|

South American crop production is growing and could herald a marked change in the arrangement of corn markets this year, with Brazil potentially taking the top spot among exporters. DTN notes that the US Department of Agriculture (USDA) expects Brazil to achieve a second consecutive year of record corn shipments in 2023, shipping 50 million metric tons (mmt) of corn to destinations around the world, a sevenfold rise across the past 15 years. By contrast, the US is expected to ship 47 mmt of corn for the 2022-23 marketing year. Brazil’s recent growth has been facilitated by a 2022 trade deal with China. Analysts expect 6 mmt to 10 mmt of the Brazilian corn crop could go to China exclusively, serving as the primary catalyst for Brazil overtaking the US as the world’s largest corn exporter.

Throughout the past 20 years, the University of Illinois notes that corn acreage in Brazil has risen 72%, versus a 12% increase in the US. Even if Brazil doesn’t manage to surpass US export capacity for corn this year, the USDA’s Economic Research Service says Brazil has another 49 million acres of land it can use to expand crop production by 2031, which will help the South America’s largest economy surge past the US in corn shipments at some point in that time period.

If Brazil undershoots expectations this year, however, that could be a bullish prospect for corn prices. Brazilian corn exports slowed to 1.335 mmt in March, down -41.4% from the prior month, as exporters shifted their focus to soybeans. Particularly warm and dry weather crept in for a large portion of Brazil’s growing regions in March, which may not have been ideal for healthy corn crops already in the ground, but it did help farmers finish up delayed plantings of the country’s “second corn crop”, known as safrinha. Safrinha is sowed in fields where soybeans have already been harvested, which significantly boosts the annual yield, but can be particularly exposed to frost and the potential for other bad weather if it is planted outside of the ideal window. Brazil plants corn all year round, but Reuters notes that the safrinha crop represents 70% to 75% of national production in a given year.

Some have speculated that this year’s late planting may be less of a concern with the long-awaited departure of La Niña. After three consecutive years of an unusually stubborn pattern, the National Oceanic and Atmospheric Administration (NOAA) declared that the climate phenomenon La Niña had officially ended early last month. That is expected to conclude a prolonged period of droughts that La Niña is typically associated with and its opposing phenomenon, El Niño, is now on the way. The latter weather pattern is typically associated with more rain and favorable harvests in Brazil’s grain producing regions. Research cited in Nature suggest that significant positive impacts of El Niño on crop yields are found in up to 30–36% of harvested areas worldwide, including maize in Brazil and Argentina.

Though La Niña has ended, it takes time for the atmosphere some to respond to new conditions, likely a good six weeks, according to DTN. A return to “Normal” weather and the start of a shift to El Niño could, therefore, arrive sometime in May, but lingering effects of La Niña cannot be totally discounted. April rains will be a critical factor for Brazilian corn, as precipitation will need to be strong to make up for late safrinha planting and, therefore, a contracted rainy season.

A large harvest in Brazil will be needed to pick up for massive losses in the corn yield of neighboring Argentina – a victim of persistent global droughts, which MRP has previously highlighted throughout the past couple of years. Gro Intelligence notes that Argentina has historically been the world’s second or third-largest corn exporter after the United States, which makes their languishing crop prospects a dire prospect for food supplies. the USDA’s Foreign Agricultural Service (FAS) has stated that, “Argentina corn exports (Oct 2022 – Sep 2023) are forecast at 29.0 million tons, the lowest since 2017/18″.

Brazilian weather and harvests throughout the next month should provide investors with valuable signals for where corn and other agricultural commodity markets will be headed in the middle portion of 2023. MRP will continue to monitor these developments in our Intelligence Briefings and other research materials throughout that period.

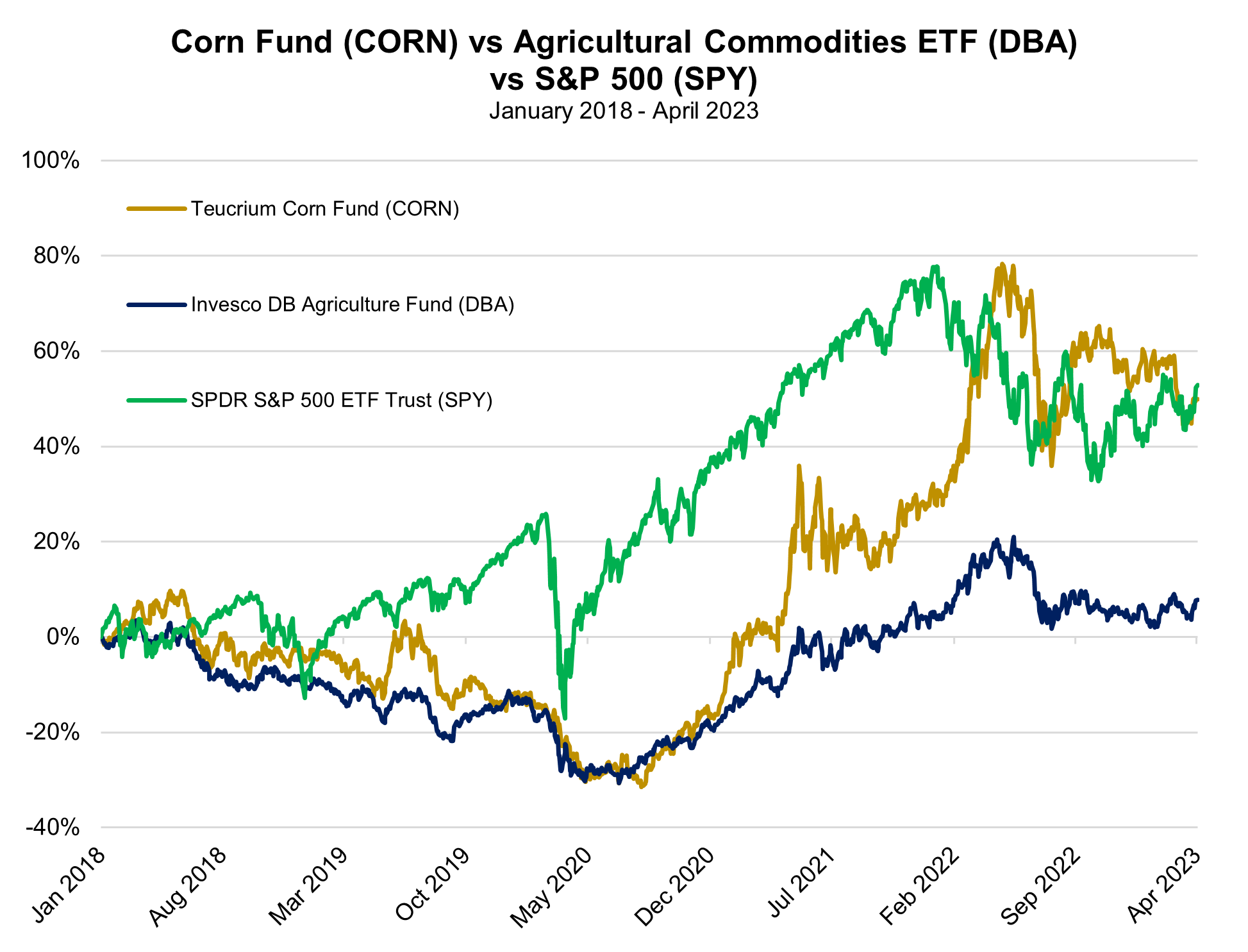

Though corn futures remain elevated far above any level experienced from 2014-2020, prices are down roughly -3.0% in the year to date. Investors can gain exposure to corn via the Teucrium Corn Fund (CORN). More diversified exposure to agricultural commodities can be found in the Invesco DB Agriculture Fund (DBA).

|

Leave a Reply