| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – March 20, 2018

FEATURED TOPIC: FACEBOOK FUMBLE & NEW EU PRIVACY RULES PAVE THE WAY FOR CRACKDOWN ON DISTRIBUTING DATA

Facebook and the broader tech sector took a beating on Monday after it was unveiled that Cambridge Analytica, a data mining and analysis firm, used a harvesting app to gain unauthorized access to the data of up to 50 million Facebook users. This personal information was subsequently used to target voters and possibly sway public opinion in the 2016 US Presidential race. While this is technically not a data breach, considering there was no external hacking involved and Facebook databases were not breached by an outside malicious actor, it bolsters the case for more stringent data legislation. Facebook, among many tech giants, generates a large sum of revenue by collecting and distributing user data to app developers and advertisers. If new legislation creates barriers to these sorts of transactions, it could have serious consequences for how internet tech giants do business.

European regulators have already laid out a hardline approach to data privacy in the EU. On May 25, a European privacy law that restricts how personal data is collected and handled, called General Data Protection Regulation or GDPR, will come into effect. The law focuses on ensuring that users know, understand, and consent to the data collected about them. Under GDPR, pages of fine print won’t suffice. Neither will forcing users to click yes in order to sign up. Companies have to spell out why the data is being collected and whether it will be used to create profiles of people’s actions and habits.

Moreover, consumers will gain the right to access data about them that companies store. Individuals also gain the right to correct inaccurate information, and the right to limit the use of decisions made by algorithms, among others. In a survey of UK consumers, 51% of respondents said they were at least somewhat likely to exercise their new rights under GDPR.

Violators of the new regulatory framework face fines of up to 4% of annual global revenue. For Facebook, that would be $1.6 billion; for Google, $4.4 billion. GDPR has already spurred, or contributed to, changes in data-collection and handling practices. Google, for instance, has announced that it will stop mining emails in Gmail to personalize ads. The legislation could also curb revenue per user growth in the European market. In 2017, Facebook’s revenue per user in Europe increased 41% from a year earlier, to $8.86. The rate of increase was faster than any other region.

While the US has yet to release any specific plans aimed at better securing the data of American internet users, tech executives will likely face congressional questioning soon. Facebook has previously been hauled in front of Congress — along with other tech companies — over issues relating to the 2016 U.S. presidential election. In a letter Monday, two senators asked Senate Judiciary Committee chairman Chuck Grassley to hold hearings on the subject, raising the specter of introducing new legislation to address handling of personal data. Social-media platforms have user bases larger than all of the major TV broadcasting companies combined, the senators noted.

In 2017, the online advertising business, led by companies like Google, Twitter, and Facebook, generated over $200 billion in revenue, representing an annual growth of over 15%. This rate of growth will likely take a hit as advertisers get used to the idea that data will grow scarcer – especially third-party data. Germany is the first market in Europe to produce a report estimating how much the GDPR could affect publisher and marketer revenues. In the report, by VDZ, the Association of German Magazine Publishers, 67% of publishers said that more than 30% of their programmatic revenue would be lost, and 53% said 30% of any revenue generated by retargeting would be lost.

First-party data, collected from one’s own audience and customers, is still the most commonly used in advertising. However, third-party data, which marketers buy from a range of external sources such as big tech, was expected to be the fastest growing data partnership over the next two years at 30%. Impending legislation, though, could negatively affect that figure.

It is very clear by this week’s public outrage that many are extremely sensitive about how their data is used and, if given the chance to consent, would opt out of their information being disseminated to third parties. When databases shrink, so too does the value of that data. Other barriers like steep fines for mishandling of data will also increase the risk that tech companies undertake when selling the data they will have access to.

Some Facebook users have resorted to deleting their profiles altogether. Last weekend, “#deletefacebook“, along with related hashtag “#CambridgeAnalyticaUncovered”

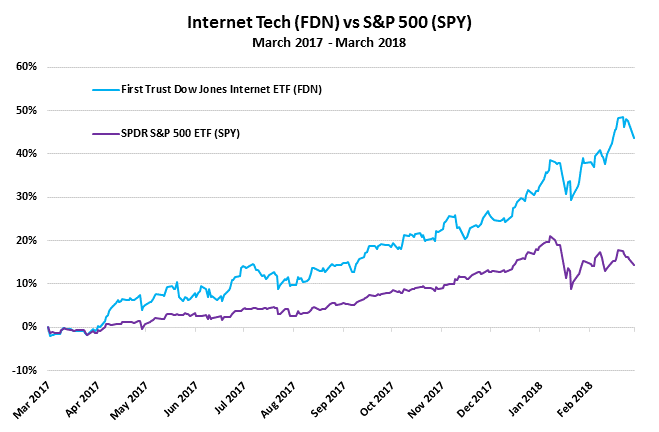

Investors interested in gaining long or short exposure to social media and internet tech firms can do so via the Internet ETF (FDN).

HERE IN THE MEANTIME are some articles relating to the automotive industry (the stories are summarized in the TECHNOLOGY section of today’s report):

- Data Privacy – Facebook Ignites Debate Over Third-Party Access to User Data

- Data Privacy – Europe’s New Privacy Law Will Change the Web, and More

- Data Privacy – Facebook is facing an existential crisis

- Data Privacy – Facebook Under Pressure as EU, U.S. Urge Probes of Data Practices

CHART: Internet Tech ETF (FDN) vs S&P 500 ETF (SPY)

OTHER STORIES HIGHLIGHTED IN TODAY’S DIBS:

- Markets:

- Structured Products – Blockchain Enters Opaque Ground With First Structured Note

- Politics and Policy:

- Antitrust – What Investors Should Expect if AT&T Loses

- Social Engineering – China will ban people with poor ‘social credit’ from planes and trains

- Finance:

- MLPs – Time to Give Pipelines Another Look

- Real Estate:

- Housing – The Next Housing Crisis: A Historic Shortage of New Homes

- Services:

- Grocers – Supermarket Bankruptcies Are Beginning to Pile Up

- Technology:

- Electronics – Apple Is Secretly Developing Its Own Screens for the First Time

- Transportation:

- Mobility – Lyft is testing a Netflix-style monthly subscription plan

- Mobility – The fate of the steering wheel hangs in the balance

- Mobility – Uber Halts Autonomous-Car Testing After Fatal Arizona Crash

- Shipping – Chinese Shipyards See Surge in Orders, Margins Remain Thin

- Commodities:

- Cannabis – Marijuana Is the New Gold for Mining Companies Going to Pot

- Oil – ‘Netflix for Oil’ Setting Stage for $1 Trillion Battle Over Data

- Water – Water and money’s $1 trillion relationship crisis

- Energy & Environment:

- Hydrogen Fuel – National Grid Eyes Decarbonizing Gas, Using Hydrogen

- Biotech:

- MedTech – AI can spot signs of Alzheimer’s before your family does

- Endnote:

- Metals – Cost of producing a penny and nickel exceeds their value. Is that enough to end their use?

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

- Joe Mac’s Market Viewpoint: A Review of MRP’s Latest Change-Driven Investment Themes

- Joe Mac’s Market Viewpoint: The Gathering Storm

- Joe Mac’s Market Viewpoint: Contrarian Crude Call

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Short-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

Emerging Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

- Brazil, IBC-BR Economic Activity, JAN: -0.56% from prior 1.16%

- Chile, GDP Growth Rate, YoY, 4Q: 3.3% from prior 2.5%

- Chile, GDP Growth Rate, QoQ, 4Q: 0.6% from prior 2.2%

- Italy, Industrial Production, YoY, JAN: 4% from prior 5.4%

- Poland, Industrial Production, YoY, Feb: 7.4% from prior 8.6%

- Russia, Industrial Production, YoY, Feb: 1.5% from prior 2.9%

- Turkey, Retail Sales, YoY, JAN: 10.7% from prior 8.9%

Structured Products – Blockchain Enters Opaque Ground With First Structured Note

Marex Solutions has created what it says is the first structured product to be registered, cleared and settled using blockchain technology. The two-month pound-denominated notes pay a coupon of up to 13% per year based on the performance of the FTSE 100 Index. If the iShares Core FTSE 100 ETF climbs no more than 2.5%, investors don’t reap any gains but receive their principal back, no matter the outcome

The structured product industry is one that could use a shake-up. Global year-to-date issuance led by JPMorgan Chase fell 2% from last year to $25.4 billion. With regulatory changes such as MiFID II and increased investor focus on fees, the products seem to be on the losing side of a war with ETFs, where issuance is growing.

The Ethereum blockchain technology can help make structured notes “cheaper, faster and safer,” according to Jethwa. It promises to cut out intermediaries that have traditionally participated in the settlement process, potentially reducing fees charged to investors. The time to complete trades can be slashed from two days “to minutes, if not seconds,” while decreasing the possibility of human error and settlement failure. B

U.S. Antitrust – What Investors Should Expect if AT&T Loses

A victory for the Department of Justice over AT&T in their bitter antitrust battle creates a far more interesting—and more uncertain—situation in the media and telecom industries, and for deal-making in general, than if AT&T wins. Such a ruling would reset the rules for mergers broadly.

The government has historically challenged horizontal mergers, which combine similar businesses in an industry, rather than vertical mergers, where businesses within the supply chain merge. If the DOJ wins, its most immediate move could be to threaten the current wave of deals in the drug industry, where insurers are buying up middlemen.

In the media industry, the verdict would leave the 2011 Comcast-NBC deal as an outlier. The government might find reason to revisit it. And, if distribution firms like AT&T can’t own content, are content firms allowed to own distribution platforms? That question is on the table right now in the pending deal between 21st Century Fox and Disney, which would leave Disney in control of streaming service Hulu.

Finally, a ruling for the government could also lead regulators to start looking at tech firms that are creating their own content. That would be consistent with a larger interest in regulating big tech. WSJ

China Social Engineering – China will ban people with poor ‘social credit’ from planes and trains

Starting in May, Chinese citizens who rank low on the country’s burgeoning “social credit” system will be in danger of being banned from buying plane or train tickets for up to a year, according to the country’s National Development and Reform Commission.

With the social credit system, the Chinese government rates citizens based on things like criminal behavior and financial misdeeds, but also on what they buy, say, and do. Those with low “scores” have to deal with penalties and restrictions. China has been working towards rolling out a full version of the system by 2020, but some early versions of it are already in place.

The new travel restrictions are the latest addition to China growing patchwork of social engineering, which has already imposed punishments on more than seven million citizens. And there’s a broad range when it comes to who can be flagged. Citizens who have spread “false information about terrorism,” caused “trouble” on flights, used expired tickets, or were caught smoking on trains could all be banned. TheVerge

MLPs – Time to Give Pipelines Another Look

The latest blow to energy master limited partnerships (MLPs) came last week when a decision by regulators potentially lowered the tax benefits for the industry. Contrarian investors should take note.

MLPs were flying high for the first five years of the economic expansion, benefiting from the shale revolution. From the time the Fed began QE through July 2014 when oil prices peaked, the sector’s total return was double that of the S&P 500. Investor enthusiasm began to wane after that. Last year’s tax legislation further removed some of the appeal of entities that pass along untaxed distributions to unit holders.

But, the biggest factor driving future returns is valuation, and the regulatory ruling succeeded in pushing MLPs to a level that has sparked past rallies. As of Friday, the index was trading at an 8% discount to the S&P 500 on the basis of price to projected funds from operations over the following year. The only two occasions in the past decade that saw a similar discount — November 2008 and February 2016 — preceded rallies of 50% and 60% respectively in the index over the following six months. WSJ

Housing – The Next Housing Crisis: A Historic Shortage of New Homes

America is facing a new housing crisis. A decade after an epic construction binge, fewer homes are being built per household than at almost any time in U.S. history. The only period when the U.S. might have built fewer homes by population was during World War II.

Although demand for housing is stronger than ever, land and construction costs have roughly doubled since the end of the last boom a decade ago. A combination of tightened housing regulations, a lack of construction labor and a land shortage in highly prized areas is driving the crisis.

Nationwide, membership in the National Association of Home Builders (NAHB) peaked at 240,000 in 2007, then dropped to 140,000 in 2012, where it has remained throughout the recovery. Meanwhile, the construction workforce in the U.S. declined to 10.5 million in 2016, from 10.6 million in 2010, when the real-estate market was already near bottom.

Then, there’s post-crisis regulation. In 2016, regulatory costs added nearly $85,000 to the cost of a home, up more than 30% since 2011.

The NAHB estimates builders will start fewer than 900,000 new homes in 2018, less than the roughly 1.3 million homes needed to keep up with population growth. The overall inventory of new and existing homes for sale hit its lowest level on record in the fourth quarter of 2017, at 1.48 million. It also now takes about twice as long to build a house than during past booms. WSJ

Grocers – Supermarket Bankruptcies Are Beginning to Pile Up

Regional grocery chains are filing for bankruptcy; European-born discounters are expanding, forcing competitors to keep their own prices low; Kroger and Walmart, the two largest grocers in the U.S., are investing in technology and expanding delivery as they try to fend off an incursion by Amazon. It’s a bleak outlook for a sector that was supposed to be rebounding this year, and some well-known names are crying uncle. Southeastern Grocers, owner of the Winn-Dixie and Bi-Lo supermarket chains, filed for bankruptcy last week.

But, even before Amazon bought Whole Foods last year, pressure was ramping up in the grocery industry, which is known for razor-thin margins. In recent years, food has proliferated at dollar stores and pharmacies. The rise of meal kits also has given consumers another dinner option, and one that often translates to less grocery shopping.

Last year, new grocery store openings plunged 29% as companies curtailed expansion plans. All of the competitive pressure comes as the grocery industry averaged only about 2% growth over the last five years. That means the industry is mainly fighting for market share at this point. B

Data Privacy – Facebook Ignites Debate Over Third-Party Access to User Data

U.S. and British lawmakers slammed Facebook over the weekend for not providing more information about how the data firm, Cambridge Analytica , came to access information about potentially tens of millions of the social network’s members without their explicit permission. Damian Collins, the U.K. lawmaker said he intended to ask Facebook CEO Mark Zuckerberg to testify before the group. Facebook executives spent much of Saturday arguing what happened didn’t constitute a data breach—even as they and the company acknowledged Aleksandr Kogan, a psychology professor from the University of Cambridge, and Cambridge abused user data.

The current controversy has its roots in a 2007 decision by Facebook to give outsiders access to the company’s “social graph”—the friend lists, interests and “likes” that tied Facebook’s user base together. Tapping that rich store of information required that a person create an app and plug it into Facebook’s platform. The move helped Facebook become a fixture in its members’ lives, catapulting the company from 58 million users to more than 2 billion today.

A 2011 paper co-written by Facebook researchers said the average Facebook user had 190 friends. That could mean that through the 270,000 people who downloaded Mr. Kogan’s app, data from 51.3 million people were obtained. WSJ

Data Privacy – Europe’s New Privacy Law Will Change the Web, and More

On May 25, the big data power balance will shift towards consumers, thanks to a European privacy law that restricts how personal data is collected and handled. The rule, called General Data Protection Regulation (GDPR), focuses on ensuring that users know, understand, and consent to the data collected about them. Companies must be clear and concise about their collection and use of personal data like full name, home address, location data, IP address, or the identifier that tracks web and app use on smartphones. Companies have to spell out why the data is being collected and whether it will be used to create profiles of people’s actions and habits.

The law’s impact will extend well past the web giants. In March, Drawbridge, an ad-tech company that tracks users across devices, said it would wind down its advertising business in the EU because it’s unclear how the digital ad industry would ensure consumer consent. Acxiom, a data broker that provides information on more than 700 million people culled from voter records, purchasing behavior, vehicle registration, and other sources, is revising its online portals in the US and Europe where consumers can see what information Acxiom has about them. GDPR “will set the tone for data protection around the world for the next 10 years,” says Acxiom’s chief data ethics officer.

Much may turn on how companies ask for consent. In September, PageFair, which helps publishers deal with ad blockers, conducted a survey in which it presented users with choices for being tracked, such as “only accept first party tracking” or “reject tracking unless it’s strictly necessary for the services requested.” Of the 300 people surveyed, only about 5 percent consented to all tracking. WIRED

Data Privacy – Facebook is facing an existential crisis

The Cambridge Analytica scandal has done immense damage to the brand, sources across the company believe. It will now take a Herculean effort to restore public trust in Facebook’s commitment to privacy and data protection. The scandal also highlights a problem that is built into the company’s DNA: Its business is data exploitation. Facebook makes money by, among other things, harvesting your data and selling it to app developers and advertisers.

Facebook sources acknowledged to CNN that it is impossible to completely monitor what developers and advertisers do with the data once it’s in their hands. It’s like selling cigarettes to someone and telling them not to share the cigarettes with their friends. On Capitol Hill, the talk of regulation is growing louder. Lawmakers seeking tighter restrictions on big tech feel even more emboldened than they did in the wake of revelations about Russian meddling in the 2016 election.

Meanwhile, Zuckerberg and the rest of the Facebook leadership seem conspicuously absent. Neither the Facebook CEO nor his top deputy, Sheryl Sandberg, have commented publicly on the matter. CNN

Data Privacy – Facebook Under Pressure as EU, U.S. Urge Probes of Data Practices

Lawmakers in the United States, Britain and Europe have called for investigations into media reports that political analytics firm Cambridge Analytica had harvested the private data on more than 50 million Facebook users to support Trump’s 2016 presidential election campaign.

On Monday, the Senate was expected to move forward with a bill that would chip away at the internet industry’s legal shield, a decades-old law known as Section 230 of the Communications Decency Act, with a bill intended to address online sex trafficking. The measure has already passed the House of Representatives and was expected to soon become law.

Fears of increased regulation also weighed on shares of Twitter Inc Google parent Alphabet Inc and Snapchat parent Snap Inc. “(Tech companies) are going to get a lot more scrutiny over what data they are collecting and how they are using it,” said Shawn Cruz, senior trading specialist at TD Ameritrade in Chicago. USNews

Electronics – Apple Is Secretly Developing Its Own Screens for the First Time

Apple is designing and producing its own device displays for the first time. The technology giant is making a significant investment in the development of next-generation MicroLED screens, which use different light-emitting compounds than the current OLED displays and promise to make future gadgets slimmer, brighter and less power-hungry. The screens are far more difficult to produce than OLED displays.

The ambitious undertaking is the latest example of Apple bringing the design of key components in-house. The company has designed chips powering its mobile devices for several years. Its move into displays has the long-term potential to hurt a range of suppliers, from screen makers like Samsung Electronics, Japan Display, Sharp Corp. and LG Display to companies like Synaptics that produce chip-screen interfaces.

The news crushed all the display makers listed above. Universal Display’s shares plunged as much as 16%. The company makes key technology and owns some OLED intellectual property; investors are likely concerned Apple’s MicroLED technology will eventually replace Universal Display’s. Controlling MicroLED technology would help Apple stand out in a maturing smartphone market and outgun rivals like Samsung that have been able to tout superior screens. B

Mobility Providers – Lyft is testing a Netflix-style monthly subscription plan

Lyft is testing monthly subscription plans for high-frequency users, a sign that the company is shifting toward a Netflix or Spotify model for transportation. The terms of the subscription models seem to vary: One all-access pass offered up to 30 standard Lyft rides for $199 a month, another was priced at $300, and another at $399 for 60 rides. Individual rides up to $15 were covered under the all-access pass. A subscription to Lyft could cost something along the lines of $200, which gets you 1,000 miles of traveling around. “You rely on the Lyft network for all your transportation needs,” said Lyft CEO Logan Green.

Uber tested its own subscription service in a number of cities in 2016, but it’s unclear whether that experiment went anywhere. TheVerge

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

Leave a Reply