We bring you our Daily Intelligence Briefing courtesy of McAlinden Research Partners. The report is provided to Hedge Connection members for free. Below is snapshot, login to view the full report. Not a member? Join today.

McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

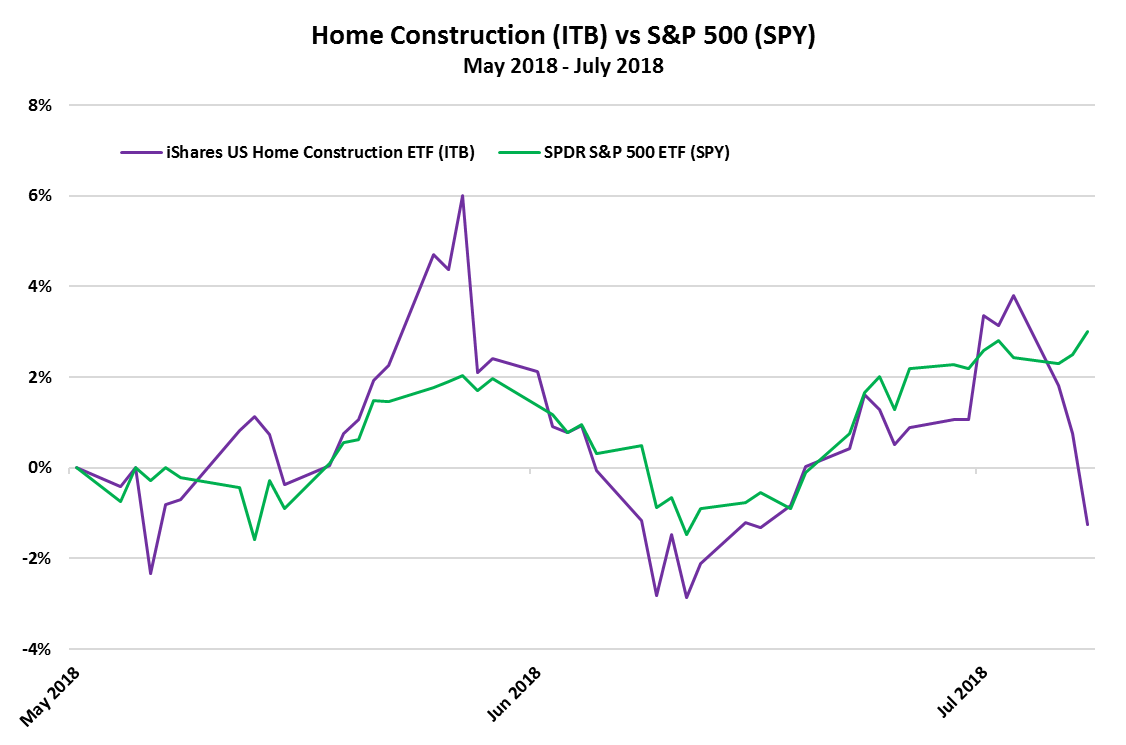

Today’s Featured Topic Homebuilders Losing Steam as Affordability Keeps Diving In late May, MRP closed its Long US Housing theme after a very strong 6-year run. The foremost reason for this closure was falling affordability due to excessive materials and labor costs, tightening inventory, and rising interest rates. In the two months since then, these issues have begun to weigh on the housing sector. The S&P Homebuilding Select Industry touched 10 month-lows on Wednesday, following a spate of bad earnings for companies including Owens Corning, Whirlpool Corp., and Beacon Roofing Supply Inc. The S&P Supercomposite Homebuilding Index retreated 3.3%, its fourth straight day of losses, with all 15 members in the red. Housing completions continue to hold their ground for now, but prospects for future weakness continues to manifest in planned construction. Housing starts declined 12.3% in June from the prior month. Residential construction permits, an indicator of longer-term direction, were 3.0% lower than the permitting pace of June 2017, a shock to analysts whose consensus estimates forecast an increase of 2.1%. New home sales tumbled 5.3% YoY below a downwardly-revised May figure to an annualized pace of 631K, the slowest in 8 months. The median price of new homes sold during the month was $302,100, 4.2% lower than in June 2017. Existing home sales also slipped 0.6% MoM and 2.2% YoY. However, median prices for exisitng homes rose 5.2% YoY in June, setting a new high of $276,900. Even with falling new home prices, the National Realtors Association’s Housing Affordability Index continues to drop towards its long-term average of 125, having declined from 195 in April 2012 to 141 currently. Slower buying has indeed freed up supply somewhat, as the inventory of homes reached 5.7 months of supply, the most in 10 months and up from 5.3 months in May. However, this may be a sign that the number of buyers are simply wearing too thin. According to the St. Louis Federal Reserve’s database, producer prices for lumber, as well as average hourly earnings for construction employees, have hit new all-time highs in 5 out of 6 months in 2018. Softwood lumber, largely imported from Canada, has seen prices increase at an especially steep pace due to 21% tariffs, which are inflating home prices by an average of $9000.This is has the effect of removing more candidates from the buyers’ pool since, for every $1,000 increase in the price of a house, 150,000 people are priced out of the market. ADP noted this week that the shortage of both skilled and unskilled construction personnel has pushed up their wages across the country by 7.1% over the last year, compared to a 3.0% average increase for all US workers. The rapidly climbing wages are indicative of a broader labor shortage in the US work force, but is also due to a wipeout of residential construction workers who went on to pursue other trades in the wake of the 2008 housing crisis. In February, MRP raised the possibility that higher mortgage rates, coupled with the Fed’s sustained tightening of monetary policy could boost home sales in the short-term, as prospective homebuyers would feel pressure to find a home sooner, before rates climb even higher. However, with 30-year fixed rate mortgages hitting 4.52% (down a bit from this year’s high of 4.66% in May), that boost has not materialized. Mortgage applications to purchase a home fell to the lowest level since May this week, while mortgage application volume was 12.6% lower than a year ago. While rising mortgage rates typically help slow price growth, lack of inventory and inflation have all but muted any alleviation. Further, it remains cheaper to rent than to own. Themonthly aggregate housing cost to the average American homeowner is currently $587, compared to only $516 for renters. Although sentiment is still positive among homebuilders, the luxury segment of the market is nearing saturation. That will force builders to eventually shift toward moderately-priced homes, which will eat at their margins. In the six years that MRP had long US Housing as a theme, the Home Construction ETF (ITB) returned 165% against the S&P’s 101% gain. Even since we closed the theme, the ITB has declined 3%, while the S&P has climbed 4%. We’ve also summarized the following articles related to this topic in the Construction & Real Estate section of today’s report.

|

|

Chart: Home Construction (ITB) vs S&P 500 (SPY) |

|

Other Disruptive Change

|

|

Joe Mac’s Market Viewpoint |

|

|

|

The Federal Reserve has said for years that it wants to get inflation in the U.S. back to 2% per year. Some indicators are already showing inflation rates higher than that. But, the Fed persists with its fixation on the core personal consumption expenditures (“PCE”) deflator as a superior measure. That number has been stuck below 2% since May 2012. The trend of the inflation data, however, may be changing soon. Joe Mac’s Market Viewpoint: CAPEX Booms! →

Other Viewpoint Reports Joe Mac’s Market Viewpoint: The Inflation Complication → Joe Mac’s Market Viewpoint: A Review of MRP Themes → |

|

Current MRP Themes |

|

|

|

|

Major Data Points |

|

|

|

1.

|

US Stocks Surge on Trade Concessions Wall Street closed deeply in the green on 25 July 2018, as strong earnings and reports that President Trump secured concessions from the European Union to avoid a trade war boosted investors’ confidence. The Dow Jones jumped 172 points or 0.7% to 25414. The S&P 500 climbed 26 points or 0.9% to 2846. The Nasdaq soared 92 points or 1.2% to a new high of 7932, ahead of Facebook’s earnings report. TE |

|

2. |

US Crude Oil Inventories Fall More than Expected Stocks of crude oil in the United States fell by 6.147 million barrels in the week ended July 20th 2018, following a 5.836 million rise in the previous week. It compares with market expectations of a 2.331 million decrease. Meanwhile, stocks of gasoline went down by 2.328 million barrels while markets expected a 0.713 million drop. TE |

|

3.

|

US New Home Sales at 8-Month Low Sales of new single-family houses in the United States declined 5.3 percent from the previous month to a seasonally adjusted annual rate of 631 thousand in June of 2018, following a downwardly revised 3.9 percent gain in May. It is the lowest rate since October, worse than market expectations of 670 thousand. Sales in the South fell sharply after hitting their highest level in nearly 11 years in May. TE |

|

4. |

US Mortgage Applications Fall for 2nd Week: MBA Mortgage applications in the United States edged down 0.2 percent in the week ended July 20th 2018, after declining 2.5 percent in the previous week, data from the Mortgage Bankers Association showed. Applications to purchase a home dropped 1 percent while refinance applications rose 0.9 percent. The average fixed 30-year mortgage rate was unchanged at 4.77 percent. TE |

|

5. |

UK Mortgage Approvals Hit 9-Month High: UK Finance British banks approved 40,541 mortgages for house purchase in June 2018, more than upwardly revised 39,528 in May but still down 0.9 percent compared with a year ago. The figure came in above market expectations of 39,100 and hit its highest level since September 2017. TE |

|

Other Disruptive Change |

|

|

There is much more to this report! McAlinden Research Partners offers Hedge Connection members weekly access to the Daily Intelligence Briefing research for free – click here to view. (You must be logged in first). Not a member? Join today. McAlinden Research Partners is currently offering a complimentary full month subscription of the DIB. Activate yours today – http://www.mcalindenresearchpartners.com/hc-trial.html

|

Leave a Reply