| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – January 22, 2018

FEATURED TOPIC: MOBILE PAYMENTS ARE GOING VIRAL; THAT’S BAD FOR MSPs & CREDIT CARD HARDWARE MANUFACTURERS

The proliferation of mobile phones and wearable devices has spurred a cultural shift around the world when it comes to handling money. Instead of using cash, checks or physical credit cards, consumers are increasingly relying on their mobile devices to pay for goods & services and to make peer-to-peer (p2p) micro transfers.

Nowhere is this more evident than in China where barcode-based technology has allowed consumers to leap frog from cash to “scan-and-go” digital payments, bypassing cards for the most part. Over 90% of Chinese consumers have adopted a mobile platform to pay for purchases, be that restaurant meals, taxi rides, art supplies, medicine, etc. That compares with a 32% adoption rate for debit and credit cards. Digital payments are processed by scanning QR (QuickResponse) codes at the point of sales which link to the customer’s bank account.

China’s mobile phone payments volume rose from 2.2 trillion yuan in 2015 to an estimated 98.7 trillion yuan ($15.5 trillion) in 2017, according to iResearch Consulting Group. CLSA expects Chinese electronic payments volume to reach 300 trillion yuan by 2021. All of this is a huge boon for Alipay (owned by Ant Financial) and WeChat (owned by Tencent), as the two companies capture almost 80% of China’s mobile transactions. In fact, WeChat’spayment revenue tripled in the first half of 2017, while Alipay is now accepted in 120,000 stores outside of China. Both platforms are also popularly used to invest in stocks, pay bills, track spending, stream content, and send money to peers which gives the duopoly hordes of personal data which they can use to market their myriad other products & services, and potentially even build a nationwide credit scoring system.

Africa with over 100 million mobile money accounts is also leading the way for digital payments, a development that is the result of limited access to financial institutions and a pervading absence of credit card culture. More than 40% of the adult population in 8 African countries are actively using mobile money to transfer cash, pay bills, top up phone airtime, remit and pay in shops. Of the top 20 countries in the world for mobile money usage in 2016, 15 were in Africa, according to a survey by the Gates Foundation, the World Bank and Gallup World Poll.

In India, Facebook’s WhatsApp messenger app is rolling out a p2p payments functionality built on the country’s Unified Payments Interface (UPI), which allows for instant money transfers between bank accounts at no charge. Other notable players in India’s mobile payments space include local wallet service Paytm which already has 280 million registered users on its platform and Google’s Tez which is closing in on 12 million users after launching there four months ago.

This disruption isn’t limited to developing nations. ANZ bank reported a surge in mobile wallet usage by Australians this holiday season. About 62% of their customers used mobile wallets or wearable devices to pay for food and gas. Similarly, in Western Europe, tech-savvy millennials are opting for phones over cash or cards, as the trend for cashless events spreads across a range of areas, including sporting competitions, music festivals and food and drink pop-up events and fairs.

As for the U.S., eMarketer estimates that American consumers used their mobile phones to pay for $50 billion worth of goods and services at a physical point of sale (POS) in 2017 – that’s a 78% increase from the previous year. That amount will nearly quadruple to 190 billion by 2021.

Increased adoption of mobile payments is not just about convenience to customers. The mobile app allows payments to be made in-store and online, as well as transfers between users, with funds drawn directly from the bank account of the user. Transactions made in this way do not typically incur a fee, making it attractive to businesses. Many industries pay billions of dollars a year in the cost of collections through card products, so the removal of fees could provide a substantial boost to profits. The International Air Transport Association, for example, states that collections cost the airline industry around $7 billion a year in fees, with the majority from credit cards.

The shift from traditional payment methods to mobile-centric solutions ushers in an exciting era of convenience and lower fees for consumers and businesses. But it also presents a real threat to some segments of the payments ecosystem. Hardware companies that supply the card readers and register systems that merchants use at the point-of-sale will lose significant business as mobile adoption grows. The Merchant Service Providers (MSPs) that set businesses up to accept credit cards are also in trouble. Unless, of course, they move to acquire new payments technologies that will keep them relevant.

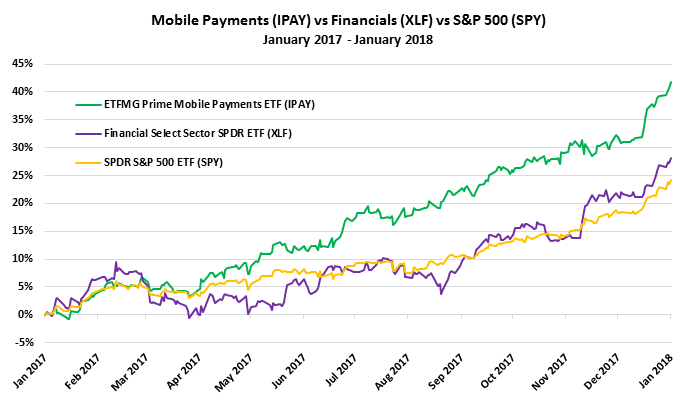

As the landscape changes, investors who want exposure to the mobile payment revolution can do so via the ETFMG Prime Mobile Payments ETF (iPAY)

HERE in the meantime are some related articles on Payments (the stories are summarized in the FINANCE Section):

- Payments – China’s mobile payments volume could exceed global credit card volume in 2018

- Payments – How the future of cash and digital payments is playing out in Europe

- Payments – The newest ways to pay for goods in Australia is surging in popularity

- Payments – The Lightning Network Could Make Bitcoin Faster and Cheaper

- Payments – WhatsApp is testing P2P payments in India, beta rolling out this quarter

- Payments – Tap and donate: Paris church now takes contactless cards

- Payments – Starbucks tests a cashless store in Seattle

CHART: Mobile Payments ETF (iPAY) vs Financials (XLF) vs S&P 500 (SPY)

OTHER STORIES HIGHLIGHTED IN TODAY’S DIBS:

- Markets:

- Bonds – European Insurers Find Yield in U.S. Municipal Bond Market

- FX – Will The Dollar Survive The Petro-Yuan?

- Stocks – Asian Stocks Are at Cheapest Relative to U.S. in Years

- Economics and Trade:

- Greece – Greece exceeds surplus target

- Real Estate:

- Storage – Self-Storage Industry Posts Banner Year In 2017

- Storage – A Slowdown Is in Store for the Self-Storage Business

- Technology:

- Mobiles – Emerging markets are driving global app downloads and usage

- PCs – PC sales are continuing to slump — fewer are sold now than when the iPhone launched

- Quantum Tech – China’s Quantum-Key Network, the Largest Ever, Is Officially Online

- Transportation:

- Autos – The unlikely partnerships that are shaping the car industry

- Commodities:

- Diamonds – Millennials Are Snubbing Diamonds

- Lithium – SQM Strikes Deal To Expand Lithium Production; Lithium Stocks Drained

- Oil – U.S. oil output could soar to levels not seen since the 1970s, predicts IEA

- Biotech:

- Pharma – You could soon be manufacturing your own drugs—thanks to 3D printing

- Pharma – Generic-Drug Makers Fall as Justice Department Threatens to Sue

- Endnote:

- Currencies – Return of the Mac: Currencies are closing the valuation gap with the dollar

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: A Review of MRP’s Latest Change-Driven Investment Themes

- Joe Mac’s Market Viewpoint: The Gathering Storm

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Long-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

Emerging Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers & Pharma (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

|

MAJOR DATA POINTS |

- United States, Baker-Hughes Rig Count, WoW, wk1/19: 936 from prior 939

- United States, Consumer Sentiment, MoM, JAN: 94.4 from prior 95.9

- Germany, PPI, YoY, DEC: 2.3% from prior 2.5%

- Slovakia, PPI, YoY, DEC: 2.2% from prior 2.5%

- Poland, PPI, YoY, DEC: 0.3% from prior 1.8%

- Belarus, GDP, YoY, DEC: 2.4% from prior 2.2%

- Tunisia, PPI, YoY, OCT: 5.9% from prior 4.8%

|

MARKETS |

Bonds – European Insurers Find Yield in U.S. Municipal Bond Market

The $3.8 trillion municipal-bond market, long the investment mainstay of U.S. residents, is seeing demand from European insurance companies drawn to higher yields and ratings than they can find closer to home. It’s boosting the liquidity of a market where U.S. states and local governments raise money. And it’s also providing a new source of business to asset managers.

The interest from corporations such as Germany’s Munich Re underscores the changing landscape in the municipal market, which is so U.S. focused that radio commercials for New York commuters tout local bonds. By the end of September, foreign buyers had increased their holdings of the securities to about $104 billion, more than double what they held a decade earlier, federal data show. European insurers in particular are drawn to the higher quality of municipals compared with corporate debt. B

FX – Will The Dollar Survive The Petro-Yuan?

This might seem a frivolous question, while the dollar still retains its might, and is universally accepted in preference to other, less stable fiat currencies. However, it is becoming clear, at least to independent monetary observers, that in 2018 the dollar’s primacy will be challenged by the yuan as the pricing medium for energy and other key industrial commodities. After all, the dollar’s role as the legacy trade medium is no longer appropriate, given that China’s trade is now driving the global economy, not America’s.

At the very least, if the dollar’s future role diminishes, then there will be surplus dollars, which unless they are withdrawn from circulation entirely, will result in a lower dollar on the foreign exchanges. While it is possible for the Fed to contract the quantity of base money (indeed this is the implication of its desire to reduce its balance sheet anyway), it would also have to discourage and even reverse the expansion of bank credit, which would be judged by central bankers to be economic suicide.

Do not underestimate the importance of this development, because it marks the beginning of a new monetary era, which will be increasingly understood to be post-dollar. The commencement of the new yuan for oil futures contract may seem a small crack in the dollar’s edifice, but it is almost certainly the beginning of its shattering.OP

Stocks – Asian Stocks Are at Cheapest Relative to U.S. in Years

Even after handily beating American stocks last year, Asian shares have actually got cheaper relative to their U.S. counterparts. On a forward price-to-earnings basis, the MSCI Asia Pacific is trading close to at least a 13-year low relative to the S&P 500, according to data compiled by Bloomberg. And on a price-to-book basis, it is at the cheapest in 16 years. According to Mark Tinker, head of AXA Framlington Asia in Hong Kong, emerging market equities, which tend to have a heavy representation of Asian shares, are as cheap against their U.S. counterparts as they were after the Asian financial crisis in 1997. B

|

ECONOMICS AND TRADE |

Greece – Greece exceeds surplus target

The Greek Ministry of Finance announced that Greece managed to succeed in exceeding the primary surplus goal it had set for 2017. The state budget posted a surplus of 1.97 euros, significantly higher than the 877 million target – although lower than the 2.7 billion surplus of 2016. The deficit target for 2017 was 5.123 billion, but the actual deficit amounted to 4.241 billion, still much higher than the 2.81 billion recorded in 2016. Greece is committed to sustaining a surplus of 3.5 per cent of the GDP until 2022, a commitment included in the omnibus bill that was ratified in Parliament this week. Neoskomos

|

FINANCE |

Payments – China’s mobile payments volume could exceed global credit card volume in 2018

China’s mobile payments were 58.8 trillion yuan in 2016. Xinhua News reported that consumers in China’s third-party mobile payment market spent a total of $3.46 trillion (23 trillion yuan) in mobile transactions during the second quarter of 2017 alone. This represents a 22.5% increase from the first quarter of this year. In 2017, Alibaba and Tencent have 92.8% of the mobile payment market: 53.7% of China’s mobile payment service customers use Alibaba’s Alipay, and 39.1% use Tencent Finance. NBF

Payments – How the future of cash and digital payments is playing out in Europe

This ease of contactless payments has spurred a cultural shift, embraced by the younger and more tech-savvy generations, who are happy to go for days without carrying physical cash and instead opt for their phones — even over cards. Older generations, meanwhile, typically prefer to have the option of the security of traditional physical cash.

In Austria, 90 percent of the 9.5 million debit cards (equal to a debit card per capita) have a contactless function, and once consumers have the opportunity to use this, few decline it. The latest statistics also show that, in Austria, NFC accounts for 31.7 percent of transactions. Of course, other nations differ in their appetite to adopt this new genre of payments: In Switzerland, 90 percent of point-of-sale terminals are contactless enabled, a testament to their popularity. But in Eastern countries, cash remains highly valued and the public in general tend not yet to fully embrace cashless payments. MPT

Payments – The newest ways to pay for goods in Australia is surging in popularity

MOBILE wallet payments usage is surging as bank customers embrace paying with a tap of their smartphone or flick of their wearable device at the checkout. Whether it be Apple, Samsung, Android, Garmin or Fitbit Pay, more lenders are rolling out a platter of payment options for customers to choose from.

New data from ANZ — the only of the big four banks to have Apple Pay — revealed a huge spike in mobile wallet transactions during the Christmas period with 3.9 million mobile wallet transactions made — an increase of 140 per cent compared to December 2016 when 1.6 million transactions were made. And 62 per cent of customers used mobile wallets to pay for groceries, dining out or they filled up at the bowser. And wearables too are rising in usage — ANZ data showed customers using their smartphone or wearables made up 4.5 per cent of all transactions compared to 2 per cent the previous year. News.AU

Payments – The Lightning Network Could Make Bitcoin Faster and Cheaper

The bitcoin network’s design effectively limits it to handling three to seven transactions per second, compared with tens of thousands per second for Visa. Poon and Dryja recognized that for bitcoin to reach its full potential, it needed a major fix. Six months later, they revealed their work at a San Francisco bitcoin meetup. They called it the Lightning Network, a system that can be grafted onto a cryptocurrency’s blockchain. With this extra layer of code in place, they believed, bitcoin could support far more transactions and make them almost-instant, reliable and cheap, while remaining free of banks and other institutions.

Last month the isolated groups developing the network, including Russell, banded together and released a “1.0” version. It has hosted its first successful payments, with developers spending bitcoin to purchase articles on Y’alls, a micropayment blogging site built for demonstration purposes by programmer Alex Bosworth. Some entrepreneurs are willing to gamble on Lightning today. Last week a VPN provider called TorGuard may have become the first company to announce it will accept payments made through the Lightning Network. Wired

Payments – WhatsApp is testing P2P payments in India, beta rolling out this quarter

Following murmurs from last April about WhatsApp gearing up to allow payments in India, FactorDaily reports that Facebook employees in the country are presently testing the new functionality in the messaging app, and that the company plans to begin testing it with about 1 percent of its user base there within the first quarter of this year.

That means that the Facebook-owned service will soon go up against numerous major players in India’s crowded mobile payments space. Built on the country’s Unified Payments Interface (UPI), which allows for instant money transfers between bank accounts at no charge, it’ll have to compete with Google’s Tez, local wallet service Paytm, and the government’s own BHIM app, among others. The news comes on the heels of WhatsApp’s launch of its new app that lets businesses message customers on the platform. TNW

Payments – Tap and donate: Paris church now takes contactless cards

The Catholic church is going digital in Paris. The city’s diocese will introduce a system allowing contactless card payments during Sunday’s mass at Saint Francois de Molitor, a church located in an upscale and conservative Paris neighborhood. The diocese explained Thursday that five connected collection baskets with a traditional design will be handed out to mass attenders during the service. They will choose on a screen the amount they want to donate — from 2 to 10 euros ($2.4 to $12.2) — and their payment will be processed in “one second.” ABC

Payments – Starbucks tests a cashless store in Seattle

Starbucks is running a single-location cashless pilot in a store located in the lobby of a Seattle-based office building, according to The Seattle Times. That location won’t accept cash for transactions — tips are still fine — for an unspecified period of time. The store reportedly isn’t using signage to notify customers that it isn’t taking cash, instead letting baristas explain it to customers who try.

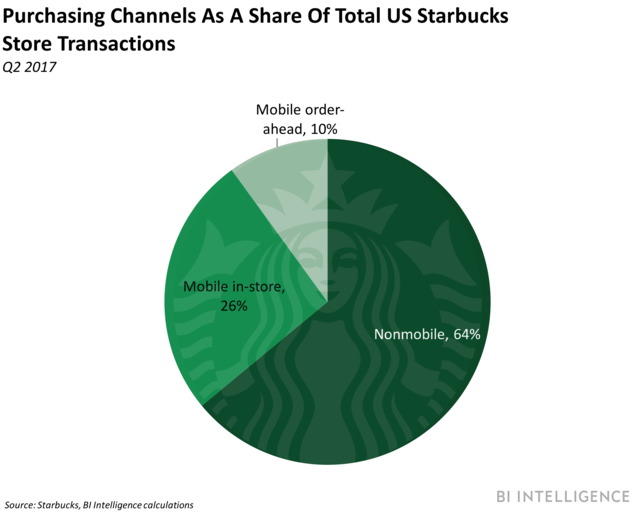

Starbucks is using the pilot, which isn’t planned to expand at this point, to evaluate customer response and garner employee feedback. Going cashless, especially in high-volume locations, could help Starbucks boost growth. It could further mobile payment popularity. Mobile payments comprised 36% of Starbucks’ total US transactions in Q3 2017, a figure that will likely continue to increase. And about a quarter of that group comes from the mobile order-ahead offering. BI

|

REAL ESTATE |

Storage – Self-Storage Industry Posts Banner Year In 2017

New construction of self-storage facilities, bestowed the dubious reputation as the “ugly duckling” of the commercial real estate market, turned in a stunning performance in 2017 with one of its best years ever. More than $2.27 billion was spent on new construction of self-storage facilities nationwide for the first eight months of 2017, the highest amount on record.This amount was more than the $1.9 billion spent in all of 2016, representing nearly a 90 percent increase year over year, according to Inside Self-Storage citing U.S. Census Bureau data.

The construction boom is attributed to a growing trend of storing household items in these facilities rather than cluttering up garages, basements and other rooms. Also, the devastation caused by hurricanes in Florida and Houston last year has helped spur self-storage construction, as more people felt their valuables would be less prone to weather-related damage in these facilities.

There is also an increasing trend of storage facilities for high-end items, such as luxury cars and expensive wines. Some of these facilities offer automated retrieval systems, in which robots locate renters’ vaults and deliver their belongings to a private room at the facility. PRN

Storage – A Slowdown Is in Store for the Self-Storage Business

The party is coming to an end in the self-storage business. For most of the current economic expansion, the sector has been beating all other major commercial property types in earnings growth and stock performance.

Self-storage company executives point out that the business remains prosperous and continues to hold its own against other property types. The only major REIT sector trading more favorably is industrial, which is trading at a 4% premium to asset value. Malls and office REITS are trading at discounts of 13% and 9%, respectively, Green Street says. The self-storage business generally has enjoyed strong growth over the years thanks to the emotional and occasionally nonsensical love affair between Americans and their stuff. Once people rent out a unit they become a captive audience for rent increases.

High-quality self-storage operations are more than 90% occupied in most markets at near-record rent levels. But there’s doubt that the market will be able to sustain such high levels with new supply being added. Green Street is projecting that net operating income growth for the self-storage sector will be below the broader REIT industry. WSJ

|

TECH |

Mobiles – Emerging markets are driving global app downloads and usage

Global app downloads across the iOS App Store, Google Play, and third-party Android stores surpassed 175 billion downloads in 2017, up 60% from 2015. And time spent in apps per day grew 30% from 2015 to reach 3 hours on average. Meanwhile, global consumer spending hit $86 billion in 2017, more than doubling the total from 2015.

App Annie expects to see continued growth in the global app market, driven largely by accelerating adoption in emerging markets. As growth in developed markets slows, emerging markets are the focal point of global app download and usage growth.

Consumers in India, Brazil, and Indonesia use 43, 41, and 40 apps each month, respectively, while consumers in the US, UK, Germany, and France use on average 35 to 36 apps each month. Furthermore, consumers in Indonesia, Mexico, Brazil, and India spend on average more minutes per day in apps than consumers in the US, UK, Germany, and France BI

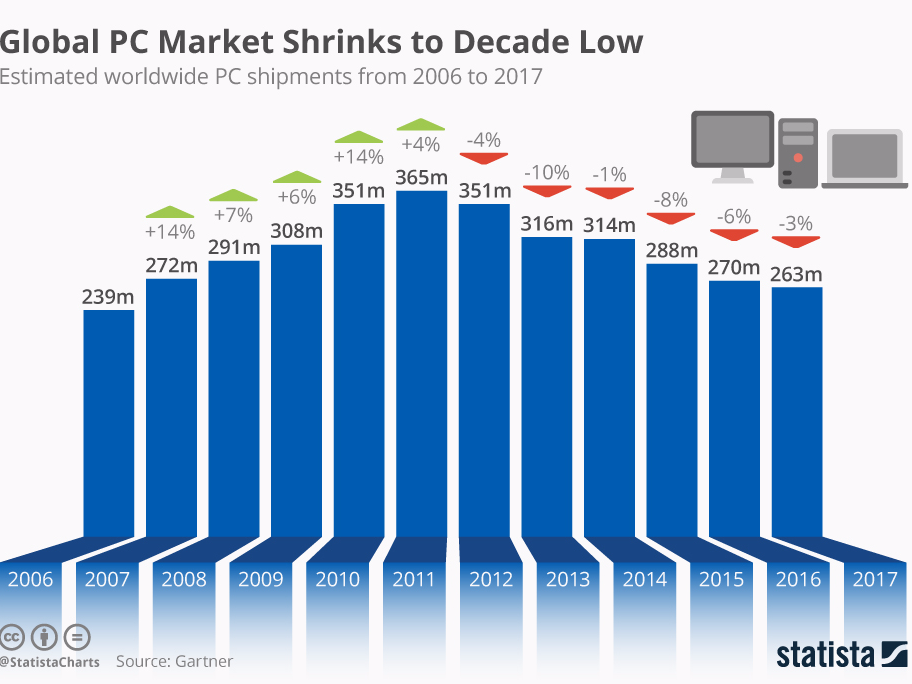

PCs – PC sales are continuing to slump — fewer are sold now than when the iPhone launched

When Apple unveiled the iPhone in 2007, it was easy to dismiss notions that smartphones like it might eventually displace the almighty PC. At the time, PC sales were still booming, and the device was the center of computing. Not only could you not download apps to that first iPhone, you couldn’t even copy-and-paste on it.

More than a decade later, things have definitely changed. Sales of smartphones surpassed that of PCs long ago, and the ever-growing stable of smartphone apps have transformed the devices into powerful pocket computers that can not only do much of what PCs can do, but a lot more besides.

With the smartphone having taken over as the mainstream computing device, electronics makers are starting to reposition the PC as a pricey gadget designed for niche audiences. BI

Quantum Tech – China’s Quantum-Key Network, the Largest Ever, Is Officially Online

China has the quantum technology to perfectly encrypt useful signals over distances far vaster than anyone has ever accomplished, spanning Europe and Asia, according to a stunning new research letter.

Quantum keys are long strings of numbers, encoded in the physical states of quantum particles. They cannot be copied. They can encrypt transmissions between otherwise classical computers. And no one can steal them — a law of quantum mechanics states that once a subatomic particle is observed, it’s altered — without alerting the sender and receiver to the dirty trick. And now, quantum keys can travel via satellite, encrypting messages sent between cities thousands of miles apart.

This long-distance quantum-key distribution is yet another achievement of the Chinese satellite Micius. The connection between Micius and Earth isn’t perfectly secure yet, however. As the team of Chinese and Austrian authors wrote, the flaw in the network design is the satellite itself. Right now, base stations in each linked city receive different quantum keys from the satellite, which are multiplied together and then disentangled. That system works fine, as long as the communicators trust that no secret squad of nefarious astronauts has broken into Micius itself to read the quantum key at the source. The next step toward truly perfect security, they wrote, is to distribute quantum keys from satellites via entangled photons — keys the satellites would manufacture and distribute, but never themselves be able to read.

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

Leave a Reply