|

On Tuesday, Ohio voted in favor of a ballot measure to legalize the sale of cannabis for nonmedicinal use, as well as the cultivation of the crop. In garnering 57% support among voters, the success of the measure will make Ohio the 24th US state to enable commerce involving recreational cannabis, defying a long-standing federal prohibition on the distribution of the drug. A total of 38 states allow the distribution of cannabis for medicinal use. Ohio’s well-established medicinal market was on track to reach $520 million in sales by the end of this year. With restrictions on recreational sales set to be removed, cannabis data firm BDSA estimates that annual sales in Ohio’s adult-use market could surge to $820 million by 2025. In 2027, that sum could swell to $1.65 billion.

A majority of Americans, representing 53% of the US population, now live in a jurisdiction where anyone at least 21 years old can legally possess cannabis. The growing expanse of state cannabis markets coincides with continual increases in the share of US residents that support deregulation of the drug. An October poll from Gallup – published on Wednesday – shows that a record 70% of 1,009 surveyed adults favor legalization, up from 68% in the prior round of polling. Gallup has conducted this survey since 1969 when the percentage of share of respondents supporting legalization was just 12%. In the most recent results, there was a majority of support for cannabis legalization among respondents from all political party IDs (Republicans, Democrats, and Independents).

Separate survey data from ATB Capital Markets shows that investors have also warmed up to cannabis recently. Roughly 61% of 23 institutional investors surveyed by ATB expect that US multistate operators (MSO) in the cannabis space will beat the S&P 500 over the next year. Though most of the respondents “reported no change or decreased exposure to MSOs over the past six months”, they estimated a 75% chance that the US government will adjust marijuana’s designation as a Schedule I narcotic to a lower priority Schedule III classification, within the next 18 months. Though the US Department of Health and Human Services’ (HHS) recommended rescheduling of cannabis would certainly mark a significant change in the character of the US’s federal prohibition, MRP noted back August that this effort will do little to materially bolster the companies suffering under the most critical issues that stem from an ongoing federal prohibition.

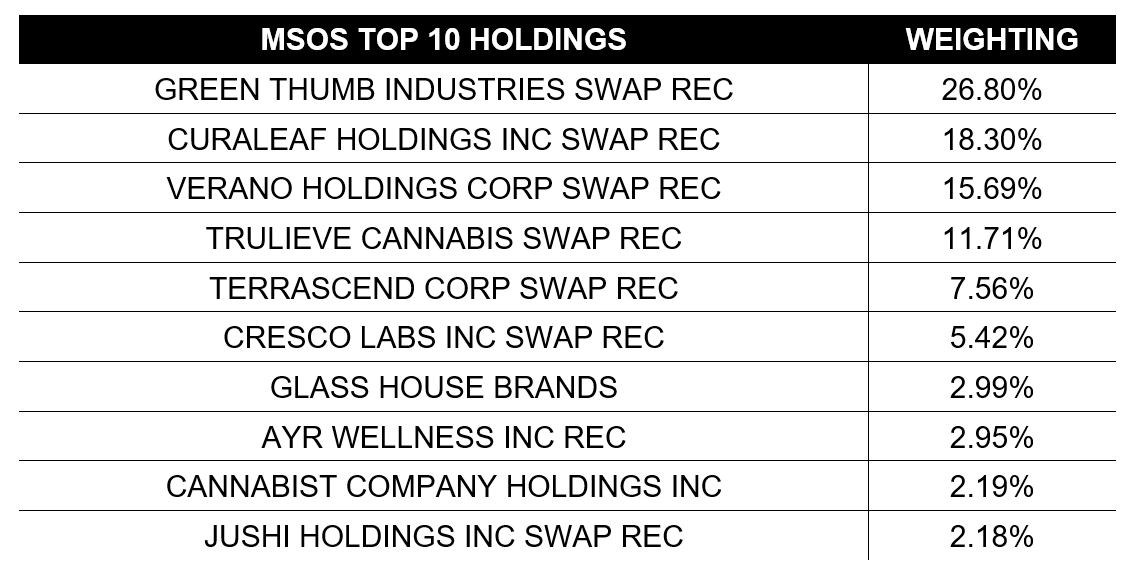

US cannabis stocks surged in the wake of this news, with the AdvisorShares Pure US Cannabis ETF (MSOS) rising by more than a third between the end of August and September 15. However, all of those gains were totally given up by the end of October. The rescheduling news was not enough to sustain cannabis shares at higher valuations while momentum behind more important reforms concerning the cannabis business’s access to the banking system was being derailed in Congress.

Lack of access to basic financial services, an issue MRP has highlighted constantly in our coverage of the North American cannabis industry over the years, has become particularly dire for dispensaries and other cannabis-focused places of business. Most banks in the US are federally-chartered and, therefore, have to do their business according to federal laws and regulations – particularly those regarding narcotics. Some state-chartered banks are more open to doing business with cannabis companies, but lack of access to financial infrastructure in the banking system has created a very cash-intensive industry, opening businesses up to a wave of robberies targeting dispensaries and other places that cannabis businesses might be stashing money they can’t get into a bank. Those vulnerabilities raise the cost of doing business by forcing firms to hire extra security, pay for greater insurance, etc.

Last summer, we noted that bipartisan support for cannabis banking reform in the US was gaining significant steam, as Senator Susan Collins (R-ME) added her name as a co-sponsor to the Secure and Fair Enforcement (SAFE) Banking Act, meaning the bill was able to garner eight Republican cosponsors – just one potential vote shy of avoiding a filibuster in the Senate. Though not a cosponsor, Senator Tommy Tuberville (R-AL) confirmed his support for SAFE in mid-June, meaning that the bill appeared to secure the votes needed to proceed to a vote without the prolonged and prohibitive delay a filibuster would present on the Senate floor, assuming all Democrats vote in favor of passing the legislation as well. The SAFE Banking Act, which would allow banks to legally handle the proceeds from a state-legal cannabis business by prohibiting certain federal banking regulators from taking adverse actions against banks and credit unions that provide services to “cannabis-related legitimate businesses”, has been around for several years and has passed the House of Representatives seven times, only to be stonewalled by the Senate.

It seemed that hurdle was about to be overcome, but a looming government shutdown, as well as the removal of a Speaker to preside over the House, halted progress on most non-budget related items of legislation. This is still largely the state of affairs in the US Congress. A new Speaker has since been appointed, but budget negotiations are unlikely to be resolved before a deadline of November 17 – the date which the federal government will run out of temporary funding if no resolution can be passed to stave off a shutdown. Resolving this crisis will likely take precedent over cannabis-related matters in the near-future.

With potential relief from Congress once again falling by the wayside, US cannabis enterprises may soon turn to litigation to speed legal reform that is desperately needed in the industry. One challenge to the Controlled Substances Act (CSA) has already been filed by publicly traded cultivator Verano Holdings Corp. Per Reuters, Verano argues the CSA, which forms the basis of cannabis’s federal prohibition, is unconstitutional and has unlawfully disrupted the business activities of regulated cannabis operators by criminalizing conduct occurring entirely within states that have legalized the drug. The case is currently in early stages within the United States District Court for the District of Massachusetts, but MRP will continue to highlight developments as they become available.

|

Leave a Reply