|

Purchasing managers indices (PMIs) continued degradation indicates that the Chinese manufacturing sector remains a significant weakness in the country’s economy. Manufacturing PMIs calculated by both the National Bureau of Statistics (NBS) and Markit Economics slipped to 49.5 in October, breaching the index’s baseline of 50, which delineates expansion from contraction. Both of those readings were the lowest since July and compounded the latest industrial profit data in China, which showed earnings were down by -9.0% in the first nine months of 2023, compared to the prior year. It is worth noting that much of the underperformance in earnings has been weighted toward the earlier portion of the year, however, as industrial profits increased by 11.9% YoY in September alone.

Along with the manufacturing PMIs, gauges of activity in China’s services and construction sectors also weakened but did not fall into contraction territory. Still, those declines pushed the NBS’s general gauge of economic activity in China to 50.7, its lowest reading this year. In late October, Beijing’s top legislative body approved on Tuesday a plan to raise ¥1 trillion ($137 billion) in additional sovereign debt to finance new infrastructure projects in the country. As The Wall Street Journal notes, this infrastructure package is relatively small, representing less than 1% of Chinese GDP, when compared to their 2008 recovery plan. Spending on that stimulus was equivalent to 12% of its GDP at the time.

Potential signs of a rebound in China’s manufacturing base will be desperately needed to re-invigorate foreign entities, which have been rapidly cutting direct and financial investments into China. Financial Times calculations based on Chinese commerce ministry data, showed that foreign direct investment into China tumbled by more than a third to ¥72.8bn ($10 billion) YoY in September, the largest decline on record, with data going back to 2014.

Data compiled by Bloomberg showed foreign funds’ net outflows from Chinese equities persisted for a record third straight month in October, with another -¥44.8 billion (-$6.1 billion) exiting mainland shares. Throughout the past three months, the net drawdown of foreign funds’ exposure to China stocks has been drawn down by more than -¥172 billion (-$23.5 billion). Overall foreign fund flows into China remain positive for 2023 thus far, rising by ¥56.4 billion in the year-to-date period, but this recent pattern has put shares at risk for an annual outflow of outside capital for the first time since 2016.

Foreign fund flows into stocks throughout the Emerging Asia ex China region have also felt the sting of growth concerns and financial risks facing China, a major driver of the broader Asian economy. In the most recent update of its regional economic outlook, the Asian Development Bank (ADB) trimmed its 2023 growth forecast for developing Asia to 4.7%, down from 4.8% projected in July. The ADB specifically cited China’s ongoing property crisis as “a downside risk” that could “hold back regional growth.”

Just like in China, outflows to other Emerging Asia nations have outpaced inflows throughout each of the last three months. Foreign investors dumped nearly -¥80.5 billion (-$11 billion) of Emerging Asia ex China shares in October, taking the cumulative selloff to about -¥197.5 billion (-$27 billion) on over the three-month period.

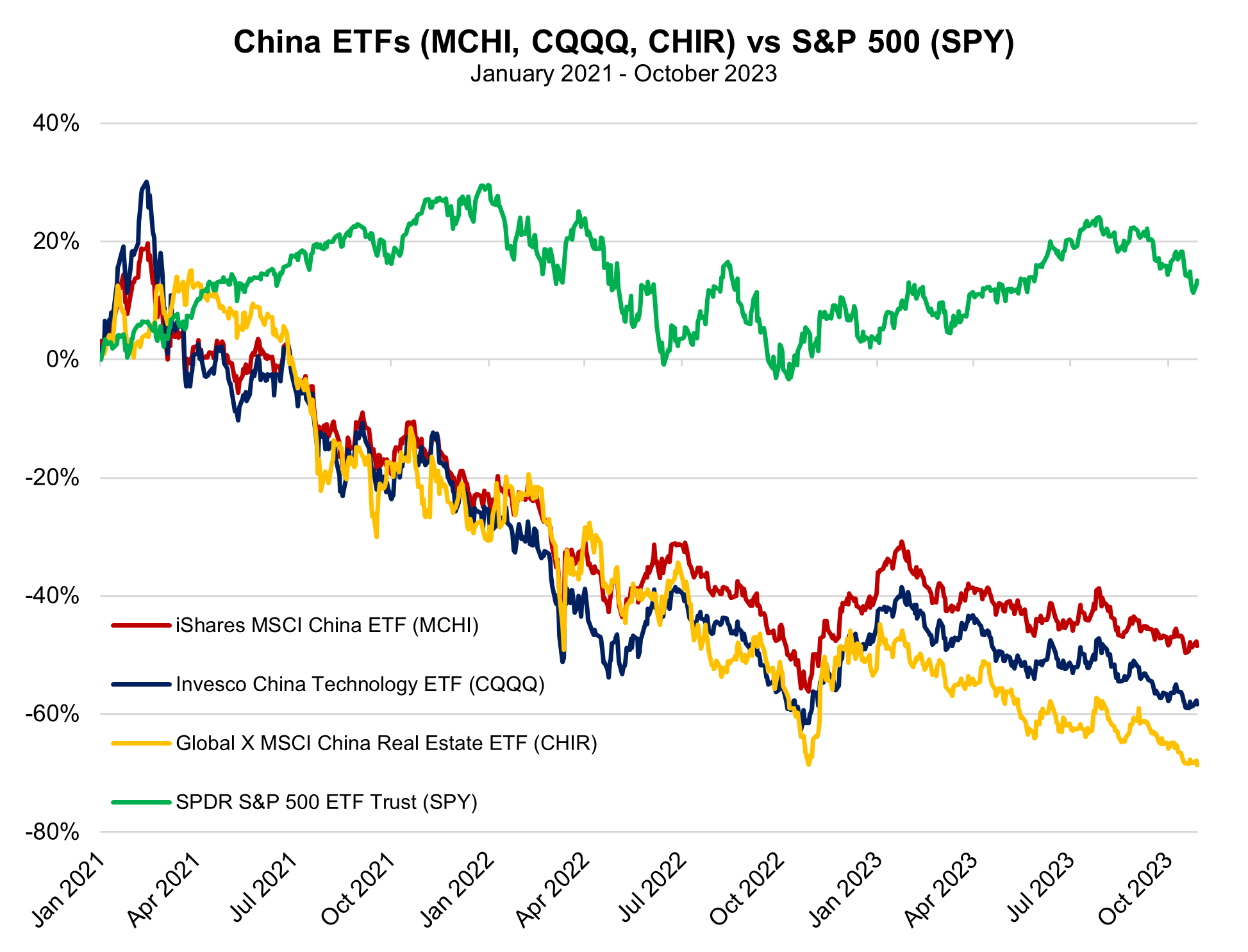

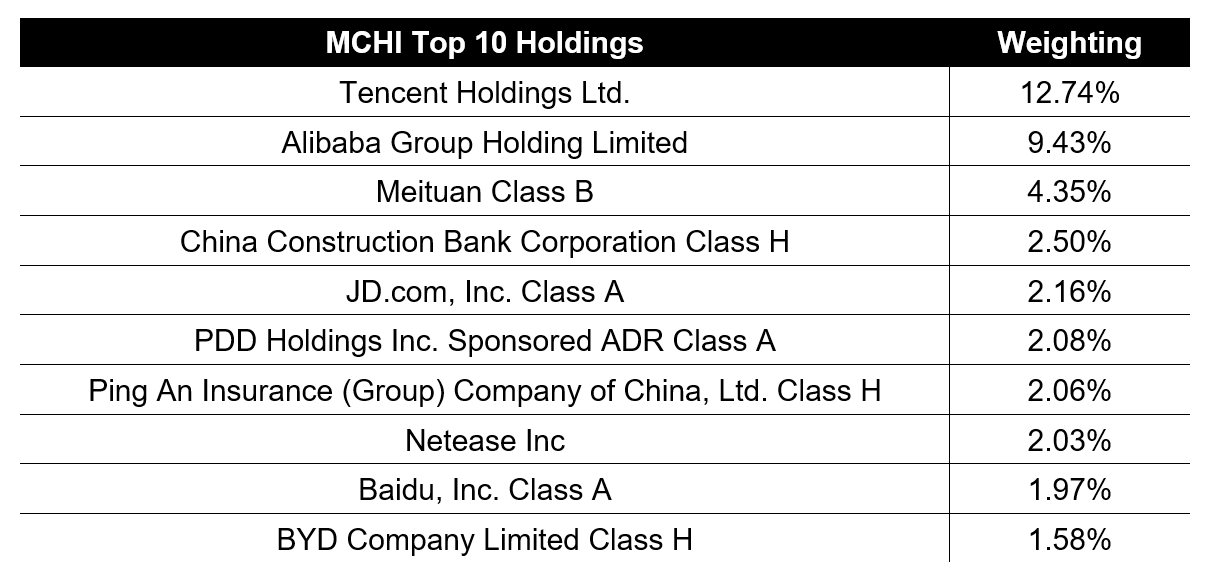

Investors can gain exposure to Chinese equities via the iShares MSCI China ETF (MCHI).

|

Leave a Reply