Contributed by Pulak Sinha, Founder and CEO of Pepper

“We’re trying to solve the problem here, Billy.” “Not like this you’re not. You’re not even

looking at the problem.” – Billy Beane (Brad Pitt), Moneyball

How many managers are looking actively at a well-constructed Deal Pipeline and predicting the performance in the fund? Deal flow is the life blood of any alternative investment firm. And our experience has been that the best managers are diligent about creating, updating and managing an active pipeline better than their peers.

How are AI and new technologies disrupting or changing the process?

Alternative Asset Managers face a challenging environment in reaching and executing new deals. Over the last 20 years, there has been a flood of money into Alternative Assets, particularly PE, without an increase in the number of target opportunities, which means they are all chasing the same deals. For example, in Private Equity, Assets Under Management have reached 5 Tn which is 20% of the entire S&P 500. On the other hand, listed companies in the US has dropped by 20% over the last 10 years. Companies are choosing to remain private for longer than any other point in the history of capital markets – Uber, Airbnb and the other unicorns have raised vast amounts of capital from private investors. A typical Credit Fund manager with a $400 Million fund could be looking at 500 to 1000 and sometimes more deals every year during its investment phase of 2-8 years.

For institutional investors, deal flow is to allocate to and evaluate new and existing funds. The challenge remains in getting allocations to the top quartile managers, in a highly competitive space when every other Family Office, Sovereign Fund, and Institutional manager is also trying to get into the same managers. The allocators need to be aware of where the best opportunities, the best new strategies and managers lie, combined with an active fundraise calendar of targets.

Creating an active pipeline relies on critical evaluation of the needs of the fund manager along with a dedicated software platform to track and manage the data. Using Excel/Outlook as the “deal tracking tool” will not cut it for most managers. Deal pipeline tools can take aggregate vast amounts of deal data, clearly show where the best deals are and help in better planning and decision making. These tools are becoming more intelligent and with the addition of analytics and Artificial Intelligence yielding impressive results for quality deal making.

Better Deal Making

The key to better deal making is cultivating and nourishing long-term relationships. These relationships include all the direct contacts in the industry as well those with the intermediaries including the investment bankers, the lawyers and other consultants.

In our previous blog post about building and leveraging Networks to scale businesses, we delved into the advantages of creating Networks for increasing business returns. In this blog we take that concept and how we can leverage the Networks toc creating better deals. We delve into the Deal Flows, its mechanics, operations and structure which is a critical outcome of creating the network. There needs to be a dedicated process and a deliberate plan to increase the number of contact points with more calls, more emails and more contact with partners.

“You cannot escape the responsibility of tomorrow by evading it today.” Abraham Lincoln

How Deal flows affect the Asset Manager:

1. Performance

The performance of the Fund is directly related to the Deal Flow. Proprietary deals are

rare and hard to come by in today’s highly competitive environments. All other

competitive deals require careful scrutiny and action. Deal making does become a

numbers game at this stage. If you see more deals you get to evaluate and invest in

more of the better deals

2. Portfolio Construction

Every Asset Manager knows that a well constructed portfolio can weather any economic

downturn or industry recession. Portfolio construction starts with carefully managing the

pipeline and actively searching for and filling the buckets that are not well represented.

Some of the best managers we spoke to keep close track of the pipeline in multiple

dimensions making sure they are participating in deals that satisfy needs of the portfolio.

3. Deal Pricing

The Deal Pipeline provides the best indicator of where deals are being priced in any

sector. Pricing is very sensitive to market conditions and would provide managers

deeper insights on their deal selection strategy

4. Strategy

Every Asset Manager promotes his strategy and how he has carefully created a

competitive advantage. An active and complete Deal pipeline helps him implement his

strategy

5. Costing of Deals

For Asset Allocators it is all about searching the best managers and getting into attractive funds. The ability to minimize this search costs adds to the bottom line. An active pipeline management helps analyze the costs involved in getting a deal along with which managers close the best funds, which strategies work, and when to focus on specific deals.

Deal Pipeline Operations

For smaller fund managers, every senior partner is involved in sourcing new deals, and dedicates several hours each week to ensure he/she is in touch with all his/her deal sources. At larger shops there are dedicated partners who are in charge of deal sourcing.

As we talk to managers, a common concern arises: the discipline and process are required to manage an active and current deal pipeline. An article published in this Mckinsey insight provided some ideas on managing the process and creating the discipline. The availability of best data tools and pipes needs to be matched with a rigorous process of entering and updating data. Managers moving towards a data driven approach are implementing processes that can help aggregate deal data into their systems. Deal pipeline processes are also actively borrowing from the sales pipeline processes that have been implemented in consumer companies.

What does tracking every deal mean?

It always starts at the beginning. It is good practice to log every deal as soon as it is received. As you get more data, log all information, what kind of assets, who is representing it, when is it likely to close, pricing, strategy, geography, anything that is relevant for decision making. This set of data yields useful information, when it is data-mined, providing insights into state of market, pricing of assets and where the best deals lie.

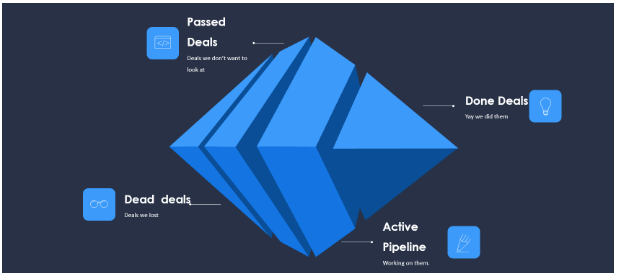

What does a Pipeline look like?

Deals typically are managed at whatever stage they lie in the pipeline. A good pipeline has anywhere between 4 and 8 stages depending on how the fund is tracking the deals to make it easier to track. Some stages may require specific external expertise. A good tracking system should clearly provide reporting on which stage the deal is in, who are the active owners and the expected outcome. The pipeline also tracks screening deals for assignments, calls and responses to queries, meeting schedules, due diligence questions and results.

Decision making and pipeline

Deal pipeline is directly correlated to portfolio returns. An active pipeline directs the team towards effective planning and allocation of time and resources. It allows junior analysts to be on the same page as senior managers, and focuses on where the resources need to be concentrated. Getting more of the firm resources or external partners involved, earlier in the process, as the team analyzes the deal, leads to better outcomes.

Documents, Notes, tweets, news, social and emails for Deals

As the deal pipeline gets built it is increasingly important that all Notes are registered in the system. Every inbound and outbound document is saved and linked to the deal. Increasingly this information could be coming from Social media like a tweet or a Linkedin invite and it would be important to log those to. All emails relating to the deals, from internal and external sources are also linked to the deal intelligently by the system. In the latest generation systems this vast trove of unstructured data becomes a useful repository, which can be mined and searched.

Deal Analytics

Managers can create vast amount of analytics and patterns on deals. Analyze what makes a deal close faster or slower, who are good partners and most importantly what deals do not close. Or analyse what are the biggest time and resource sinks associated with deals.

What New Technologies are bringing to Asset Management

What’s new for Deal Managers? What we as Technologists suggest to our partners is keeping the data pipes open and filling up with all the data they can get. This data will form the base for Artificial Intelligence that will help predict better deals in the future. AI will impact management decision making in a big way, with its ability to spot patterns and hidden information. But it does need vast amounts of data before any pattern can be established. We at Pepper are running pilots, along with Managers about how deals can be analyzed by AI algorithms. One result is the numbers are telling one story but the opportunity could be telling a whole other story.

Prior article: How Investment Managers Can Leverage Network Effects to Scale their Business

Pulak Sinha is the Founder and CEO of Pepper, a technology provider, designing the next generation of digital infrastructure for investment managers, incorporating the latest in Cloud, Artificial Intelligence, Open Architecture and User Interface Technologies. Before leaving to start building the digital platform that would become Pepper, Pulak Sinha was a founding member of GSO Capital Partners — currently one of the largest credit hedge funds. Pulak has also gained valuable expertise in the field of regulatory risk, market risk and credit risk management for large banks, having worked at Citigroup, Bank of America and Credit Suisse. He has an MBA from Columbia Business School and an undergraduate in engineering from IIT in India.

Leave a Reply