| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – January 29, 2018

FEATURED TOPIC: U.S. AIRLINES FACE HEADWINDS FROM 3 DIRECTIONS IN 2018

The fortunes of the U.S. airline industry have come a long way since 2013 when Warren Buffet called it a “death trap”. Since the start of this century, airlines had been plagued by all sorts of troubles such as global travel slowdowns from the 9/11 attacks, climbing fuel prices which resulted in record losses of $54 billion for the industry by 2009, and price wars that decimated margins. Then, thanks to some structural changes, the industry reached an important turning point in 2016 when it became cumulatively profitable for the first time since 2001. Here’s what changed:

INDUSTRY CONSOLIDATION: The industry, which was highly fragmented and inefficient, has undergone intense consolidation as airlines partnered up with other carriers that operated different or complementary routes. As a result, the top four carriers in the U.S. Airspace – American, Delta, United and Southwest – now represent 85% of market share in capacity. With fewer companies competing, each carrier is able to serve more destinations and with greater operational efficiency. It is also easier for them to collaborate on measures that preserve pricing power, reduce capacity, mitigate overlap, and standardize administrative procedures like ticket changes.

INVESTOR BASE CONSOLIDATION: Shareholder consolidation is another important change that has been linked to enhanced market power among the main carriers. The top six owners of each airline hold up to 40% of the vote, which is enough to significantly affect the control of the company. The implication is that a carrier can be brought back in line if it fails to adopt measures that run counter to the overall industry’s interests or that erode shareholder value. Thanks to this common ownership factor, airlines can confidently make changes – for example paying for additional perks or creating new seating classes that compete with the ultra low-cost carriers – knowing that the other major carriers will follow suit.

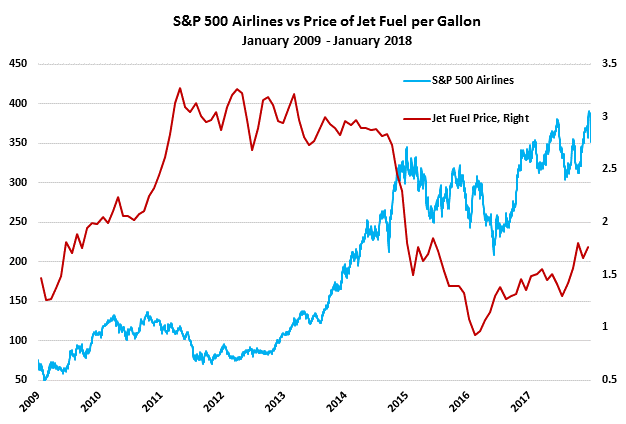

LOWER FUEL COSTS: The price of oil plunged over 70% between summer of 2014 and early 2016. During that same period, the cost of jet fuel also fell from over $120/bbl to below $40/bbl, providing a major boost the bottom line of airline companies as fuel along with staffing are the two biggest expenses for the industry.

While it may seem like the airline industry’s woes are well behind us and a stable future lies ahead, the new economic structure faces serious tests in 2018 in the form of growing capacity, and rising labor and fuel costs — historically a bad combination for the group.

RISING CAPACITY: Last week a number of U.S. carriers announced plans to add seating capacity, particularly in the cheaper fare categories, as a defensive move against fast-growing ultra low-cost carriers such as Spirit Airlines and Frontier Airlines. This year, Alaska Air expects to increase capacity by 7.5% and JetBlue by as much as 8.5%. United Continental plans to expand capacity by 6% in each of the coming three years. This has triggered concerns that capacity will outstrip demand and the airlines will be forced into fresh price wars which will create a drag on profits. Competition on transatlantic routes is also rising thanks to low fares offered by international carriers such as Norwegian and WOW Airlines.

RISING LABOR COSTS: For the past few years, employee wages have been the main cost headwind for most airlines as carriers have had to pay up to reach agreements with pilots, flight attendants and other work groups. Now, the airlines plan to hire more staff as part of their new expansion plans. But the reality of a pilot shortage and a generally tight U.S. labor market will push labor costs much higher.

RISING FUEL PRICES: A recovery in the price of oil, driven by production curbs in OPEC nations and Russia, and by demand amid healthy economic growth, means aviation jet fuel prices have also surged. In fact, airline fuel costs have doubled in two years and American Airlines has already forecast that fuel prices will climb 24% this year, which is bound to hurt everyone’s margins.

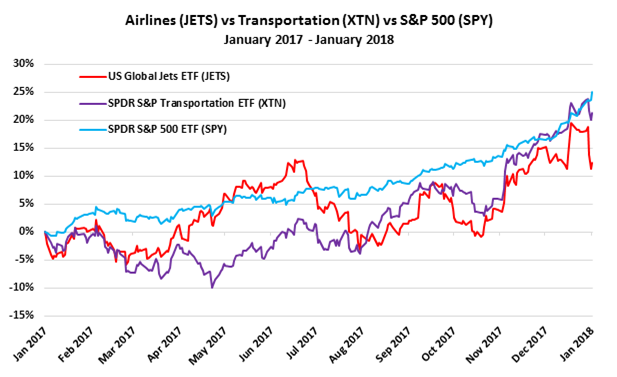

Southwest sees airline seats capacity growing about 5% this year, which is above the 2.6%-3% GDP growth rate that economists are predicting. This raises the issue of whether even accelerating U.S. economic activity can absorb that new capacity. If the answer is no, particularly in the wake of higher fuel price, then airline margins and earnings could tumble. American Airlines CEO, Doug Parker, argues that this time will be different. Only time will tell. The Airlines ETF (JETS) outperformed both the broad market (SPY) and the transportation ETF (XTN) during the first half of 2017, which coincided with falling oil prices. But that leadership has ended and for the past 6 months, as oil prices have been rising, JETS has been underperforming the SPY and the XTN.

HERE in the meantime are some related articles on Aviation (the stories are summarized in the TRANSPORTATION Section):

- Aviation – Airline Slump Deepens as `Risky’ Growth Bet Stirs Fare Worries

- Aviation – Wall Street is afraid your flight could get cheaper

- Aviation – What fare war? American CEO predicts higher fares

- Aviation – United turnaround plan: bolster hubs, revive smaller markets

- Aviation – United Airlines Finds Way to Cut Costs That Doesn’t Involve Booting Overbooked Passengers

- Aviation – Global air finance titans ponder whether boom will ever end

- Aviation – NASA tests light, foldable plane wings for supersonic flights

- Aviation – Norway Is Going To Use Electric Planes For All Short Flights By 2040

CHARTS: (1) Jet Fuels vs Crude Oil; (2) Airlines vs Jet Fuel; (3) Airline ETF (JETS) vs Transportation ETF (XTN) vs S&P 500 (SPY)

OTHER STORIES HIGHLIGHTED IN TODAY’S DIBS:

- Markets:

- Stocks – Algos Show These European Stocks Will Gain From a Stronger Euro

- Economics and Trade:

- ASEAN/India – Asia’s newest love story: Modi and ASEAN are lost in each other’s eyes

- U.S. – Robust imports slow U.S. economic growth in fourth quarter

- Real Estate:

- Infrastructure – December construction starts up 12%, total year starts up 3%

- Infrastructure – Trump raises infrastructure investment plan to $1.7 trillion

- Homebuilders – Lumber prices have timber mills cheering, but home builders passing costs to buyers

- Services:

- E-Commerce – China’s JD Prepares to Take on Amazon on Its Home Turf

- Luxury Retail – New Wave of Chinese Shoppers Splurges on Luxury Goods

- Waste Management – Recycling market suffering from transport capacity shortage

- Manufacturing and Logistics:

- Capex – Tax Incentive Puts More Robots on Factory Floors

- Technology:

- AI – AI sits in on Salesforce’s board meetings and has something to say

- Commodities:

- Marijuana – Canada Estimates It Sold 20% of Its Pot Crop Abroad in 2017

- Energy & Environment:

- Natural Disasters – We could see twice as many big earthquakes this year, because the equator has shrunk

- Biotech:

- Pharma – Chinese drugmakers tap GE tech, seeing biologic boom ahead

- Pharma – NYC seeks $500M in suit aimed at opioid manufacturers

- Endnote:

- CHART: Davos – World Economic Forum Power Grid

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: A Review of MRP’s Latest Change-Driven Investment Themes

- Joe Mac’s Market Viewpoint: The Gathering Storm

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Short-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

Emerging Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

- United States, GDP, QoQ, Q4: 2.6% from prior 3.2%

- United States, Baker-Hughes Rig Count, WoW, wk1/26: 947 from prior 936

- United States, Durable Goods Orders, MoM, DEC: 2.9% from prior 1.3%

- United Kingdom, GDP Growth Rate, YoY, Q4: 1.5% from prior 1.7%

- Canada, Core Inflation Rate, YoY, DEC: 1.2% from prior 1.3%

- Euro Area, Loan Growth, YoY, DEC: 2.8% from prior 2.8%

Stocks – Algos Show These European Stocks Will Gain From a Stronger Euro

Engie SA, Novo Nordisk A/S and Logitech International SA are among the European stocks that stand to benefit the most from a strengthening euro. That’s according to research by Quant Insight, which uses algorithms to identify assets most sensitive to particular factors like currencies, inflation expectations or economic growth.

The region’s stock traders are turning their focus to the euro again after its recent strength, even as some bet stronger economic growth will eclipse its drag on equities. European companies get roughly half their sales from outside the region, so the direction of the euro can have an impact on earnings. B

ASEAN/India – Asia’s newest love story: Modi and ASEAN are lost in each other’s eyes

Leaders of the Association of South-East Asian Nations (ASEAN) are chief guests at India’s Republic Day celebrations in New Delhi today (Jan. 26). Prime minister Narendra Modi hopes the warmth of his embrace will win him friends in a region dominated by China.

But even before this outreach, Modi has fared well in southeast Asia. In fact, he has to thank the people of ASEAN for being ranked the third most-popular world leader by a Gallup International Association (GIA) survey in collaboration with CVoter International, released in January 2018. The net rating in south Asian countries has fallen, but Modi received the biggest boost from Vietnam, followed by Indonesia and the Philippines. Quartz

U.S. – Robust imports slow U.S. economic growth in fourth quarter

U.S. economic growth unexpectedly slowed in the fourth quarter as the strongest pace of consumer spending in three years resulted in a surge in imports.Gross domestic product expanded at a 2.6 percent annual rate in the fourth quarter, compared to 3.2 percent in the third quarter, restrained by a widening trade deficit and only modest inventory accumulation, the Commerce Department said on Friday. President Donald Trump’s goal is for U.S. economic growth of 3.0 percent annually and the Republican-controlled Congress in December pushed through a $1.5 trillion package of tax cuts in the largest overhaul of the tax code in 30 years in an attempt to boost growth. R

Infrastructure – December construction starts up 12%, total year starts up 3%

The value of total construction starts in December rose 12% month over month to a seasonally adjusted rate of $733.3 billion, according to Dodge Data & Analytics, erasing November’s 12% slide. Total starts for 2017 increased 3% to $745.9 billion, Dodged reported. The three categories Dodge tracks — nonbuilding, nonresidential and residential — made positive showings in December, but nonbuilding starts was the standout with a leap of 43%, largely due to the start of the $2 billion I-66 project in Virginia. CDive

Infrastructure – Trump raises infrastructure investment plan to $1.7 trillion

U.S. President Donald Trump said on Wednesday that his long-awaited plan to help rebuild the nation’s infrastructure would result in about $1.7 trillion in overall investment over the next 10 years, a larger figure than he previously announced. The plan, which will be detailed in part at next week’s State of the Union address, “will actually probably end up being about $1.7 trillion,” Trump told a gathering of mayors at the White House. Trump previously valued the plan, which is expected to feature a mix of federal and local investment, at $1 trillion.

The administration is expected to ask Congress for $200 billion in federal spending on infrastructure aimed at encouraging more than $1 trillion in state, local and private financing to build and repair the nation’s bridges, highways, waterworks and other infrastructure. Reuters reported last week that the plan involved $100 billion in cost-sharing payments for projects and $50 billion for rural projects, with the remaining $50 billion largely split among “transformative” projects such as high-speed trains, and funds for federal transportation lending projects. R

Homebuilders – Lumber prices have timber mills cheering, but home builders passing costs to buyers

Just as there are two sides to every coin, the relatively high and stable prices for lumber over the past year have the Montana wood products industry happy — but home builders are frustrated because they have to pass on those costs to consumers in the midst of already lofty housing prices. Todd Morgan, the director of Forest Industry Research at the University of Montana’s Bureau of Business and Economic Research, said lumber production fell in Montana from 506 million board-feet in 2016 to 481 million board-feet in 2017. But tight supply coupled with high demand kept prices up.

For Hoyt, the fact that the United States re-installed tariffs and countervailing duties on imported Canadian softwood is bad news, because that means Canadian lumber isn’t relatively cheap anymore. However, that has been great news for the timber industry in Montana, according to Julia Altemus, the executive director of the Montana Wood Products Association. Missoulian

E-Commerce – China’s JD Prepares to Take on Amazon on Its Home Turf

JD.com Inc. is preparing to make its U.S. debut with a beachhead in Los Angeles, seeking to best arch-rival Alibaba and challenge Amazon.com Inc. on its home turf. The $68 billion company, which said in December it’ll start online sales in the U.S. by the second half of 2018, is now seeking funds to bankroll a logistics build-up to support an international expansion. JD is in final-stage discussions to sell 15 percent of its logistics arm to Tencent Holdings Ltd. and other investors in an early fundraising round.

That’s a precursor to a logistics initial public offering in China or Hong Kong in about three years, Liu said, giving his most detailed outline of JD’s global push to date. The company founder wants to leapfrog Alibaba Group Holding Ltd., which like JD rode an unprecedented Chinese consumer spending boom but remains largely home-bound. B

Luxury Retail – New Wave of Chinese Shoppers Splurges on Luxury Goods

A new wave of big-spending Chinese shoppers is driving torrid sales growth for the global luxury-goods industry after two years of cautious Chinese buying. Buoyed by a surging stock market, Chinese consumers are splurging at home, during trips to Europe and increasingly online. Their pursuit of luxury items—including fancy watches, designer clothes, handbags and high-priced liquor—has revved up as the damping effect of an anti-corruption crackdown by Chinese authorities and terror attacks in Europe has faded over the past year.

Luxury-goods purchases by Chinese shoppers jumped 12% last year to €84 billion ($104 billion), according to consulting firm Bain & Co., with their share of the global total rising to 32% from 30% in 2016. Analysts say the pickup in spending could even accelerate this year. On Thursday, the luxury conglomerate and industry bellwether reported record annual revenue and profits, led by a surge in Chinese sales. Revenue for 2017 was €42.6 billion, up 13%, while profits rose 29%. WSJ

Waste Management – Recycling market suffering from transport capacity shortage

The recycling industry, which is heavily dependent on road transport, is feeling the effects of the current trucking shortages and high costs, Plastics Recycling Update reported. Pending ELD enforcement, a driver shortage and ongoing weather challenges, such as recent hurricanes and the polar vortex, have also had an impact on transport availability. Spot rates and contract markets are also playing a significant role in limiting cost effectiveness and value. SCDive

Capex – Tax Incentive Puts More Robots on Factory Floors

New tax rules are hastening automation and modernizing in U.S. factories, giving manufacturers an incentive to buy machinery and boost productivity in a tight labor market. The revised tax code allows companies to immediately deduct the entire cost of equipment purchases from their taxable income for the next five years. Previously, companies generally were allowed to write off only a portion of the cost in a single year.

U.S. manufacturers already are benefiting from a global economic upswing, a weaker dollar that has made American products more competitive overseas and improved business sentiment at home. Manufacturing output in the U.S. rose 3% in December compared with the same month the previous year, Federal Reserve data show, up from a year-earlier increase of 1%. Some manufacturers have already increased their planned capital spending.

Joel Prakken, chief U.S. economist at the forecasting firm Macroeconomic Advisers in Washington, D.C., estimates the new tax law will add 5% to business spending on equipment nationally by 2024. He sees the tax law boosting manufacturing production by an additional 1.25% by 2025. WSJ

AI – AI sits in on Salesforce’s board meetings and has something to say

Salesforce’s board has gotten a lot more familiar with the company’s artificial intelligence program, Einstein. CEO Mark Benioff told a World Economic Forum panel that Einstein sits in on executive meetings every Monday morning and tells him what it thinks, reports CNBC. Salesforce and IBM recently extended their partnership to bring Salesforce services, including Salesforce Service Cloud Einstein, to the IBM Cloud and Watson IoT platform, according to an IBM announcementlast week.

Benioff’s announcement shows that robots and AI are invading every level of business, from assembly line workers to the C-suite. AI, ML and deep learning can assess a situation more holistically than its human counterpart and oftentimes make better recommendations. But carrying out conclusions ultimately falls to humans — at least for now. CIODive

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

Leave a Reply