The following post is courtesy of Diane Harrison who is principal and owner of Panegyric Marketing, a strategic marketing communications firm founded in 2002 specializing in alternative assets.

As inflation pressures continue to roil the traditional financial markets, it seems a great time to remind investors just why alternatives can provide a stabilizing effect on portfolios. Alternative investments have the potential to perform exceptionally well during inflationary periods, as many of them are consumer- necessary regardless of prices, such as certain foodstuffs and crops, oil, as well as things such as shipping and infrastructure.

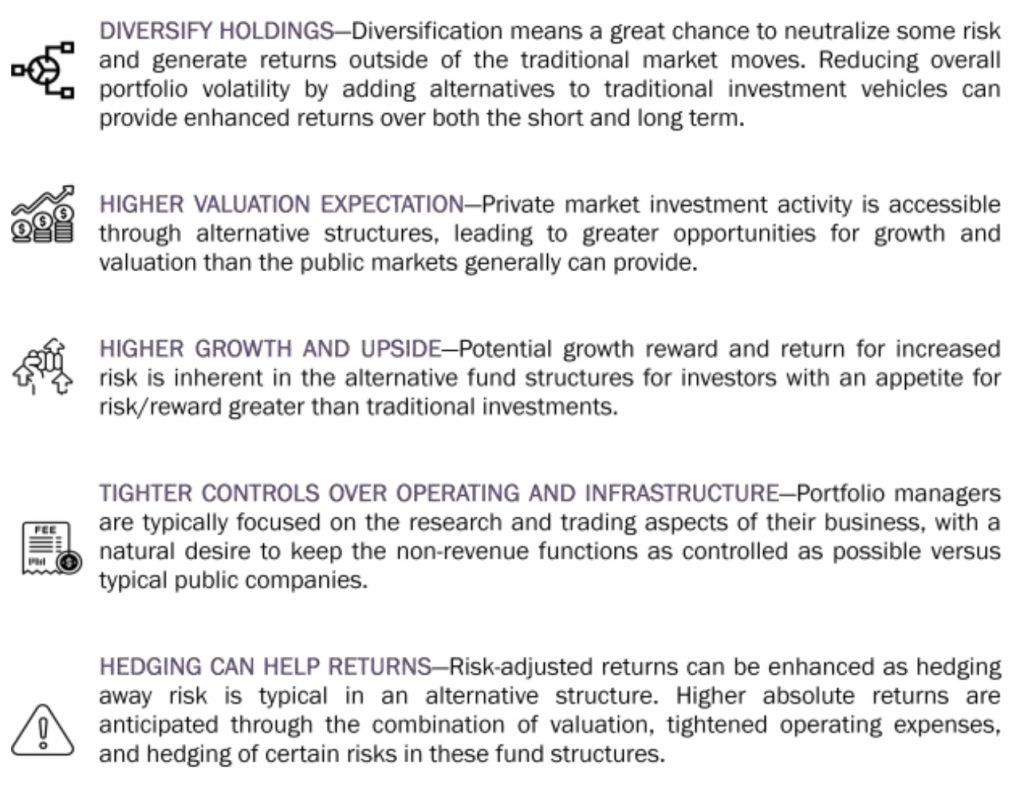

Last fall, Forbes.com ran an article that did a nice job reinforcing the value that alternative assets can bring to a strong portfolio allocation process. Summarizing the article’s key points, here are 5 solid reasons alternatives should play a significant role in your overall portfolio allocation strategy.

While inflation is never an optimal situation for most economic forces, it bears repeating that people will still require heat, food, housing, and travel regardless of the state of inflation. Utilization will be modified and spending habits altered, but food, utilities, gas, and water will be consumed. Transportation will likewise have to transport materials and people around the globe on a daily basis.

Selecting alternative assets that can capitalize on the usage of these types of investments can work to neutralize the impact inflation surely will play on the traditional assets in your portfolio.

Leave a Reply