|

Though China continues to struggle with reviving its equity markets and domestic economic growth, that hasn’t slowed Beijing’s diplomatic onslaught in the middle east, which has focused heavily on expanding its international commerce with the Kingdom of Saudi Arabia. New initiatives aimed at expanding foreign investment in each nation have focused on energy ventures and the reach of the countries’ financial institutions.

Earlier this year, MRP detailed a Chinese-brokered settlement between Iran and Saudi Arabia, in which both countries – each major suppliers of energy products to the Chinese market – agreed to re-establish formal relations and end seven years of severed ties and political disassociation. That followed a Riyadh summit attended by the Crown Prince and Prime Minister of Saudi Arabia, Mohammed bin Salman, and Chinese President Xi Jinping in late 2022, which heralded the signing of 30 investment agreements between Saudi and Chinese companies worth roughly $50 billion.

China is already Saudi Arabia’s largest trading partner and further economic integration could drag the kingdom even further away from western influence, which has waned in Riyadh for several years. Softening Saudi Arabia’s ties to North America and Europe would allow China to secure a significant foothold in its ongoing de-Dollarization drive. Even prior to its recent ascension to membership status among the BRICS coalition, which was originally a grouping of Brazil, Russia, India, China, and South Africa, Saudi Arabia had reportedly begun considering the creation CNY-denominated futures contracts, known as the Petroyuan, in the pricing model of Saudi Aramco – the world’s largest oil and gas producer by market cap. The outstanding Petrodollar system, which dominates the global oil trade, denominates international crude revenues in USD.

Some BRICS members have already begun facilitating cross-border trade in local currencies, including India, who recently purchased crude oil from the UAE and paid in Rupees for the first time ever. ING notes that the simultaneous admission of oil and gas exporters Iran, UAE, and Saudi Arabia to the BRICS grouping “will inevitably focus debate on the use of non-Dollar currencies in trade”.

Back in March, MRP noted that Aramco announced a sizeable 10% stake in privately controlled Chinese refiner Rongsheng Petrochemical Co Ltd for about $3.6 billion. That followed news of a separate joint venture with two other Chinese companies to build a new $10 billion refinery and petrochemicals complex in China’s north-east with a capacity of 300,000 bpd. The addition of new refining capacity will likely be a boon for Aramco in years to come as the International Energy Agency (IEA) has projected that petrochemicals will account for more than a third in oil demand growth by 2030, rising to 50% of demand by 2050 as transport electrifies.

Cooperation between the two nations in alternative energy markets has also been boosted this month by Saudi Arbia’s Acwa Power Co announcing plans to begin operations in China next year. Acwa is a key developer of solar, wind, and hydrogen energy infrastructure and an entrance into China, which leads the world in installed solar capacity, will compound billions of Dollars’ worth of projects already financed in its domestic Kingdom. In turn, Bloomberg reports that China-based solar sector supplier GCL Technology Holdings Ltd. is in advanced talks with Saudi Arabia regarding the opening its first overseas factory. The world’s second-largest manufacturer of polysilicon will likely look to become a key supplier for the massive desert-based solar projects that Acwa is already working on.

Perhaps the most consequential energy project in Saudi Arabia that could soon be impacted by improved Chinese relations is the construction of its first nuclear power plant. Riyadh originally sought out US companies as to bolster its civil nuclear capabilities, but demanded that the Kingdom have no restrictions on the enrichment or mining of its own uranium. The Financial Times reports that the US was preferred as a partner, since it is perceived to have superior nuclear technologies than other nations, yet Washington has objected to potential nuclear proliferation in the Kingdom. As negotiations between the Saudis and Americans fizzled, state-owned China National Nuclear Corp. (CNNC) submitted its own bid to build a nuclear plant in Saudi Arabia’s Eastern Province.

The CNNC bid may be 20% cheaper than competing offers from South Korea’s Kepco and France’s EDF, and Chinese government is unlikely to require the same nonproliferation clauses that the US has demanded, which could be key to them sweeping the nuclear deal out from under the US. The Wall Street Journal reports that Mohammed bin Salman is prepared to move ahead with the Chinese company soon if talks with the US fail to advance.

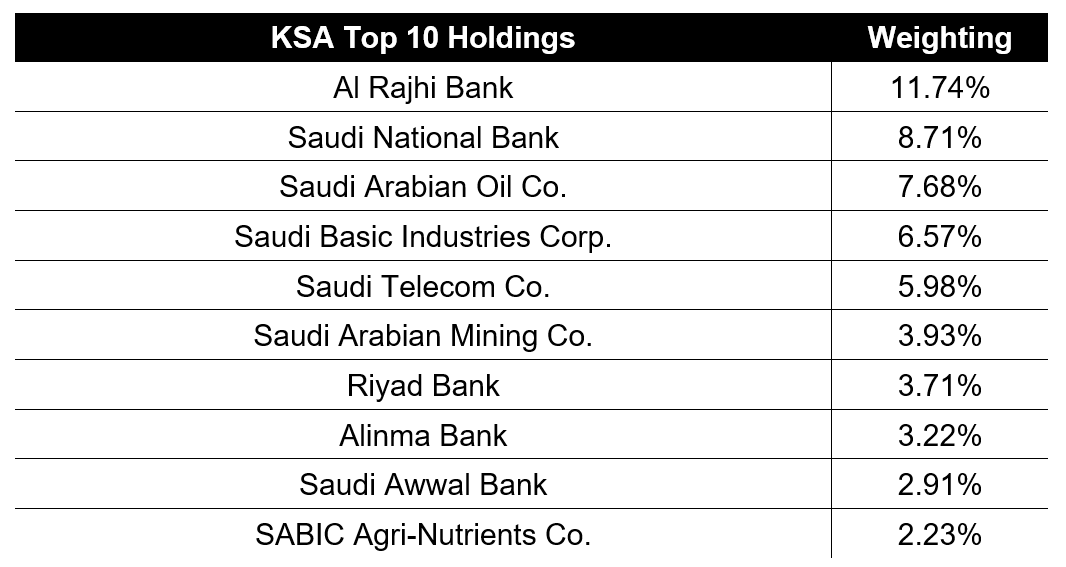

Though the energy sector is clearly the number one priority for cooperation between China and Saudi Arabia, they’re also expanding financial ties. Early this week, The Saudi Tadawul Group, which owns the Saudi stock exchange Tadawul, and the Shanghai Stock Exchange signed a memorandum of understanding (MOU) to “explore ways to work together on cross-listing stocks, fintech, exchange-traded funds (ETFs) and data exchanges.” That move coincided with the Bank of China (BOC) opening a brand-new branch in Riyadh, becoming just the second Chinese bank to open in Saudi Arabia after the Industrial and Commercial Bank of China (ICBC) opened their own branch in 2015. ICBC expanded its presence in the Kingdom last May, opening a branch in the city of Jeddah.

|

Leave a Reply