Contributed by Keith Amchin, CPA & Portfolio Manager for Thinkshop Advisors LLC

As societies continually modernize over time, the world is steadily becoming more advanced and connected. The expanding global middle class has increased resources, opportunities and the desire to travel and enjoy leisure activities. Improvements in health and life expectancy enable increased mobility and the capacity to participate. This trend has been evidenced by the relentless growth of cruising, casinos, theme parks and sporting events, and is truly an enduring global phenomenon. It is a movement that can continue unabated for many years to come.

Globalization, the media and the internet, have universalized entertainment. For example, Disney has spread theme parks across the globe. Casinos have expanded from Las Vegas, to Macau and beyond.

Cruise ships travel to and depart from virtually everywhere on earth. And then there is the sports category, which is unique unto itself. Many sports have local followings and origins, but they have started to expand their global reach. The NFL played 3 games in London in 2018 (and has since 2007) and 1 game in Mexico City. The NBA played their ninth regular season game in nine years in London in early 2019 and 2 preseason games in China in 2018. At the start of the 2018-19 season the NBA announced that they have 108 international players from 42 countries on opening night rosters. With the internet and media streaming, and players and fans from every conceivable corner of the world, the NBA is truly an emerging international spectacle.

Within the entertainment category, the public investment opportunity for sports is limited. There is Manchester United PLC (MANU) which owns the renowned UK soccer team and has related branded licensing rights. There is also the Liberty Braves (BATRA) which holds the Atlanta Braves baseball team and a real estate development project called Battery Atlanta around the team’s stadium. And then there is the best and most diversified sports and entertainment opportunity of all– Madison Square Garden.

Madison Square Garden:

Madison Square Garden (MSG) is the publicly traded leader in sports franchises, entertainment venues and entertainment. The company has a long history of investing in entertainment properties that offer steady and organic growth. Historically, sports franchises have offered impressive capital gain opportunities. We believe that MSG is no exception. Is MSG a slam dunk?

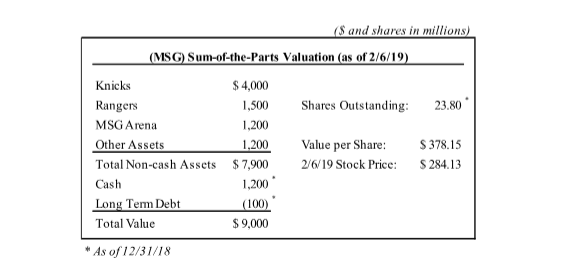

MSG has highly valuable assets and its discount to private market value is not currently being recognized by the market. We believe our sum-of-the-parts valuation will prove that this stock is highly undervalued. We view the size of the valuation discrepancy, and the irreplaceable nature of its trophy assets, as providing an extraordinary margin of safety for the investment.

The inflation-protected, hard asset value of its real estate and sports properties provide enviable downside protection. There are several potential catalysts in place: capital reallocation transactions, NBA/NHL ownership changes and Dolan family led corporate events (examples: AMCX and the first MSG spin). We believe shares are currently worth a minimum of $375-425 (approximately 30-50% upside to the present price of $284) and expect the valuation disconnect to close, as investors digest the value of its assets and realize the high likelihood of management unlocking these values.

The significant assets of MSG are: the NY Knicks $4 billion (Forbes valuation), the NY Rangers $1.5 billion (Forbes valuation), Madison Square Garden arena $1.2 billion (approximate book value) and Cash on hand $1.2 billion. Other assets of note include the LA Forum arena, air rights for Madison Square Garden, Radio City Music Hall/The Rockettes and the Tao Group of restaurants and nightclubs. These other assets are valued conservatively at $1.2 billion. Therefore, total assets for MSG overall are $9.1 billion, with only $100 million of long-term debt. With 23.8 million shares outstanding, each MSG share is worth nearly $380 per share.

And additionally, there are plenty of potential valuation kickers to salivate about:

Sports betting:

Sports betting has the power to provide leverage to the value of the MSG owned sports franchise properties and the MSG owned arenas. Sports betting will increase interest and viewership in team sports as well as create advertising, arena signage and fee income revenue opportunities. Upon the 2018 state legalization of sports betting by the Supreme Court, Mark Cuban owner of the Dallas Mavericks said: “I think everyone who owns a top four professional sports team just basically saw the value of their team double.” New Jersey has quickly legalized sports betting and New York is anticipated to follow in 2019.

Penn Station/Hudson Yards development:

The real estate development projects around MSG, (including a potential Penn Station renovation,) can only serve to enhance the valuation of the arena and its associated air rights.

Improved sports franchises/playoff games:

The Knicks (MSG’s most valuable asset) have repositioned the team for the future with a major trade of their injured star player Kristaps Porzingis. This stunning trade opened up major “cap space” for acquiring established talent, as the Knicks now have the financial flexibility to sign two max free agent “superstars” beginning July 1, and catapult their future prospects. With the NBA’s worst record at the present time, the Knicks will have a highly coveted pick in the upcoming college draft, and will have a shot at adding another exciting and transformational player to their roster. The excitement around the Knicks seems likely to elevate the value of the franchise. Playoff games (which are lucrative schedule additions) may finally return after a long term absence.

Investment from Silver Lake Partners:

Silver Lake has taken an investment position in MSG, and steadily increased its position to 8.4% of the outstanding shares. They believe the shares are undervalued, and have stated that they would like to support the company and its efforts to create long-term value. Silver Lake could be a valuable facilitator in any value enhancement transaction.

MSG Sphere arenas:

The company is developing technologically advanced 18,000 plus seat arenas in Las Vegas and London that are expected to be ready in 2021-2022. This ambitious and unique project intends to feature state of the art sound systems and digital technologies that excite audiences and revolutionize the performance arena experience.

Spin Transaction into a Sports company and an Entertainment company:

The Board of Directors of MSG has approved a spin of the company into two separate entities—a sports company and an entertainment company. This transaction is anticipated to occur by year end 2019 and should result in a higher sum of the parts valuation, due to assets being easier to value on a stand-alone basis and as a result of some savvy financial reallocations.

As you can see, the unique combination of, limited opportunity “trophy” properties, (with a history of steady appreciation in fair market value,) the globalization of sports and entertainment plus exciting next wave growth opportunities makes Madison Square Garden a first team all-star and a “slam dunk” of an investment.

Thinkshop Advisors LLC, founded in 2014, is a New York State Registered Investment Advisor and an independent investment management firm headquartered in Melville, NY, located 30 miles from New York City. Thinkshop Advisors offers equity long-short strategies through private placements, separately managed accounts and managed retirement accounts.

Leave a Reply