|

Chilean state-owned miner Codelco has struggled to retain its management since June, following former CEO Andre Sougarret’s departure from his post (effective at the end of June) after a tenure that lasted just a year, citing “complexities” in running the world’s leading copper supplier. Not long after Sougarret’s replacement, Ruben Alvarado, took over as the company’s third CEO in just over a year’s time, Codelco is now dealing with further executive shakeups. Earlier this month, CFO Alejandro Rivera disclosed that he would be stepping down from his post and departing Codelco’s copper business for a yet undefined role related to the company’s lithium mining operations. The company’s Head of sustainability, Nicole Porcile, also resigned her position. Chile is the world’s leading copper-exporting nation and Codelco the top global supplier of the red metal.

These resignations followed shortly after Codelco faced a credit rating downgrade by Moody’s Investor Service. The miner’s baseline credit assessment was cut two notches to ba2 from baa3. The outlook assigned to Codelco was negative, suggesting more turbulence may lie ahead. The rationale behind the downgrade was straightforward, with Moody’s citing “lower production volumes, consequently higher costs, and higher capital spending requirements”. All of these were factors that MRP highlighted earlier this year in our coverage of Chile’s copper mining woes, noting that Codelco’s second-quarter production dropped -17% from a year earlier, and its expected annual projection was cut to a range of 1.31 million to 1.35 million metric tons, down from a previous call of 1.35 million to 1.42 million.

Copper output from Codelco’s operations fell in 2022 to the lowest level in 25 years, but chairman Maximo Pacheco sees 2023 as the bottom for the miner’s performance, with a recovery on tap for 2024. However, Pacheco has acknowledged that costs could continue to rise and remain unpredictable. Per Chile’s Centre for Copper and Mining Studies (CESCO), rising expenditures mean Codelco’s debt is likely to reach $30 billion by 2030 from just $18 billion now.

An October report from Chilean Copper Commission (Cochilco) noted that the direct costs associated with copper mining reached 198.8 cents per pound, a YoY increase of 39.6 cents. Rising costs have been accompanied by setbacks and lengthening timelines for development as well.

Higher costs are a major headwind for many copper miners in Chile. For example, Teck Resources shares plunged earlier this week after estimated costs associated with the next phase of development at its flagship Quebrada Blanca mine in Chile were increased. This project, referred to as QB2, is now expected to cost between $8.6 billion and $8.8 billion, compared with an earlier estimate of $8 billion to $8.2 billion. That is just the latest adjustment in a series of cost increases over the past several years. Bloomberg notes that the project’s cost was estimated at just $4.7 billion in 2019.

Teck claims QB2 is one of the largest undeveloped copper resources in the world and has an initial mine life of 27 years, but getting the project up and running remains a daunting and costly project. A new delay came last week when regional government regulators sought to stand in the way of a $3 billion expansion at QB2. As a result, Teck scrapped a previously submitted environmental permit application and will now draft a new version. In addition to the time it will take to re-draft the paperwork, submitting a revised application will tack on around 12 months to the overall regulatory process.

New reforms in Chile have raised the top tax rate will to 47% (up from a specific tax rate of 37%) for companies that produce over 80,000 tonnes of fine copper per year. Reforms also established a 1% ad valorem tax on copper sales from companies that sell more than 50,000 tonnes of fine copper, and an additional 8% to 26% tax depending on the miner’s operating margin. Chilean President Gabriel Boric has further raised costs on miners by implementing higher minimum wages and a reduction in the country’s workweek, likely to stunt the efficiency of mining and non-mining firms operating in the Chile’s economy.

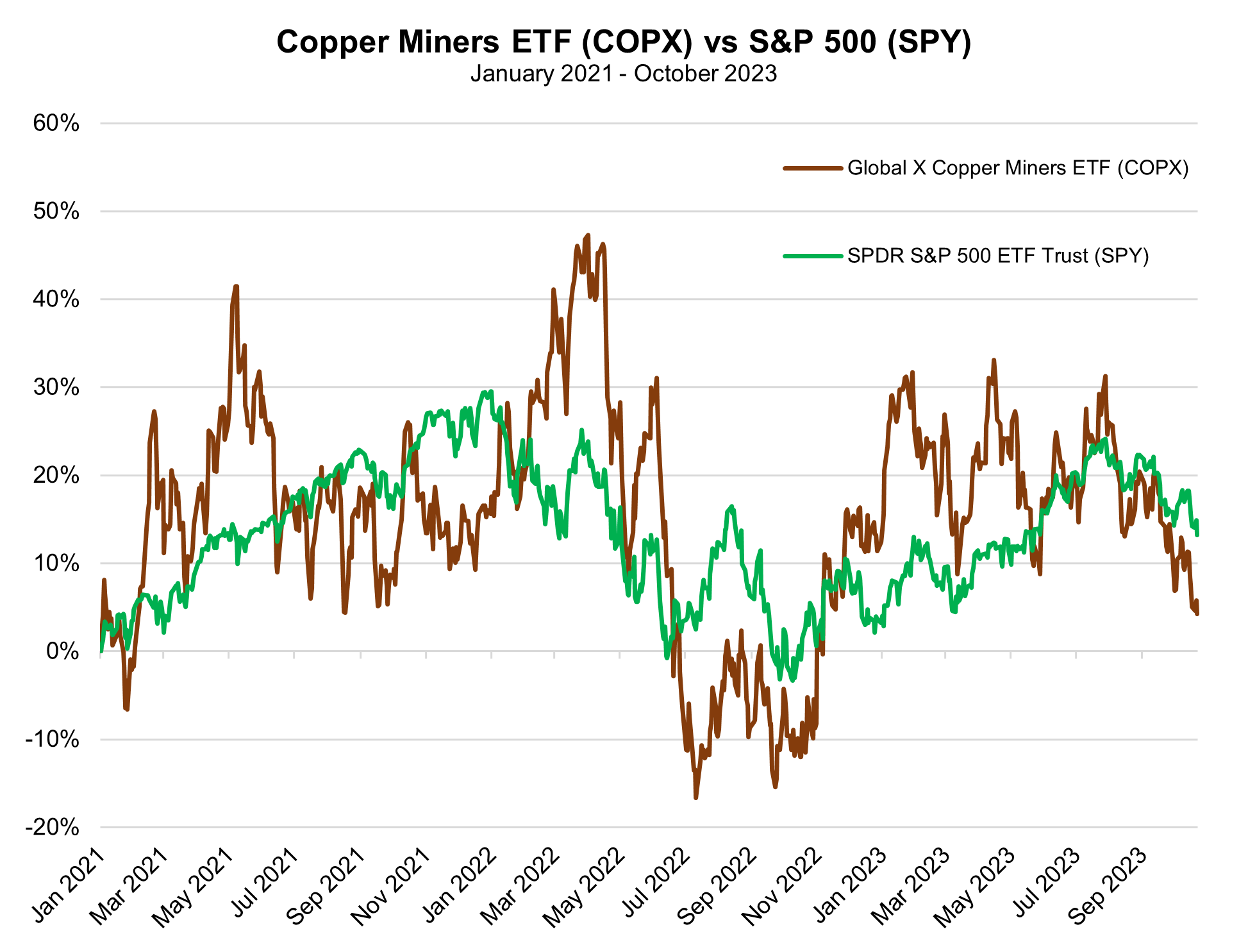

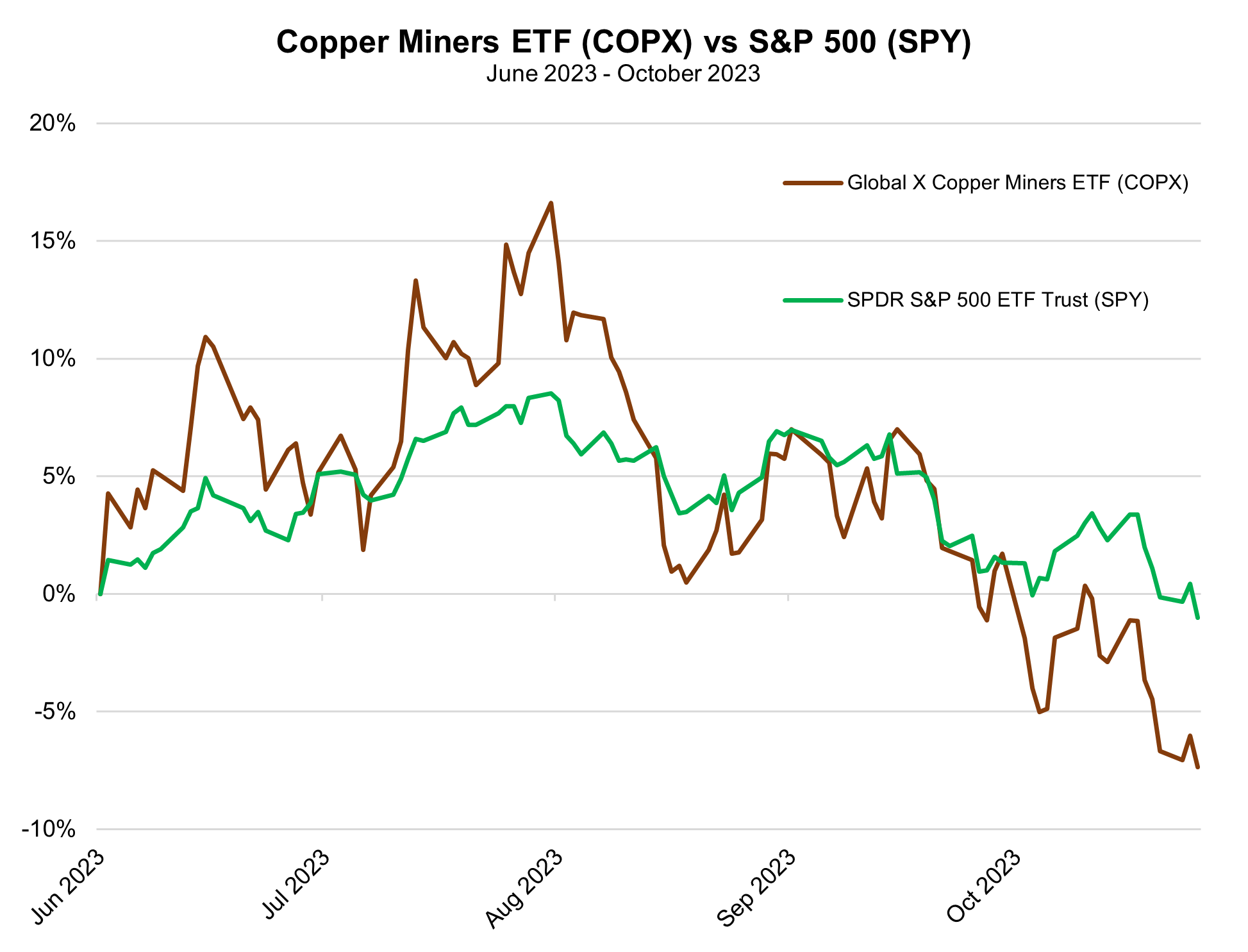

Though BNAmericas notes that fifteen major copper projects are due to start operations by the end of 2026 in Chile, timelines and cost structure will still subject to uncertainty. Further risk to the global copper supply will be added by similar problems plaguing neighboring Peru, the world’s second-largest copper producer, where political instability and red tape have put pressure on that country’s output projections as well. MRP has provided detailed coverage of South America’s copper giants, key components in producing sufficient amounts of metal to power an ongoing energy transition. If production out of these nations remains relatively subdued, that could have significant implications for the price of copper. Investors can gain exposure to copper via the Global X Copper Miners ETF (COPX).

Despite a supply deficit in July and August, the International Copper Study Group (ICSG) estimates the copper market was in a 99,000 tonne surplus throughout the first eight months of 2023, compared with a -313,000 tonne deficit in the same period a year earlier. Lower demand out of China has cut copper prices throughout the year, and is expected to keep the market in a surplus through 2024, but concerns regarding supply remain as the adoption of solar power, electric vehicles, and other copper-intensive new energy technologies picks up steam in the latter half of the 2020s.

|

Leave a Reply