|

Headwinds facing commercial property owners appear to be strengthening. MRP noted last month that risk is generally rising in the commercial real estate space, which can be seen in the types of commercial mortgages coming to market. Per Bloomberg data, Sales of Commercial Mortgage Backed Securities (CMBS) deals without government backing have fallen more than 80% this year. The Real Deal notes that leading commercial real estate firms including CBRE, JLL, Colliers and Cushman & Wakefield, and others have moved forward with cost-cutting measures, including layoffs. More recently, Morgan Stanley analysts suggested that commercial property valuations could drop by as much as -40% while nearly $1.5 trillion in debt is due for repayment by the end of 2025. Over the next four years, debt maturities on commercial real estate properties are set to continue climbing, peaking at $550 billion in 2027.

Demand for office space is becoming particularly concerning, as average office vacancy rates across the US rose to 16.9% at the end of the first quarter, up from 12.4% two years ago. JLL data shows that New York City’s office vacancy rate had risen to a record 16.1% in the first quarter, representing more than 76 million square feet. That seems a bit counterintuitive, considering many companies have implemented return to office plans and listings for remote jobs have dwindled, but a rising wave of layoffs has helped many firms to consolidate the office space they’re occupying and cut costs. Moreover, corporate bankruptcy filings, which reached a 12-year high across the first two months of this year, have begun to hollow out the number of companies that may have demanded office space.

Prices on high-quality office properties have fallen about -25% in the past year, according to Green Street data, cited by Bloomberg. About 4.8% of office properties with CMBS were managed by special servicers in March, a third party which will work with a borrower that’s fallen behind on their mortgage payments to determine if the latter can become current on their loan. That rate is up from 3.2% a year ago, according to Trepp.

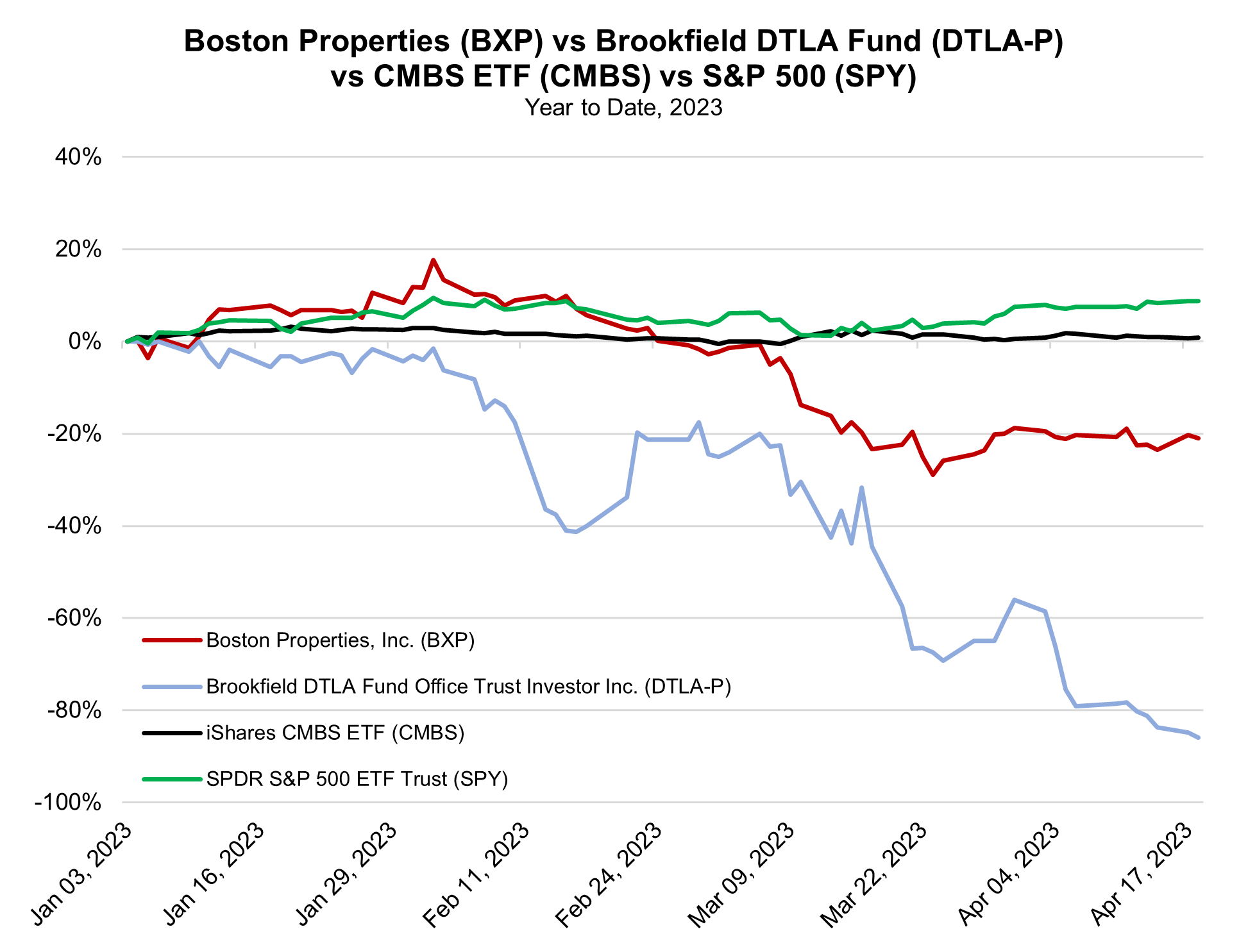

Real estate investment trusts (REITs), which directly own properties (as opposed to CMBS that are derived from a pool of loans), have also felt the sting of weakened occupancy, which has caused investors to sour on the office segment of the asset class. Per S&P Global Market Intelligence data, US equity REITs experienced a meaningful increase in average short interest throughout March, rising 36bps to 3.5% of shares outstanding. Office REITs saw the biggest gain in average short interest across all property types, posting an increase of 1.5 percentage points from the previous month to 6.2% of shares outstanding. Boston Properties, an office-focused REIT which oversees more than 12 million square feet of office space in New York, has been slammed this year as shares have tumbled -21.0% since the start of 2023.

Visible cracks appear to be expanding among some large commercial property owners’ portfolios, particularly those belonging to real estate giant Brookfield Asset Management. Yesterday, it was reported that Brookfield had defaulted on a $161.4 million mortgage backed by more than a dozen office buildings, mainly in the DC market. Among those offices, occupancy rates averaged 52% in 2022, down from 79% in 2018 when the debt was underwritten, according to a report highlighted by Globest. Meanwhile, the floating rate payments on this debt have been boosted by rising interest rates throughout much of that period, recently jumping to about $880,000 per month in April. That is a massive increase from just over $300,000 per month a year earlier.

Last month, MRP covered Columbia Property Trust Inc.’s default on more than $1.7 billion of debt backed by seven of its nineteen buildings, worth more than 40% of what Pimco paid to acquire the firm in September 2021. What’s especially interesting about the portfolio is that the occupancy rate for the buildings wasn’t especially low – gauged at 84% at the end of last year, according to the Wall Street Journal. The more severe concern is, once again, interest rates, given Pimco’s decision to take out a floating-rate mortgage on the properties in 2021, back when rates were much lower than they are today and signaling from the Fed seemed to suggest they’d remain suppressed. As we know now, that was far from the reality that would play out over the following year and a half, pushing up the portfolio’s annual debt payment costs to more than the buildings’ most recent annual cash flow at the time the loan was issued.

Back in February, two other Brookfield-owned properties in Los Angeles fell into default. Brookfield chose to default on loans for the two properties rather than refinance the debt, likely due to dismal prospects for office space demand. Those buildings are the Gas Company Tower, with $465 million in loans, and the 777 Tower, with about $290 million in debt, each part of a portfolio called the Brookfield DTLA Fund Office Trust Investor. The DTLA fund has been tumbling for several years now and is set to begin delisting and deregistering shares, starting with its Series A preferred stock, according to a March 31 filing to the Securities and Exchange Commission.

In just the YTD period, shares of Brookfield DTLA have fallen -85.9% to just $0.56. Bloomberg notes that Brookfield, the parent firm of the largest landlord in Los Angeles, has over $750 million in debt set to come due on LA’s Wells Fargo Centers North and South Towers in the fourth quarter. Per CoStar reporting, Brookfield DTLA has already warned investors that lenders may choose to foreclose on the 54-story North Tower.

|

Leave a Reply