| MRP | MCALINDEN RESEARCH PARTNERS | DIBS |

|

| DATA | ECON | POL | FIN | REAL | LABOR | MFG | TECH | ENERGY | END |

We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.

Daily Intelligence Briefing – May 15, 2018

FEATURED TOPIC: Digital Streaming is Cutting Cable Deeper Than Ever Before

Cable companies have had to accept declining customer bases until they come up with a counter-punch against the rise of streaming and other cord-cutting services. From the beginning of 2015 through the end of last year, nine million Americans have either cut the cord or chosen not to buy a traditional cable package when moving into new households. Now, recently released earnings figures may foreshadow a more vigorous than expected move toward cutting the cord.

Charter Communications, which offers cable service under the Spectrum brand, announced on Friday that it lost 122,000 TV customers in the first quarter of 2018, exceeding projections of only 40,000 lost subscribers ahead of the earnings report. Comcast announced it had lost 96,000 customers for the quarter, its fourth straight quarter of subscriber losses, and slightly worse than analyst projections. AT&T’s DirecTV satellite service lost 188,000 customers in the same period, driving down video revenue by $660 million despite growth of its own online streaming service. Total cable subscriber numbers declined 3.4% over the course of 2017, a faster decline than in 2015 and 2016. Meanwhile, cable’s major antagonist, Netflix managed to net 1.96 million new subscribers.

Other services continue to capitalize on the trend too. Amazon now has more than 100 million customers for its Prime subscription service, which includes an offering of live NFL games available to stream. Google Inc. is ramping up its YouTube TV streaming service, an online bundle of cable channels that competes with the likes of Hulu Live and Sony PlayStation Vue. And Facebook and Apple have each set aside as much as $1 billion for original programming meant to lure more viewers away from traditional TV. HBO, the top video service for global subscribers, has begun implementing plans to secure loyalty in international markets by developing local, foreign-language shows from Spain and Scandinavia.

While the average household spent $106 a month on pay-TV service last year, up 3% from 2016, penetration of multichannel pay-TV services among households with broadband has fallen below 80%, a seven-year low. However, higher bills are probably bad news for the cable industry. Back when consumers began to complain about high costs and annoying ads, cable and broadcast executives responded by trying to stuff more ads into every viewing hour by speeding up or editing down programs. Instead of trying to cut down consumers’ bills, the average cable bill increased in price by 74% since 2000, even adjusted for inflation. All while the average income saw either tepid growth or remained flat. During this period, cable companies continually fomented distrust against themselves with opaque billing, rising fees, and bad service. In 2017, companies like Comcast and Charter, and Dish were voted to be among America’s most hated companies by their own customers.

On a positive note for the industry, big cable is in the process of changing its ways. Cable companies and other providers are finally working to offer “skinny bundles,” mobile-friendly packages that offer fewer channels at a lower price. While many of those offer the same additional tiers as their larger predecessors, consumers are instead supplementing with Netflix or other streaming services instead of replacing cable outright.

They’ve also begun cutting ads, whether by choice or necessity. National TV ad sales peaked in 2016, when they exceeded $43 billion, but sales fell 2.2% last year, and the firm estimates that they will fall at least 2% each year through 2022. By contrast, digital ad spending reached an all-time high of $88 billion in 2017 — a 21% increase over the previous year. Even in the face of declining sales, networks have actually raised the cost of advertising on their airwaves in recent years, but the strategy has been relatively ineffective since ratings continue to decline sharply. More pain could already be loaded into the pipeline, as the hottest shows on TV networks — which command the highest ad prices — are attracting mostly older viewers. This season’s top-rated show, the revival of “Roseanne,” has a median viewer age of 52.9 years. The network show with the lowest median age is “Riverdale” on the CW, at 37.2. Traditional TV is already well behind the curve in picking up younger viewership to sustain their future.

A final threat to the television industry is the ballooning content bubble; what insiders are calling “peak TV“. This year, an estimated 520 scripted series will be produced for broadcast, cable and over-the-top internet services in the U.S. That’s up 7% from 2017 and nearly 50% from just five years ago. As Disney and Apple prepare to launch their own streaming services, crowding the field with even more content, the threat of a shakeout could become very real. While this would threaten traditional TV and streaming services alike, the content war could pose a more significant threat to the former since their model is contingent on access to entire channels as opposed to digital streaming services that focus on access to the best individual series and content.

It may not be too late for cable companies to save themselves, considering they own most of the broadband that alternative services stream on. The response to a decreased customer base for TV could be to raise prices for internet service, but that could end up backfiring, as some are just beginning to have some success with their own streaming services. The most impending question going forward for big cable is whether customers will want to stick with the same providers that many have garnered a distaste for over the last two decades.

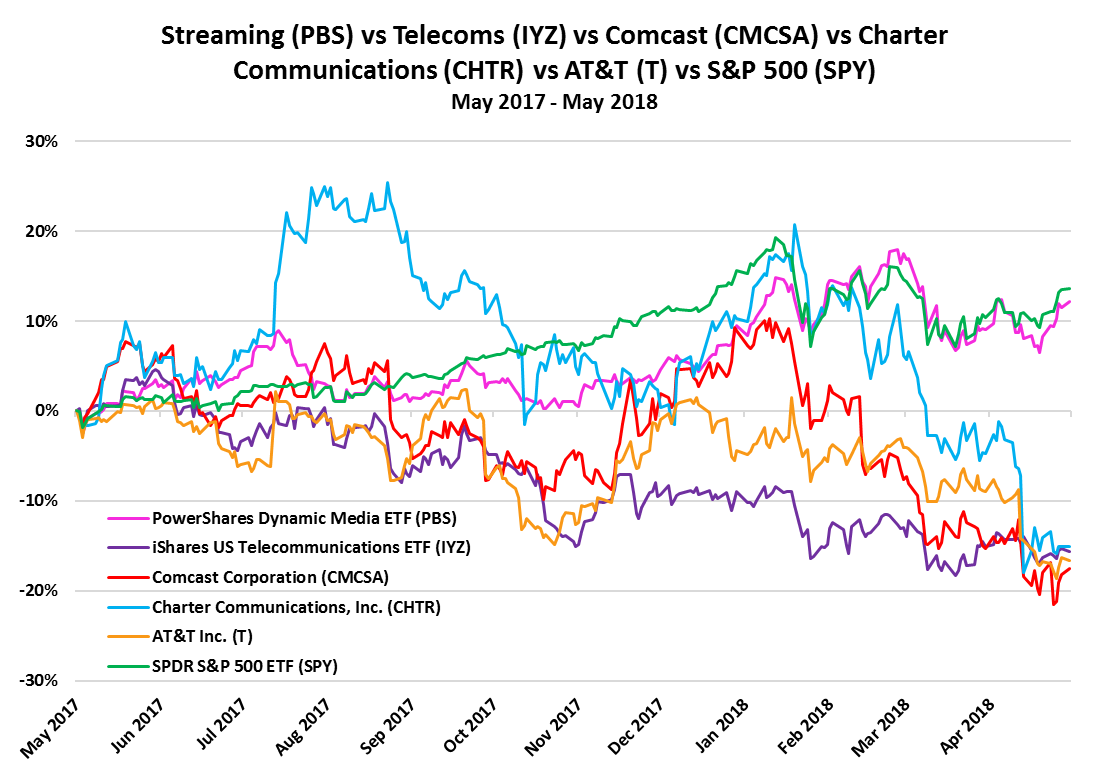

Investors can gain exposure to streaming services via the Dynamic Media ETF (PBS) and telecoms via the Telecoms ETF (IYZ). Some publicly listed cable companies that will be effected by the transformational changes in the multimedia entertainment market are Comcast (CMCSA), Charter Communications (CHTR), and AT&T (T).

HERE IN THE MEANTIME are some articles relating to this featured topic (the stories are summarized in the SERVICES section of today’s report):

- Cord Cutting – TV Industry Tests Limits Of Consumer Demand

- Cord Cutting – Why Traditional TV Is in Trouble

- Cord Cutting – Disney’s approach to streaming ESPN could determine the future of television

- Cord Cutting – Cord-Cutting Pain Spreads to High-Yield Bond Market

- Cord Cutting – IAB: Mobile drives digital ad spend to all-time high of $88B

CHART: Streaming (PBS) vs Telecoms (IYZ) vs Comcast (CMCSA) vs Charter Communications (CHTR) vs AT&T (T) vs S&P 500 (SPY)

OTHER DISRUPTIVE CHANGE:

- Markets:

- Volatility – How a volatility virus infected Wall Street

- Economics and Trade:

- Trade War – Trump orders U-turn over sanctions against Chinese telecoms group

- Politics and Policy:

- Iran – U.S. Ready to Impose Sanctions on European Companies in Iran, Bolton Says

- Finance:

- Blockchain – HSBC says performs first trade finance deal using single blockchain system

- Services:

- Cannabis – Jim Beam Heir Turns to Pot With Plan for a Cannabis Empire

- Retail – Amazon Doesn’t Have to Be Retail’s Worst Nightmare

- Technology:

- EVs – Electric Vehicles, Batteries, & Chargers Seeing Rapid Growth

- Commodities:

- Palladium – Palladium in Cars Set for Record on Demand From China

- Energy & Environment:

- Solar – California Rooftop Solar Mandate to Boost Sales 14% Over 4 Years

- Crops – Farmers Across High Plains Brace for Hard Times as Drought Bears Down

- Renewables – U.S. Renewable Capacity Soars

- Biotech:

- CRISPR – Feng Zhang and David Liu’s base-editing CRISPR startup officially launches with $87M

- Pharma – Pharma breathes easy as Trump’s drug pricing plan fizzles

- Endnote:

JOE MAC’S MARKET VIEWPOINT

- Joe Mac’s Market Viewpoint: The INFLATION COMPLICATION

- Joe Mac’s Market Viewpoint: A Review of MRP Themes

- Joe Mac’s Market Viewpoint: Beyond the HOUSING HEADWINDS

- Joe Mac’s Market Viewpoint: The Coming Value Rotation

- Joe Mac’s Market Viewpoint: Beyond the BOND BUBBLE

CURRENT MRP THEMES

|

Autos (S) |

Electric Utilities (L) |

TIPS (L) / Long-Dated UST (S) |

|

Defense (L) |

Industrials & Materials (L) |

U.S. Financials & Regional Banks (L) |

|

ASEAN Markets (L) |

Oil & U.S. Energy (L) |

U.S. Homebuilders & Construction (L) |

|

France (L), Greece (L) |

Palladium (L) |

U.S. Healthcare Providers (S) |

|

Gold & Gold Miners (L) |

Robotics & Automation (L) |

Video Gaming (L) |

|

Lithium (L) |

Steel (L) |

Value over Growth (L) |

About the DIBs: MRP focuses on identifying transformational change in the global economy and offering an investment thesis whenever an opportunity arises that has not yet been recognized by the market. The DIBs are MRP’s compilation of articles and data from multiple sources on subjects reflecting disruptive change that have potential investment implications for an industry or group of securities. We share these with our clients who may already have or may be considering exposure in the industries affected. The subjects change daily and constitute an excellent update on featured topics.

Fed Mester Supports Gradual US Rate Increases

The Federal Reserve should continue its gradual approach to raise interest rates given that inflation has not yet reached the target of 2 percent, Cleveland Fed President Loretta Mester said in a speech. “In my view, the medium-run outlook supports the continued gradual removal of policy accommodation; it seems the best strategy for balancing the risks to both of our policy goals and avoiding a build-up of financial stability risks,” she added. TE

Argentina Peso Slides to New Record Low

The Argentine peso touched a new record low of 24.70 against the USD at the opening of trading on Monday bringing the decline in the last 2 weeks to 18 percent amid doubts the central bank and the government will be able to handle stubbornly high inflation and current account deficit.

The central bank already raised rates by 1275bps to 40% since April 27th and has been using its reserves to stem the peso’s decline. On May 8th, the government announced it started talks with the IMF for financial aid bringing the fears of an economic and financial crisis similar to 2001-2002. TE

Euro Gains on ECB Villeroy de Galhau Comments

The euro rose 0.4% to $1.1987 around 12:30 PM London time on Monday after ECB policymaker Villeroy de Galhau said that guidance on the timing of a rate rise could precede the end of its bond-buying stimulus programme. TE

Coffee Hits 26-month Low

Coffee decreased to a 26-month low of 112.8 USd/Lbs. TE

Volatility – How a volatility virus infected Wall Street

On February 5, the mounting bout of market volatility suddenly shredded XIV, in a day so torrid that traders have since dubbed it “vol-mageddon”. The ETN had lost 94 per cent of its value and its manager announced plans to shutter the fund entirely. The collapse of XIV and two other similar funds exacerbated the turmoil, turning what could have been a normal, even healthy reversal into a terrifying slide. The US stock market suffered one of the swiftest 10 per cent slumps in history, and global equities lost $4.2tn that week.

Over the past six decades, volatility has come to dominate risk-management models across the finance industry. At the same time, a motley crew of academics and investment bankers have turned volatility itself into something that can be sliced and diced, bought and sold, just like any bond, stock or barrel of oil. This has arguably created a potentially dangerous feedback loop, one that makes markets even more prone to booms and busts. Despite its flaws, volatility-based risk management is the scaffolding upon which most of the modern investing industry is built; in practice, all derivatives involve an implicit bet on volatility.

The question is whether anything can or even should be done about it. Volatility’s dominant role in the financial system calls to mind Winston Churchill’s adage on democracy: perhaps it is the least bad of all the systems. Whether the volatility-trading industry is big enough to shake the $80tn global stock market is still up for debate. FT

Trade War – Trump orders U-turn over sanctions against Chinese telecoms group

Donald Trump has ordered the US commerce department to assist a Chinese telecoms group that the agency nearly put out of business a month ago, following a personal request from China’s president. The U-turn on ZTE Corp came despite a commerce department decision in April banning the manufacturer from sourcing vital components from US companies. A move that in effect put ZTE out of business, with the company announcing on Friday that it had halted operations because of the seven-year ban.

It marked the second time in the past month that the Trump administration had moved to roll back sanctions against a foreign company that had nearly been pushed into insolvency, raising questions over how thoroughly the White House was co-ordinating sanctions policy with federal agencies.

At the time, US officials said the case launched during the Obama administration was not part of Mr Trump’s escalation of trade pressure against Beijing. But during a meeting in Beijing earlier this month, Chinese officials raised a resolution to the ZTE case as one of their demands for a broader agreement on trade. s

ZTE last week suspended trading in its shares in Hong Kong and Shenzhen given the gravity of the US moves for the commercial future of a company that relied heavily on imported US chips and other components. FT

Iran – U.S. Ready to Impose Sanctions on European Companies in Iran, Bolton Says

National security adviser John Bolton warned Sunday that the U.S. is prepared to impose sanctions on European companies if their governments don’t heed President Donald Trump’s demand to stop dealing with Iran.

European officials have said they are looking for ways to help their companies escape the brunt of the U.S. sanctions. France’s foreign minister said Friday he had asked for exemptions or longer grace periods for the exit of French companies such as oil-and-gas giant Total SA and car maker Peugeot SA that have returned to the Iranian market since the 2015 nuclear accord.

In some areas, U.S. and European diplomats have some shared views on how to approach Iran, which could be carried over if there were a new agreement. In recent months, U.S. and European diplomats have agreed on ways to constrain Iran’s missile program and discussed how to strengthen inspections of Iran’s nuclear program.

Despite complaints in European capitals, European allies might agree to a new U.S. approach once they digest Mr. Trump’s decision and face the threat of sanctions. WSJ

Blockchain – HSBC says performs first trade finance deal using single blockchain system

HSBC has performed the world’s first trade finance transaction using a single blockchain platform, in a push to boost efficiency in the multi-trillion-dollar funding of international trade. HSBC and Dutch bank ING completed the deal for Cargill last week when a shipment of soybeans was transported from Argentina to Malaysia via the global commodities trader’s Geneva and Singapore subsidiaries. While there have been other trade finance deals that use blockchain in conjunction with other technologies, the Cargill transaction marked the first use of a single, shared digital application rather than multiple systems.

The use of blockchain technology in the banking industry is expected to reduce the risk of fraud in letters of credit (LoC) and other transactions as well as cut down on the number of steps used. The LoC process creates a long paper trail and takes between five and 10 days to exchange documentation. Putting all of Asia Pacific’s trade-related paperwork into electronic form could slash the time it takes to export goods by up to 44 percent and cut costs by up to 31 percent.

HSBC said the transaction was executed on a platform called Corda, which was developed by R3, a New York-based blockchain consortium whose members include more than 100 banks, regulators and trade associations. R

Cannabis – Jim Beam Heir Turns to Pot With Plan for a Cannabis Empire

With the end of what Ben Klover calls “Prohibition 2.0,” he is preparing to take Green Thumb Industries public in Canada. Prospects for the cannabis industry have never been greener as a majority of Americans now favor legalization. Twenty-nine states allow cannabis for medical or recreational use and sales are projected to reach $75 billion by 2030 from about $6 billion in 2016.

Kovler said he and Chief Executive Officer Pete Kadens, 40, hope to grow the business quickly before more U.S. markets open up. GTI operates 12 dispensaries in Maryland, Massachusetts, Nevada, Pennsylvania and Illinois, and has plans to expand to Florida. With products in more than 100 stores, the company’s revenue topped $20 million last year and should exceed $70 million this year.

Having closed a $45 million funding round this year, with backing from mostly U.S. investors, GTI is turning to Canada because the cost of raising capital there will be cheaper.

Takeovers in the Canadian market are accelerating as regulations ease up. Aurora Cannabis Inc., a Vancouver-based provider of medical marijuana, agreed to buy rival MedReleaf Corp. for C$3.2 billion ($2.5 billion). B

Retail – Amazon Doesn’t Have to Be Retail’s Worst Nightmare

Traditional brick-and mortar chains are starting to strike some innovative partnerships with their arch-competitor, turning to unconventional arrangements in the hopes of getting more shoppers back into their stores.

The clearest example of this is Kohl’s Corp., which has a pilot program underway in which Amazon shoppers can return certain items to select Kohl’s stores. Since the program has launched, traffic to Kohl’s stores that offer Amazon returns has been 8.5 percent higher than nearby stores that don’t offer that service. And importantly, stores that offer Amazon returns appear to be doing a better job of attracting customers that aren’t Kohl’s regulars. Amazon, meanwhile, gets help overcoming a key hurdle it faces as an e-commerce-based business: People tend to prefer making returns to stores.

Chico’s FAS Inc. has begun selling some items from its namesake clothing brand on Amazon, but it gives customers the option to return those purchases to Chico’s stores.

Sears Holdings Corp. announced that Sears Auto Centers would offer installation services to customers who buy tires on Amazon, with an option at checkout to ship the tires directly to a Sears location. B

Cord Cutting – TV Industry Tests Limits Of Consumer Demand

This year, an estimated 520 scripted series will be produced for broadcast, cable and over-the-top internet services in the U.S. That’s up 7% from 2017 and nearly 50% from just five years ago. Yet TV industry watchers say it’s only a matter of time before the market heads toward the backside of that peak. Eventually the industry will split into winners and losers as consumers comb through their multitude of choices and bundle their programming.

Most at risk are companies in the multichannel pay-TV business such as AT&T and Comcast. Some studios might abandon their own streaming TV services and return to supplying content for the remaining services. These players include the likes of CBS, Viacom, and Walt Disney.

Content production in the TV industry and consumption still are rising. In the U.S. last year, the average household paid for 2.04 streaming video services. That’s up from 1.79 the prior year. Netflix has the most viewers, followed by Amazon Prime Video and Hulu, and there are more than 200 over-the-top video services in the U.S. alone. Major streaming services are expected soon from Disney and Apple, crowding the field even more.

Meanwhile, penetration of multichannel pay-TV services among households with broadband has fallen below 80%, a seven-year low. Traditional pay-TV is very much in decline. IBD

Cord Cutting – Why Traditional TV Is in Trouble

Ratings are on the decline, especially among young people, some of whom don’t even own televisions. Advertising on TV has long been the best way for marketers to reach a large number of people at one time, but cracks are showing.

National TV ad sales peaked in 2016, when they exceeded $43 billion. Sales fell 2.2 percent last year, and it is estimated that they will fall at least 2 percent each year through 2022. Some of the decline could be mitigated through new business with platforms like Hulu, but it’s not yet enough to upset the decrease of traditional sales.

As TV ad spending has begun to drop, marketers have been diverting more money to tech giants like Google and Facebook. Companies love digital advertising because it gives them the ability to target ads based on their own lists of customers and profiles like “first-time car buyers.”

As networks navigate these changes, they are moving to reduce the number of ads they show. Ads, after all, make money, but they also annoy viewers. Both NBCUniversal and the Fox Networks Group have said they will trim the total time of commercials shown during some of their shows; Fox has announced a goal of reducing ad time to two minutes an hour by 2020. NYT

Cord Cutting – Disney’s approach to streaming ESPN could determine the future of television

Disney is going to collect some of the money that runs through its channels while building streaming ammunition in case a war with the bundlers ever happens.

That is why the recent launch of the ESPN+ streaming service in a new ESPN app are important in the continuing transformation of how video content is consumed. It is the first step in Disney’s role in supporting and helping solidify a new normal for how we will interact with our televisions: Taking the additional targeted “tiers” and other goodies that cable companies have traditionally offered and selling them directly to consumers in separate apps.

Cable companies and other providers are offering “skinny bundles,” mobile-friendly packages that offer fewer channels at a lower price. While many of those offer the same additional tiers as their larger predecessors, consumers are instead supplementing with Netflix or other streaming services, most of which are not the traditional content providers like Disney.

Disney has decided that a system of smaller bundles and outside additions is the future, buying a majority stake in streaming-technology company BamTech to deliver its own on-demand services. MW

Cord Cutting – Cord-Cutting Pain Spreads to High-Yield Bond Market

The consumer stampede to streaming media from traditional broadcasters is claiming an unexpected victim: high-yield bond investors. Telecommunications, cable and satellite companies have borrowed hundreds of billions of dollars in junk debt to build networks that would allow them to dominate their markets for decades to come. These companies comprise about one-quarter of the $1.25 trillion junk-bond market.

The proliferation of internet-based providers is upending that expectation, forcing investors to question the safety of bonds they bought from companies such as satellite broadcaster Dish Network, cable giant Charter Communications, and landline telecommunications company Frontier Communications.

Dish, founded by satellite tycoon Charlie Ergen, may be the canary in the coal mine of the new technological landscape. Junk-bond investors have lent his companies more than $30 billion over the past 25 years. Now they are dumping Dish bonds and buying record amounts of derivatives that insure against a default by the company, fearing that the industry’s rapid evolution is outpacing Mr. Ergen’s business strategy.

Some of Dish’s $16 billion of bonds traded Tuesday at around 82 cents on the dollar, and Dish credit-default swaps were the most heavily traded high-yield contract in the default derivatives market over the past three months. WSJ

Cord Cutting – IAB: Mobile drives digital ad spend to all-time high of $88B

Digital ad spend reached an all-time high of $88 billion in 2017 — a 21% increase over the previous year’s $72.5 billion. This marks the first time in the history of the IAB report that digital ad revenue has overtaken television.

Mobile claimed 57% of total ad revenues in 2017 and mobile spend increased 36% year-over-year to $49.9 billion in 2017 from $36.6 billion in 2016. Digital video also hit a record in 2017 at $11.9 billion, a 33% year-over-year increase from $8.9 billion in 2016. Video grew 54% to $6.2 billion on mobile devices, the first time mobile video revenues overtook desktop video.

Social media advertising rose 36% to $22.2 billion from $16.3 billion in 2016. Search reached $40.6 billion, an 18% increase over 2016. Banner advertising is up 23% to $27.5 billion — 67% came from mobile banners. Digital audio grew 39% to $1.6 billion.

Despite growing questions about how effective digital ads are, investments continue to pour into the space, with mobile as a standout channel contributing to that momentum. The IAB’s report is also in-line with other recent industry research around digital advertising’s continued, explosive growth. Magna’s 2018 advertising forecast predicts digital ad sales will reach $97 billion this year, and 60% of that is expected to come from mobile. MDive

EVs – Electric Vehicles, Batteries, & Chargers Seeing Rapid Growth

Electric vehicles are becoming more widespread. And it’s not just all the new plug-in options available today — EV batteries and charging stations are also proliferating around the globe. Tesla, one of the very early movers in the market, is still the best-selling EV brand in the United States.

The future of Europe’s carmakers depends on reliable supplies of cheap lithium-ion cells and at least seven big new ‘Gigafactory’-scale battery pack production plants are planned for Europe. While European automakers mull over plans, Tesla has leapfrogged the industry with its Gigafactory 1 in Nevada. As a result, Tesla’s partner Panasonic maintains the lion’s share – 33% – of the market for lithium-ion batteries.

Electric vehicle charging points, another key signifier, also show substantial growth over the past decade. The number of outlets has also grown as the technology has matured with 47,000 of them now scattered across the country, including 6,270 fast charging outlets. To put that into perspective, the number of charging points in the U.S. increased in 2017 by about 17.5%, which is more than 100 times what it was back in 2008. The fastest growth in this category comes from Tesla’s Superchargers (45%), CHAdeMO (30%), and CCS (23%). CT

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

*

* *

* *

*

Leave a Reply