| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – February 12, 2018

FEATURED TOPIC: 2018 EQUITY MARKET STORM – WHAT’S NEXT AND WHERE TO FIND COVER

Four months ago, MRP wrote about The Gathering Storm that was approaching the equity markets. We cited a number of disturbing signs on the horizon, including extended valuations, the age of the bull market, extensive retail / high net worth portfolio leverage, trading automation technology, overly bullish sentiment, insider selling, and uncertainty about the Fed. We also worried that a surprise pickup in inflationary pressures and the Fed’s initial foray into unwinding its balance sheet might throw the markets off-kilter.

At the time we wrote: “there are many good reasons to be concerned about a developing storm beginning in the fourth quarter of this year, and extending well into 2018… MRP believes the catalyst will most likely be a change in a key variable that drives valuation.” It appears the storm has finally materialized, albeit a little later than MRP had anticipated. It is likely that February’s correction is as much connected to the beginning of the Fed’s balance sheet reduction as to fears of an inflationary surge and faster rate hikes.

INFLATION

Signs of U.S. inflation have been subdued throughout this cycle, mostly due to the fact that food and energy prices have been in a deflationary spiral even though services inflation has been on the rise for quite some time. Wage growth too remained stagnant despite an unemployment rate below 5%, defying the Phillips Curve model which illustrates the inverse relationship between inflation and unemployment. However, January’s jump in average hourly wage growth to 2.9% provided a jolt to inflation nay-sayers. Even goods inflation is starting to kick in. American manufacturers and food companies now have to contend with the triple whammy of rising materials, labor, and freightcosts, with fuel prices soaring and trucking capacity extremely tight. They will have to either raise prices themselves or accept the profit squeeze.

FED BALANCE SHEET REDUCTION

The consensus view on the Street has been that the quadrupling of the Fed’s balance sheet and prolonged period of very low interest rates have greatly contributed to high equity and bond valuations. We therefore wondered how the markets would react once the unprecedented experiment of unwinding the Fed’s $4.5 trillion balance sheet began. Last quarter, the Fed’s balance sheet actually increased instead of decreasing. But in January, the balance sheet shrank by $24.493 billion which, as the first chart below shows, may have triggered a get-real moment for market participants.

VALUATION

The equity market has now had a 10% correction. Meanwhile, earnings projections have been going up due to a stronger economy and tax cut windfalls. Consequently, valuations have decreased since we published our Gathering Storm report. At the time, the forward P/E for the S&P was over 20, well above the historic median of around 16. As a result of higher earnings projections and this month’s correction, however, the forward P/E is now below 17, which should help prices stabilize — albeit temporarily.

SO WHAT HAPPENS NOW?

MRP’s view is that, in the short term, treasury yields will stabilize around 3% for a while, Q1 earnings will be a blow out, and the stock market will rally and make possible double top sometime in Q2. But, when interest rates resume their upward path, volatility will emerge once again. The price adjustment experienced by the market thus far will likely not be limited to the current 10% drop.

Going forward, the broad U.S. equity market is unlikely to deliver the same nominal and inflation-adjusted returns as investors have enjoyed over the past five years. Similarly, fixed income returns should be lower than recent coupon rates. Yet, even in a broad capital market decline in stocks and bonds, there are always some securities that will outperform relatively, if not absolutely.

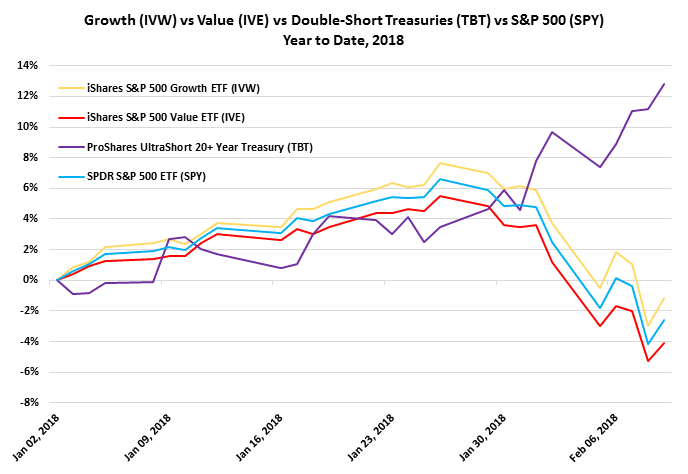

In the bond space, treasury inflation-protected securities become more attractive as inflation and inflation expectations creep up. Investors can gain exposure through the iShares TIPS Bond ETF (TIP) or the Vanguard Short Term Infl-Prot Secs ETF (VTIP). For those who believe rates will rise and prefer a bigger payout than just inflation protection, the ProShares UltraShort 20+ Year Treasury ETF (TBT) might be the way to go.

As for equities, we believe the decade-long trend of growth stocks outperforming value stocks will begin to reverse. The present value of future earnings growth will be revised down as interest rates rise, affecting growth stocks disproportionately; value should smartly beat growth as rates go higher. Here are our thoughts about the coming Value Rotation.

AND HERE are some related articles on the equities meltdown (the stories are summarized in the MARKETS section of today’s report):

- Stocks – China, Hong Kong Are the Biggest Losers as Stock Rout Spreads

- Stocks – Experts say algorithms added to the market volatility in the biggest stock market point drop in America’s history

- Stocks – Meltdown raises fears of ‘financial innovation the planet doesn’t really need’

CHART: (1) Fed Balance Sheet vs S&P 500; (2) Growth (IVW) vs Value (IVE) vs Short Treasuries (TBT) vs S&P 500 (SPY)

OTHER STORIES HIGHLIGHTED IN TODAY’S DIBS:

- Markets:

- Bonds – Lower U.S. Taxes May Dent Insurers’ Demand for Municipal Bonds

- Cryptocurrencies – Republican Senate Candidate Accepts The Largest Single Bitcoin Donation in Federal Election History

- FX – Chinese Yuan Slides to Biggest One-Day Drop Since 2015 Devaluation

- Economics and Trade:

- China – Sizing Up China’s Debt Bubble

- Inflation – New Worry for CEOs: Rising Costs From Metals to Meat

- Inflation – Higher shipping prices are reaching the dinner table

- UK – Brexit will hit the UK’s car and aviation industries hardest

- Finance:

- Banks – China Banks’ Stealth Meltdown

- Services:

- AR Retail – Covergirl partners with Walmart on AR-enabled mobile web sales

- Manufacturing and Logistics:

- CAPEX – Corporate America’s Spending Roars On

- Industrial Mobility – General Motors increases manufacturing productivity with automated vehicles

- Transportation:

- Logistics – Shipping Shakeup? Amazon May Deliver Some Of Its Own Orders

- Trucking – New heavy-duty truck orders hit highest level in over a decade

- Commodities:

- Oil – Venezuela’s Pain is OPEC’s Gain

- OJ – Flu Fears Halt a Long Decline in Orange Juice Sales

- Energy & Environment:

- Electricity – ChargePoint delivers 8 GWh of electricity in over 1 million electric car charges per month

- Electricity – Utilities continue to increase spending on transmission infrastructure

- Biotech:

- MedTech – Hospitals turn to chatbots, AI for care

- Pharma & HC – Historic Flu Season Drives Sales Across the Health-Care Industry

- Endnote:

- CHART: AI – China vs US AI industry financing comparison 1999-2017

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: A Review of MRP’s Latest Change-Driven Investment Themes

- Joe Mac’s Market Viewpoint: The Gathering Storm

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Long-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

Emerging Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

- United States, Baker-Hughes Rig Count, WoW, wk2/9: 975 from prior 946

- United States, Wholesale Trade, MoM, DEC: 0.4% from prior 0.6%

- Philippines, Industrial Production, YoY, DEC: -10.3% from prior -9.3%

- Switzerland, Unemployment Rate, MoM, JAN: 3.3% from prior 3.3%

- Finland, Industrial Production, YoY, DEC: 4.2% from prior 4.2%

- Norway, Core Inflation Rate, YoY, JAN: 1.1% from prior 1.4%

- Norway, PPI, YoY, JAN: 10.4% from prior 7.3%

- Russian Federation, Interest Rate Decision, 7.5% from prior 7.75%

Stocks – China, Hong Kong Are the Biggest Losers as Stock Rout Spreads

As global equity investors reel from the biggest selloff in two years, nowhere has the pain been more acute than in China and Hong Kong. Benchmark indexes in the world’s second- and fourth-largest stock markets have fallen faster than any of their major peers since the rout began late last month, with worries over a Chinese deleveraging campaign adding to global concerns about rising interest rates and stretched valuations.

The big questions are whether stocks are signaling trouble ahead for the world’s second-largest economy, and whether declines in China will create a negative-feedback loop with international markets. For now at least, analysts aren’t anticipating a 2015-style meltdown.

That said, market declines in China have a habit of snowballing. Many observers are braced for more volatility as liquidity conditions tighten before the Chinese New Year break that starts next week. On average, declines of 10 percent or more in the Shanghai Composite have lasted two months before the index began a reversal of the same magnitude. B

Stocks – Experts say algorithms added to the market volatility in the biggest stock market point drop in America’s history

As the Dow Jones industrial average collapsed 700 points in 20 minutes Monday afternoon and the stock market jerked from bad to cataclysmic, traders and analysts coalesced around an increasingly routine explanation: Blame the machines.

Algorithmic trading – proprietary computer programs that can perform thousands of trades a second – has become a reality for global markets. Marko Kolanovic, JPMorgan Chase’s global head of macro quantitative and derivatives strategy, wrote in a report last year that passive and algorithm-driven “quantitative investing” accounted for about 60 percent of stock trades, compared with 10 percent from more traditional trades.

Investment managers say the algorithms’ cold calculations end up sparking hysterical sales among the humans, undermining confidence and feeding a vicious cycle that leads more and more algorithms to do their thing. PPG

Stocks – Meltdown raises fears of ‘financial innovation the planet doesn’t really need’

The global market turmoil of the past week has shone a light on complex trading instruments listed in the United States and Europe – a number of which have been taken off the market – which some investors blame for the scale of the disruption. Monday’s stock sell-off triggered the biggest rise ever in S&P 500 volatility futures, forcing Credit Suisse and Nomura to close down products that enable investors to short the VIX after they posted massive losses.

The VIX itself measures market expectations of how choppy the S&P 500 might be over the coming month. With the U.S. index becoming the most widely-traded in the world, the VIX is seen by many as a key barometer of investment sentiment. One of the main concerns with the products now available is that regular retail investors with no specialized knowledge have been trading them in growing numbers, greatly exacerbating the market swings they can produce. R

Bonds – Lower U.S. Taxes May Dent Insurers’ Demand for Municipal Bonds

Put on the Taylor Swift and pull out the Ben & Jerry’s ice cream: The municipal-bond market’s long relationship with property and casualty insurance companies may be breaking up.

That’s because last year’s tax overhaul slashed corporate rates to 21 percent, making tax-exempt debt less attractive to a segment of the insurance industry that has $342 billion in municipals, accounting for one-third of its debt investments, according to Federal Reserve data. That’s threatening to pose another potential drag on the $3.8 trillion market, where prices have been sliding amid concern the Federal Reserve will increase interest rates more aggressively to slow the economy.

Property and casualty insurers are likely to be “net sellers” in the first quarter, he said, forecasting that the companies’ allocations to municipals will drop by 2 to 4 percentage points during the quarter. B

Cryptocurrencies – Republican Senate Candidate Accepts The Largest Single Bitcoin Donation in Federal Election History

Missouri Republican candidate, Austin Petersen, the former Libertarian, has received 24 bitcoin donations so far in his campaign for Senate – the largest of which, valued at $4,500, is officially the largest single Bitcoin donation ever accepted by a US politician according to the Federal Election Commission. It also opens the debate about cryptocurrencies, political donations and transparency.

The reason this recent development is ‘newsworthy’ surrounds the matter of fact way it was reported. It is a purposeful sign that maturity has encroached upon the Bitcoin landscape, in that senior lawmakers now seem happy, across the political divide, to accept these non-government backed digital currencies to help improve campaign contribution and donor engagement. CCN

FX – Chinese Yuan Slides to Biggest One-Day Drop Since 2015 Devaluation

The Chinese yuan dropped 1% against the U.S. dollar Thursday, notching its biggest one-day decline since the Chinese central bank devalued the currency in August 2015. One dollar bought 6.3260 yuan as of the 4:30 p.m. close for domestic trading on Thursday, marking a 1% decline in the Chinese currency against the dollar from Wednesday. Even with the yuan’s sudden fall Thursday, it has surged more than 8% against the dollar in the past year, amid a broad-based pullback for the greenback.

The yuan’s drop Thursday eclipsed moves in other major currencies, which is unusual. The euro fell 0.2% against the dollar, while the Japanese yen lost 0.3% against the greenback. Many fund managers went into the year betting on a stronger yuan, largely fueled by expectations for further dollar weakness.

In the offshore market, where the yuan trades more freely, the yuan fell 0.4% to 6.3480 per dollar. That meant the yuan’s value was weaker in offshore trading hubs such as Hong Kong than in the tightly controlled domestic market, a throwback to the months following the yuan’s 2015 devaluation. WSJ

China – Sizing Up China’s Debt Bubble

Over the past decade, China’s credit boom has been the largest factor driving global growth. Now, President Xi Jinping is encouraging banks and businesses to start deleveraging. In 2008, China’s total debt was about 141% of GDP. By mid-2017 that had risen to 256%. Countries that take on such a large amount of debt in such a short period typically face a hard landing.

China is the second-largest economy in the world, the biggest trading nation, and has the third-largest bond market. A meltdown would have global repercussions. Countries with the closest trade ties are the most at risk. South Korea, Malaysia, and Vietnam each have exports to China valued at more than 10% of their GDP; commodity exporters South Africa and Chile are not far behind.

A financial crisis that hits the spending power of China’s middle class would also be a blow to corporate America. When China’s shift to a more consumer-driven economy created large markets for U.S. corporations, companies from Apple to Yum! Brands began to count the country as a significant source of sales and a growth market. At Intel, for example, China rose from 13% of its total revenue in 2008 to 24% in 2016. B

Inflation – New Worry for CEOs: Rising Costs From Metals to Meat

U.S. manufacturers and food companies are grappling with rising material and ingredient costs on top of pressure from higher wages—a potential double whammy that could force them to raise prices or accept lower profit margins. Over the past six months, however, the world’s major economies have been enjoying a rare spell of synchronized growth, boosting commodity prices.

The economic rebound is raising demand for materials like steel, aluminum and copper used to build everything from houses and office buildings to automobiles and smartphones. In 2017, prices of steel-mill products rose 7.8%, while industrial chemicals rose 11.7%, according to the Labor Department. Food prices were more volatile: raw-milk prices dropped 10% while prices of slaughter hogs jumped 14% and the cost of wheat increased nearly 13%. WSJ

Inflation – Higher shipping prices are reaching the dinner table

Higher shipping prices are reaching the dinner table. Tyson Foods says the nationwide shortage of trucks and drivers will add $200 million to its costs this year, and the WSJ’s Jacob Bunge reports the largest meat processor says that along with rising wages for its workers will raise prices for U.S. consumers. Tyson CEO Tom Hayes says the company is already talking with grocery stores, restaurants and distributors about raising prices.

Tyson’s stance is a sign of the stresses that are spreading across supply chains as consumer-facing companies rush to take advantage of strong demand but find distribution channels squeezed, partly because operators have kept capacity tamped down through a long stretch of lackluster growth. WSJ

UK – Brexit will hit the UK’s car and aviation industries hardest

The government’s drive to promote high-tech sectors is likely to be undermined by leaving the European Union, according to the first detailed examination of UK manufacturing post-Brexit. In an analysis of 122 sectors, the UK Trade Policy Observatory at the University of Sussex found that aerospace, automotive and pharmaceutical manufacturers would be hardest hit if trade with the EU became more difficult after Brexit.

If the UK left the European Union without a deal, then increased trade friction could cause the motor vehicle sector to shrink by 10.4 per cent, the academics suggest, with the air and spacecraft industry contracting by 8.1 per cent. For regions of the country that depend on these industries for work, this is worrying news. Wired

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

Leave a Reply