|

Though wheat futures have continued to trend lower in recent weeks, one of the most critical agreements maintaining the fluidity of the global grain trade is at risk of being severed. That agreement is the Black Sea Grain Initiative, a quadrilateral deal between Russia, Ukraine, Turkey, and the UN to assure agricultural commodities can safely transit through the Black Sea and through Turkey’s Bosphorus Strait, the gateway between the Black Sea and the Mediterranean Sea. There, observers from all parties have a chance to inspect the cargoes before any ship can pass. Unloading of cargo in Ukraine is monitored by a joint coordination center in Istanbul. Russia and Ukraine are among the world’s largest exporters of grain.

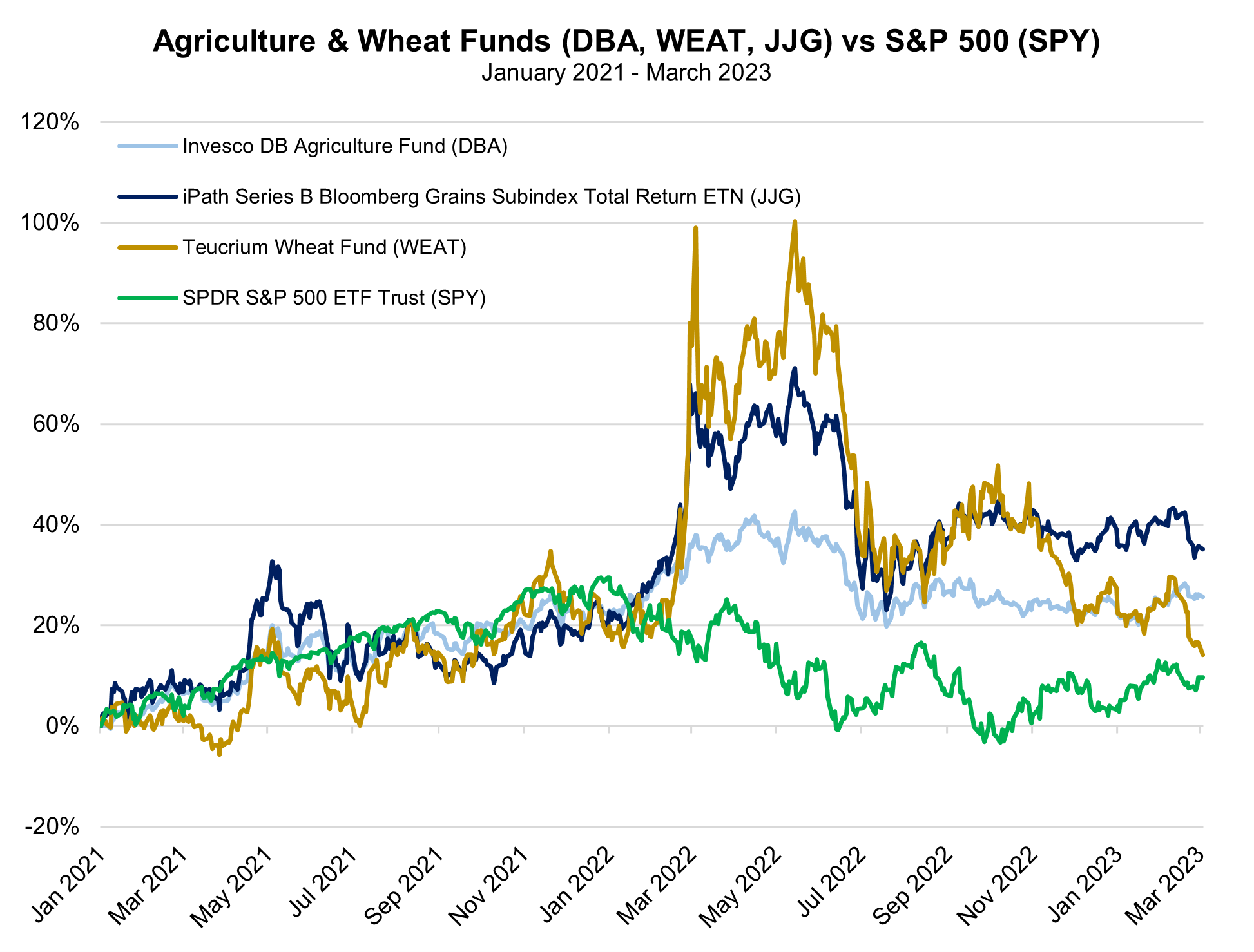

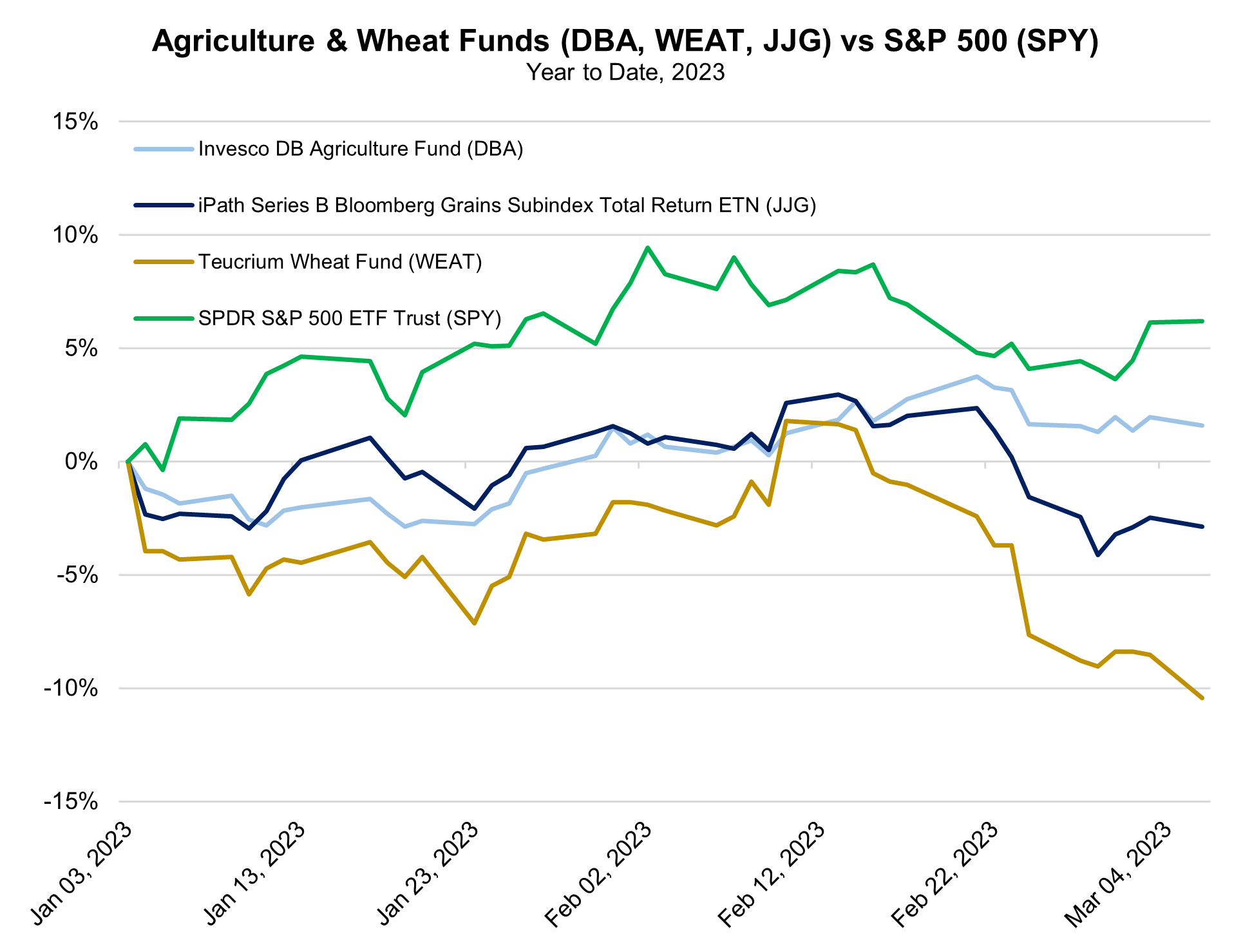

Per figures available at the end of February, the transit of 765 ships carrying over 22 million tons of grain, largely corn and wheat, has been facilitated by the Initiative, easing a significant backup of grain supplies in both Russia and Ukraine, as well as skyrocketing prices that shot up to record highs near $12.80 per bushel last May. That was right before negotiations on the current initiative began and, since then, wheat futures have essentially halved, falling to 19-month lows near $6.80 in recent days. That is now well-below the spot price for wheat at the start of Russia’s invasion of Ukraine on February 24, 2022.

The Black Sea grain Initiative was implemented on July 22, 2022 for a period of 120 days and renewed for an identical period on November 18. That means there are just 10 days until the current iteration of the deal expires on March 17. With no extension of the agreement, Russia could utilize their navy to re-initiate a blockade of key Ukrainian ports in Odessa, Chornomorsk, and Yuzhne.

Futures contracts indicate traders seem very confident that no disruption will envelop the key transit route through the Black Sea. However, statements from key figures involved in negotiations to extend the Black Sea Grain Initiative may not be developing very well. Just last week, Russian Foreign Minister Sergei Lavrov accused the West of “shamelessly burying” the agreement, accusing countries that have imposed sanctions on Moscow of not doing enough to ease restrictions on Russia’s own exports. Russian news agency TASS reported earlier this month that the grain deal could only be extended if the interests of Russian producers of agriculture products and fertilizers are taken into consideration. It’s not totally clear if the Russians are looking for additional concessions the be included in the grain deal, but it likely sees the success of the grain deal as significant leverage in negotiations for more leniency in other industries, where the country faces international restrictions on trade, banking, logistics, and insurance.

US Secretary of State Anthony Blinken is unlikely to be directly involved in negotiations, but is very likely privy to what is being said behind closed doors by participating parties. Speaking to a Group of 20 meeting, Blinken noted that it is “imperative the G20 speak up on behalf of extending and expanding the grain initiative”. In addition, Blinken stated, “Russia has deliberately and systematically slowed its pace of inspections, creating a backlog of ships that could be delivering food to the world today.”

MRP highlighted the subject of Blinken’s recent allegations back in January, as we noted that inspections of ships departing Ukraine by Russian authorities had been slowing gradually for some time. In September, inspections were running at a pace of 10.4 per day, then a peak rate of 10.6 in October. Since then, however, it’s been all downhill, with the pace of inspections experiencing successive declines to 7.3 ships per day in November, 6.5 in December and 5.3 toward the end of January. A backlog of more than 100 vessels were idling in the waters off Turkey when we published that Intelligence Briefing, but that figure had risen to 140 by mid-February, according to the Ukrainian Grain Association. If Russia is truly slowing inspections intentionally, it wouldn’t be the first time they’ve actively disrupted cooperation between the parties involved. Russia went so far as totally suspending their involvement in the deal at one point in October last year, but that protestation only lasted several days before it ultimately rejoined.

If Russia wants to hold onto the grain deal as a bargaining chip in its back pocket, Lavrov’s protestations may represent tough talk from figureheads who will ultimately agree to a last-minute renewal of the agreement. Moreover, it is becoming more difficult for Russia to fund their war effort now prices of oil and gas, Russia’s most lucrative exports, have fallen from their 2022 highs. Warfare costs money and Russia relies heavily on its export economy to fund its fiscal expenditures. S&P Global Commodity Insights estimates Russia’s fiscal breakeven oil price (the average price it needs to sell oil at to balance their annual budget) at roughly $114.00 per barrel in 2023, up from just $64.47 per barrel prior to the February 24 invasion.

With international benchmark Brent Crude trading below $86.00 on Tuesday morning, the gap between the market price of oil and Russia’s breakeven mark is unlikely to be closed anytime soon, making other sources of secure revenue even more critical than they were at prior stages of the war. Per Bloomberg, its seaborne wheat shipments in January and February totaled 6.1 million tons, about 90% more than the year-earlier period, according to ship lineups from Logistic OS. Risking a severing of this lucrative revenue stream would be a difficult decision, but could hurt Russia’s geopolitical counterparts as well.

Grain prices now falling well-below their year-ago levels will likely disperse a deflationary wave over certain food prices, making it slightly easier for central banks to achieve their goals of reining in inflation. However, if wheat futures were to ramp back up, it would diminish or wipe out the deflationary impact of suppressed food prices. When central banks raise interest rates, that impacts the interest each respective government has to have to pay on sovereign debt they issue. Recent rate hikes, meant to tamp down on rising price pressures, meant the US Treasury Department had to contribute a record $213 billion in interest payments on the national debt in the last quarter of 2022. CBO estimates show the US will pay a total of $640 billion toward interest expenditures in 2023, which will rise to $739 billion in 2024.

Additionally, not all wheat is created equal, particularly when accounting for cost. Ukrainian wheat, for example, is known as a very cheap grain to produce, meaning that, even if you managed to replace all Ukrainian supply with wheat from other regions, prices would still have to move higher than they were before Ukraine’s product was blocked from the market, since greater costs were incurred to farm those grains. For grain prices to remain relatively cheap, the world needs Ukraine and Russia to be able to transport grain safely into the Mediterranean. The fate of the Black Sea Grain Initiative will likely play a significant role in determining the trajectory of wheat prices for months to come.

MRP recently joined Interactive Brokers on IBKR Podcasts to discuss the Black Sea Grain Deal and more recent trends in wheat markets. That podcast (as well as a transcript) can be streamed or downloaded for free here. |

Leave a Reply