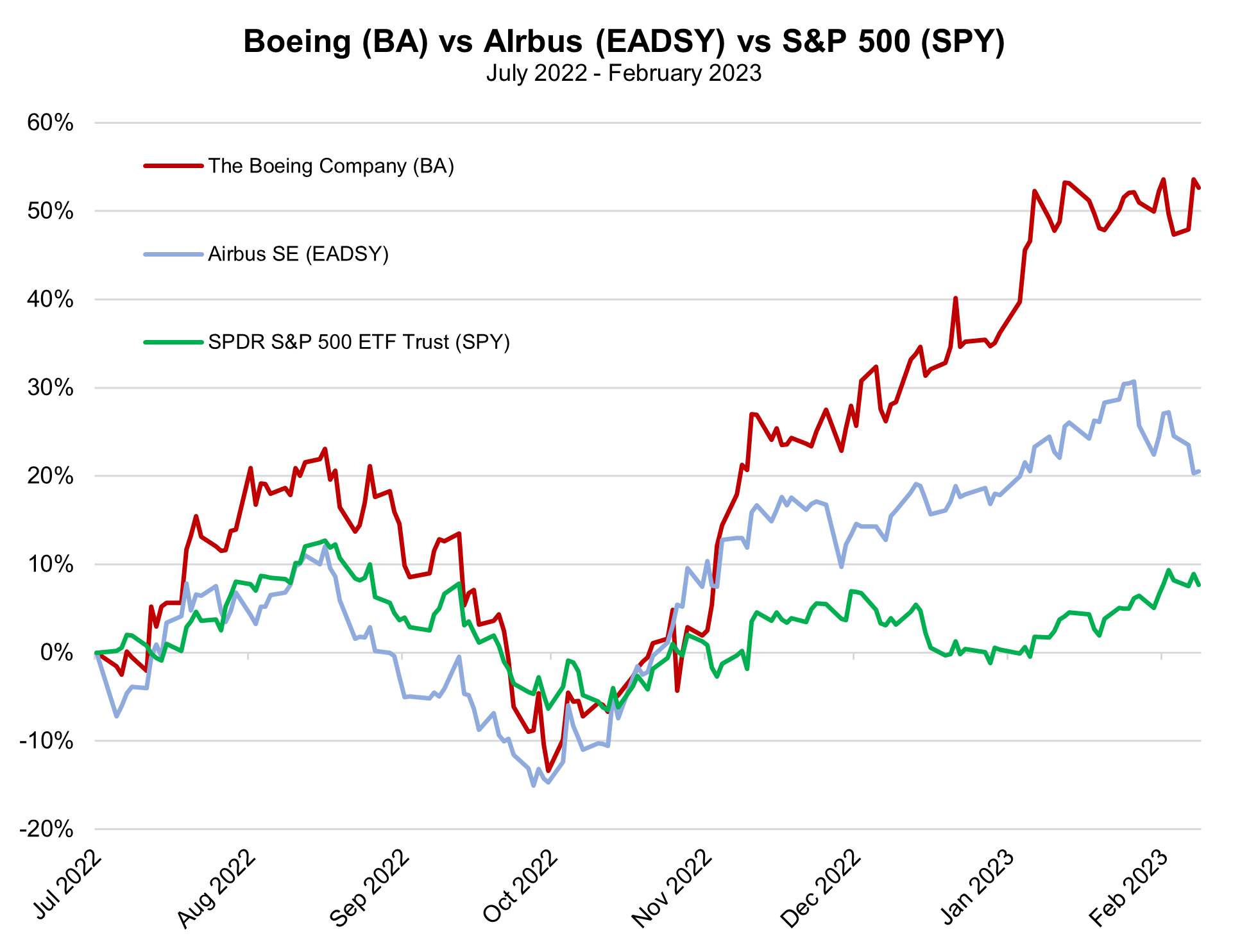

The world’s two dominant jet manufacturers, Boeing Co. and Airbus SE, experienced a wave of rising orders throughout the back half of 2022 and into the new year. That has pushed shares of each company toward outperformance throughout the past six months. Boeing has risen even more steeply than its competitor in that period, despite persistent controversy and continually trailing Airbus’s orders and deliveries.

Throughout all of last year, Boeing delivered 480 airplanes and won 774 net new orders after allowing for cancellations in 2022, posting their best year for sales since 2018. Still, Europe’s Airbus again bested its American counterpart in both of those measures for the fourth year straight, delivering 661 commercial aircraft in 2022 and registering 820 net new orders. Airbus also reported a larger backlog than Boeing, with a supply of 7,239 unfilled orders to work through. Boeing’s backlog at the end of 2022 was just 5,430 aircraft. Per Defense & Security Monitor, both companies’ book to bill ratios improved from 2021 to 2022, as Boeing’s rose from 1.41 to 1.61 and Airbus’s from 0.81 to 1.24. The book to bill ratio measures the amount of orders coming in versus deliveries (orders received/orders shipped) and any result above one typically represents resilient demand.

What’s interesting about Boeing’s orders book, however, is that 4,312 jets (79% of the backlog) were 737 NG/MAX narrowbody jets. This is notable because virtually all of the company’s underperformance throughout the past several years can be chalked up to issues they’ve had with the design and manufacturing of the MAX model, compounded by negligence and lacking oversight by executives. For several years, MRP has covered the fallout from two disastrous 2019 crashes of Boeing 737 MAX jets within a 5-month span, culminating in the death of all 346 passengers and airline crew on board each flight. We were quick to recognize the severity of this situation, despite Boeing’s attempts to downplay their planes’ issues.

At the outset of a global grounding of all 737 MAX jets, Boeing led investors and airlines to believe that a fix of the faulty MCAS software present in the jet, along with re-certification would come as soon as mid-May 2019. When no progress on re-certification was present by that June, MRP expressed skepticism about the simplicity of the repairs that would be needed, noting that, in addition to software problems, almost 150 parts inside the wings of 312 Boeing 737 jets were potentially defective and had to be replaced. On June 4, 2019, we initiated SHORT Aviation and Airlines themes (closed on January 8, 2020 and March 30, 2020, respectively), largely focused on Boeing and the fallout that would be felt by suppliers and commercial airline operators. Total direct costs to Boeing as a result of the MAX disasters are equivalent to more than $20 billion. To this day, the aviation manufacturer’s share price remains more than -35% below its price at the start of June 2019.

Though Boeing was able to escape SEC scrutiny by paying a $200 million fine to settle civil charges claiming that it misled investors, Boeing is yet to escape the legal quagmire they’ve fallen into. As we noted in October of last year, after US District Court Judge Reed O’Connor in Fort Worth, Texas, legitimized claims from crash victims’ families that a 2021 deferred prosecution agreement allowing Boeing and its executives to avoid any criminal conviction was not satisfactory. The judgement stipulates that Boeing would acknowledge responsibility for their acts and make appropriate payment to victims’ families, but a number of those families claim they were not consulted about this decision.

Judge O’Connor said in his October ruling that the lies Boeing told the Federal Aviation Administration (FAA) helped the company avoid additional pilot training that otherwise would have been required, and may have saved lives, if Boeing employees had not been untruthful in their dealings with regulators. “In sum, but for Boeing’s criminal conspiracy to defraud the FAA, 346 people would not have lost their lives in the crashes,” the judge wrote. At the end of January, Boeing officials were arraigned in a federal courtroom in Fort Worth, pleading not guilty to conspiracy to defraud the US government. Those proceedings remain ongoing.

Despite all of that, it seems as though many buyers of Boeing jets have managed to overcome any hesitation they might have regarding the 737 MAX, particularly in China, the first country of all to ground the MAX jet. Over the last month, China Southern Airlines and Hainan Airlines became the first Chinese airlines to re-activate flights involving the 737 MAX. Simple Flying reports Six airlines, including China Southern, Fuzhou Airlines, Hainan Airlines, Kunming Airlines, Shandong Airlines, and Shenzhen Airlines, have declared that they plan to operate Boeing’s 737 MAX sometime in 2023. MRP previously noted that Airbus managed to usurp some of Boeing’s business in the largest Asian economy, but Boeing now appears to be ramping up their dealing with eastern airlines, securing a 15-unit order for 737 MAX jets from Hong Kong’s Greater Bay Airlines Co. just yesterday.

The winds certainly turned in favor of the aviation business as air travel made a triumphant return toward the end of 2022, but it remains to be seen how durable that demand will remain. Per CNN, Boeing has announced plans to cut about 2,000 white-collar jobs in finance and human resources, but the company claims those firings are to make room for 10,000 employees focused on engineering and manufacturing. Airbus, for its part, has disclosed plans to hire 13,000 new employees in 2023.

|

Leave a Reply