The following article was contributed by Adam Kay of Kay Financial Solutions.

With a shortage of “good help” already in the workplace, the supply potentially even less in future years as the Boomers all retire. The diminishing workforce, coupled with increased competition from other employers, makes attracting and retaining of key personnel even more crucial and challenging. The general population has at the same time become increasingly concerned with benefits such as healthcare and retirement accounts amidst market volatility and growing doubt of government funded programs like social security. Despite this, many employers also faced with growing costs to provide said benefits have gradually scaled back on what they do provide or subsidize. While a black and white analysis of the numbers may warrant these benefit reductions today, the long-term ramifications may be accomplishing exactly the opposite.

Employee turnover rates across industries have only increased in the last few decades. Gone are the days of staying with one company for 20-30 years and retiring with a pension. This has resulted in higher costs to train and retrain new hires, eating up much of the savings “earned’ by reducing employer sponsored benefits. It also means the dilution/dissemination of proprietary information and processes with the departing employees. Loyalty, intellectual property and employee satisfaction are much more difficult to quantify than other previously mentioned expenses on a balance sheet. When it comes to distinguishing a firm from the competition and overall profitability however, they may be far more valuable than anything previously highlighted in the long run.

What is Non-Qualified Deferred Compensation?

Non-Qualified Deferred compensation plans; Even as I read it I can almost picture some attorney sitting across my desk looking back condescendingly. Broken down, deferred compensation is just pay that is not received until a later date. The most common type comes in the form of a 401k match. For most the first thing that pops into their minds when thinking of future income, or more specifically retirement income as it relates to their employment, is 401k. For simple comparison this is an example of a Qualified plan. In most cases the term qualified when it pertains to employer sponsored retirement plans means it falls under the watchful eye of ERISA and as such must be at least offered to all full-time employees. Non-Qualified in this definition allows plans to be specific for certain employees.

Brief history of the 401k.

Since the revenue act of 1978, when the 401k was created in an effort to place much of the retirement income burden on the individual, it has been the prevalent type of plan offered from many small businesses to the goliaths on fortunes top 100. In the last decade there have been several amendments to the 401k. More specifically recent legislation pertains to the oversight and administration of these plans. The rationale has been to place a more “paternal’ obligation on the sponsoring employer. With the pension protection act and even more recently the DOL rulings, the idea now is to hold plan sponsors or at least the advisors who administer these plans to a higher standard of fiduciary responsibility. Previously there was simply a bare minimum suitability requirement. The spirit of this intent has also led to the creation of what is generally referred to as target date funds. Funds which target a retirement date close to the participants anticipated retirement date and as it approaches the fund gradually becomes more conservative with holdings. Conceptually at least putting even the most ignorant of an investor on the risk tolerance path widely accepted by those more educated on the subject.

Problems with the 401k…

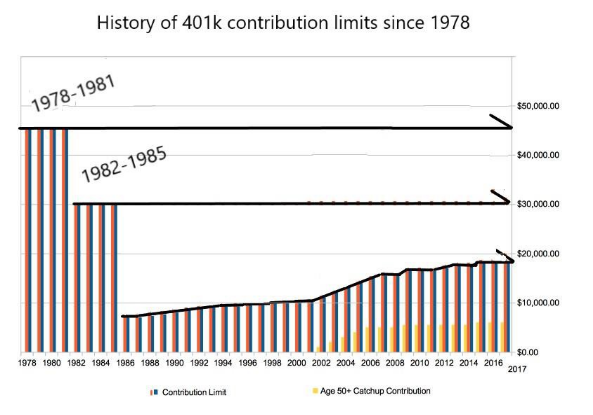

While overall the methodology and new oversight may help the masses with more prudent options for their portfolio, it does nothing to address the potential gap or shortage of retirement funds that will prevent many from retiring comfortably. This is partly a result of the limits imposed on allowable contributions. Since 1986 they have actually more than doubled yet today they are still set at less than half the contribution limit allowed when created. Currently 18,000 for most represents the max contribution allowed, down from almost 50,000 at the inception of 401k plans. The following graph shows how significant the contribution limits have changed over the years.

Even with these lower limits, many still don’t maximize them. Resulting in an account balance at retirement which likely will not support the quality of life most would hope for. Even higher is the income disparity for those in higher income brackets max contributions or not. Worse still are those attempting to contribute more yet sent back contributions when their plan fails certain testing requirements. Put simply the lower income employees have not contributed enough and the plan has become over weighted with larger contributions from a select few. The requirements attempt to equalize this “top heavy” plan by sending back certain individual’s contributions. For these individuals even though the balance at retirement will in most cases be larger than the “rank and file” employee, it will be from a percentage standpoint even less as it compares to their pre-retirement income. This is a function not only of the static limitations on the contribution limits of 401ks but also anti-discrimination rules as they pertain to Qualified plans. Qualified plans or employer sponsored plans are governed by ERISA, annual filings and especially in recent years increased oversight and compliance regulations.

How is non-qualified deferred comp different?

IRS section 409A covers NQDC Plans that are non-qualified or not subject to ERISA and associated regulations. These plans offer far more flexibility and can be used in conjunction with qualified plans like 401k’s while not affecting each other. Non-qualified in other contexts can refer to investments that are not tax deferred such as bank accounts or non-IRA brokerage accounts. To the contrary in this case there are several non-qualified investment vehicles that do enjoy the benefit of tax deferral. These can be utilized on an individual basis yet one important distinction of a properly set up non-qualified deferred compensation plan is in addition to the tax deferral, there is no current income taxation on the amount deferred until distributed from the plan later. In other words, they can be funded pre-tax. An additional benefit of section 409A plans is there are no defined contribution limits. The contribution limit instead can be paraphrased as to what the IRS deems to be reasonable compensation for the industry. Allowing significantly larger contributions than any other “group” retirement plan. Key also is since they do not fall under the umbrella of ERISA and other qualified plans, the sponsor can “discriminate”, or select certain employees to include without the requirement for a blanket contribution to all other full-time employees.

Other Pros?

From a participant standpoint and from a employer standpoint NQDC plans can be as equally beneficial for tax benefits and the padding of retirement income sources. From an employee standpoint the benefit should be obvious. Potential for exponentially larger retirement income savings then with 401k’s or other alternatives, usually funded by the employer. From an employer standpoint the benefits, other than the corporate deduction, can be significant in many less direct areas. Several slang terms to describe the concept exist which are telling as to the ancillary benefits of these plans. The phrases Golden – handcuffs or simply fringe executive benefit plans or executive carve-outs. Said another way this section of the code allows for companies to reward or incentivize certain employees from the rest while differentiating themselves from competing employers. These rewards have an obvious benefit from a recruiting standpoint, standing out from firms that don’t offer such perks. They can help retention also as many sponsors choose to incorporate vesting schedules. This makes it harder for an employee to change firms knowing they will forfeit large invested amounts and potentially years of retirement income. Additionally it allows the recouping of previous contributions for employees that sever service before a designated time period. These recovered funds can help offset the cost of hiring and re- acclimating the employee’s replacement. The flexibility of who are included can also be used to reward employees for length of service. For example, only those employed for 5 or 10 years or more can be included. No set or defined contribution limits of course add yet another level of flexibility that can be enjoyed with non-qualified plans not available in other group plans. An attractive feature for still others concerned with volatility in traditional mutual fund based or more and more frequently indexed funds is the ability to utilize non-market correlated assets for some or all of the funding. These include both structured guaranteed products and debt instruments as well as various fully insured options to hedge not only market risk but also corporate liability and health/mortality risks.

Cons?

As a result of the increased specialty and the fact that while not regulated by ERISA, the IRS can focus a watchful eye on these types of arrangements. They typically have higher startup costs then 401ks yet less on -going costs. There are no annual filings of a 5500 as with a 401k however there is an extensive plan document that must be written and recorded in Washington. The document details obligations of all parties and timing and specifics of distributions from the plan etc. Quite often some type of trust is established to shelter the assets involved or at least offer some separation to that of the general creditors. With less insulated plans they can be fully at the risk of creditors and litigants of the parent corporation. Something that qualified plans like 401k’s are not subject to. In its simplest form a NQDC plan is just a promise, granted in writing, by a company to pay an employee a set amount at a future date. The obligation falls on said corporation and not with a pension guarantee fund as with other qualified defined benefit plan options. Go with one of those however and again you are subject to discrimination rules governing traditional group plans. In addition, with most defined benefit plans, like those falling under section 412 of the IRS code, mandatory contributions and mandated investments apply over set period of years. If not complied with, The IRS can retroactively disallow previous years contributions, putting the company and employees in a very difficult tax situation. Multiple professionals should be consulted to insure compliance with the regulations that do exist when setting up any type of employee retirement plan

Wrapping up…

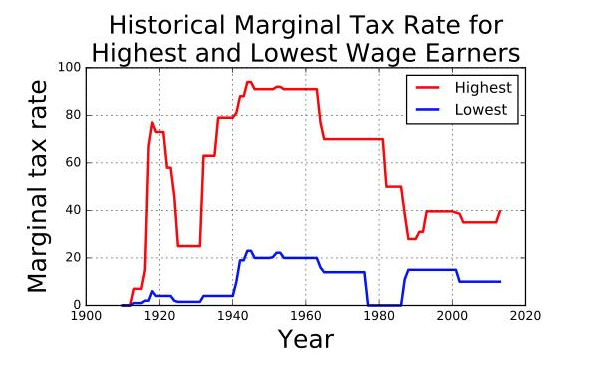

In summation, even the most “wet” behind the ears accountant will tell you tax deferral is a good thing from a wealth accumulation perspective. Add in the various qualitative benefits to employees and employers mentioned, many would agree these combined help the pros outweigh the cons. It used to be the norm to stay at one company for 20-30 years. Present day, the feeling is if you haven’t moved around a few firms, future employers will question your merit. Retention is growing even more difficult with the grass is always greener mentality prevalent. To maintain intellectual property, create incentives from hiring to length of service to rewarding loyalty, all with a deduction to the parent company and the ability to mediate turnover costs via recouping of past employee compensation should they leave unexpectedly; Non-Qualified deferred compensation plans are experiencing a resurgence from the heyday’s of the pioneers in the 1950’s who struggled with some of the highest tax rates we’ve seen in US history. The chart below gives a fairly clear picture of where we are on the “tax scale” with the perspective of the last 100 years. The question is, where we go over the next hundred.

Leave a Reply