|

North American lumber prices have been trending lower since March of last year, tumbling more than -75% from highs above $1,450 per 1,000 board feet to last Friday’s close below $345, a three-year low. The decline is not a regional phenomenon, but a global one. According to the American Journal of Transportation, the recently-updated Global Sawlog Price Index (GSPI), consisting of sawlog prices from 21 key regions worldwide, has now fallen for two consecutive quarters from an all-time high of $94.96 per cubic meter (m3) in Q2 2022 to $87.50/m3 in the final quarter of 2022, a -8% decline. The recent downturn in the GSPI follows a two-year period of increases.

Some have speculated that a 6.2% MoM rebound in the softwood lumber component of April’s producer price index (PPI), its first gain in nine months, could suggest that more resilient demand is tightening supplies available for American construction companies. However, Canadian Forest Industries reports typical usual spring buying of construction framing softwood lumber had yet to materialize by the end of April. Suppliers, therefore, had plenty of inventory on hand as supply continued to outpace demand. If that perspective is correct, the most recent PPI reading may have only been an outlier and a meaningful reprieve for lumber futures could still be somewhat distant. On a YoY basis, softwood prices were down -39.0%, but that was the thinnest annual decline so far in 2023.

It’s likely that a comeback in lumber futures will be dependent on the eventual revival of homebuilding activity. In January, housing starts tumbled to an annualized rate of 1.334 million, a 31-month trough. Despite housing inventory crashing -40% compared to 2019, homebuilding activity has yet to rush in to fill that gap. There has been some recovery into March, as housing starts rose to a pace of 1.420 million, but that was still the weakest rate for any March since 2020 when the COVID-19 pandemic originally sent homebuilding and lumber prices tumbling. After the smoke of that first COVID wave started to clear, however, record low mortgage rates, remote work, and a resulting migratory shift away from the US’s urban areas spawned a boom in the homebuilding and mortgage business.

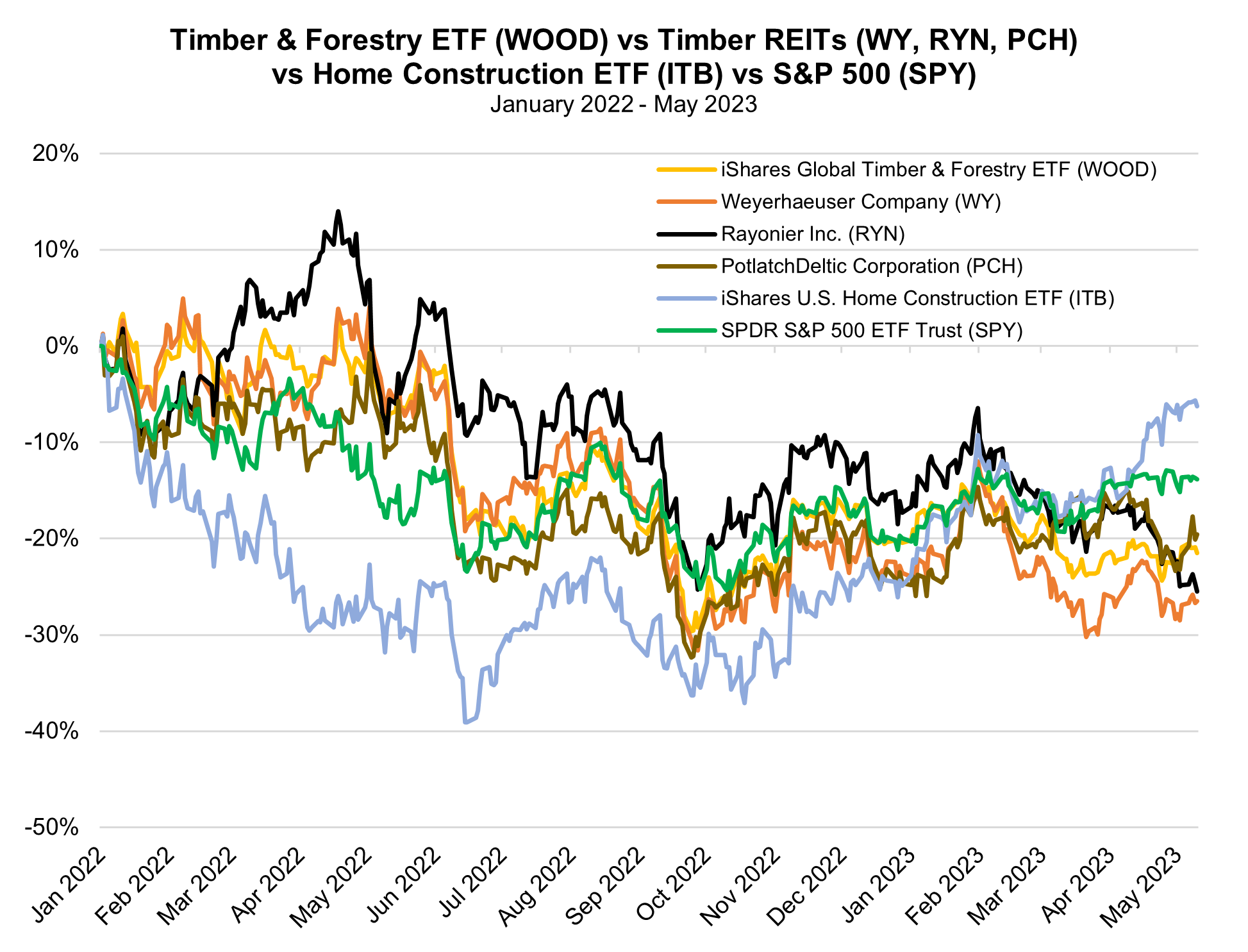

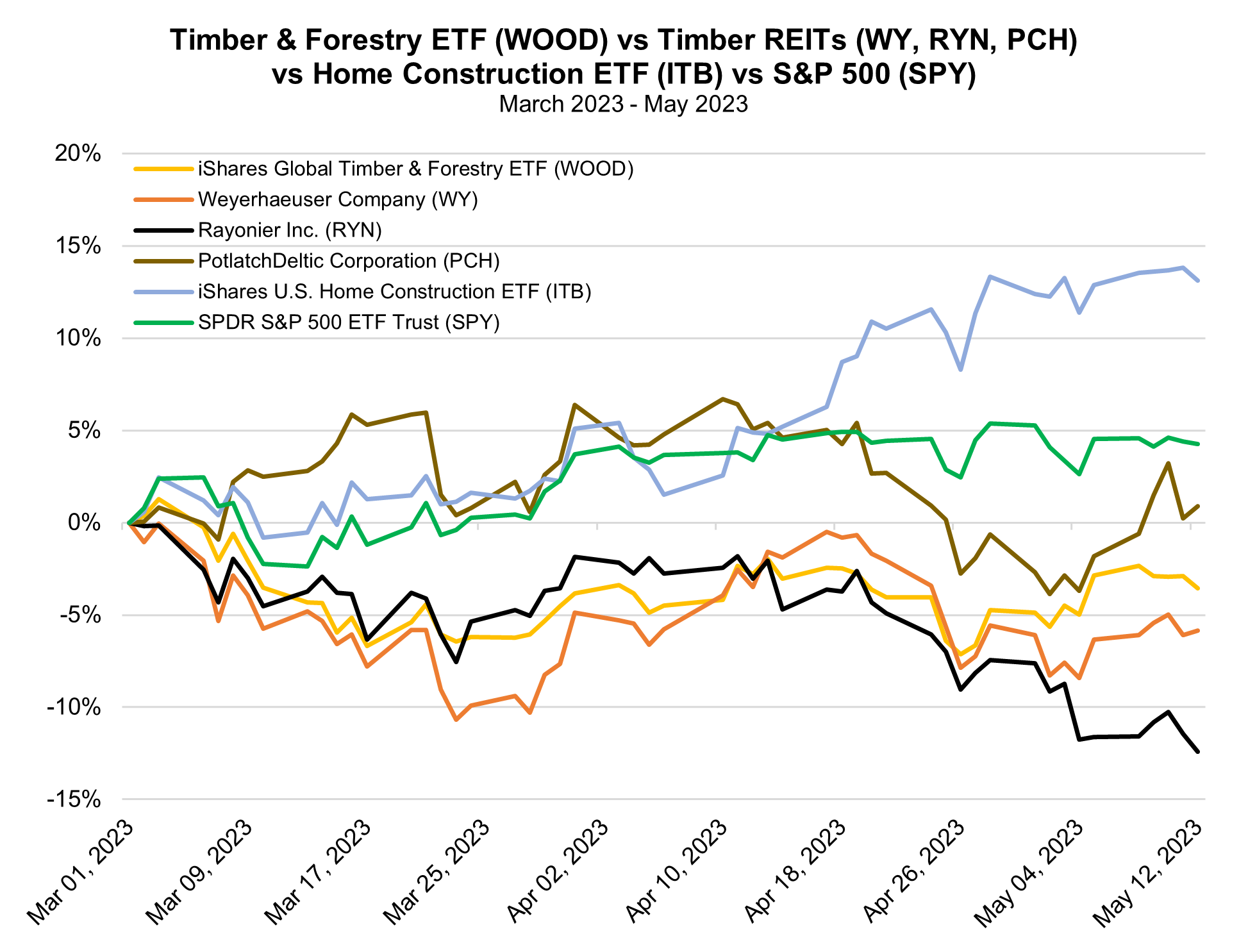

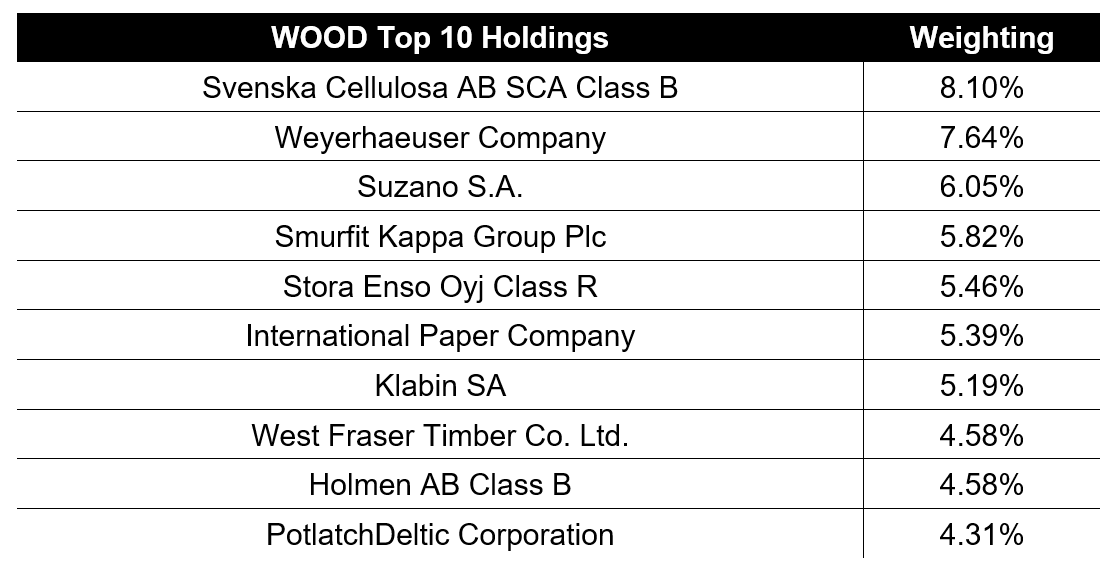

MRP recognized these disruptive trends in our June 2020 Viewpoint, Record Low Rates Power the Housing “V”, referring to our conviction that a V-shaped recovery was already underway after homebuilder sentiment and construction activity bottomed in April. MRP was well-ahead of the game, adding LONG Homebuilders to our list of themes on March 6, 2020. In that same vein, we added LONG Lumber to our list of themes on July 23, 2020, expecting the commodity to experience a similar run-up on increasing home construction. Though we tracked the performance of our LONG Homebuilders theme with the iShares U.S. Home Construction ETF (ITB), we used a basket of timberland REITs, including Weyerhauser (WY), Rayonier (RYN), and PotlatchDeltic Corp (PCH), to track LONG Lumber’s performance. Both themes outperformed the S&P 500, as the ITB rose 42% versus the S&P 500’s gain of 30% throughout the theme’s lifespan (March 2020 – March 2021), and the REIT basket rose 32% versus an S&P 500 gain of 29% (July 2020 – April 2021).

A lot has changed since the COVID-era housing boom, including the way lumber futures are traded. As the Wall Street Journal notes, volatility in lumber prices has been enough to shatter the long-lived futures contract that gained huge traction during the commodity’s run-up in 2021. Launched in 1969 and equivalent to 110,000 board feet, the LBS contract will enter its last trading session on Monday. The new LBR contract, which began trading last year, is worth just 27,500 board feet. Essentially, delivery of lumber contracts will now be equivalent to the amount of wood needed to build a single home. The old contract would be fulfilled with a railcar, as opposed to LBR’s load filling up only a truckload. Per WSJ, the new contract, worth one-quarter the amount of wood, could theoretically result in four times the volume of futures contracts needed to meet current demand, inviting speculators and adding liquidity to the market.

In addition to the aforementioned REITs, investors can gain exposure to lumber, forest products, agricultural products, and paper and packaging products made from timber via the iShares Global Timber & Forestry ETF (WOOD).

|

Leave a Reply