Contributed by Kevin Parks, Chief Investment Manager of Parks Capital Management

Community Banks: Hidden in Plain Sight

The community banking sector is a crucial driver of the domestic economy. Of the nearly 6,000 U.S. banks, more than 9 in 10 are classified as community banks(1). These institutions mirror the micro economies they serve, providing capital and opportunity to small businesses and entrepreneurs that larger banks underserve. Despite their obvious importance locally and nationally, few investment vehicles exist to invest in community banks. For many investors, the opportunity set is simply too small, and the lack of buy- and sell-side support fosters a void in consensus opinion.

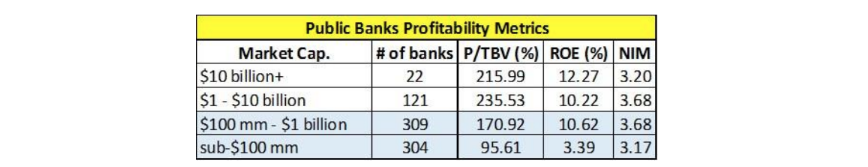

While a majority of the true community bank universe is privately-held, the publicly-traded universe skews towards smaller companies. These banks do not command the headlines that larger peers do, despite producing comparable earnings profiles and superior growth metrics. Four banks may possess half of the U.S.’s banking assets and deposits, but community banks are less complex, more transparent, and will benefit from rising rates more so than any financial institution.

Small-Cap Banks: The Unloved

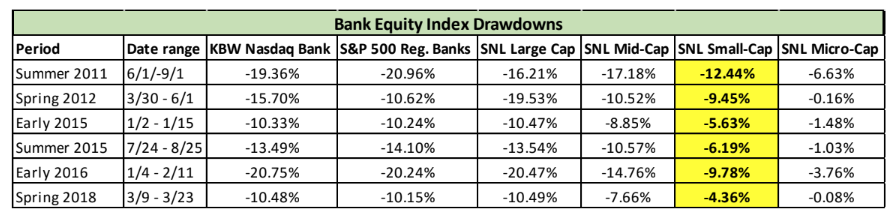

Often, lesser-known segments of the capital markets will be significantly mispriced for reasons unrelated to the fundamental quality or performance of a company’s underlying business. In the banking sector, the valuation disconnect between small-cap banks and their larger peers is 25-30%(2), compensating investors for any illiquidity in those companies’ shares. The valuation discrepancy is a source of upside potential as well as downside support. Over the years, small-cap community banks have consistently outperformed the overall sector in periods of market volatility. Institutional investors largely ignore small-cap community banks, as it is difficult to allocate substantial capital on an individual name basis. Further, community banks are not meaningful components of most sector-focused indices or ETFs, making it even more difficult for investors of any size to access this investment theme. This is both a blessing and a curse, as massive inflows to passive investment funds disproportionately benefit larger banks’ share prices when markets rally. This dynamic works both ways, though: PCM analysis observes that, in the last seven years, when big bank indices have sold off more than -10%, the small-cap sector has outperformed by a median of approximately 600 bps.

Small-Cap Alpha: Deeper Dive

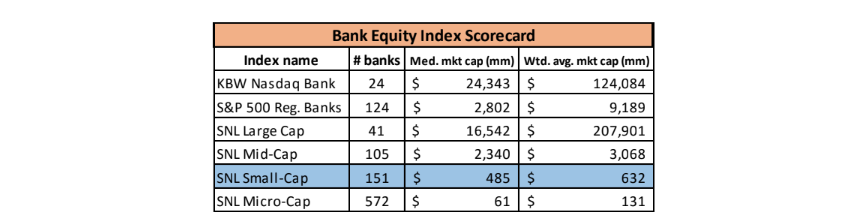

To explain why small-cap community banks tend to outperform, let’s step back to examine the inputs used in this analysis. For this study, we used six bank-focused indices. The KBW Nasdaq Bank and S&P 500 Regional Bank are the only two which are accessible to investors via ETFs (tickers: KBWB and KRE, respectively). The four SNL indices are merely reference points, created by S&P to track the overall performance of public banks in those market cap segments.

It stands to reason that in times of stress, technical selling will tilt towards the larger, liquid banks and the ETFs which hold them. In almost all the drawdown periods, macro events triggered sell-offs in the respective indices. Community banks have virtually no direct exposure outside of the U.S., so short-term international blips and harsh geopolitical rhetoric have even less relevance on long-term intrinsic values.

Directionally, the SNL indices are good gauges of publicly-traded bank equity performance within each market cap designation. Like most indices, SNL’s are market cap weighted, and that explains the divide between median and weighted-average market cap. And while the performance of microcap banks may seem especially intriguing, even the small hypothetical ownership SNL’s index applies would be difficult to accumulate, since most are not exchange traded.

Conclusion: Finding a Pure Play

The thesis of this white paper is that small-cap community banks outperform larger peers during sell-offs, and that’s part art, part science. Market data support this, and going forward, the prominence of ETFs and other index-tracking investment funds could exacerbate this trend. With equity markets at all-time highs, investors may gravitate towards strategies with low correlation in both directions.

(1) Source: FDIC’s Quarterly Banking Profile

(2) Source: S&P Global Market Intelligence, Parks Capital Management research (both those sources apply to all tables/charts, as well); Data as of 9/24/18

About Parks Capital Management

Parks Capital Management is an SEC-registered investment adviser which manages a long/short equity fund focused on small-cap, publicly-traded community banks. As of August 2018, it also serves as sub adviser to certain funds managed by Atlanta-based Angel Oak Capital Advisers. Kevin Parks is Founder & Chief Investment Officer of Parks Capital Management, which launched its fund in August 2016. He graduated from Syracuse University with a degree in Finance and received his M.B.A. from New York University’s Stern School of Business. Kevin also serves on the board of directors of Tuesday’s Children, a charity which provides programs and services to all those directly impacted by the events of September 11th, 2001.

Leave a Reply