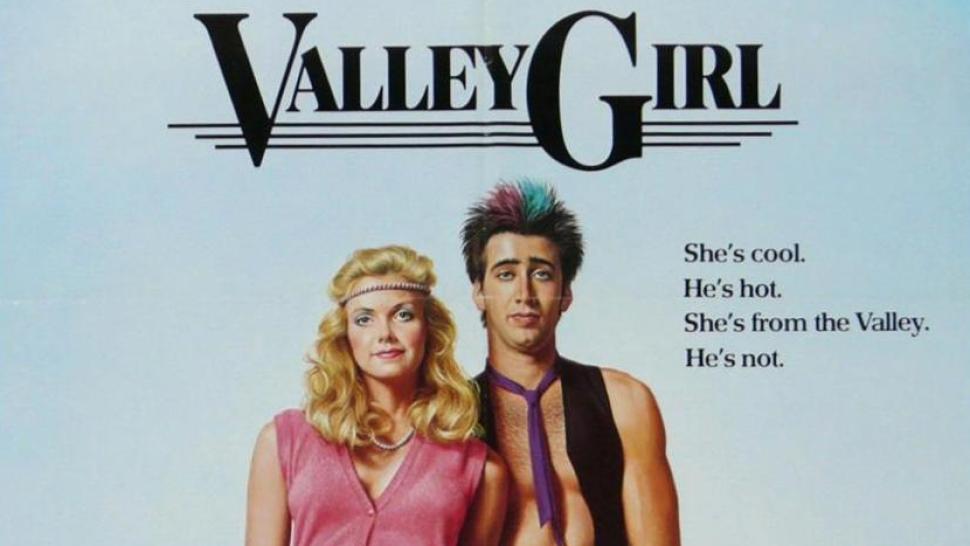

I was roughly 13 years old when I fell for Nicolas Cage in Valley Girl. Between the Modern English montage of soda sharing and late-night phone calls (on corded phones and pay phones!) and the bitchin’ clothes and slang, my tweenage heart sang just a little for Hollywood punk Randy. In fact, if not for that movie, I doubt the phrases “Tubular!” and “Gag me with a spoon” would have ever made an appearance in my semi-rural Alabama hometown, even if the latter is what Northerners often think out loud when trying grits for the first time.

Although American slang has come a long way since 1983, I do still find myself using the phrase “gross me out!” on occasion. Weirdly, I almost never say it in reference to Martha Coolidge’s marvelous flick, but it does pop up in conversations with asset managers from time to time.

That’s right, if you’re a fund manager who has marketed your separate account, hedge fund or other offering, there’s a reasonable chance your pitch book might have barfed me out. Why? Gross returns, y’all. And I’m not talking about actual performance losses.

So many fund managers continue to show gross returns in their pitch books, and it makes me want to yell “Grody to the max!” during many a manager’s pitch.

Per GIPS standards gross-of-fees returns are “the returns on investments reduced by any trading expenses, including transaction expenses for real estate and private equity incurred during the period” while net-of-fees returns are defined as “the gross-of-fees returns reduced by investment management fees (including performance-based fees and carried interest).” GIPS goes on to say in another memo that “because fees are sometimes negotiable, presenting gross-of-fees returns shows the firm’s expertise in managing assets without the impact of the firm’s or client’s negotiating skills. Accordingly, firms are recommended to present gross-of-fees returns.”

Bag. Your. Face.

Look, I know I’m no one and GIPS is, well, GIPS. But seriously? It seems to me that showing net returns is the best measure of investment prowess since it proves you can (or can’t) both execute your investment strategy AND I dunno, put food on the table and pay your office rent, too.

Also, gross returns aren’t what an investor can actually attain in your fund since, and I’m just spitballing here, you probably aren’t going to start managing money for free. So, to be honest, gross returns are kind of like showing an investor something totally rad and then yelling “psych!”

Believe me, I do understand why managers may want to show the gross returns. Because they are net of fees they are, by definition, higher than net returns. They make you look so much more, like, gnarly (in the good way). But because the Securities and Exchange Commission generally asserts managers should show performance results net of fees (except in certain limited instances as defined by the Clover letter, for example) I find many fund managers succumb to both GIPS and the SEC guidance by showing investors gross AND net returns. Which, to me, is the worst of all possible worlds.

I mean, what better way to show an investor why cheaper is better, why they should negotiate their buns off for the lowest fee level possible or, I dunno, even just say screw it and go all passive or smart beta on you? Like, “here’s what you could have gotten if I wasn’t making money off you, Investor. But neener neener neener.”

And since, again per GIPS, “…firms are not specifically required to present gross-of-fees or net-of-fees performance but are allowed to present either, or both with equal prominence, as long as the returns are clearly labeled and accompanied by the required disclosures to help the prospective client understand how the measure(s) have been prepared” MAYBE, just maybe, you should consider showing the returns that offers the best proof of your worth and value as an active manager. I mean, wouldn’t that be totally radical, y’all?

I did get over my Nicolas Cage crush, by the way, and well before the disastrous mullet/wife beater combo of 1997’s Con Air, but I for sure continue to have just a tiny bit of Valley Girl in my redneck roots. And I’m begging you all: Stop grossing me out!

And please follow me on Twitter (@MJ_Meredith_J) for daily doses of research, salt and snark.

And please follow me on Twitter (@MJ_Meredith_J) for daily doses of research, salt and snark.

Leave a Reply